On February 8, the Reserve Bank of India (RBI) Governor Shaktikanta Das announced a 25 basis-point (bps) hike in the repo rate to 6.50 percent, its highest level since August 2018. The central bank has hiked rates by a cumulative 250 bps since it started the rate tightening cycle in May 2022. The repo rate was 4 percent a year ago.

The consecutive rate hikes are affecting individual borrowers who have taken or are looking for floating-rate home, car and consumer durable loans. “The continuous increase in interest rates will dampen the sentiment of borrowing for individuals,” says Harsh Vardhan Patodia, president of the real estate developers’ body, CREDAI.

Rate hike impact on home loan borrowers

All floating-rate retail loans sanctioned by banks after October 1, 2019, are linked to an external benchmark, which is the repo rate in most cases. So home loans linked to repo rates would have the quickest transmission of increased policy rates.

Most banks have fully passed on the repo rate increase of 225 bps to the consumers of home loans till date.

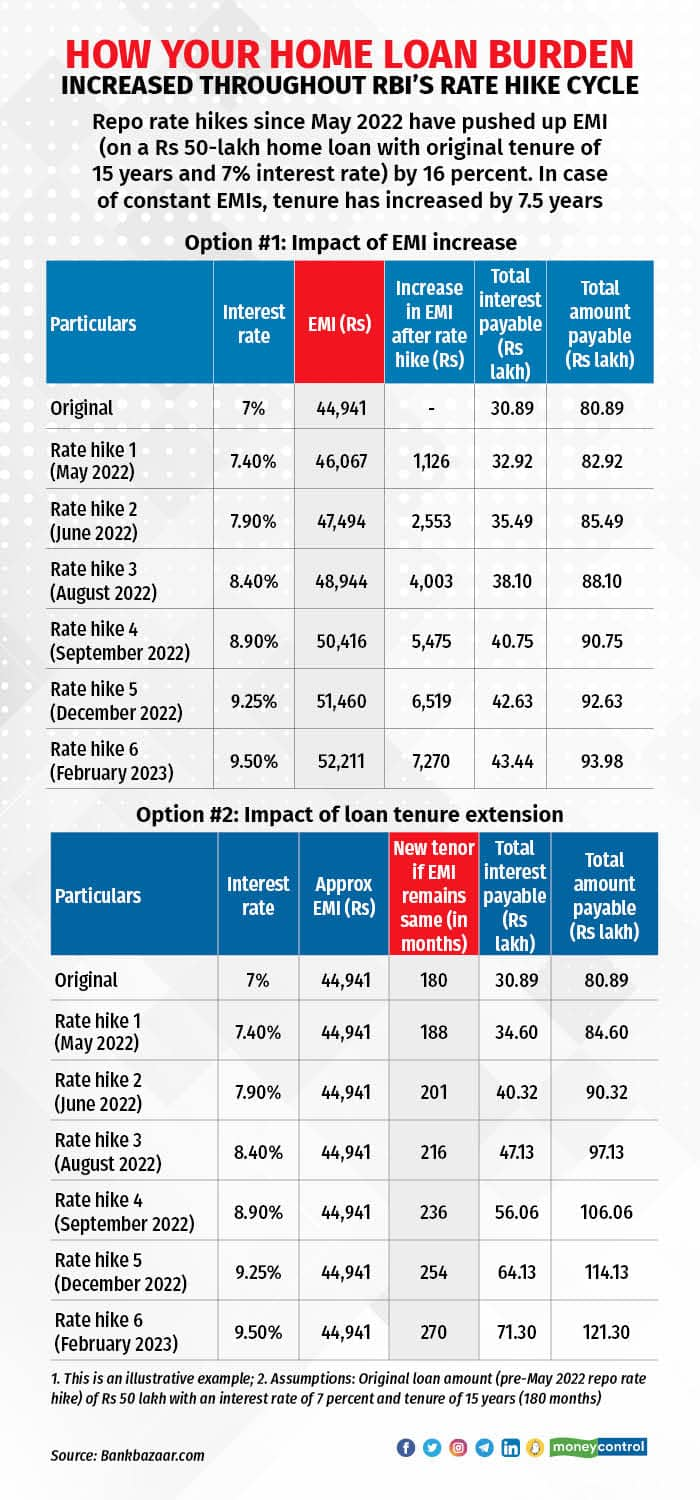

Back-of-the-envelope calculations show that if you had taken a home loan of Rs 50 lakh for a 15-year period, a rate hike of 250 bps will result in increase of interest outgo by Rs 12.5 lakh, assuming you choose the option to increase the EMI (see graphic).

“Lenders have done their utmost to mitigate this impact and keep equated monthly instalments (EMIs) at the same level by lengthening loan duration whenever possible,” says Anuj Sharma, chief operations officer, India Mortgage Guarantee Corporation. He adds that with the latest rise in repo rate, banks’ ability to assist borrowers is limited (as loan term extensions have already been exhausted), and the increase would eventually be passed on to borrowers, increasing the monthly payments.

