In 2023, retail lending grew by 18 percent year-on-year (YoY), with unsecured lending (loans not backed by collateral) continuing to see high growth. Personal loans and credit card spending grew at 22 percent and 28 percent respectively, as per the latest Reserve Bank of India (RBI) sectoral credit growth data in the sixth edition of the BankBazaar Moneymood Report. The report summarises retail credit trends in the year gone by and expectations for 2024.

India now has 94 million credit cards that service transactions worth Rs 5,577 on average. As per Bankbazaar, the average personal loan amount disbursed in 2023 was Rs 1.71 lakh.

High-interest rates and elevated inflation did little to slow down the demand for credit.

One of the key developments in 2023 was the RBI applying the brakes on unsecured and small-ticket loans. This has been seen as the central bank proactively managing the excess growth of small loans before asset quality worsens in this category.

Impact of increase in risk weights

In 2023, the RBI raised risk weights on loan categories including credit cards, personal loans, consumer durable loans, and loans to non-banking financiers to curb excessive lending in these riskier segments.

Therefore, lenders (banks and NBFCs) are now required to maintain higher capital reserves for riskier loan categories. For instance, earlier, for every Rs 100 in personal loan receivables, the risk-weighted assets would have to be 100 percent of Rs 100, that is, Rs 100.

Now, after the increase in this to 125 percent, the risk-weighted assets become 125 percent of Rs 100, that is, Rs 125. So, assuming a 9 percent capital adequacy ratio (CAR), the bank would need to now set aside 9 percent of Rs 125, which comes to Rs 11.25 compared with Rs 9 at 9 percent of Rs 100 earlier. Therefore, the increase in capital requirement is Rs 11.25 minus Rs 9 = Rs 2.25 for every Rs 100 in personal loan receivables or 20 percent. This means the bank must put aside more funds, reducing the amount it can lend.

