Among the many ways startups have attracted talent over the years are ESOPs, or employee stock ownership plans. If the company turns out to be a success, it sees a bump in its valuations, as do the ESOPs. And if the employees get to cash out in a bumper stock market listing, it can bring them windfall gains.

Take the case of SaaS firm Freshworks, which had a stellar listing on the Nasdaq in September 2021, turning many of its ESOP-owning employees into crorepatis. When Zomato listed successfully in July 2021, the net worth of many of its senior executives with ESOPs skyrocketed.

But it’s not only startups that grant ESOPs to their employees, other large and well-established companies too reward their employees with ESOPs. Leading Indian IT firms such as Infosys and Wipro, and others such as Larsen & Toubro and ITC, also offer ESOPs to their employees.

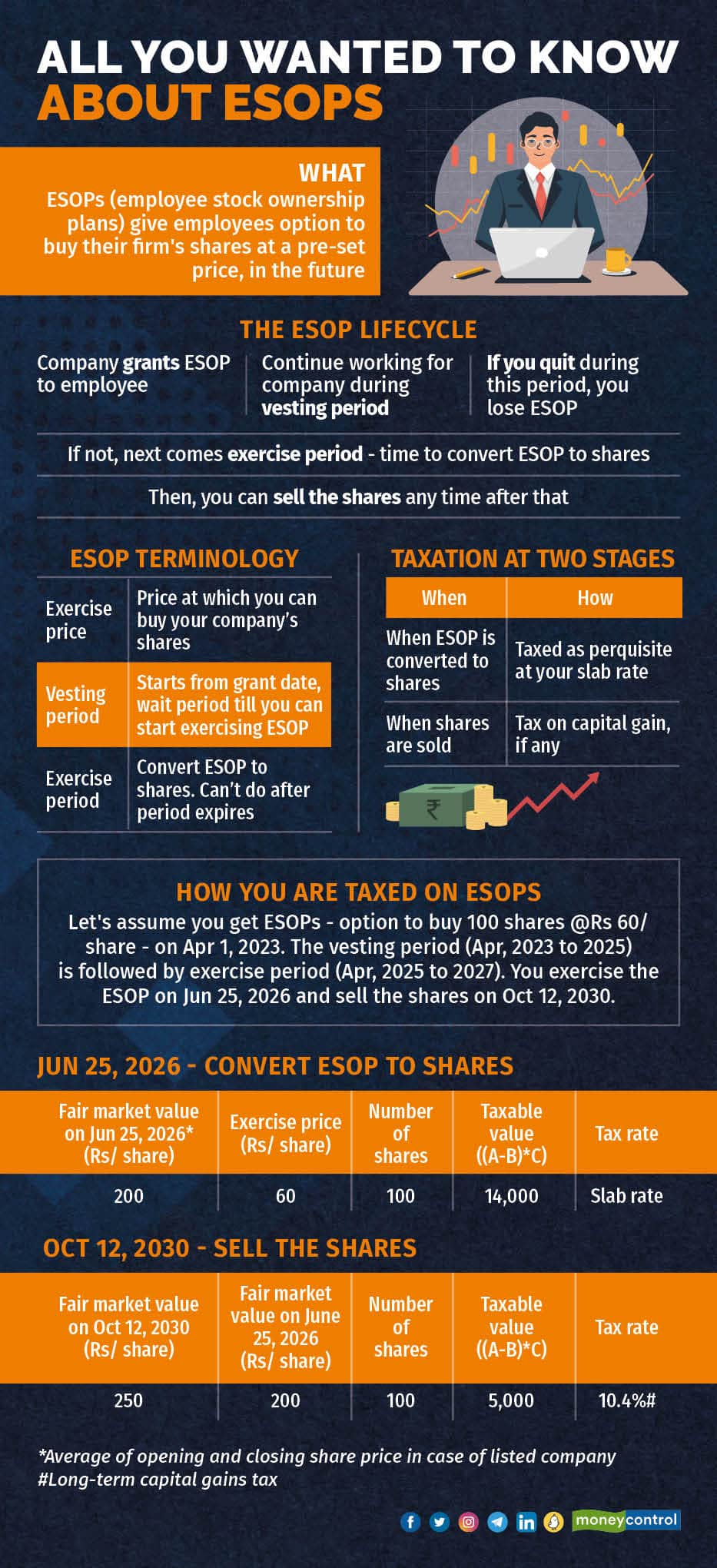

What are ESOPsAn ESOP gives an employee the option to buy the shares of his firm at a pre-determined price in the future. ESOPs form part of an employee’s compensation package. They are used by companies to reward and retain employees. ESOPs help align the interests of the employee with the firm’s, and in the case of start-ups, also helps them avoid paying big salaries and conserve cash.

