All good things, as they say, must come to an end.

For close to four years, including the last two COVID-19-hit years since March 2020, when home loan rates touched 15-year-lows, borrowers have enjoyed a benign interest rate regime.

But now they have to make peace with the rising interest rate cycle. On May 4, the Reserve Bank of India (RBI) started withdrawing the accommodative measures introduced during the pandemic with a 40-basis point (bp), unscheduled repo rate hike (one basis point = 0.01 percentage point). On Monday, RBI Governor Shaktikanta Das announced another steep increase of 50 bps, to take the repo rate to 4.9 percent.

Home loan borrowers will start feeling the pinch of the latest hike once their banks reset their repo-rate-linked lending rates (RLLR). So, if your current home loan rate is 7.05 percent—up from 6.65 percent before the May rate hike took effect—it will go up to 7.55 percent. All retail floating-rate loans sanctioned after October 1, 2019, are linked to an external benchmark, which in the case of most banks is the repo rate. Therefore, all banks will pass on the entire rate increase to their borrowers.

Also read: Borrowers to see steep hike in EMIs, interest burdenRead on to find out how you can blunt the rate rise impact.

Increase your EMI payoutTypically, banks tend to extend the loan tenure instead of increasing the EMI, or equated monthly installment, when interest rates rise. Unless that is, your current repayment tenure is the maximum that you are eligible for due to your age. While it makes EMI payments easier for borrowers as they need not cut corners to be able to afford it, this approach pushes up the interest burden over the extended repayment tenure. Therefore, experts advocate asking your bank to increase the EMI amount to account for rate hike instead of extending the tenure. “Increasing EMI is definitely an option and is a recommended option, but the EMI will have to increase disproportionately if the rise in interest is to be negated,” says Vipul Patel, founder and CEO, of Mortgageworld.in, a loan consultancy firm.

