For home loan borrowers, the golden phase of low-interest rates during the Covid pandemic is well and truly over.

With the Reserve Bank of India (RBI) announcing a 50 basis-point (bps) repo rate hike on Friday, aimed at curbing inflation, the repo is back to the pre-pandemic level of 5.40 percent. This is the third rate increase this financial year, starting with the unscheduled revision of 40 bps (one basis point is 0.01 percentage point) in May 2022. The cumulative repo rate hike between May and August stands at 140 basis points.

Borrowers to feel the heat of the hike

All floating-rate retail loans sanctioned by banks after October 1, 2019, are linked to an external benchmark, which is the repo rate in case of most banks.

“Home loans and other retail loans linked to repo rates will witness the quickest transmission of policy rate hikes,” says Naveen Kukreja, CEO and co-founder, Paisabazaar.

Home loans linked to older interest rate systems – Marginal Cost of Funds-based Lending Rate (MCLR) and Base Rate – too will also turn expensive, with the higher repo rate pushing up their cost of funds.

What should borrowers do?

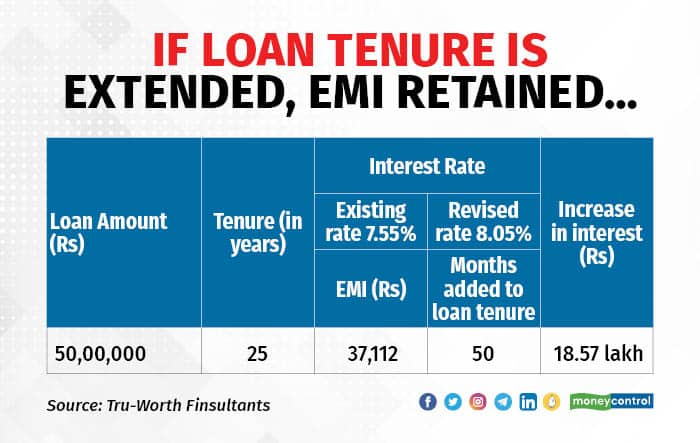

Usually, banks tend to extend the loan tenure when rates rise, instead of increasing the equated monthly instalment (EMI). You can either let the bank do so or choose to increase the (EMI). “Opting for tenure extension will result in higher interest cost than increasing the EMI,” says Kukreja.

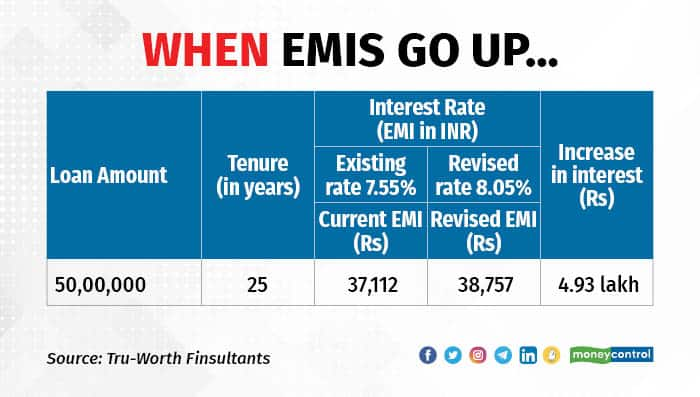

For instance, suppose you have taken a Rs 50-lakh home loan at 7.55 percent interest per annum, with a tenure of 25 years. The EMI will be Rs 37,112. After the 50 bps hike, the revised rate will be 8.05 percent. If you do not choose to increase the tenure, the EMI will go up to Rs 38,757 (see graphic), and you will shell out Rs 1,645 more per month. The overall increase in interest burden over 25 years will be Rs 4.93 lakh.

Since banks prefer extending the loan tenure, interest outgo for home loan borrowers can rise sharply over tenures of 15-25 years.

In the same illustration, if the bank decides to extend the loan tenure while keeping the EMI intact, the repayment period will increase by over 50 months. This means that the additional interest payout due to the interest rate revision, over 29 years and two months, will be close to Rs 18.57 lakh.

Prepay to save on interest outgo

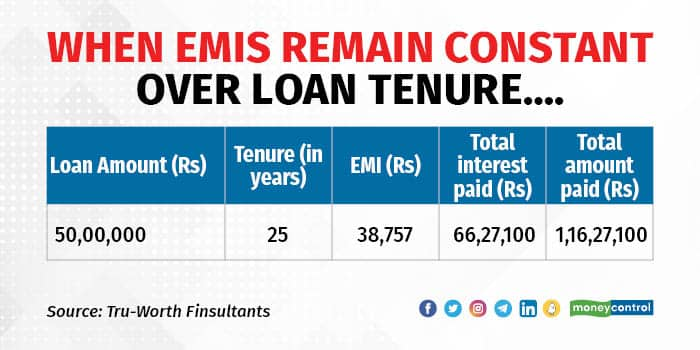

Consider that you have taken a home loan of Rs 50 lakh at 8.05 percent over a 25-year tenure. The EMI would be Rs 38,757. If you continue to pay your regular EMI without any prepayments, then you will end up paying out a total interest of Rs 66.27 lakh over 25 years.

