A 250-basis-point hike in the repo rate since May 2022 has hit most Indians rather hard in terms of higher borrowing costs. This has in turn impacted people’s aspirations, as reflected in changes in the purpose for which they borrow money, according to online financial products marketplace BankBazaar.com’s Aspirations Index (BAI), 2023.

For example, 47 percent of loan applicants availed of credit to build or buy a house in 2023, compared to 49 percent in 2022. Similarly, a smaller percentage — 32 percent in 2023 versus 35 in 2022 — took an education loan. On the other hand, the percentage of those borrowing for medical and other emergencies was higher in 2023 than 2022. (see graphic)

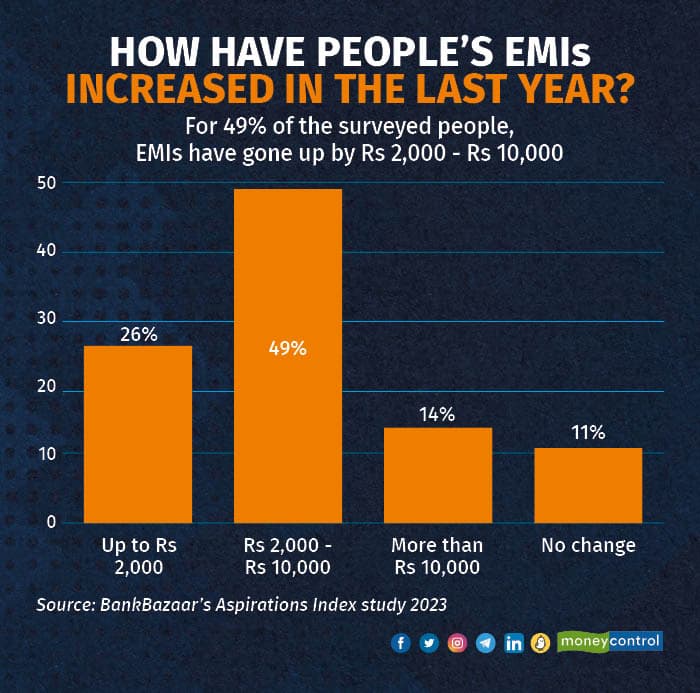

Before the RBI pressed the pause button in April 2023, the central bank undertook multiple rate hikes. The repo rate went from 4 percent before May 2022 to 6.5 percent by February 2023. As a result, borrowers saw their EMIs (equated monthly instalments) and / or loan tenures balloon. Per the report, 49 percent of those surveyed experienced a Rs 2,000 to 10,000 hike in their EMI over the past year. (see graphic)

The BankBazaar.com study shows a drop in people’s aspirations in 2023 compared to the year prior. The index is down from 87.3 in 2022 to 85.3 in 2023. This fall has been driven by a rise in living and borrowing costs.

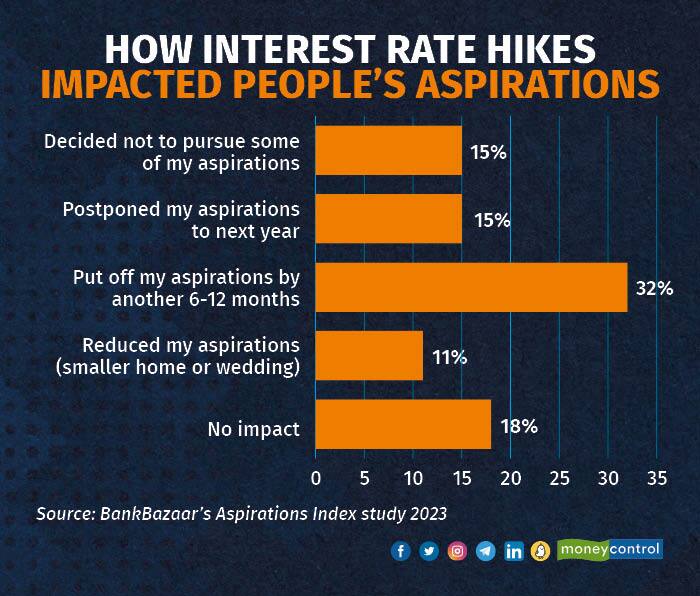

What’s heartening, however, according to the report, is that many have actually decided to postpone their aspirations rather than trim or drop them. (see graphic)

The study surveyed 1,732 professionals in the 22-45 age group across 17 goals categorised into five aspirations — Health, Relationships, Wealth, Fame, and Personal Growth — from a personal finance perspective. The study covered those with a monthly salary of over Rs 30,000 across six metros and over 18 tier-2 cities. The index has been constructed based on responses to three questions — importance of a goal, how confident one was of achieving it, and how prepared (financially or otherwise) one was for the same — with respect to each of these 17 goals.

Also read: Credit card rewards: When the wrong Merchant Category Code can be costly for cardholdersWhat are people aspiring toHealth remains the number one aspiration, followed by Relationships and Wealth. Each of the aspirations, in turn, are based on certain goals (see graphic).

Mental health and happiness has emerged as the top goal for the second time in a row. Saving and investing for one’s children’s education and buying a house are the next two top goals per the Aspirations Index.

What’s worth noting is that mental health, which is the top goal, also has the highest ever aspiration-readiness gap. That is, the gap between one’s aspiration and the extent to which one is prepared for it.

Adhil Shetty, founder and CEO, BankBazaar.com says, “We suspect this has to do with the pandemic. On the one hand, we were all battling tremendous stress and anxiety of the kind we've never experienced for a sustained period. On the other, this was also the time when far more awareness was generated about mental health issues.”

Biggest hurdlesThe study highlights some key hurdles that stand in the way of one’s aspirations. According to the report, high cost of living followed by work pressure were the top hurdles. For women respondents, it was family responsibilities, followed by high cost of living, and work pressures. With offices having re-opened post Covid, people have returned to the cities. This has added to their cost of living.

Also read: Don’t be loanly: Perk up your credit profile with these tipsEarly retirementWhile early retirement still figures among the top goals for 20 percent of the respondents, it has gone down in importance — from sixth position in 2022 to ninth in 2023. Not just that, the number of people with a retirement corpus fell from 60 percent last year to 56 percent this year.

But on a positive note, the percentage of those with a retirement corpus of Rs 2 crore or more has gone up from 14 percent in 2022 to 20 percent in 2023.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.