Electric vehicles have been in the news for all the wrong reasons of late.

A series of fires and explosions involving electric vehicles (EV) has raised serious questions around the safety of these in-demand, eco-friendly means of transport. Union Minister for Road Transport Nitin Gadkari has issued a warning to electric vehicle manufacturers, asking them to pull up their socks or face action.

Also read | Government will penalise EV companies found negligent: Nitin Gadkari

Premiums may go up, but claims to be honoured

The question is: will insurance premiums really go up?

At present, insurance companies are closely watching developments and their decisions will depend on trends. If such incidents continue unabated, EV owners will have to brace for a hike in premiums. “Insurance premiums may rise if instances of EVs catching fire go up,” says Shanai Ghosh, Executive Director and CEO, Edelweiss General Insurance.

Insurers could resort to more stringent underwriting — the process of determining the risks and pricing of the products — if the safety concerns are not resolved. “If such incidents continue, they might affect the overall underwriting process, leading to a rise in premiums. In such cases, insurers might have to revise their premium charges,” says Indraneel Chatterjee, Co-founder, Renewbuy, an online insurance aggregator. However, he sees these as temporary setbacks and believes that the EV industry is set to thrive in the years to come.

There are others in the industry who also do not view the accidents as major setbacks. “Such stray incidents will not impact the pricing philosophy of electric vehicles. In the past year around five lakh vehicles have been sold. Fire in 2-5 vehicles indicates a very low probability of damage. Had these incidents been in the range of 50-100 then the pricing of electric vehicle insurance would have been different. As the incidents are far and few, it is unlikely that the premiums will increase,” Adarsh Agarwal, Chief Distribution Officer, Digit Insurance, told Moneycontrol in an interview.

At present, you need not worry about claims if your vehicle is damaged due to such manufacturing flaws. Insurers say that they will honour claims related to the recent spate of incidents and at the same time closely track outcomes of manufacturers’ review and the government’s investigations. “We are awaiting the conclusion of the same. Currently, normal fire claims are admissible under our policy,” says Ghosh.

However, if your OEM has recalled your vehicle and you have incurred any ancillary expenses in connection with such a recall, your insurer will not cover the same.

Also read | Explained: All about insurance requirements for e-bikes

EV insurance in India: taking baby steps

The string of incidents also has implications for the EV insurance segment, although it is still at a nascent stage, as it comprises a relatively minor portion of non-life insurance companies’ motor portfolio. “Electric vehicles are clearly the future of mobility. At present, they make up a relatively small part of our motor business. However, we are studying global data to ascertain safety trends, the percentage of cars that get into accidents and so on,” says Anup Rau, MD and CEO, Future Generali India Insurance.

Despite the fire incidents, insurers are optimistic about the EV market potential in India. “This is one of our strategic focus areas and it is backed by our partnerships with some key original equipment manufacturers (OEM) in this segment. Industry reports indicate that the EV market in India is expected to grow at an estimated CAGR of 47 percent from 2022 to 2027,” says Ghosh.

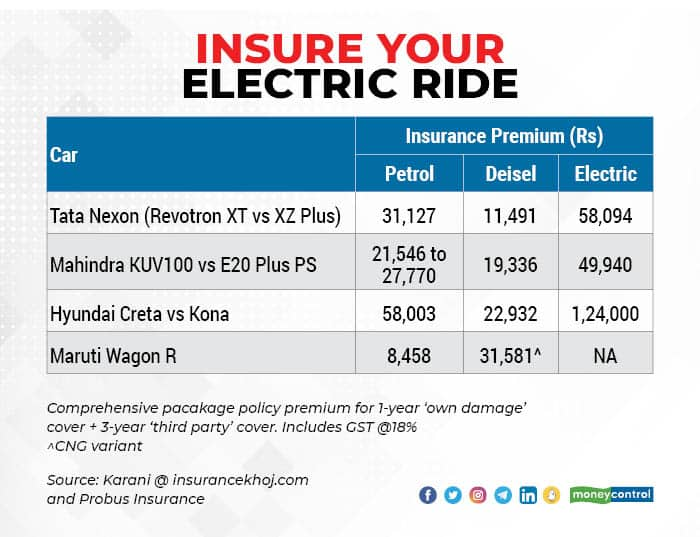

She cites increasing environmental consciousness, the entry of global EV companies in India and government support as the key reasons for this segment’s strong growth potential. “Additionally, in order to boost the growth and usage of environmentally friendly vehicles, regulator IRDAI proposed a discount of 15 percent on third-party motor premium rates for electric vehicles, in March. The premiums on EVs are so far lower than on petrol and diesel vehicles,” says Chatterjee.

What lies ahead

The probability of such incidents recurring poses a huge risk.

“Any new-age industry will face challenges. The recent fire events have raised safety concerns around EVs. However, it is also an opportunity for insurers to collect, relook and evaluate and improve their existing underwriting models for electric vehicles. It can also help insurers come up with covers that can safeguard consumers more from such incidents,” says Chatterjee.

Ghosh says that her company is working on EV-specific covers that would cover these “additional identified risks.”

Untoward fire incidents are one part of the problem. The battery makes up the majority of the EV price, leading to expensive own-damage cover premiums, though third-party premiums are cheaper. Depreciation of the vehicle is a key factor in determining motor insurance premiums and electric vehicles’ structure could pose a challenge here. “In an EV, the cost of the battery is approximately 50-60 percent of the vehicle cost, which makes it difficult to ascertain the vehicle’s depreciation in the near future. Also, repairing the battery is very expensive, and given the unavailability of spare parts, the claim servicing cost of EVs will increase,” says Chatterjee.

While there is significant interest in EVs among customers, safety concerns and the lack of infrastructure continue to be key obstacles in this segment’s path to faster growth. “One key requirement to enable this growth is the expansion of charging infrastructure and affordable portable charging accessories,” says Ghosh.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!