The market closed moderately higher amid consolidation, with the Nifty 50 snapping its three-day losing streak on December 11. The breadth was in favour of the bulls, as about 1,344 shares gained, compared to 1,160 shares that declined on the NSE. The consolidation is likely to continue until the benchmark indices decisively break the tight range of the past four days on either side. Below are some trading ideas for the near term:

Vidnyan S Sawant, Head of Research at GEPL Capital

PCBL | CMP: Rs 487.7

PCBL has completed its intermediate correction, rebounding strongly from the 50% retracement level. The stock's price structure, characterized by higher tops and higher bottoms, confirms the continuation of its bullish trend. Additionally, the ratio chart of PCBL versus Nifty indicates sustained outperformance, reflecting the stock's relative strength and resilience in the broader market. This alignment of price action and relative performance underscores its potential for further upside.

Strategy: Buy

Target: Rs 570

Stop-Loss: Rs 448

HDFC Asset Management Company | CMP: Rs 4,543.85

HDFC AMC has been in a strong uptrend since April 2023, consistently forming higher highs and higher lows. A key technical development occurred in June 2024, where the stock witnessed a polarity shift, with the prior resistance from 2019 acting as a robust support level. This indicates a strengthening bullish structure. Additionally, the ratio chart of HDFC AMC against the Nifty showcases sustained outperformance, reinforcing the stock's relative strength in the broader market.

