One thing that every borrower values is certainty – the comfort of knowing that their EMI (equated monthly instalment) will remain unchanged throughout the tenure of the loan.

Bank of Baroda recently introduced fixed-rate car loans. Until last week, the bank offered only floating-rate loans. Now it offers both. Depending on your credit score, you can get a loan for a new car from Bank of Baroda at a fixed rate of 8.70 to 11.15 percent or a floating rate (linked to the repo rate) of 8.85 to 12.15 percent.

When it comes to car loans, banks provide a range of interest rate options.

“Private sector banks usually offer car loans at fixed interest rates while public sector banks usually offer them at floating interest rates. However, some banks offer loans at both fixed and floating rates,” said Sahil Arora, business head, unsecured loans, at Paisabazaar.

IDFC FIRST Bank, IDBI Bank and Punjab National Bank are a few other lenders that offer both options.

Possibility of lower rateWith the Reserve Bank of India pausing its interest rate increases and further hikes looking less likely than before, a floating-rate car loan looks tempting. But when the RBI will eventually begin cutting the repo rate (thereby lowering the cost of a floating rate car loan) is anybody’s guess.

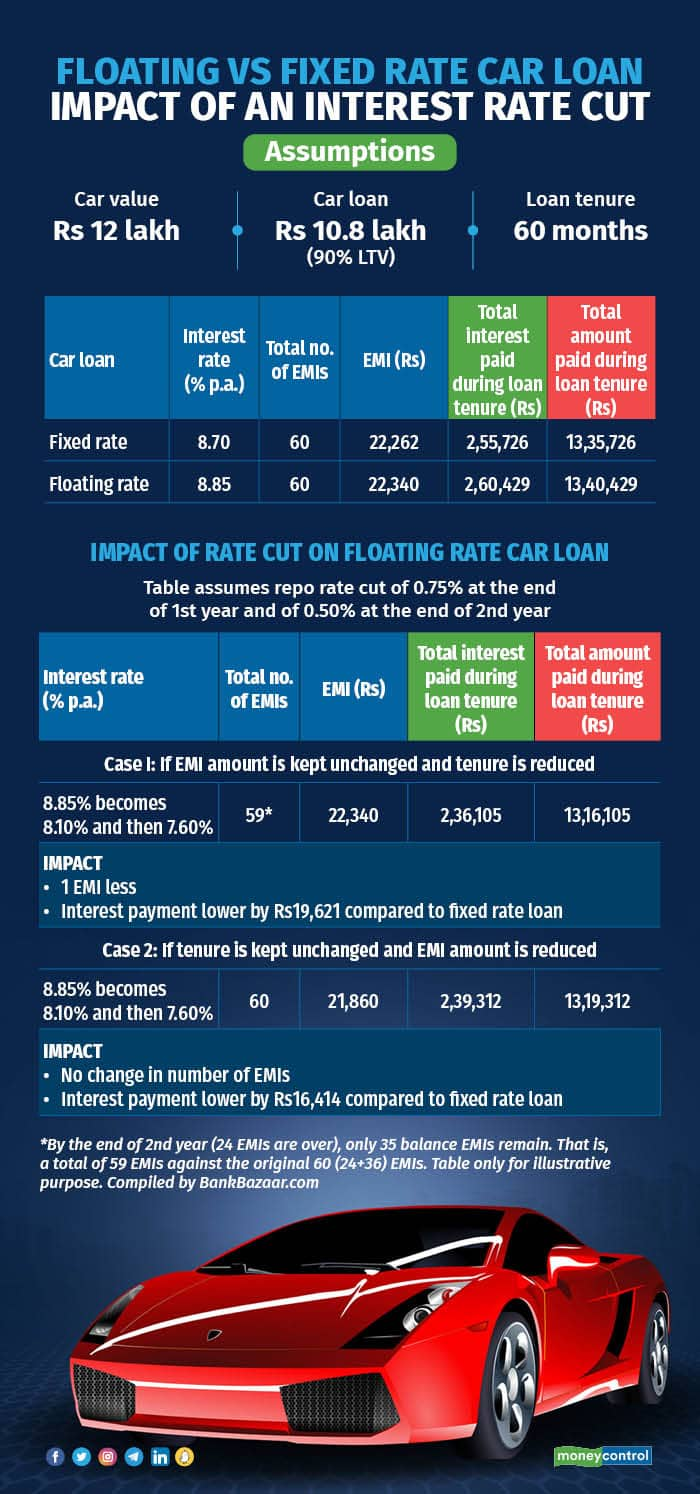

On the other hand, a fixed-rate car loan offers the certainty of an unchanged rate throughout the loan tenure and, as in the case of Bank of Baroda, even a lower rate of interest to start with. The bank offers a fixed rate of 8.70 percent (8.65 percent for electric vehicles) and a floating rate of 8.85 percent on pre-paying to those with a credit score of 771 or higher. (See table for details)

The table shows the bank-wise range of interest rates. The rate that a bank finally offers depends on factors such as a person’s credit score, the loan tenure, type of vehicle – electric or non-electric – and, in some cases, whether the applicant is a bank’s existing home loan customer.

While deciding between floating and fixed rate loans, another factor to consider is the loan tenure.

According to Tivesh Shah, founder, Tru-Worth Finsultants, if the tenure is short – say three years – then a large component of the EMI will go towards principal re-payment from the start itself, so a rate difference of 0.5 to 1 percentage point (under a floating-rate loan) won't make much difference.

For longer-term borrowings such as home loans, the bulk of the EMI in the first half of the repayment period goes towards paying interest and a smaller portion goes towards principal re-payment. In such a situation, a change in the interest rate in the initial years can have a significant impact on your loan liability.

