Rising aspirations are also adding to EMIs — home loans to own a piece of the city, education loans to secure a better future… the list continues to grow. Juggling multiple EMIs is now a reality millions of households are living with.

Amid growing burden, debt consolidation has emerged as a prudent strategy. Rolling all existing loans into one new loan — typically a lower-interest loan via banks can ease cash flow amid rising living costs.

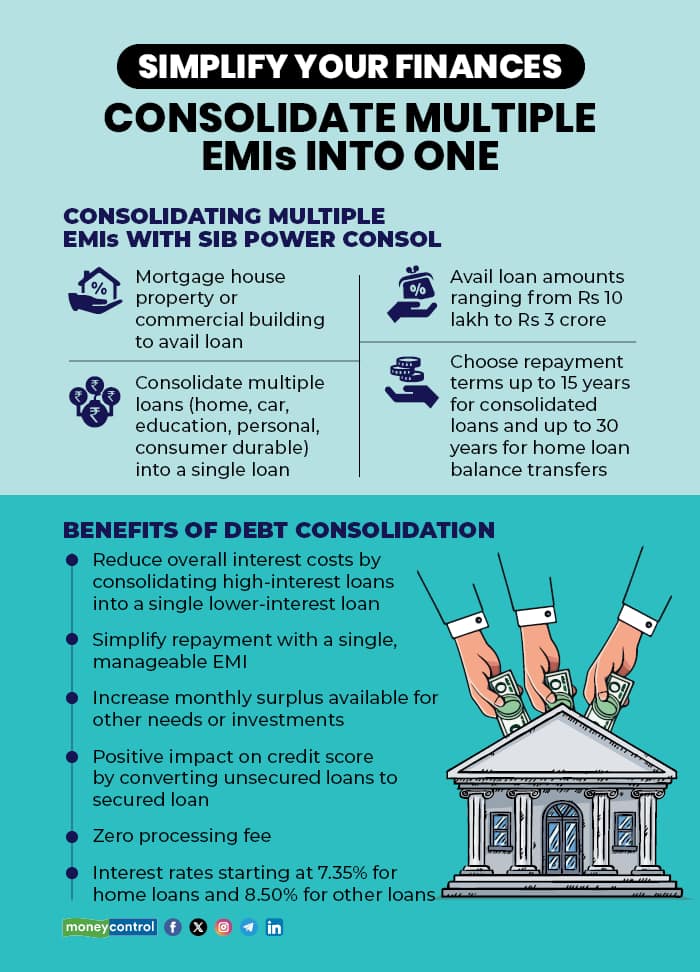

South Indian Bank (SIB) has launched SIB Power CONSOL, a new loan product designed to help customers reorganise and manage multiple debts more efficiently, with reduced interest rates and unified EMI.

What it offers?

SIB Power CONSOL enables customers to consolidate various loans, including home loans, car loans, education loans, personal loans, and consumer durable loans, into a single loan with a lower interest rate and unified EMI.

The bank acts as a debt counsellor, offering customers a clearer and more manageable repayment structure.

This is a property-based loan where the customer can mortgage either house property or commercial buildings and borrow up to 75 percent of the property value, optimising its worth without disposing it.

Individuals can avail consolidation loans ranging from Rs 10 lakh to Rs 3 crore, with repayment terms of up to 15 years for consolidated loans and up to 30 years for home loan balance transfers.

Targeted at salaried customers, self-employed professionals, self-employed non-professionals between 30 and 55 years of age, the product aims to simplify repayment and reduce the financial burden caused by managing multiple loans at once.

“Debt consolidation is a way to simplify your financial life by merging various loans and credit card balances into one loan, often at a reduced interest rate. That way, you can focus on a single payment,” Raj Khosla, MD, MyMoneyMantra.com, said. This unified approach enhances control over finances, often leading to interest savings.

Also read | NFO launches surges across hybrid, index and thematic mutual funds but should investors jump in?

How it works?

Once the loan is approved, SIB will clear the customer’s outstanding dues, replacing them with a single, manageable monthly repayment aligned with their current financial capacity.

The processing fee is zero. Home loan consolidation interest rates start at 7.35 percent, while other loan consolidation rates start at 8.5 percent.

Benefits of consolidating debt

The primary advantage is reducing overall interest costs by consolidating high-interest loans into fewer, lower-interest loans. “Consequently, the total EMI outflow should also come down - reducing the debt burden and increasing the monthly surplus available for other personal needs (or investments),” said Parijat Garg, a digital lending consultant.

One operational benefit would be to not worry about ensuring enough balance in the bank account for multiple EMIs getting debited on different dates.

“Converting several unsecured loans to a higher outstanding secured loan would over a period time have a positive effect on one's credit score too, which can further in time reduce the applicable rate of interest,” Garg said.

Should you opt for it?

This secured loan, with a minimum ticket size of Rs 10 lakh, targets customers with good credit profiles and collateral.

"It's suitable for self-employed individuals with multiple high-interest unsecured business loans (18-36 percent interest p.a.) and a loan against property, allowing them to consolidate debt using property collateral," Garg said. For salaried individuals, it appears to be a balance transfer option.

When considering consolidation, assess the overall impact. "Foreclosing loans may incur 2-4 percent charges, and extending loan tenure can increase total interest paid," said Garg.

Evaluate savings based on total interest outflow, not just monthly EMI or interest rate. Prioritise consolidating loans with early tenure, as interest components are higher in initial years.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.