Where an employer provides a rent-free accommodation to its employees, a certain percentage of its value is taxable in the hands of the employee, as a ‘perquisite’, under the head ‘Income from Salaries’. Last month, the Central Board of Direct Taxes (CBDT) introduced a few amendments relating to the valuation of perquisites for accommodation provided by employers.

The amendments are effective from September 1, 2023. Hence, the calculation of the housing perquisite should be made using the old rates till August 31, 2023.

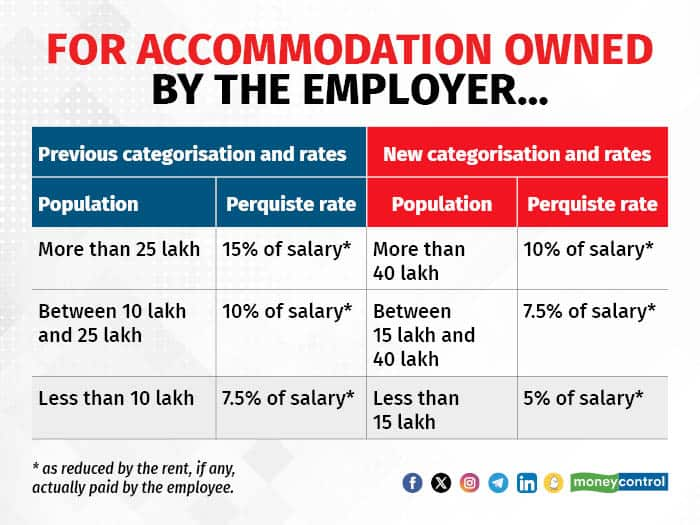

1. Change in rate at which perquisites are valued and categorisation of cities based on populationThe amendment aims to bring changes to the categorisation and limits of cities and populations, along with revised perquisite rates based on the 2011 census, compared to the 2001 census used previously.

Below is the comparison of population and perquisite rates as per 2001 and 2011 censuses for employers (other than central/state government)

The perquisite value will be the actual rent paid by the employer or 10 percent of salary (15 percent previously) whichever is lower, as reduced by the rent, if any, actually paid by the employee.

For the said valuation, salary means basic salary as increased by all taxable allowances (excluding perquisites).

2. Introduction of Cost Inflation Index (CII) for perquisite valuationWhere the employee continues to occupy the same accommodation (provided by the employer) for more than one year, the perquisite valuation for the subsequent years will be capped to an extent by the introduction of the Cost Inflation Index (CII).

Suppose, Mr. X has been provided unfurnished accommodation. In such a case:

Value of the perquisite for the FY 2023-24 (i.e. first year where accommodation is provided) will be lower of the following:

(i) Rent paid assumed as Rs 160,000; or

(ii) Salary is assumed at Rs 12 lakh

(a) 15 percent of salary for April 2023 to August 2023 – Rs 75,000 (15 percent of Rs 5 lakh)

(b) 10 percent of salary for September 2023 to March 2024 – Rs 70,000 (10 percent of Rs 7 lakh)

Aggregating to Rs 1,45,000. Accordingly, the perquisite for FY 2023-24 works out to Rs 145,000.

Value of the perquisite for FY 2024-25 will be lower of the following:Now, the same accommodation is provided to Mr X for FY 2024-25. The salary has increased by 30 percent, i.e., Rs 15.6 lakh.

As per the amended rule, the perquisite will be calculated as under:

a) 10 percent of salary = Rs 15.6 lakh * 10 percent = Rs 156,000; or

b) Rent paid Rs 168,000 (assuming 5 percent increase in rent); or

c) Perquisite for FY 2023-24 x CII of FY 2024-25/CII of FY 2023-24 (CII for FY 2024-25 is assumed 369 considering 6 percent inflation rate) i.e., Rs 145,000* 369/348 = Rs 153,750

Therefore, the perquisite value for the FY 2024-25 will be Rs 153,750.

This amendment ensures that the perquisite valuation is linked not just to salary but also to inflation.

3. Change in plinth area and definition of remote work· Temporary accommodation provided to employees at select sites

Where the employer provides an employee working at mining/on-shore exploration/project execution/dam/power generation/off-shore sites, with temporary rent-free accommodation, it will not be taxable as a perquisite, if the following conditions are satisfied:

a) The accommodation having a plinth area not exceeding 1,000 square feet (increased from 800 square feet previously), is located not less than eight kilometres away from the local limits of any municipality or cantonment board; or

b) The accommodation is located in a remote area*

*Remote area means any area other than an area which is located:

i) within the local limits of; or

ii) within a distance of 30 km (down from 40 km previously) from the local limits of,

any municipality or a cantonment board having a population of one lakh (increased from 20,000 previously) or more, based on the 2011 census (as against 2001 census used previously).

ConclusionBy incorporating the 2011 census data, reducing the perquisite rates, and introducing the CII, the amendment seeks to benefit employees provided with accommodation by their employers.

(With inputs from Niji Arora, Director, Zalak Shah, Manager, and Ami Rathod, Assistant Manager with Deloitte Haskins & Sells LLP)Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.