“An ESOP-holder doesn’t have any right as a shareholder until he converts the ESOPs into shares. Upon becoming a shareholder, he will have the same rights as any other shareholders of the company, i.e., the right to receive dividends, to vote etc.,” explains Diviay Chadha, Partner, Singhania & Co., a law firm.

After converting the ESOPs into shares, you can sell them on the stock market if yours is a listed company.

But what are your exit options if it is an unlisted company?

According to Chadha, you may be able to sell the shares to a third party, or these could be bought back by the company itself. This will happen in accordance with the provisions of the Companies Act, the company’s ESOP policy, and its shareholder’s agreement.

Nishant Agarwal, Senior Managing Partner, ASK Private Wealth, says that what often happens is that an incoming investor gives ESOP-holders the opportunity to liquidate part of their shares.

Also read: Should employees seek ESOPs in lieu of a higher salary?Exercise your optionESOPs come with an exercise price, exercise period, and vesting period. To put it simply, first your employer grants you ESOPs. This gives you the right to buy your company's shares once the vesting period gets over. After that, you are either free to hold these shares or sell them. Let’s take an example to see how this works. Say, on April 1, 2023, your employer grants you ESOPs, or the option to buy 100 shares of the company at Rs 60 per share (exercise price), starting two years from then. The two-year period, from April 1, 2023 to 2025 is called the vesting period.

The vesting period only entitles you to the ESOPs. It does not, however, allow you to buy your company's shares. It’s like a bonus that you are now eligible for, but you only get to see it once you remain with the organisation for a certain period of time. This is the vesting period. Once the vesting period gets over, the exercise period begins. It is only during the exercise period that you can convert these ESOPs into actual shares.

Let’s say, the exercise period lasts for two years (from April, 2025 to 2027). That means, you can convert the ESOPs to shares any time during this period. Once you have the shares, you are free to sell them, if you wish. Or you can hold on to them.

How are ESOPs taxedESOPs are part of an employee’s compensation and get taxed in two stages (see table).

The first instance of taxation happens on the exercise date — when an employee exercises her option to buy the shares. Let’s suppose the fair market value (FMV) of the shares is Rs 200 apiece. The difference between the FMV and the exercise price of the shares (Rs 200 – Rs 60) *100 = 14,000) is taxed as a perquisite at the employee’s slab rate. In case of a listed company, the average of the opening and closing stock price on the exercise date is taken as the FMV.

The second time taxation comes into play is when the employee sells these shares. Let’s assume the market price of the shares is Rs 250 apiece on the day of sale. Then, the difference between Rs 250 and Rs 200, multiplied by 100 (the number of shares), that is, Rs 5,000, will get taxed as capital gain. Depending on the holding period of the shares, it will be taxed as short or long-term capital gain.

Also read: MC Explains: How is an ESOP different from RSU and ESPPMind the risksWhile ESOPs can be a good way to make a windfall gain in future, they can be risky. As an employee with ESOPs, you expose yourself to high concentration risk. If the fortunes of your company plummet, not only will it put your investment at risk, but also your job.

Agarwal elaborates further on the risk aspect. “When one exercises their ESOP, money needs to be paid not only for the ESOP issue price, but also the perquisite tax (as enumerated above). But in future, if the final realized sale price (when the shares are sold) is lower than the fair valuation at the time of exercise, excess money would have been paid as perquisite tax”, says Agarwal.

He further adds, “With an unlisted company, there is always the risk of limited liquidity and the ability to find buyers easily for smaller lots. At times, certain conditions might be applied by the company on the ESOP sale, such as the need to take the company’s permission before sale / transfer to outside buyers, or the right of first refusal to buy to be given to the company or its founders, etc.”

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.