The crash in share prices of technology companies on the US markets reminds us of a painful lesson: Don’t let employee stock option plans become too big in your investment portfolio

You would have surely heard stories of how regular, everyday employees became millionaires and retired early because of their stock options. And there is no denying the huge potential for wealth creation via stock options.

This is one reason why many startups offer ESOPs (or restricted stock units or employee stock purchase plans) to their recruits. Even senior officials in established businesses are open to having stock options as a major chunk of their compensation structure.

But these success stories are rare and good to hear when the company’s share prices are going up.

The dark side of ESOP stories Let’s remind ourselves of two great companies of yesteryears, Kodak and Nokia. Imagine the plight of their employees who too had stock options and their stocks became worthless as the companies headed towards bankruptcy.

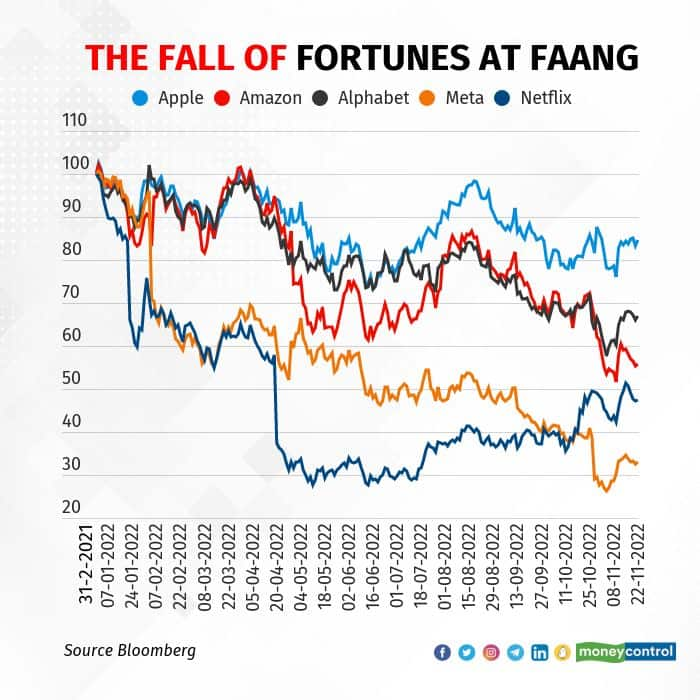

With the ongoing correction in US stocks and more specifically in the technology space, the ugly side of stock options is gradually unfolding in real time for many people employed by these companies. Have a look at the price correction (or crash) in 2022 for some of the revered FAANG (the acronym stands for Facebook (now Meta), Apple Amazon, Netflix and Alphabet, with the G representing its original name, Google) stocks.

The deep correction in many of these names has put a question mark on whether these stocks will return to their peaks anytime soon in the new non-zero interest rate environment

The deep correction in many of these names has put a question mark on whether these stocks will return to their peaks anytime soon in the new non-zero interest rate environmentThis is just an illustration of the carnage. The deep correction in many of these names has put a question mark on whether these stocks will return to their peaks anytime soon in the new non-zero interest rate environment.

But leaving aside the economics of what is possible and what isn’t, let me share one example of how this is impacting real people now.

A friend works at Adobe, a well-established company in the tech space. Due to his stock options, 80 percent of his net worth was tied to the company’s shares. But in the last one year, the shares fell from highs of almost $700 each to around $290 now. That’s a deep cut of almost 60 percent. He told me that at one time, the value of his stocks was about Rs 1.3 crore, and now it’s about Rs 55-60 lakh (including new stock vests).

While he believes in the company’s future and awaits a rise in its share price, he does believe that he was a bit greedy and should have reduced his exposure earlier. He has a home loan outstanding of about Rs 1 crore that is weighing on him and which he could have easily cleared that with company stocks just a few months ago but now cannot.

As an investment advisor, I regularly come across situations like this quite often where stock options are a substantial part of the financial portfolio of my clients.

Companies will continue to compensate employees with equity incentives and there is no doubt that it can be a huge wealth creator for employees if things work out. But you never know when things can go wrong for any company. History is filled with large, established companies going down and taking employees with them.

And these days, young employees are blindly running after cash-burning startups offering ESOPs. They fail to understand that many of these startups may not be in existence in a few years and their shares will be worthless too.

How to handle employer stocks in your portfolioWhen your company’s stock is heading only up, selling your stocks might look foolish. But remember, eventually you have to take care of your financial goals. This is not a race to become a billionaire because of your stock options. You have to act prudently and limit your exposure to the employer stocks accordingly.

Your income anyway depends 100 percent on your employer. You don’t want your investment portfolio to have the same dependency, do you?

Note – Company/stock names used in the article are for example only. Please do not consider this as an investment advice to buy/sell/hold any of them. Please talk to your investment advisor if you have doubts about the growing size of your stock options.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.