Shreesh Biradar

Our outlier is Varun Beverages (VBL), a Rs 13,000 crore market cap company that bottles Pepsi products.

Varun Beverages was started by Ravi Kant Jaipuria as part of RJ Group. Varun Beverages has been associated with PepsiCo since 1990. It initially started as business associate of PepsiCo in select territories and has slowly expanded itself. Varun Beverages buys the franchisee rights from Pepsi for a territory and then sells the products in Pepsi Co name, effectively a bottling plant and reseller.

Varun Beverages has been increasing number of licensed territories and sub-territories either by directly procuring it from Pepsi or acquiring the firm which has the rights.

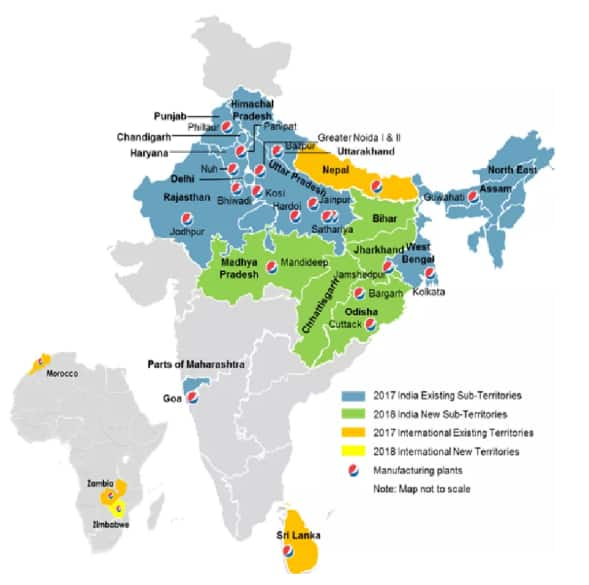

At the current juncture, PepsiCo is spread over 21 states in India apart from countries like Nepal, Sri Lanka, Zimbabwe, Zambia and Morocco. Most of the growth has come in terms of inorganic expansion by acquiring new territories and expanding the distribution network. Varun beverages has more than 51 percent market share in Pepsi beverages in India. The India portfolio contributes nearly 75 percent of the revenue.

VBL was unable to get a foothold in South Indian Market for a long time. It has recently acquired franchisee rights from SMV Group to manufacture PepsiCo beverages in 13 districts of Karnataka, 14 districts of Maharashtra and three districts of Madhya Pradesh.

(Image source: Capitalmind)

(Image source: Capitalmind)

Varun Beverages currently has 20 manufacturing plants pan India and five manufacturing facilities in international geographies. Most of the manufacturing plants have been places to increase the reachability across their territory. Varun Beverages is currently serving 1/8th of the world's population and is the second biggest international franchise of PepsiCo.

VBL has 75 depots across India with 2,100 owned vehicles and nearly 1,000 primary distributors. To incentivise the retail outlets VBL has provided the visi-coolers. By end of September VBL has distributed nearly 4,74,500 coolers.

Products

Products of Varun Beverages can be classified into two divisions viz. Carbonated soft drinks (CSDs) and non-carbonated beverages (NCBs).

Carbonated drinks

Carbonated drinks include Pepsi, Pepsi Black, Diet Pepsi, Mountain Dew, Mirinda, 7Up, 7Up Nimbooz Soda, Slice Fizzy Drinks and Everess. VBL has manufacturing and distribution rights for all the carbonated drinks. (The products are Pepsi owned, but Varun Beverages is a contract manufacturer and distributor)

(Image source: Capitalmind)

(Image source: Capitalmind)

Non-carbonated beverages

Non-carbonated beverages include Slice, 7Up Nimbooz, Tropicana, Sting, Gatorade, Aquafina, etc. VBL has only distribution rights for Tropicana segment (they don't make Tropicana, only distribute it) and for the rest it has manufacturing and distribution rights. VBL is setting up a plant for manufacturing of Tropicana, which will be up and running in 2019.

Financials

The business is seasonal in nature and the peak is usually summer and bottom is winter, when sales dry up. The below chart reflects the same. And if we look at YoY, the volume have been growing.

Note: VBL operates its financial year starting with Jan and ending with December. (Image source: Capitalmind)

Note: VBL operates its financial year starting with Jan and ending with December. (Image source: Capitalmind)

To make any geography profitable, VBL needs to sell atleast 10 million cases.

Most of the revenue growth achieved is in by means of inorganic expansion. VBL has continuously added new territories (domestic and international) and simultaneously built capacity around it, rather than just eyeing distribution.

(Image source: Capitalmind)

(Image source: Capitalmind)

The same has been reflecting in its revenue. Revenue has roughly grown at 16 percent CAGR and profit by astounding 48 percent CAGR over the last six years.

And even now, most of the areas under which VBL is operational, has not been completely saturated (in terms of penetration). Also still it has South India to cover, where it doesn't have any presence.

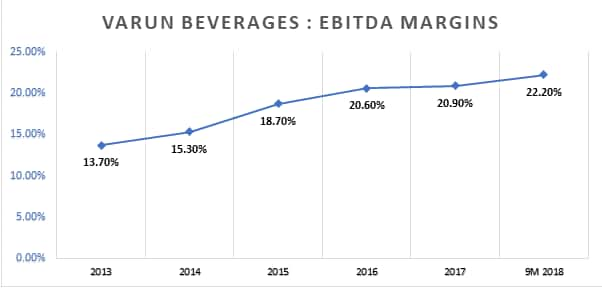

EBITDA margins

Manufacturing and distribution of beverages has been a high margin business for VBL. The current EBITDA margins are at the level of 22 percent. Most of the margins come due to in house manufacturing and strategic locations of plants across India.

