The National Pension System (NPS) may be growing in popularity as the instrument of choice for retirement planning but many do not make optimal use of the various investment strategies offered under the scheme.

For instance, many end up choosing auto allocation by default even when they have the time and bandwidth to go for active choice and ensure higher allocation to equities, which can lead to a significantly bigger retirement corpus over the long term, say financial advisors.

“For example, two years ago when we met a client we realised that he had chosen the auto option. We advised him to switch to active choice. This decision has made a difference of 25 percent (growth) to his portfolio,” says Harshad Chetanwala, financial planner and Co-founder, mywealthgrowth.com. This is primarily because the equity component in auto options tapers in line with the subscriber’s age, which is not the case with active choice. Even under the newly introduced balanced lifecycle fund, equity exposure is linked to the subscriber’s age.

Do note, however, that equity growth is a function of market performance and the bull run in Indian markets has had a role to play. If your investment horizon is over ten years and you have the risk appetite to stomach volatility in the interim, higher equity allocation throughout your investment tenure could mean higher returns compared to other asset classes. Besides equity, other asset classes that NPS offers are corporate debt, government securities and alternative assets.

Here’s a look at how active and auto choices work:

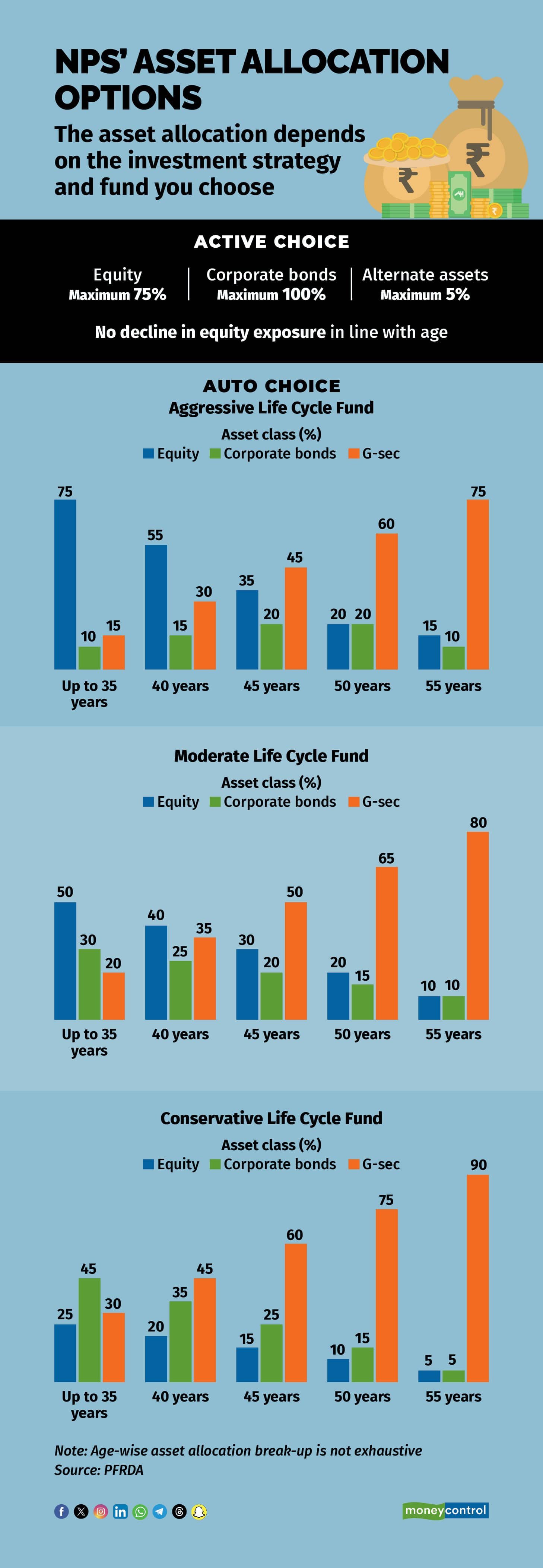

Auto choice for passive investorsNPS subscribers without time or expertise to keep track of asset allocation and performance can choose the auto mode. In this passive method of investing, the allocation across asset classes will be linked to your age in pre-agreed proportion through three life-cycle funds, with the equity portion remaining fixed until the age of 35 years and decreasing as you grow older. The objective is to insulate your corpus against market volatility, so that your corpus does not plummet drastically closer to retirement. Auto choice does not allow investment in alternative assets.

Within this option, you can choose between aggressive, moderate and conservative lifecycle funds. So, if a 35-year-old subscriber were to choose the aggressive plan, the maximum allocation would be 75 percent. However, this will gradually go down to 55 percent once the subscriber turns 40 and further to 15 percent at the age of 55 years.

If the subscriber chooses moderate or conservative funds, equity allocation is capped at 50 percent and 25 percent, respectively. A 55-year-old who is closer to retirement will get an equity allocation of 15 percent, 10 percent and 5 percent under aggressive, moderate and conservative funds respectively.

Also read: NPS Vatsalya: Why children’s pension cannot be priority over education or parents' retirement plans

Active choice for savvy investorsBetter suited for financially aware investors, the active choice allows the flexibility to decide asset allocation, though some restrictions exist. For one, even for younger investors (up to the age of 35 years), equity allocation cannot exceed 75 percent. Not more than 5 percent of your contribution can be invested in alternative assets. The objective is to rein in the propensity to take risk by going all out on equity investments. Even risk-averse investors can make use of this choice and invest up to 100 percent in both corporate debt and government securities, as these are considered to be ‘safer’ avenues.

Also read: Active vs Auto: Which National Pension System (NPS) investment choice is better?

Chetanwala is of the firm opinion that active choice is a preferable option due to the freedom it offers. “For a 40-year-old, the difference in equity allocation under active choice and aggressive life cycle fund is substantial (20 percentage points). Now, this individual has more than ten years to retire. So, a higher equity component over this period can make a huge difference to your portfolio,” he says.

As mentioned earlier, active choice is better suited for investors with greater risk-taking capacity who understand and closely monitor financial markets and can make changes to their portfolios based on market conditions.

On the other hand, auto choice is a passive option linked to age, where investors do not need to keep track of market movements once they take their pick. “NPS is meant to create a substantial retirement corpus for your retirement years. For those who are not savvy, it may not be easy to make the right calls all the time. A pre-defined allocation strategy can help reduce risks,” says Pankaj Mathpal, Founder, Optima Money Managers, pointing to auto choice’s advantages. However, if you have the ability to take on higher risks, you can still select the active choice.

A similar approach will come in handy while choosing between aggressive, moderate and conservative lifecycle funds. “Besides risk appetite, it also depends on your age, and thus, investment horizon. If you are 30 (and retirement is over 25 years away), you can choose the aggressive option where equity allocation can go up to 75 percent. Equity is meant for wealth creation over the long term. Those who are around 40 can choose the moderate plan, while subscribers closer to retirement can opt for the conservative lifecycle fund,” says Mathpal.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.