The EMI burden has shot up substantially in the past 10 months, and any further increase in interest rates will make it more difficult for new borrowers to be eligible for home loans.

The repayment challenge

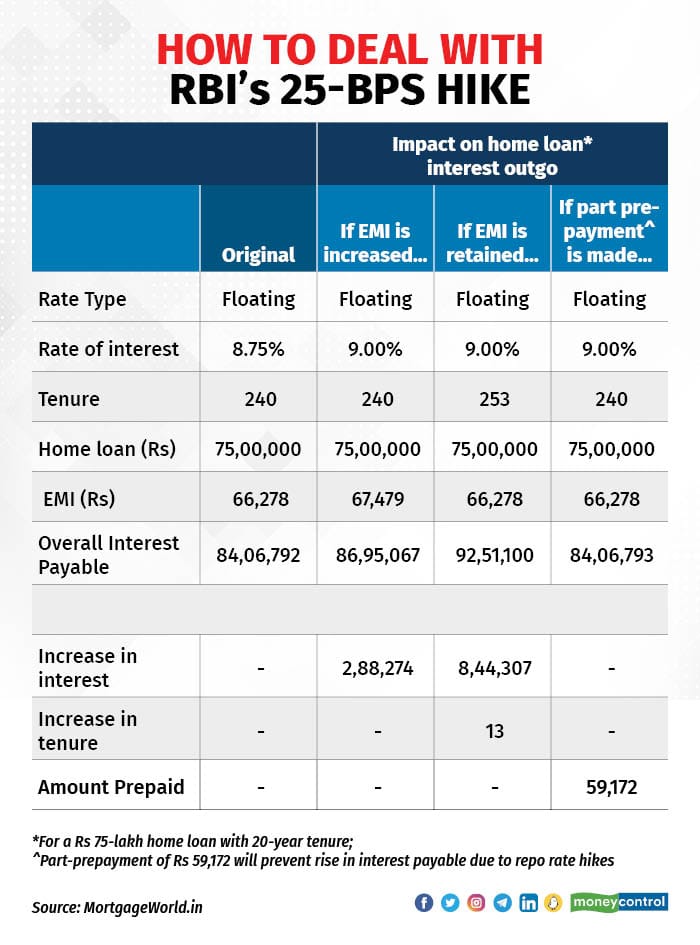

If you keep the EMI constant and, instead, increase the loan tenure, you end up paying higher interest. Assume you are currently servicing a home loan of Rs 75 lakh, with an interest rate of 8.75 percent, and the original tenure was 20 years or 240 months.

After today’s the hike in interest rates, if you wish to keep the EMI steady, your loan tenure goes up to 253 months. But this means that your interest payout also increases by roughly Rs 8.4 lakh. “If you increase just the EMIs, the overall additional interest burden will be Rs 2.88 lakh,” says Vipul Patel, Founder, MortgageWorld, a loan consultancy firm (see table).

Dip into savings and prepay

Patel adds that it might be difficult to voluntarily increase EMIs at this stage given the job insecurity situation. Many in the tech sector have had to face being laid off, there is paucity of funds and cash flows are under strain. Maintaining cash flows is important.

So you could consider making part-prepayment of the loan out of your savings and investments rather than increasing EMIs. Long-term loans like those for housing allow this and in a rising interest rate environment, rethink your repayment strategy. Just an extra few thousand every month can reduce your interest payout over the long term.

“Prepaying your home loan as and when funds are available can do wonders and shorten your ballooning loan tenor,” says Adhil Shetty, CEO, BankBazaar.com.

“At 9 percent-plus home loan rates, the opportunity cost of retaining money in alternate asset classes diminishes considerably,” says Arun Ramamurthy, director, Andromeda Sales and Distribution, a distributor of loan products and credit cards.

He adds that this is even more so considering the new tax regime which has no exceptions for home loan interest payments. The post-tax interest rate on a home loan is around 13 percent, which is tough to generate over a long-time frame from other asset classes, and that too with acceptable risk.

A good strategy is to earmark a portion of your annual bonus to prepay your housing loan every year.

Increase the EMIs annually

Financial advisors suggest increasing the EMIs once a year by a certain percentage as per your saving ability. “For instance, a 20-year home loan can be repaid in 12 years if you prepay 5 percent of the loan balance once a year. You could go faster or slower depending on your financial situation,” says Shetty. He adds that a home loan is a low-cost loan so for most, it makes sense to repay it slowly while balancing it with investing needs.

Also read: What should debt fund investors do as RBI hikes repo rate?

Switch the lender

Even in a high interest rate scenario, there will always be opportunities to switch. “At present, your existing lender may not look to retain you as a customer if you were to get a better deal. But you should actively look to switch even if the difference between the rates offered by existing and new lenders is just 35-50 basis points,” says Patel.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.