If we can see the margins in 2013, it was at 13.70 percent. Post that VBL has acquired new territories and added new manufacturing plants. The backward integration has bought more margins in logistics and manufacturing.

(Image source: Capitalmind)

(Image source: Capitalmind)

Tropicana for which VBL has not yet started manufacturing and only has distribution network, has lower margins compared to peers. The margins are as low as 10-12 percent. This is a significant low compared to peers.

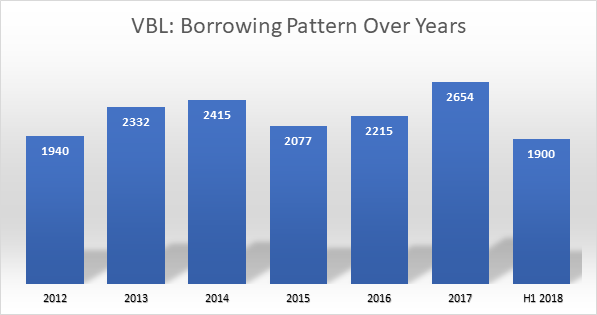

Inorganic growth comes at a cost

All the acquisitions of territories and plants VBL has done is through debt. This has spiked up the debt levels of VBL. VBL started with debt of Rs 1,940 crore and at its peak of expansion it had a debt of Rs 2,654 crore.

Despite this, their cash flows seem strong enough to be able to repay this very fast.

(Image source: Capitalmind)

(Image source: Capitalmind)

Post 2017, debt levels has come down as most of the capex done in previous years have started generating cashflows. And they did not do any new capex in 2018. Currently it pays roughly 4 percent of its revenue towards finance costs.

Their debt to equity is 1:1, but out of about Rs 980 crore of operational EBIDTA, they pay about Rs 211 crore towards interest – an interest coverage ratio of 4x.

Trigger factors

Acquiring new territories

VBL has very recently acquired manufacturing and distribution rights in Karnataka and Maharashtra. Both are comparatively big states, which till now were out of bounds for VBL. This will add a significant growth to its top line. And still it has some states like Tamil Nadu, Kerala, Andhra Pradesh, Telangana and Gujarat to cover. These are regions which see higher temperatures in summer and have higher demand during the period.

Apart from Indian sub-continent, VBL has got a foothold in Africa. a high growth market. Zambia has seen a growth 35 percent in last one year. Any new territories added over their will be an added advantage.

Improving the revenue and margins in existing territories

VBL has gone into an acquisition spree. All the new acquisitions have lower penetration with just 20 percent. In comparison, the older territories have penetration level to 30-35 percent. This gives lots of headroom for newer territories like Jharkhand for future growth.

Also with in house manufacturing of Tropicana, the margins will improve significantly. Till now Tropicana has been dragging the consolidated margins. (Tropicana drags down margins by 3 percent, since they don't make the product)

New innovative products with changing trends

PepsiCo has evolved with time. As the generation changes so is their drinking habits. Consumers are going towards lower calorie drinks. In line with that Pepsi has launched diet Pepsi, Pepsi Black and Sting. The recently launched products contribute nearly 2-3 percent of VBLs revenue. More new products offerings are required to drive the future growth.

Risks

Sugar and crude prices key to margins

Sugar and crude has been the major cost factor involved in manufacturing. Most of the beverages have sugar content in it (except diet Pepsi). Any increase in sugar prices directly hits margins. Crude prices are important as most of the packaging materials are derivatives of crude. Rise in crude prices will adverse effects on VBL. According to management, any increase in input cost up to 5 percent is borne by the firm. Anything above that is directly passed on to customers.

Fad of carbonated drinks is waning away

Globally, most of the developed countries are shunning beverages with high calories. And consumers are moving towards more healthy drinks rather than carbonated drinks. This trend has left beverage giants like Pepsi and Coca Cola in search of newer emerging markets like Africa, South Asia, etc. India too has placed higher taxes on sugared drinks. Smaller countries like Sri Lanka have shunned high sugar drinks

VBL is facing de-growth in the by almost 20 percent this year, in Sri Lanka.

The same trend has been catching up the upper urban consumers in India. This might at some stage reach a tipping point and start spiralling down. New products with changing times will keep the beverage industry going forward.

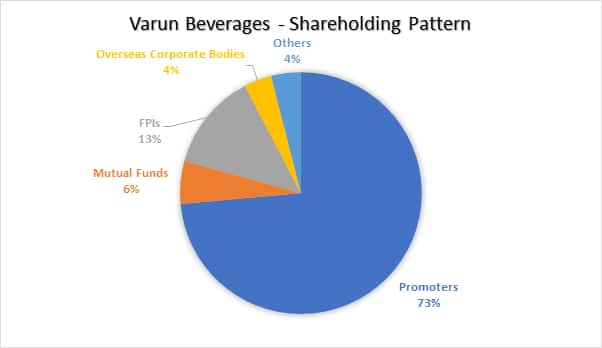

Shareholding pattern

Promoters hold 73.56 percent stake in VBL. FPIs hold another 13.03 percent stake. Mutual funds like Reliance Growth Fund, Sundaram Value Fund and Tata Large and Midcap Fund together hold another 5.72 percent. Corporate bodies in Singapore own 3.73 percent and the tiny 3.96 percent is controlled by retail investors.

(Image source: Capitalmind)

(Image source: Capitalmind)

Share Price Chart

(Image source: Capitalmind)

(Image source: Capitalmind)

This article first appeared on Capitalmind and has been reproduced with permission. You can read the original article here.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.