Strategy: Buy

Target: Rs 5,232

Stop-Loss: Rs 4,185

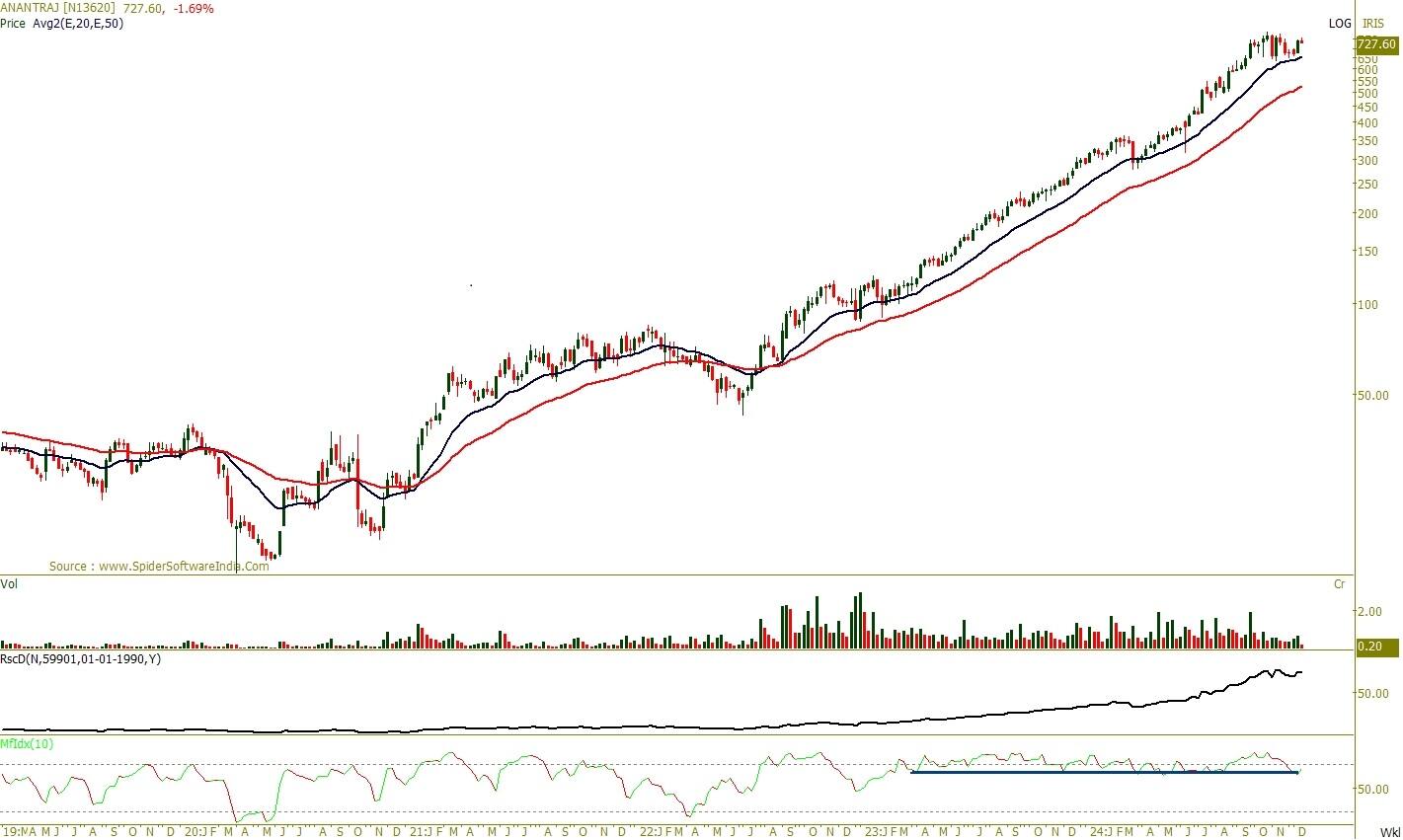

Anant Raj | CMP: Rs 727

Anant Raj maintains its upward trajectory with a notable rise in trading volumes in recent weeks. The stock consistently trades above the 12-week and 26-week EMAs (Exponential Moving Averages), underscoring bullish momentum. The ratio chart (Anant Raj against Nifty) shows sustained upward movement, highlighting strong relative strength, while the Money Flow Index rebounds from the demand zone, confirming buyer interest.

Strategy: Buy

Target: Rs 850

Stop-Loss: Rs 668

Lemon Tree Hotels | CMP: Rs 142.81

Lemon Tree Hotels displays a robust price structure, marked by a successful mean reversion from the 100-week EMA, indicating strong support at this key level. Following a 50% retracement, the stock has resumed its upward trajectory, signaling renewed bullish momentum. The RSI has confirmed this strength with a bullish crossover, reflecting improving momentum and buyer interest. Furthermore, the ratio chart against the benchmark index reveals a double bottom pattern, reinforcing the stock's relative strength and suggesting continued outperformance in the broader market.

Strategy: Buy

Target: Rs 163

Stop-Loss: Rs 130

Jatin Gedia, Technical Research Analyst, Capital Market Strategy at Mirae Asset Sharekhan

Tata Communications | CMP: Rs 1,840

Tata Communications has formed an Inverted Head and Shoulders pattern on the daily charts and has closed above the neckline, suggesting a breakout from the pattern with bullish implications. The breakout has been accompanied by above-average volumes, indicating a genuine breakout. The daily momentum indicator has a positive crossover, which is a buy signal. We expect the stock to continue its positive momentum on the upside, with targets of Rs 1,943–2,000 from a short-term perspective. A stop-loss of Rs 1,800 should be kept for long positions.

Strategy: Buy

Target: Rs 1,943, Rs 2,000

Stop-Loss: Rs 1,800

Indian Railway Catering & Tourism Corporation | CMP: Rs 855.5

IRCTC was trading in a downward sloping channel, which has been breached on the upside, indicating a trend reversal. The stock has broken out of a five-day consolidation range on the upside with above-average volume, which is a bullish sign. The daily momentum indicator has a positive crossover, which is a buy signal. Thus, we expect the stock to continue its positive momentum and target levels of Rs 888–921 from a short-term perspective. A stop-loss of Rs 826 should be maintained for long positions.

Strategy: Buy

Target: Rs 888, Rs 921

Stop-Loss: Rs 826

Shitij Gandhi, Senior Technical Research Analyst at SMC Global Securities

Alembic | CMP: Rs 150

In the past few weeks, Alembic has been consolidating in a broader range of Rs 120–140, with prices trading well above its 200-day EMA on daily charts. Technically, the stock has given a fresh breakout above the ascending triangle pattern, with positive price action seen alongside rising volumes. Therefore, one can accumulate the stock in the range of Rs 145–150, targeting an upside of Rs 170–175, with a stop-loss below Rs 130.

Strategy: Buy

Target: Rs 170, Rs 175

Stop-Loss: Rs 130

KRBL | CMP: Rs 319

Over the last few months, KRBL has been trading lower, with prices sustaining well below its 200-day EMA on daily charts. Technically, the stock has formed a Double Bottom pattern around the Rs 265 level and given a sharp rise, as momentum has picked up above its 200-day EMA once again. A fresh breakout has been observed in the W pattern. Therefore, one can accumulate the stock in the range of Rs 315–320, targeting an upside of Rs 365–370, with a stop-loss below Rs 285.

Strategy: Buy

Target: Rs 365, Rs 370

Stop-Loss: Rs 285

EIH | CMP: Rs 426.8

After marking its 52-week high of Rs 502.20, EIHL has been trading lower, forming a series of lower highs and lower bottoms on the weekly chart. A decline was witnessed, accompanied by profit booking. However, the stock found support at its 200-day EMA on the daily charts, and a bounce in prices has been observed since. This week, a fresh breakout occurred above the falling trendline of the declining channel. Therefore, one can accumulate the stock in the range of Rs 420–425, targeting an upside of Rs 482–485, with a stop-loss below Rs 380.

Strategy: Buy

Target: Rs 482, Rs 485

Stop-Loss: Rs 380

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!