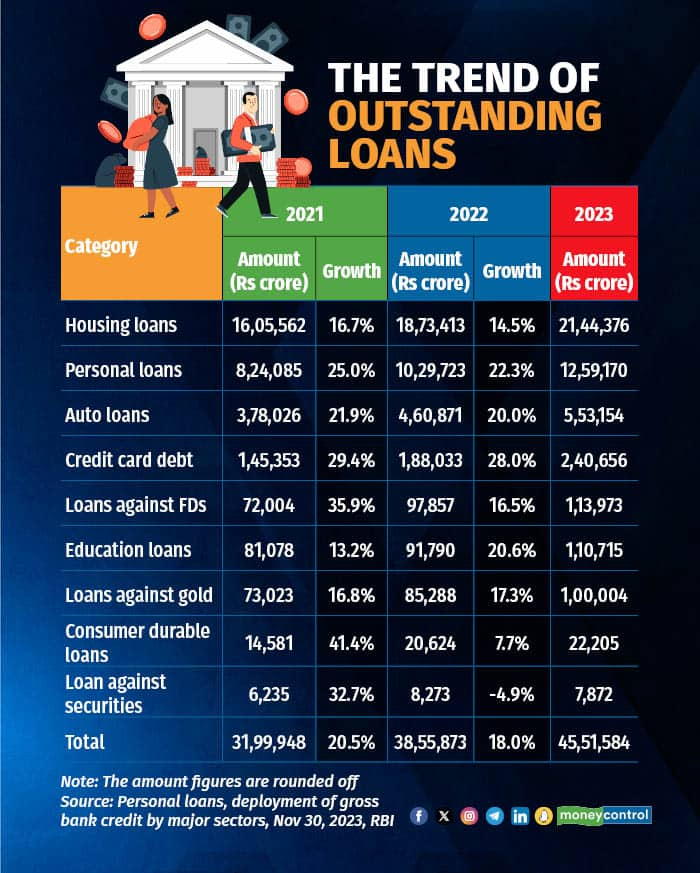

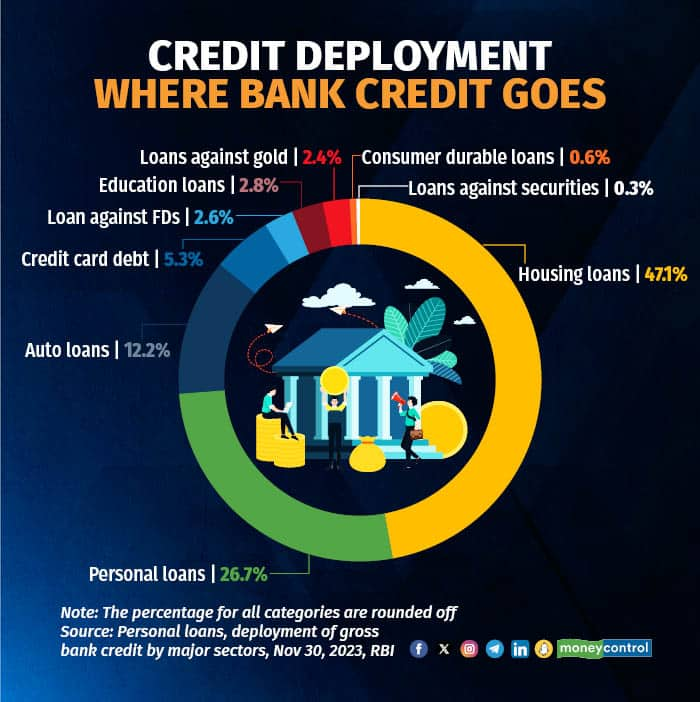

Top four categories of loans account for 92 percent of the debt

Year 2023 was another year of high credit demand, despite elevated interest rates. Some segments continued to grow faster than others. Housing loans, which make up 47 percent of the retail pie, grew 14.5 percent YoY to Rs 2.14 lakh crore, while auto loans capped another year of 20 percent YoY growth to Rs 5.53 lakh crore. However, the share of home and auto loans slipped 127 basis points (bps) to 59 percent of the retail credit pie, while the share of personal loans and credit card dues grew 137 bps to 33 percent. One bps is one-hundredth of a percentage point.

These top four categories grew by a robust 18 percent to Rs 41.97 lakh crore even as we saw a slowdown in consumer durable loans (refer to graphic).

In 2023, there was a slump in the consumer durable loans segment, which grew by only 7.7 percent YoY, compared to a whopping 41.4 percent in 2022. The education loan segment was back on track after slow growth in 2022 (refer to graphic).

“In 2024, hopes are high of inflation easing from its current levels, which will cool down interest rates, too,” says Adhil Shetty, Chief Executive Officer (CEO), BankBazaar.com. He adds that when that happens, loans will be cheaper. But with the RBI’s risk weight tweak, high-risk, small-ticket lending will draw back. Prime borrowers will continue to get the best loan offers, but it will be harder for subprime borrowers as lending to the risky segment tightens.

Home loan growth was slower compared to last year

According to the BankBazaar Aspiration Index, in 2023, home ownership continued to be one of the top three goals. The demand for home loans continued its upward trajectory despite higher interest rates, and the loan book of banks grew above Rs 21 lakh crore. However, growth was slower compared to last year (refer to graphic), and loan ticket sizes continued to rise. In 2023 -- the average home loan ticket size disbursed on Bankbazaar was Rs 28.19 lakh. For metros, the average home loan ticket size was Rs 33.10 lakh, and for non-metros, it was Rs 22.81 lakh.

According to the report, in 2024, if inflation eases, an interest rate reversal could take the housing market to new heights. The falling rates will help all borrowers.

Personal loans grew 22 percent, but ticket size declines

As per the study of personal loan trends in BankBazaar’s Moneymood 2024 report, the average personal loan ticket size had been declining since 2019; the trend continued in 2023.

According to the report, while personal loans grew by 22 percent YoY, buoyed by global and local demand and a steady supply of innovative products that allowed customers to access small-ticket loans, the recent increase in risk weights for personal loans has made them more expensive and harder to get.

Shetty expects that in 2024, the unsecured loan landscape will change and adapt to the RBI’s new rules. Well-capitalised lenders will do well, but stressed lenders will struggle. “The demand, especially for small-ticket loans, will remain high. At the same time, the higher risk weights are going to have an impact on how fast unsecured loans grow as small-ticket loan providers become more cautious,” says Shetty.

Also read | Personal loan or gold loan: Which is the winner if you need money urgently?

Co-brands and collaborations to drive credit card growth

As per credit card spending trends in the report, the number of credit cards outstanding crossed 94.7 million in October 2023. In tandem, credit card spends surged to record levels, hitting Rs 1.79 lakh crore. Average spend per card grew to Rs 5,577 from Rs 5,052 last year in the Diwali month — an increase of 10.4 percent YoY (refer to graphic).

“In 2023, co-branded cards continued to be the flavour as banks and fintechs increasingly partnered to come up with innovative products in a time of shrinking rewards,” says Shetty. These trends were amply supported by RBI policies that allowed customers to choose their network provider and saw credit cards expand to UPI, he adds.

However, in 2024, it remains to be seen how an increase in risk weights would affect the credit card segment. With Rupay cards now available on UPI, it is only a matter of time before other networks also get to leverage UPI. Shetty expects credit cards to continue to remain the preferred instrument for larger spends and the average spends set to rise. Collaborations between fintechs and banks will continue to draw a larger segment of new users with tailor-made rewards and benefits, he adds.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.