If you are looking to buy a house, this is the ideal time to close a deal – home loan interest rates continue to slip further, along with stamp duty rates in some states such as Maharashtra and Karnataka. Home-buyers have rarely had it so good in the recent years.

The first week of March saw hectic activity in the home loan space, with State Bank of India slashing its lowest rate to 6.7 percent for home loans of up to Rs 75 lakh and 6.75 percent for loan amounts of over Rs 75 lakh. Only salaried loan-seekers with CIBIL credit scores of over 800 will be entitled to these new, best rates. Others will have to pay 10-15 basis points more. Women borrowers, however, will get additional concessions of 5 bps (100 bps = 1 percentage point).

Lowest rates in years

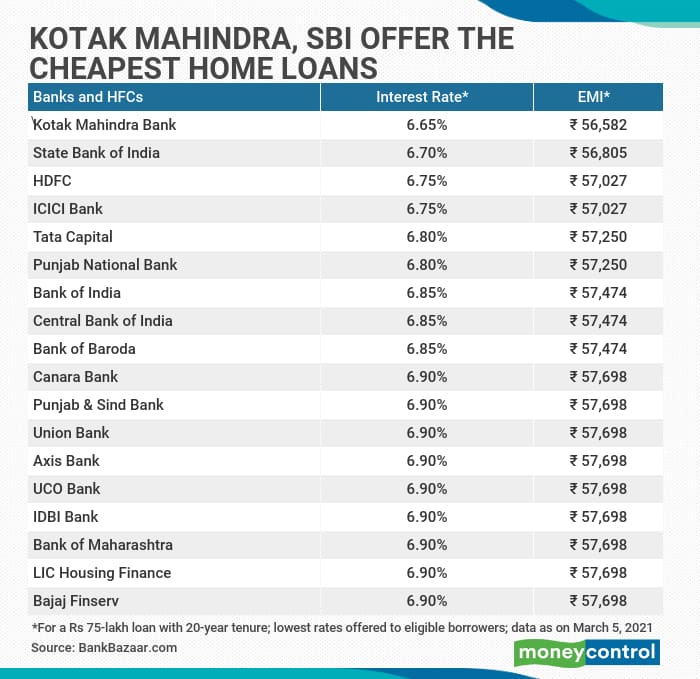

SBI was promptly followed by Kotak Mahindra Bank, which was already offering the cheapest home loans, as it reduced its rates further to 6.65 percent, as per data from Bankbazaar. These concessional offerings will be available till March 31. ICICI Bank joined the party a day later, lowering its rates to 6.70 percent for home loans of up to Rs 75 lakh, and 6.75 percent for loan amounts of over Rs 75 lakh.

If you are an existing home loan borrower who is stuck with higher interest rates, it is time to make the switch. Home loan balance transfer can help you save a tidy sum as savings on interest outgo over the tenure of your loan. Also, an increasing number of lenders are adopting a transparent, credit score-based lending, particularly in the home loan space. This trend has once again brought the importance of maintaining a good loan and credit card debt repayment track record to the fore. You must not miss your EMIs to ensure your credit score is not affected; also, do not apply for too many credit cards.

A note about the table

Interest rates on home loans for all listed (BSE) public and private sector banks and HFCs as listed in NHB's website that offer home loan up to Rs 75 lakh have been considered for data compilation. Banks/HFCs for which data is not available on their websites, have not been considered. Banks and HFCs in their respective sections are listed in ascending order on the basis of interest rate i.e. bank/HFC offering lowest interest rate on home loan (loan amount= Rs 75 lakh) is placed at top and highest at the bottom. Lowest rate offered by the bank/HFC on a loan of Rs 75 lakh has been taken into account in the table.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.