Indian markets extended gains after the Reserve Bank of India (RBI) announced a special liquidity facility of Rs 50,000 crore for mutual funds to calm investors jittery after the Franklin Templeton fiasco.

The Sensex closed the day 416 points, or 1.33 percent, higher at 31,743.08 and the Nifty settled 128 points, or 1.40 percent, up at 9,282.30.

"On the domestic front, all eyes will be on earnings announcements and news related to the coronavirus pandemic. Meanwhile, monthly derivatives expiry could further add to the volatility. On the global front, the Fed meeting (April 28-29th) would be on investors’ radar as an update with respect to its recent actions to combat COVID-19, as well as economic outlook, will be keenly watched," said Ajit Mishra, VP - Research, Religare Broking.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-months data and not of the current month only.

Key support and resistance level for the Nifty

According to pivot charts, the key support level for Nifty is placed at 9,229.4, followed by 9,176.5. If the index continues moving up, key resistance levels to watch out for are 9,356.15 and 9,430.

Nifty Bank

The Nifty Bank closed 2.52 percent higher at 20,081.15. The important pivot level, which will act as crucial support for the index, is placed at 19,877.66, followed by 19,674.13. On the upside, key resistance levels are placed at 20,254.77 and 20,428.33.

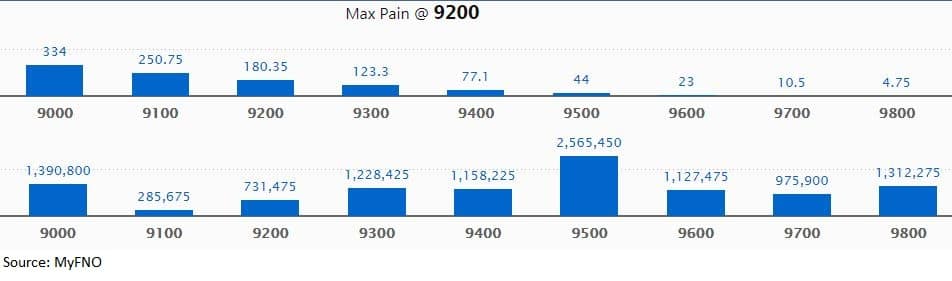

Call option data

Maximum call OI of 25.65 lakh contracts was seen at 9,500 strike. It will act as a crucial resistance level in the April series.

This is followed by 9,000, which holds 13.91 lakh contracts, and 9,800 strikes, which has accumulated 13.12 lakh contracts.

Significant call writing was seen at the 9,500, which added 3.06 lakh contracts, followed by 9,600, which added 2.36 lakh contracts, and 9,700 strikes that added 2.11 lakh contracts.

Minor call unwinding was witnessed at 9,200, which shed 1.55 lakh contracts, followed by 9,100 strikes, which shed 1.48 lakh contracts.

Put option data

Maximum put OI of 32.31 lakh contracts was seen at 9,000 strike, which will act as crucial support in the April series.

This is followed by 9,200, which holds 13.84 lakh contracts, and 8,800 strikes, which has accumulated 11.91 lakh contracts.

Put writing was seen at the 9,200, which added 7.14 lakh contracts, followed by 9,300 strikes, which added 6.7 lakh contracts.

A minor put unwinding was seen at 9,800 strike, which shed 2,025 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

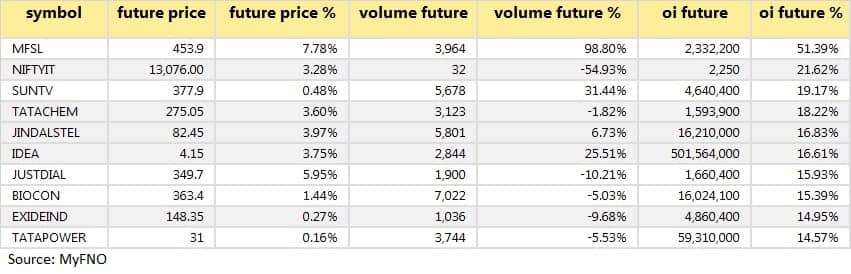

86 stocks saw long build-up

Based on open interest (OI) future percentage, here are the top 10 stocks in which long build-up was seen.

