Wealth creation. A comfortable retired life. An expensive holiday. A good life.

Mouth-watering as these prospects seem, it’s difficult for many salaried people to imagine having all these. Take the case of this gentleman, Ron, whom I met recently in my investor education course.

Ron has a good debt equity mix, sticks with mutual funds and has done some level of goal (financial) planning. Ron’s contention was that financial plans were easy to make, but many things derailed the plan regularly.

Challenge No. 1: Expensive medical treatment, little insuranceRon had a couple of difficult months with a family member having an emergency brain surgery. His employer insurance covered 60% of the claim, but the balance had to be paid by him. His emergency fund was depleted and he had to exit some investments too. Ron has a total health cover of Rs 5 lakh, which is inadequate for complex surgeries.

Rising medical costs can be an impediment to wealth creation, especially if you or your dependents are in and out of hospitals, frequently. A life-threatening illness can set you back by many years as far your financial planning is concerned. With medical inflation in India being above 10 percent, it becomes necessary to have at least Rs 10-15 lakh of health insurance along with critical illness cover. That’s the bare minimum you should have. It is not just the hospital bills that you--or Ron in this case--need to worry about. The associated expenses are high as well so it becomes important to have a critical illness cover or a health expense fund that can be used in such emergencies.

Just having a health insurance plan is not enough. Having a good amount of cover with the least sub limits and exclusions is also important. Ron mentioned that he never took the external cover because he was confused with all the information on various schemes. I urged Ron to look at the Moneycontrol health insurance rating for this.

Challenge No. 2: Too many loansRon has also been finding it difficult to save given the equated monthly installments (EMIs) he has to pay. Ron has taken a second home loan to finance the purchase of a flat since he is almost nearing closure of the first home loan. He believes that the flat will give him 12-15% returns and a loan at 7.5% will still allow him to make gains.

Often, individuals are not able to understand the impact of loans on overall wealth and end up taking higher loans.

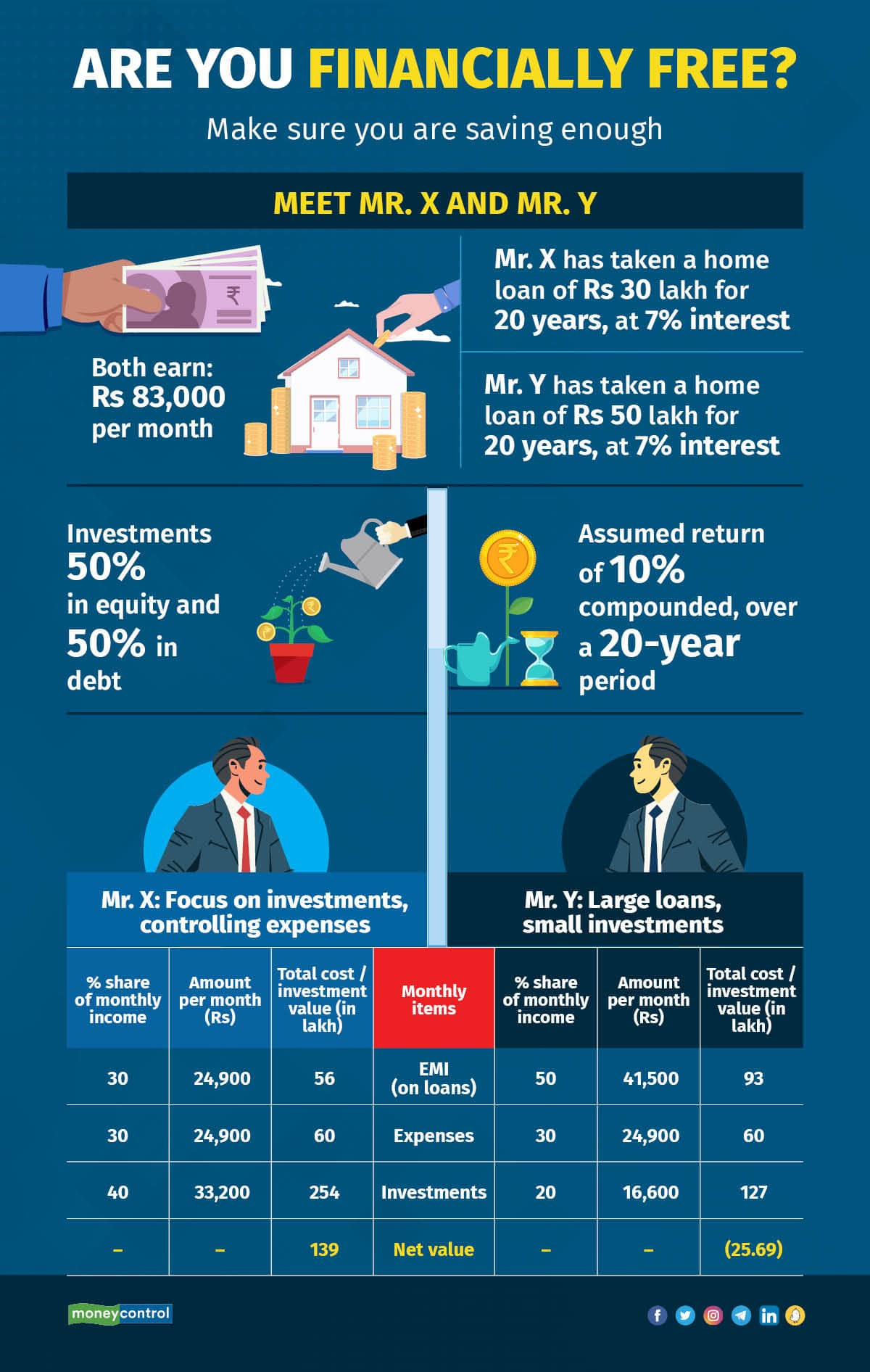

Let us assume a person X and a person, Y, who have the same salary but X has a smaller loan and Y has a bigger loan. As can be seen, after 20 years, Y ends up negative because of his loan interest compounding, where as in the case of X, the investments compound and grow exponentially.

Like other investors, Ron too is concerned about the rising inflation. A quick check revealed 10 percent allocation in equity mutual funds and the balance in fixed deposits and insurance. With a 10 percent allocation to equity, it is difficult for the portfolio to beat inflation.

3 steps to become financial independentIt’s not rocket science you get your finances in order. But you need to disciplined. These are three broad steps that I recommend to get your investment portfolio right:

There are many factors involved in management of finances and one needs to be prepared for things not going to plan. Least possible loans, having the right covers with an extra amount for unexpected situations and the right blend of products which give good returns on an inflation adjusted, post tax basis will certainly go a long way in making the journey to financial freedom smoother.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.