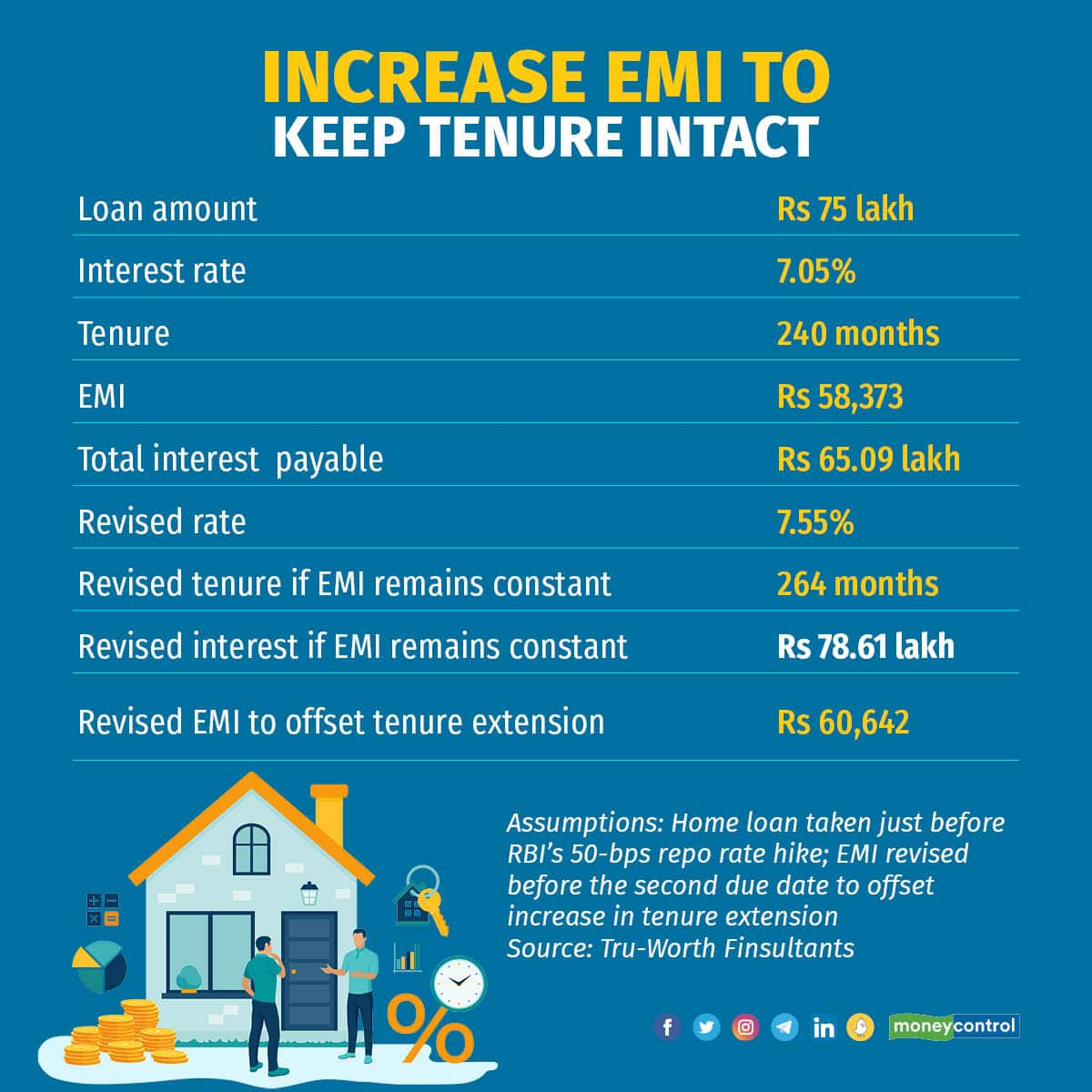

So, if you want to retain your original loan tenure and keep a check on the increase in interest outgo due to the rate hike, you will have to be prepared to pay higher EMIs. “On a Rs 75-lakh loan with a tenure of 20 years, you will have to pay Rs 2,269 more per month to ensure that your tenure remains the same and the increase in interest outgo does not spiral of control,” says Tivesh Shah, CEO & Founder of Tru-Worth Finsultants.

In addition, you can increase your EMI amount—put another way, make small, regular prepayments—beyond what is needed to reduce your overall interest burden. “Usually, lenders prefer your total EMIs across loans to be less than 50-55 percent of a person’s net monthly income. So, they may ask for income proofs and bank statements to reassess their repayment capacity before approving increased EMIs,” says Ratan Chaudhary, head, home loans, Paisabazaar.com, a fintech company.

However, both lump-sum part-prepayment and higher EMI options should be considered only if you can afford the same without disturbing investments meant for other goals such as children’s education or your retirement.

A large number of borrowers successfully pre-pay their loans with tenures of over 20 years within five to seven years. They do so by increasing their EMIs in line with their annual increments and directing their surpluses to their home loan.

