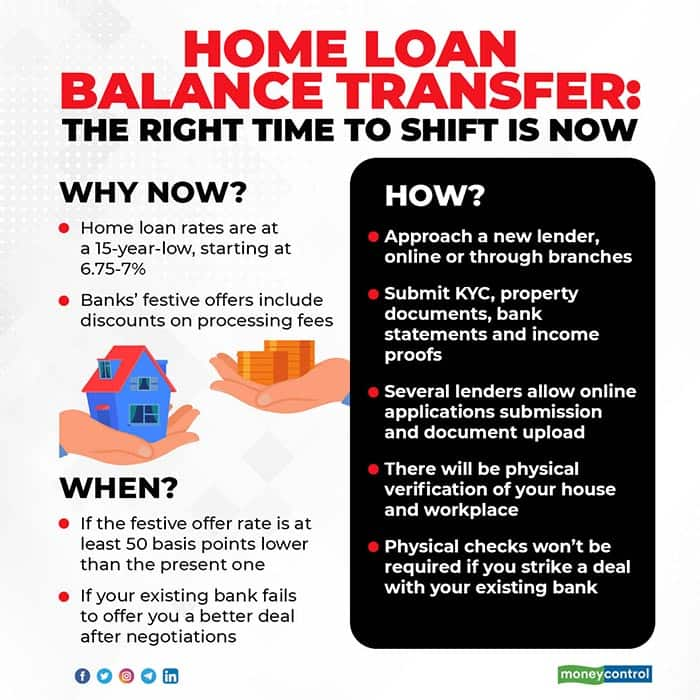

Home-buyers are spoilt for choice this festive season. Real estate developers are dangling discounts, some state governments have slashed stamp duties and banks are competing with each other to offer lower interest rates. Already, interest rates are at a 15-year low. For instance, Kotak Mahindra Bank is offering home loan interest rates starting at 6.75 percent, while Bank of Baroda’s rates start at 6.85 percent. State Bank of India (SBI) has announced a 25 basis points concession on loans of over Rs 75-lakh to customers, based on their credit scores, if the application is made through its YONO app.

If you intend to buy a house for self use and are fairly confident of your job prospects, it indeed looks like the most opportune moment to take the plunge.

New home-buyers might have several parameters to consider while buying a house and applying for a new loan, but if you are an existing borrower, your choice should be relatively easier. The offers are meant to lure existing borrowers of other banks too.

You must make the switch, especially if your loan is pegged to the older marginal cost of funds-based lending rate (MCLR) or Base Rate regimes.

Switch you mustIf new loan offers are around 50 basis points cheaper than your current loans, there is no reason to delay home loan refinancing.

Let’s suppose you took a Rs 75-lakh loan with an original tenure of 20 years. Of this, three years may have elapsed. Assume currently you are paying interest at the rate of 8 percent a year. If you decide to switch to another lender who is offering 7.5 percent, you will save Rs 8.15 lakh over the balance tenure and shave 13 EMIs off your schedule.

“In fact, even if the difference is only 25-35 basis points, a switch will make sense,” says Vipul Patel, Founder, Mortgageworld, a loan consultancy firm. Carry out a cost-benefit analysis before doing so. One percentage point is equal to 100 basis points.

Moreover, several banks have slashed their processing fees and you do not have to pay any foreclosure charges in any case. For example, SBI will not levy any processing charge if you buy a house from the list of the bank’s approved projects. “The special offers are more on the lines of a reduction and waiver on processing fees. The reduction in interest is low, usually in the range of 5 basis points. These offers vary from lender to lender, and the mechanism of reduction is specific to the lender,” says Adhil Shetty, Founder and CEO, Bankbazaar.com.

All new retail loans sanctioned after October 1, 2019 have to be linked to an external benchmark, which is the Reserve Bank of India’s (RBI) repo rate in case of most banks. It offers greater transparency and higher degree of predictability. When the central bank reduced the repo rate cumulatively by 115 basis points in March and May, all banks had to pass on the entire rate cut to their repo-linked loan borrowers. Earlier, most existing borrowers’ grouse was that while banks were quick to increase rates in line with the policy rates, they were not as prompt when it came to reducing interest rates. Now, when there is a repo rate cut, lenders have no choice but to pass on the entire benefit to all their borrowers.

While housing finance companies do not have to abide by the external benchmarking regime, competition is bound to force them to offer comparable rates. If they do not slash interest rates in line with the market, however, ensure that you choose to transfer your loan to another lender. However, it is best to first negotiate with the existing lender.

Negotiate with your bank; move on if it doesn’t workEven if your loan is linked to the RLLR, check the festive offers from other lenders. “All festive offers are for new customers, and do not have any impact on existing ones. Typically, the spread of the loan will remain the same for the entire loan tenure unless the credit score of the borrower has changed significantly,” says Shetty. The spread of a loan – the difference between the final loan rate and the repo-rate (or any external benchmark that your bank has linked your loan rate to) – will remain the same for existing borrowers since the repo rate hasn’t changed now. But banks have reduced their spreads for new borrowers. As per RBI regulations, the spread mentioned in your loan contract will remain constant for three years.

For example, Bank of Baroda has crunched its spread by 15 bps for new borrowers. Since the repo rate has not been reduced, existing borrowers’ spread will remain unchanged for at least three years once the loan contract is signed. “Some banks have narrowed the credit and risk spread in the festive season to offer benefits to new to bank consumers. The spread for existing clients will remain as contracted at the time of availing the loan,” says Patel.

If you change your lender now, your new bank will regard you as a new borrower and hence pass on the benefits of reduced home loan rates, and you be eligible for the concessional rates and fees. “Having said that, our advice is to write to existing lenders to amend and adjust the rates offered to them. In case this negotiation fails, you can go for the balance transfer facility to get the maximum benefit out of the festive benefit schemes,” adds Patel.

Asking your existing lender for a better rate will not only save you the trouble of sifting through cumbersome documentation, but also the charges, as this switch will be internal. “Moving your loan to a lower interest in the early years of the loan will reduce your interest burden in a very big way. However, refinancing comes with its own costs, including processing, mortgage deed and legal fees, etc. You need to make sure that the cost of refinancing your home loan does not make it more expensive than your existing loan,” says Shetty.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!