The benchmark indices hit more than a five-week high on March 20, with the Nifty 50 rising sharply by 1.2 percent as bulls gained more strength. The market breadth was also positive, with 1,640 shares rising compared to 989 shares that corrected on the NSE. The momentum is likely to sustain amid possible range-bound trading. Below are some trading ideas for the near term:

Mandar Bhojane, Equity Research Analyst at Choice Broking

Mahanagar Gas | CMP: Rs 1,369.7

Mahanagar Gas is showing signs of a potential breakout from a consolidation pattern, typically a bullish reversal signal. The stock has been trading within a defined range for months, forming higher lows, indicating a gradual build-up of buying momentum. It is currently near the 100-day EMA (Exponential Moving Average), having taken strong support at this level, but remains below the 200-day EMA. A sustained move above the 200-day EMA could confirm a trend reversal and attract further bullish sentiment.

On the upside, resistance is seen at Rs 1,460, with a breakout potentially pushing the stock toward Rs 1,580. Immediate support is at Rs 1,300, with a stop-loss at Rs 1,250 to manage risk. The RSI (Relative Strength Index) at 60.52 is trending upward, indicating strengthening buying momentum.

Strategy: Buy

Target: Rs 1,580

Stop-Loss: Rs 1,250

SBI Cards and Payment Services | CMP: Rs 856.85

SBI Card remains in a consolidation phase within a descending channel, indicating short-term range-bound movement. The stock has been forming higher lows, suggesting buying interest at lower levels while facing resistance near Rs 890. It is trading above key EMAs (20-day, 50-day, and 200-day), reflecting a strong trend. Recently, it took support at the 200-day EMA, reinforcing a long-term bullish outlook. Sustaining above these levels could strengthen its position for an upward breakout.

On the upside, resistance is observed in the Rs 960 - Rs 1,040 range, with a breakout potentially pushing the stock toward Rs 960. Immediate support is at Rs 840, with a stop-loss at Rs 790 to manage risk. The RSI at 66.72 indicates moderate strength, suggesting room for further upside if buying interest increases.

Strategy: Buy

Target: Rs 960, Rs 1,040

Stop-Loss: Rs 790

Gujarat Fluorochemicals | CMP: Rs 4,004.2

Gujarat Fluorochemicals is exhibiting a bullish breakout from a consolidation phase after forming a double-bottom pattern, a strong reversal signal indicating potential upward momentum. The stock is trading above key exponential moving averages, signaling a shift in momentum toward bullish territory.

The recent breakout above the Rs 3,850 resistance level suggests a change in sentiment, with increased buying pressure driving the stock higher. If the price sustains above this breakout level, further upside potential remains, with the next major resistance at Rs 4,200. A successful move above this level could push the stock toward a target of Rs 4,400. On the downside, immediate support is located at Rs 3,800. The RSI is currently at 66.62 and trending upward, reflecting growing buying momentum.

Strategy: Buy

Target: Rs 4,400

Stop-Loss: Rs 3,700

Chandan Taparia, Head Derivatives & Technicals, Wealth Management at Motilal Oswal Financial Services

InterGlobe Aviation | CMP: Rs 5,086.75

InterGlobe Aviation (IndiGo) has given an ascending triangle breakout on the daily chart with a surge in volumes visible. The ADX (Average Directional Index) Line is headed up, which confirms the strength of the uptrend.

Strategy: Buy

Target: Rs 5,414

Stop-Loss: Rs 4,932

Hindustan Aeronautics | CMP: Rs 3,819

Hindustan Aeronautics has broken out of a Pole and Flag pattern on the daily chart with a surge in volumes visible. The RSI indicator is rising, which confirms the positive momentum.