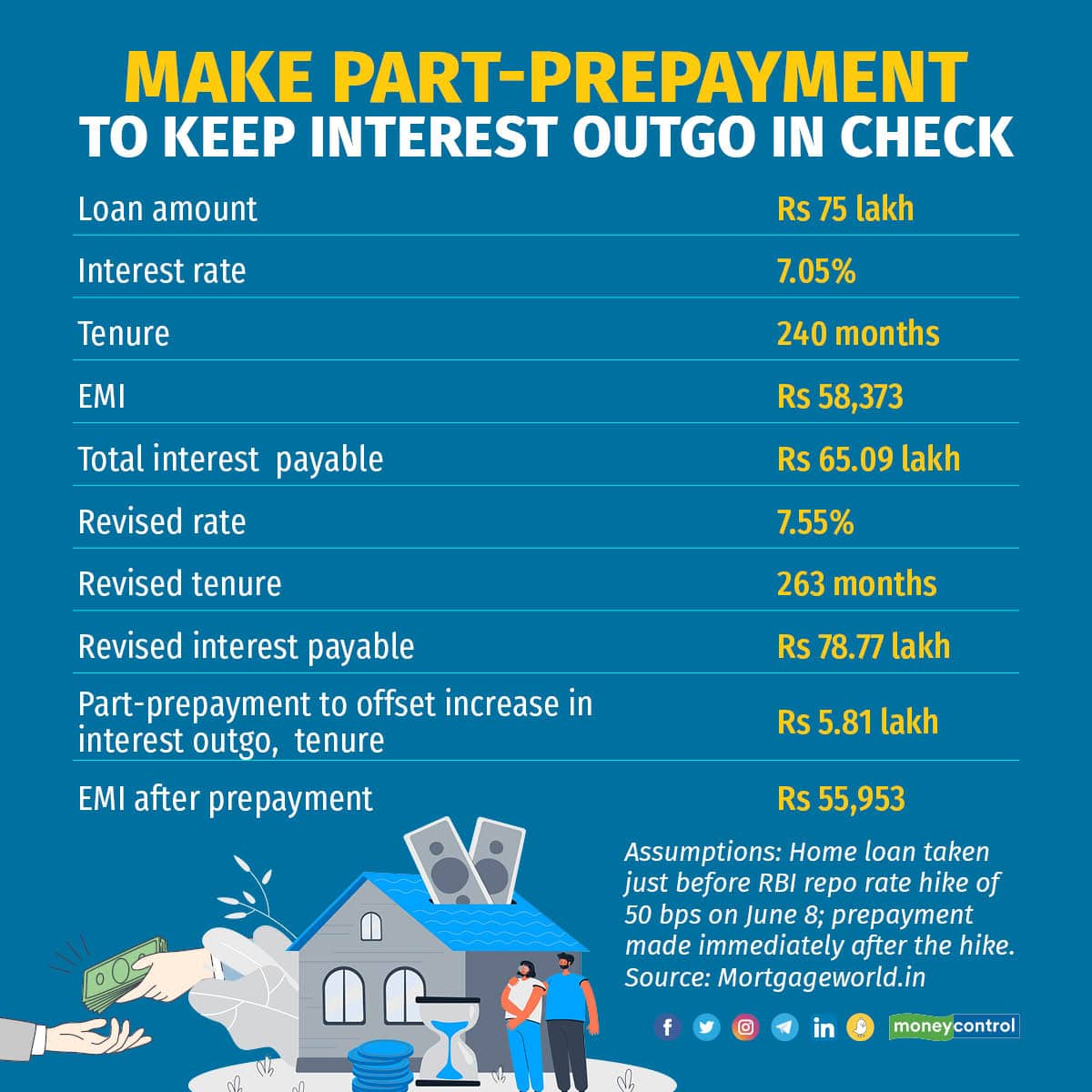

This time, however, making small pre-payments will not be enough to keep your current EMI, repayment tenure and interest payout intact. This is because the quantum of hikes is huge – 90 basis points within a span of 34 days. If you wish to completely offset the impact of the latest rate hike, you will have to make a substantial lump-sum prepayment. “For example, on a Rs 1-crore home loan with a 25-year tenure, you will have to prepay close to Rs 4.38 lakh to mitigate the impact of this 50-bps hike,” says Patel. And, if you want your EMIs and loan tenure to go back to pre-May 4 levels, you will have to pre-pay a whopping Rs 7.82 lakh, he adds.

Even if your surpluses are not adequate to completely blunt the impact of repo rate hike, small part prepayments can still help. “Assuming a constant average interest rate, you can pay off a 20-year loan in around 12 years by prepaying 5 percent of the loan balance once every loan year. Five percent is not too big a payment and better than not prepaying at all. It allows you to prepay slowly and leaves you money to invest for goals such as saving for retirement and educating your children,” says Adhil Shetty, CEO, of Bankbazaar.com.

In addition to annual bonuses and surpluses, you can also liquidate low-yielding investments such as traditional endowment policies that fetch 5-6 percent annual returns over the long-term or even fixed deposits. It is best, however, to leave your Employees Provident Fund (EPF) and (NPS) corpus untouched as doing so could set your retirement planning back by years.

An option that is often recommended to home loan borrowers for reducing the interest rate burden is switching lenders, which might be of little use if your home loan is linked to repo rate and your potential new lender is also a bank. This is because most banks have adopted the repo rate as their external benchmark, so every bank has to pass on the entire rate revision—be it increase or decrease—to their borrowers. Yet, if you find deals where another lender offers an interest rate that is lower than yours by at least 35-50 bps, you could consider transferring your loan.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.