The benchmark indices showed a strong recovery from the day's lows in late trade, ending at fresh all-time closing highs with gains of about a third of a percent on September 25. On the NSE, 1,475 shares declined, while 1,008 shares advanced. The Nifty 50 is expected to maintain its upward momentum, supported by a fall in volatility. Below are some trading ideas for the near term:

Jatin Gedia, Technical Research Analyst at Sharekhan by BNP Paribas

Dr Reddy's Laboratories | CMP: Rs 6,691.5

Dr Reddy's Laboratories has attracted buying interest around the cluster of key hourly moving averages and the 38.2 percent Fibonacci retracement level of the previous rise. The hourly momentum indicator has reached the equilibrium line, suggesting that the consolidation is complete, and the stock may start a new cycle. We expect the stock to trade with a positive bias.

Strategy: Buy

Target: Rs 6,825, Rs 6,900

Stop-Loss: Rs 6,580

Petronet LNG | CMP: Rs 330

Petronet LNG has completed a five-wave decline, and we expect a retracement of the fall. The daily momentum indicator has shown a positive crossover, which is a buy signal. We expect the stock to reach levels of Rs 345–352 on the upside. A stop-loss of Rs 320 should be maintained for long positions.

Strategy: Buy

Target: Rs 345, Rs 352

Stop-Loss: Rs 320

Vidnyan S Sawant, Head of Research at GEPL Capital

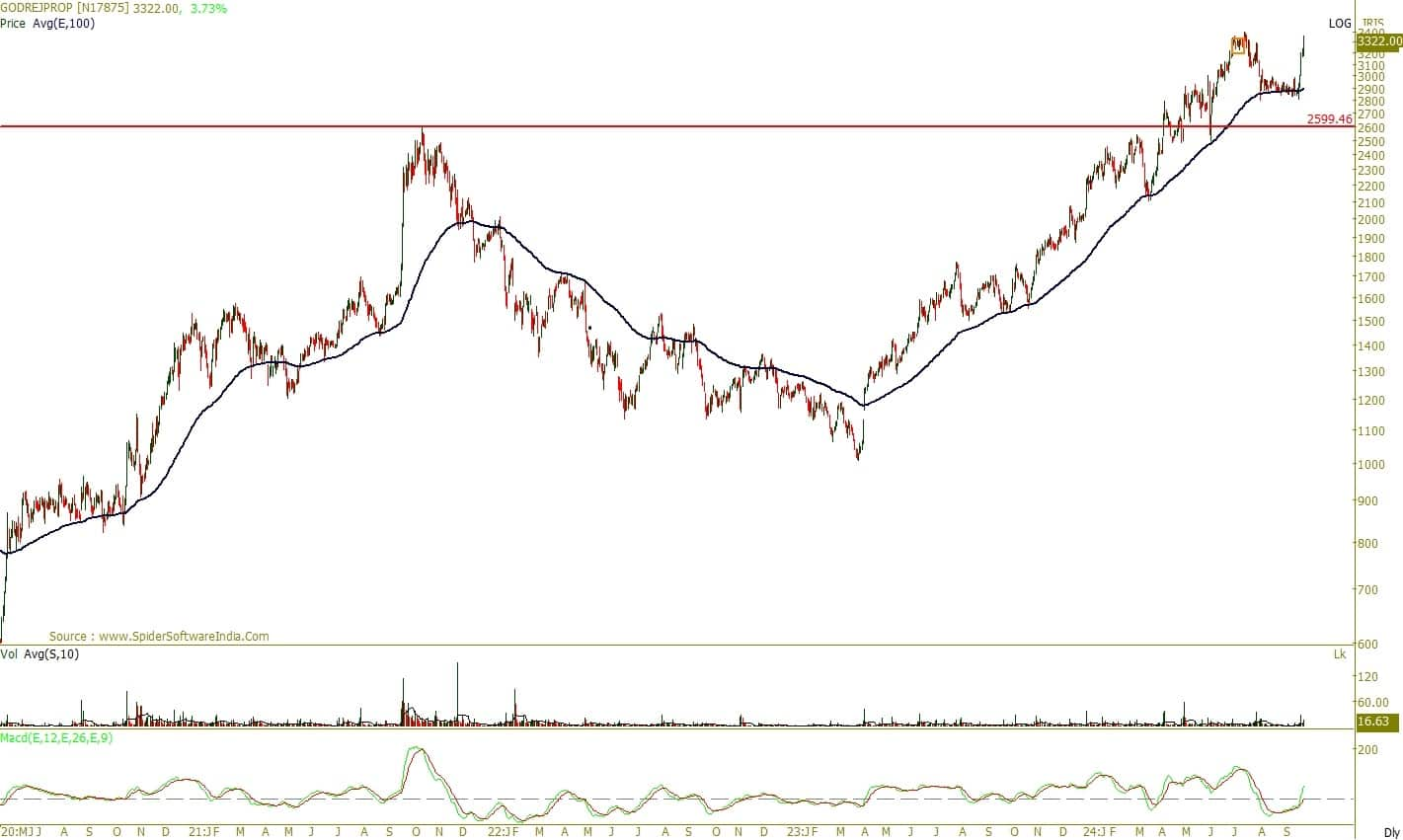

Godrej Properties | CMP: Rs 3,327.5

Godrej Properties has demonstrated strong momentum, with a 41-day decline being retraced in just 6 days, indicating a robust price structure. After breaking out of its year 2021 swing high in April 2024, the stock moved into positive territory. A bullish mean reversion from the 100-EMA (Exponential Moving Average), along with a rising MACD (Moving Average Convergence Divergence), signals accelerating momentum. Additionally, volume activity has surged above the 10-day average, reinforcing the bullish price action. Looking ahead, the stock has the potential for an upside target of Rs 3,986, with a recommended stop-loss at Rs 3,050 on a closing basis for effective risk management.

Strategy: Buy

Target: Rs 3,986

Stop-Loss: Rs 3,050

Firstsource Solutions | CMP: Rs 342.5

On the monthly scale, after breaking out of its year 2021 swing high, Firstsource Solutions has consistently formed higher highs and higher lows. On the weekly chart, it is attempting to break out of a five-week consolidation zone, signaling a likely continuation of its upward trajectory. The MACD indicator is trending higher, reinforcing the bullish momentum. Looking ahead, the stock has potential for an upside target of Rs 400, with a recommended stop-loss at Rs 312 on a closing basis to manage risk.

Strategy: Buy

Target: Rs 400

Stop-Loss: Rs 312

PG Electroplast | CMP: Rs 675