Strategy: Buy

Target: Rs 4,039

Stop-Loss: Rs 3,712

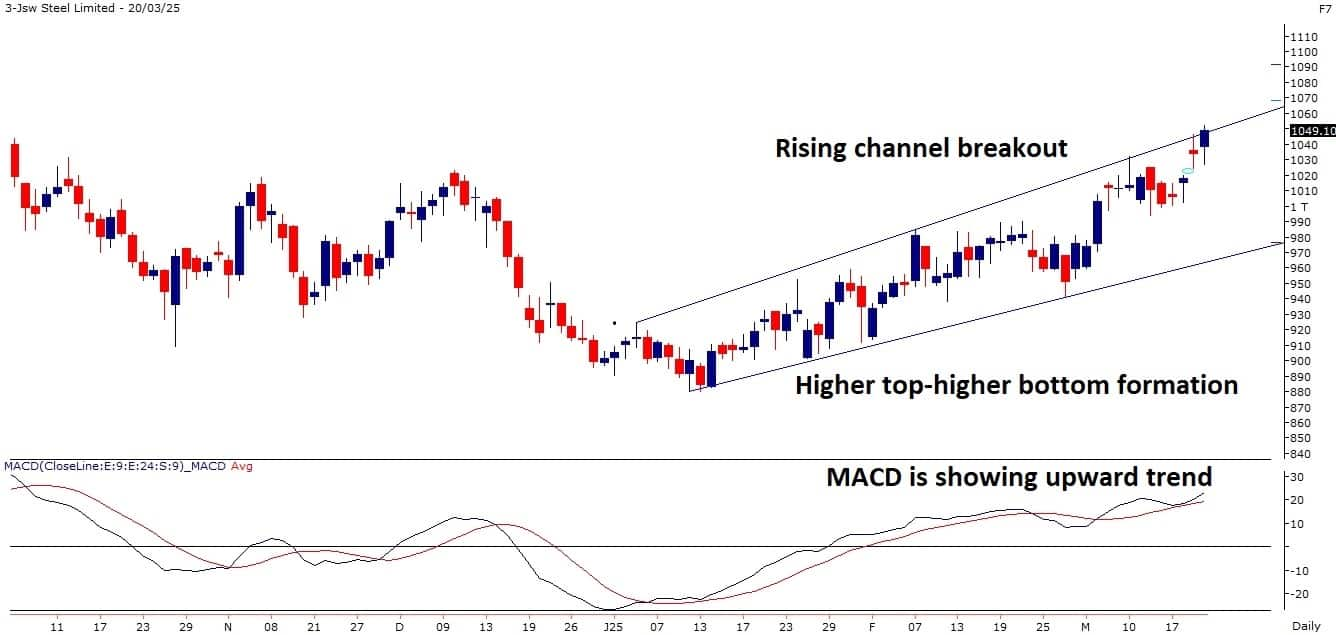

JSW Steel | CMP: Rs 1,050.25

JSW Steel has broken out of a rising channel on the daily chart with higher-than-average traded volumes. The MACD (Moving Average Convergence Divergence) indicator is positively placed, which has bullish implications.

Strategy: Buy

Target: Rs 1,110

Stop-Loss: Rs 1,020

Om Mehra, Technical Analyst at Samco Securities

Welspun Corp | CMP: Rs 872.1

Welspun Corp has given a decisive breakout after a prolonged consolidation phase, signaling renewed bullish momentum. The stock is trading firmly above all key moving averages, indicating underlying strength and the potential for trend continuation. A sustained move above Rs 888 could unlock further upside potential, reinforcing the bullish setup. On the downside, any dip towards the Rs 850 zone could offer a buying opportunity for accumulation.

The stock is also holding above the daily Supertrend, further validating the positive structure. The RSI remains in a strong zone, hovering around 70, reflecting sustained buying interest. Additionally, robust volume participation confirms the strength of the breakout, increasing the probability of further upside.

Strategy: Buy

Target: Rs 960

Stop-Loss: Rs 825

Titan Company | CMP: Rs 3,193.1

Titan Company has shown a strong recovery from recent lows in the latest trading session. The stock has successfully broken above the Rs 3,120 resistance level, indicating renewed buying interest and a potential shift in momentum. The 20-day moving average is turning upward, suggesting the formation of a short-term uptrend. Additionally, the spike in trading volumes confirms strong participation from buyers, adding credibility to the rally. The RSI above 50 signals improving momentum, leaving room for further upside. Any dip towards the Rs 3,150 zone could offer a favourable entry opportunity.

Strategy: Buy

Target: Rs 3,380

Stop-Loss: Rs 3,030

JSW Infrastructure | CMP: Rs 295.7

JSW Infrastructure displayed notable strength in the last session, gaining 2.92%. The stock has successfully breached the key resistance zone of Rs 277-280, which had been a crucial hurdle for buyers. Now trading comfortably above the 100-day moving average, the price structure signals a continuation of bullish momentum. A strong volume surge over the past two sessions further validates buying interest, indicating heightened participation. The RSI stands at 69, reflecting sustained strength, while a bullish crossover in the daily MACD reinforces the positive outlook.

Strategy: Buy

Target: Rs 318

Stop-Loss: Rs 284

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.