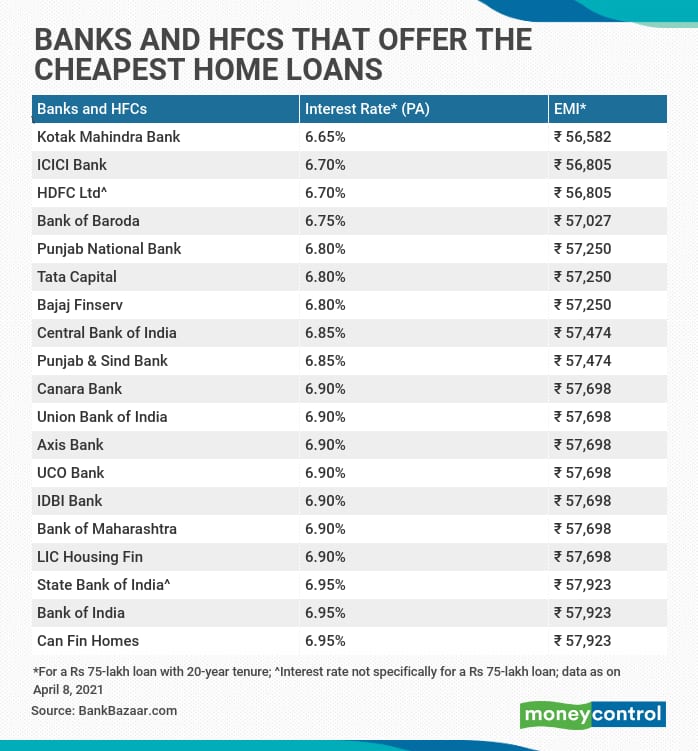

Kotak Mahindra Bank continued to top the list of cheapest home loan lenders, even as State Bank of India (SBI) restored its lowest interest rate to 6.95 percent, after its concession rate offer ended on March 31.

With this, mortgage major HDFC and private sector lender ICICI Bank now offer the second-best rates of 6.7 percent, as per data from Bankbazaar.

Cheaper home loans

If you are looking to buy a house for self-use, it is indeed the best time to close the deal. However, while choosing a lender, do not go merely by lowest rates on offer. How transparently effective home loan rate is structured will have a huge bearing on your experience as home loans come with longer tenures of over 15-20 years. All retail floating-rate home loans are linked to an external benchmark, which is the Reserve Bank of India’s (RBI) repo rate in case of most banks, since October 1, 2019. This, combined with operating cost and credit risk premium – the two components of the spread over the repo rate – make up your effective home loan rate.

Ascertain your bank’s policy on computing and altering credit risk component of your interest rate during the loan repayment tenure. Banks that disclose the credit score grid transparently will work best. This is because credit risk premium can change in line with your credit assessment (bank’s view on your creditworthiness), so you need to know how the bank will compute your credit risk premium as also any change in this parameter through the tenure.

A note on the table

Interest rate on home loans for all listed (BSE) public and private banks, and HFCs as listed in NHB's website, which offer home loan up to Rs 75 lakh have been considered for data compilation. Banks/HFCs for which data is not available on their websites have not been considered. Banks and HFCs in their respective sections are listed in ascending order on the basis of interest rate, that is, bank/HFC offering lowest interest rate on home loan is placed at top and highest at the bottom. Lowest rate offered by the bank/HFC on a home loan of Rs 75 lakh has been considered in the table. EMI is calculated on the basis of interest rate mentioned in the table for Rs 75-lakh-Loan with tenure of 20 years (processing and other charges are assumed to be zero for EMI calculation).

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!