PG Electroplast has demonstrated a strong price structure on higher timeframes, consistently maintaining its upward trend. In the recent week, the stock broke out of a rising channel, continuing its pattern of higher highs. On the daily chart, it experienced a breakout from an NR 11 pattern, indicating a range expansion. The MACD momentum study shows a steady upward trend, confirming that positive price action is supported by strong momentum. Looking ahead, there is potential for further upside, with a target of Rs 824. To manage risk effectively, it's advisable to set a stop-loss at Rs 621 on a closing basis.

Strategy: Buy

Target: Rs 824

Stop-Loss: Rs 621

Platinum Industries | CMP: Rs 412.7

Platinum Industries shows strong momentum across timeframes, currently trading within 5 percent of its all-time high. On the daily scale, the stock experienced a bullish mean reversion from the 40-day EMA, suggesting the upward trend is likely to continue. The MACD remains in buy mode, reinforcing the positive outlook. Looking ahead, the stock has the potential to reach an upside target of Rs 490. For effective risk management, a stop-loss at Rs 376 on a closing basis is recommended.

Strategy: Buy

Target: Rs 490

Stop-Loss: Rs 376

Shitij Gandhi, Senior Technical Research Analyst at SMC Global Securities

Axis Bank | CMP: Rs 1,268

After marking its 52-week high of Rs 1,339.65 in July, Axis Bank witnessed a series of profit-booking and retraced toward its 200-day EMA on the daily charts. Technically, the stock formed a triple bottom there and once again gained renewed bullish momentum. This week, a fresh breakout has been observed above the key resistance level of Rs 1,250, as the stock saw long build-up with rising volumes. Therefore, one can buy/hold/accumulate the stock for an expected upside of Rs 1,420–1,425, with a downside support zone of Rs 1,250–1,240.

Strategy: Buy

Target: Rs 1,420, Rs 1,425

Stop-Loss: Rs 1,180

Tata Communications | CMP: Rs 2,127.7

Tata Communications has been maintaining its bull run, with prices mounting within a rising channel through the formation of higher highs and higher lows. This week, a fresh breakout has been observed as the stock marked its 52-week high of Rs 2,134.35. The price-volume action, accompanied by a channel breakout, suggests further upside potential. Therefore, one can buy/hold/accumulate the stock for an expected upside of Rs 2,320–2,325, with a downside support zone of Rs 2,110–2,100.

Strategy: Buy

Target: Rs 2,320, Rs 2,325

Stop-Loss: Rs 2,000

Power Grid Corporation of India | CMP: Rs 363.75

For the past month, Power Grid has been consolidating in the range of Rs 325–360, as range-bound moves at higher levels kept the stock in a consolidation phase. This week, fresh momentum was witnessed as the stock gave a breakout above the Inverted Head & Shoulders pattern. Therefore, one can buy/accumulate the stock on dips till Rs 353, for an expected upside of Rs 385–390.

Strategy: Buy

Target: Rs 385, Rs 390

Stop-Loss: Rs 340

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.