Shares of food delivery giant Zomato listed with 52 percent gains in the initial offer (IPO). The issue was oversubscribed 38 times.

Investors in many IPOs are pocketing handsome listing gains, especially when the company is into some new-age digital business. The only problem is getting allotments, as the IPO issue gets oversubscribed many times over.

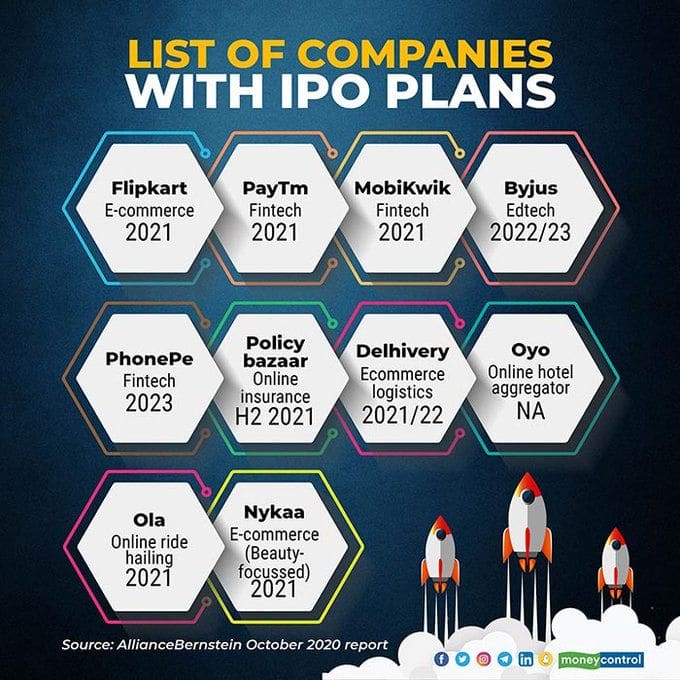

Some investors consider purchasing shares ahead of IPOs. Many names are floating around as probable candidates and some of these are in the initial stages of preparations for an IPO. But buying these shares from the unlisted space with a view to making a quick buck may not be as easy as it sounds.

Buying unlisted sharesWhen a company files for its IPO, the shares held by existing investors and employees see prices going up in the private market. For example, One97 Communications, the parent company of Paytm, estimates its share price to go up to Rs 3,000. A year ago, it was quoting at Rs 1,500 a share.

Buoyant stock markets and possible listing in near future have ignited demand for the shares of the company.

Shares of Care Health Insurance are also in demand after news reports of IPO plans of the company surfaced and shares started quoting above Rs 230. To be sure, prices quoted in the markets are volatile and should not be treated as fair value estimates.

How does the trade take place?Since these shares are not traded in the public market, you do not have a ‘market price’. Instead, you get an indicative market price or selling quote. Some wealth management firms help investors buy unlisted shares. Portals such as Analah Capital and Unlistedkart also offer to arrange such shares for you. “If you are a large investor, then shares can be arranged for a fixed fee. In most cases, the selling quote includes the remuneration of the broker,” says Rupesh Nagda, Managing director & Founder, Family First Capital. A demat account is mandatory.

When you transact in a listed share, the order placement and payment mechanism are very much standard. There is no counterparty risk as the transactions are carried out on the stock exchange. The securities are credited to your demat account by your broker, following a T+2 cycle. However, when you deal in unlisted securities, you should be doubly careful since there is a counterparty risk. “We prefer to transact through NSE Clearing Limited. The stocks and money change hands through the clearing house in one day,” says Nagada.

Is trading in unliked shares, risky?The biggest risk you take here is that of liquidity.

“Investments in stocks entail business risk. When you buy a listed share and if your opinion about the business changes, then you can sell it on the exchange quickly. But in the case of unlisted shares, the price discovery is a problem and liquidity is a bigger problem,” says a fund manager who wish not to be identified. If the company does not get listed, then you may get stuck and the prices too may correct. Shares of HDB Financial Services were accumulated by many investors in 2019, expecting an IPO soon. However, the company is yet to announce one. Factoring in the possibility of IPO getting delayed is important.

Information shortageYou have to understand the business, the industry dynamics, the profitability of the business and future growth. If you cannot arrive at a fair value estimate yourself or through a trusted advisor, then you may land in trouble. “Check the earnings of the company and do not overpay. The future growth should reward you. Avoid buying stories where risk-reward may not be in your favour,” says Shyam Sekhar, Chief Ideator, ithought Advisory.

Overpaying for a stock can hurt your returns. Sekhar points out that some investors bought shares of UTI AMC ahead of the IPO at high valuations. But the IPO price (Rs 554) was lower than the price ahead of IPO.

Given such risks and the ticket size of transactions (unlisted shares typically require trades of atleast Rs 5 lakh) means that retail investors must avoid buying them, no matter how tempting it sounds.

Should you buy?Even if you have the necessary risk appetite to invest in unlisted stocks, do not allocate more than 10 percent of your equity portfolio to such opportunities. “You should ideally have 80 to 90 percent of the equity investments in liquid instruments. Unlisted shares, apart from carrying the usual equity asset risk, are also uncertain as to when their IPOs will come. Plus, they score low on liquidity,” says Vishal Dhawan, Founder and Chief Financial Planner, Plan Ahead Wealth Advisors.

While Dhawan advises investing in a bouquet of unlisted shares to spread out risks, Nagada prefers to own one or two stocks where risk-reward is favourable.

The Securities Exchange Board of India prescribes a six-month lock-in period for non-promoter investors from the date of IPO allotment, if they are pre-IPO investors. If you buy and sell in the unlisted stage after holding for more than two years, then the gains are taxed at 20 percent after indexation. Gains earned on shares held for less than two years, are added to the investor’s income and taxed at the slab rate.

“Stretched valuations seen in equity markets worldwide have already lifted prices of un-listed shares. If there is a correction in secondary market, then the same will not only dampen the IPO sentiment, but also the valuations enjoyed by un-listed shares,” says the fund manager quoted above.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.