The government wants to promote more electric vehicles. That’s fine. But many youngsters, especially those under the age of 20, use e-bikes without having proper knowledge of the driver’s license and insurance. Many of these e-bikes can reach speeds of up to 25 kilometres an hour. Riders could cause a damage to those on the road or to other vehicles. And there may not be a third-party insurance policy to cover the damage. The rider has to pay the compensation himself. If you ride an e-bike frequently, then here’s what you need to know about the insurance cover.

My electric bike runs so slowly. Why do I need an insurance cover?Yes, many e-bikes have a speed limit. More than 90 percent of the electric vehicles on Indian roads (including cars) are low-speed electric scooters that travel at less than 25 km per hour. That isn’t exactly a snail’s pace and can knock someone down and cause some damage if you drive recklessly. Hence, aside from driving safe, it’s best to have an insurance policy to cover for any damages you may cause to someone else.

But there are many commercial e-bikes available in large cities in India these days. Remember, as we told you earlier, the third-party insurance cover (that covers for the damage you cause to others) is to be bought on the vehicle. In simple words, you cannot buy a third party insurance cover for a rented bike.

Yulu, one of the largest fleet of rented electric bikes in the country however, does not have such an insurance. Hemant Gupta, co-founder and chief of operations at Yulu, which runs a fleet of more than 10,000 electric two-wheelers, says, “We do not have a third-party insurance cover as the Miracle e-bikes are covered under the non-motorised vehicle category. These do not require a driving license as a low-speed limit of 25 km per hour and low capacity reduce the risk of accidents.”

The Yulu e-bike Miracle has a maximum speed of 25 Km per hour and hence does not require any license to ride.

I rent my e-bike. Should I buy an insurance cover too?Third-party insurance covers are bought for the vehicle, not for an individual. Aditya Sharma, Head-Motor Business, Bajaj Allianz General Insurance says: “The companies owning these vehicles need to take insurance, rather than the individual using such bikes.” You, can, however buy a standalone personal accident cover to cover for any damages caused to you due to an accident.

Do I need a driving license to ride an e-bike?Whether you ride a bike or drive a car, you need a valid driver’s license. Despite a valid insurance policy (third party, own damage or personal accident cover), if you meet with an accident, your insurance company will not pay the bills for underage riders without valid licenses. In 2019, nearly 45,000 accidents involved persons not holding a valid license.

“Anyone without a valid license is not supposed to drive registered motor vehicles. If they do, motor insurance will not cover the claim, as it is not legal,” says Adarsh Agarwal - Appointed Actuary at Digit Insurance.

In India, the minimum age to drive a car or ride a motor cycle with gear is 18. However, if you are between the ages of 16-18, you can still ride a non-motor and non-gearless bike. Most of the e-bikes we see on roads today, fall in this category.

“Users of rental services should be cognizant of the cover available before initiating their ride,” says Amitabh Jain-Head Motor and Health Claims and Underwriting, ICICI Lombard General Insurance.

As per the Motor Vehicles Act, there is a proposal that a license would be compulsory for 16-18-year-old teenagers riding any vehicle that has a maximum 250 kilo watt capacity and can travel at a speed of up to 70 km per hour. If this becomes an Act, then all sorts of e-bikes will mandatorily require a license and a third-party insurance cover.

What should you do if you have your own e-bike?A comprehensive insurance cover, works better than a mere third-party insurance policy. For two wheelers, insurance cover is critical as they have resulted in 1.67 lakh accidents in 2019, killing 56,000 people and injuring almost 1 lakh minors.

If your e-bike has a speed higher than 25 km per hour and has a capacity of more than 250 Kilo Watt, then you would have to purchase a valid insurance cover, even if it is an electric bike. “Low speed and power vehicles can be driven without having a valid license. But for other electric vehicles with more power (greater than 250W), where active license and registration are required, customers should opt for a comprehensive policy with add-on covers,” says Jain.

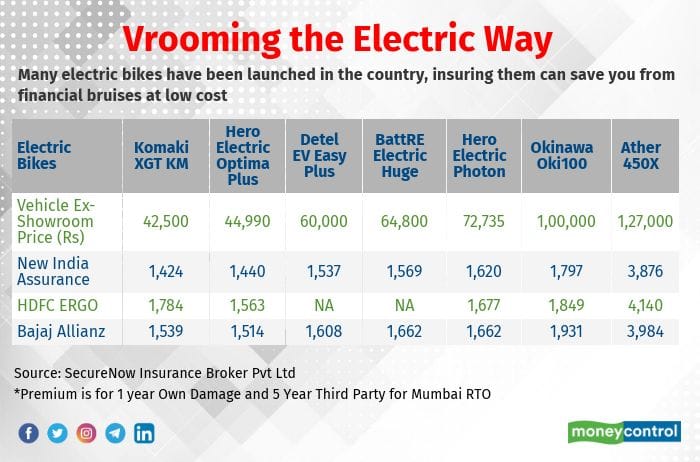

A third-party cover for any two-wheelers would cost Rs 1,000-3000 based on the engine capacity, for a period of five years. While a comprehensive policy would cost Rs 4,500-6000 based on the vehicle and the coverage. This would include compensation for even loss of vehicle due to theft. In which case, you must also have a license.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.