“It is highly probable that we may continue with stable interest rates for the next two years or so if the global scenarios remain the same, before the rates start moving downwards,” Shah said.

Given these factors, he suggested that one should choose a fixed interest rate car loan for shorter tenures.

Adhil Shetty, CEO of BankBazaar.com, has a similar view.

“The difference in interest rates on fixed and floating loans for short-term loans is not always very large. Often, the fixed rates may be priced lower than the floating rate by 5-10 basis points, especially if interest rates are expected to go down,” said Shetty.

When it comes to longer-tenure car loans, say five years and above, there are divergent views.

“If you are looking at a longer tenure of around four to eight years or if the rates seem to be in a downswing, you may be better off with a floating rate loan,” Shetty said.

Arora offered a different perspective.

“Those with a loan tenure of five to seven years and planning to stay put (not make pre-payments) should note that there can be multiple reversals in the interest rate regime during their loan tenure. So, if you prefer certainty in your EMIs, you can opt for a fixed-rate car loan,” said Arora.

Here are some numbers (table below) that show how rate changes can impact your floating rate loan.

There’s another factor to consider when opting for a fixed-rate car loan. Unlike a floating-rate loan that has no pre-payment penalty, there may be charges or conditions attached to pre-paying or foreclosing (fully paying off) a fixed-rate loan before a certain minimum period.

State Bank of India, which offers only fixed-rate car loans, does not levy any pre-payment charge but levies foreclosure charges at the rate of 2 percent of the closure amount (plus GST) if the loan is closed within a year of disbursal. There are no foreclosure charges after one year.

Bank of Baroda does not levy any pre-payment charge on its floating-rate car loans. On its fixed-rate loans, the bank does not levy any charge for pre-payments of up to Rs 40,000 (cumulatively) in the first two years. After two years, there is no charge for pre-payment, irrespective of the amount.

So, if you opt for a shorter-tenure car loan (up to three years) today, a fixed-rate loan can be a good choice. You can get the loan at a competitive rate (lower than floating rates) and also have the comfort of rate certainty during the loan tenure.

If you are considering a five to seven-year loan and don’t want any rate uncertainty, then opt for a fixed-rate loan. If you intend to pay off your loan earlier, then a floating-rate loan might offer you more flexibility.

Also read: Increase home loan EMIs or tenure: What should borrowers do?Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.