“Avoiding such a heavy interest burden is what drives most people towards prepayments,” says Dev Ashish, a SEBI-registered investment advisor (RIA), and founder, StableInvestor. He adds that in a rising rate environment, rethink your loan repayment strategy and consider making prepayments to save on rising interest cost.

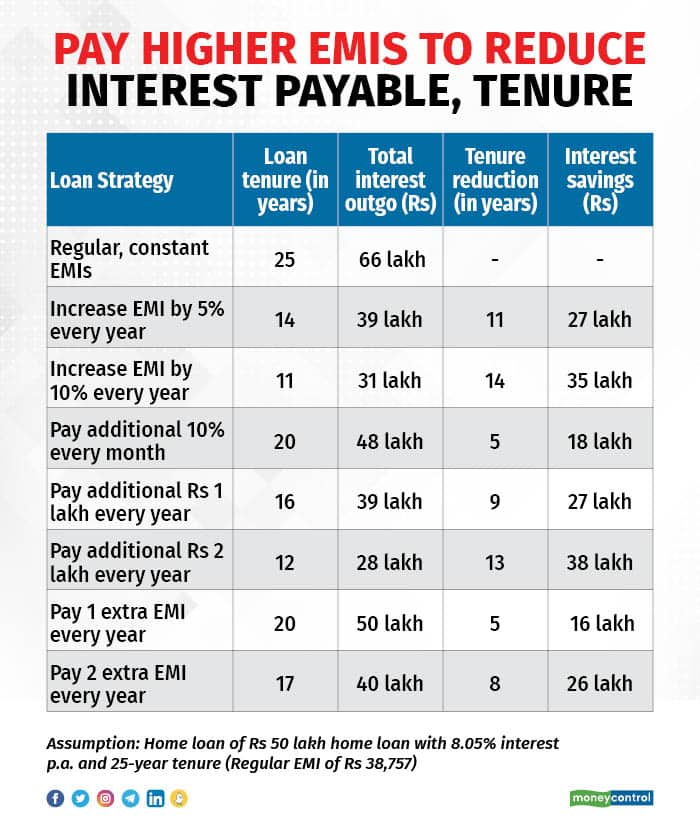

Here are four strategies to reduce your home loan burden. The illustrations here take into account a Rs 50-lakh home loan with a 25-year tenure and interest rate of 8.05 percent (EMI Rs 38,757).

Increase your EMIs by 5-10 percent every year

Systematic, regular prepayments can go a long way in reducing your home loan outstanding amount. “Your salary increases annually. In the same manner, consider increasing EMIs every year,” suggests Ashish. Look at increasing your EMIs by at least five percent every year. As a result, your 25-year home loan will be paid off in just 14 years and your interest cost will be much lower, i.e., Rs 39 lakh.

However, if you choose not to increase your EMIs you would end up paying an interest of Rs 66 lakh during the tenure. If you could increase your EMIs by 10 percent, then your savings would be even higher. Your liability will end in the 11th year and you will only pay Rs 31.37 lakh as interest, resulting in total savings of around Rs 35 lakh on interest outgo.

Pay 10 percent more EMI every month

Restructure your monthly expenses to generate more savings. On your regular EMI of Rs 38,757, add 10 percent (Rs 3,875) and pay a monthly EMI of Rs 42,632 through the loan tenure. This will help you save Rs 18 lakh on interest payments and close your loan by the 20th year.

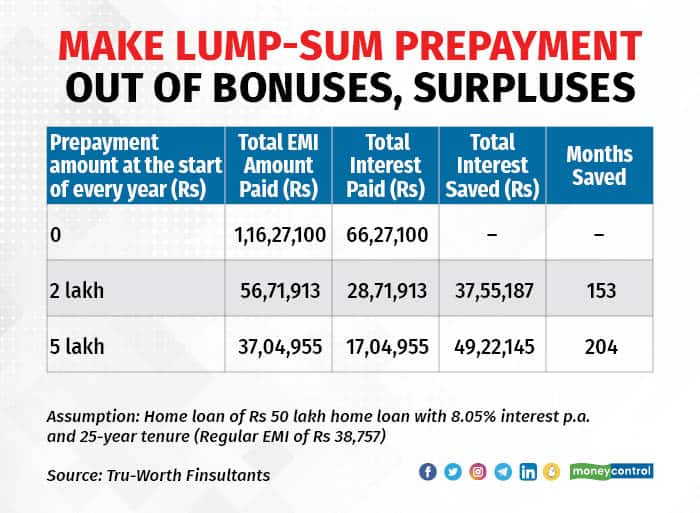

Make lump-sum prepayment

If rejigging your monthly budget to increase EMIs looks difficult, dip into annual bonuses. If you could pre-pay Rs 1 lakh every year, you can reduce interest outgo by Rs 27 lakh and clear the loan in the 16th year. A higher pre-payment amount will naturally mean greater reduction in overall interest payable.

Pay an extra EMI every year

A smaller lump-sum – say, an extra EMI – can also result in large savings. For instance, one additional EMI per year will reduce your interest outgo by Rs 16 lakh and tenure by five years.

You can pick any of these strategies to reduce your loan burden and pre-closing your loan earlier. “Borrowers can look at combining the above strategies as well to further accelerate the prepayment plan,” says Ashish. For example, increasing the EMI by 10 percent every year and also using one’s bonus to pre-pay Rs 1 lakh annually.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!