6 stocks saw long unwinding

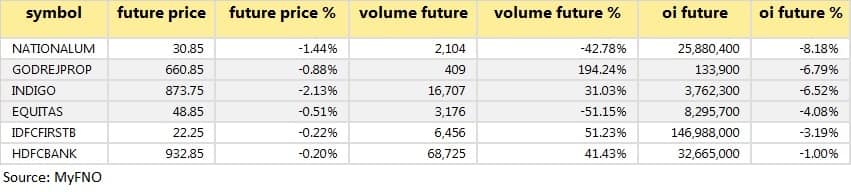

20 stocks saw build-up of shorts

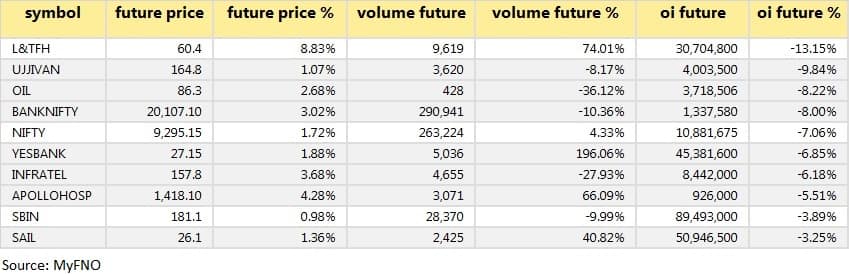

An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on OI future percentage, here are the top 10 stocks in which short build-up was seen.

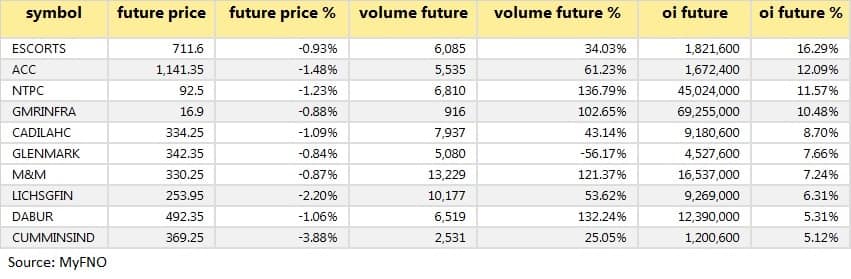

33 stocks witnessed short-covering

A decrease in OI, along with an increase in price, mostly indicates short-covering. Based on OI future percentage, here are the top 10 stocks in which short-covering was seen.

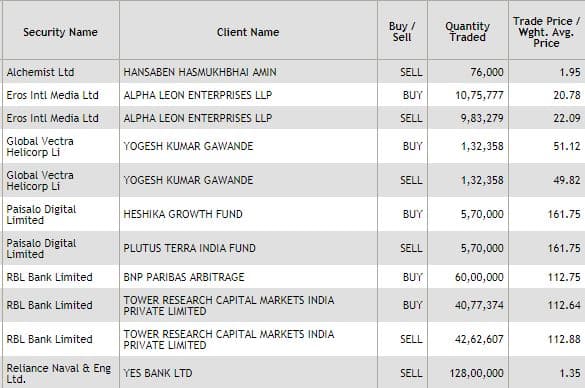

Bulk deals

(For more bulk deals, click here)

Board meetings

TVS Motor Company: The board will meet on April 28 for general purposes.

Axis Bank: The board will meet on April 28 to release its quarterly result.

Stocks in the news

IndusInd Bank Q4: Profit fell 76.8 percent to Rs 301.84 crore, net interest income rose 5.1 percent to Rs 3,231.19 crore QoQ.

HDFC Life Q4: Profit declined 14.4 percent to Rs 311.65 crore, net premium income rose 2.2 percent to Rs 10,476 crore YoY.

Adani Power Q4: Loss at Rs 1,312.86 crore against profit of Rs 634.64 crore, revenue down 8.2 percent at Rs 6,172 crore YoY.

Ambuja Cements Q1: Consolidated profit stood at Rs 742.59 crore for the first quarter of CY20, a 6.8 percent growth over the same period last year.

UPL: Company completed the acquisition of Yoloo (Laoting) Bio-technology.

8K Miles Software: Swasti Bhowmick resigned as Chief Financial Officer.

Minda Industries: Company resumed partial production at Pantnagar, Waluj and Clarton Horn manufacturing facilities.

DCW: Company partially resumed its operations in Sahupuram plant.

Shipping Corporation: Company physically handed over the vessel MT Maharaja Agrasen to the buyer's representative at Galle Anchorage in Sri Lanka.

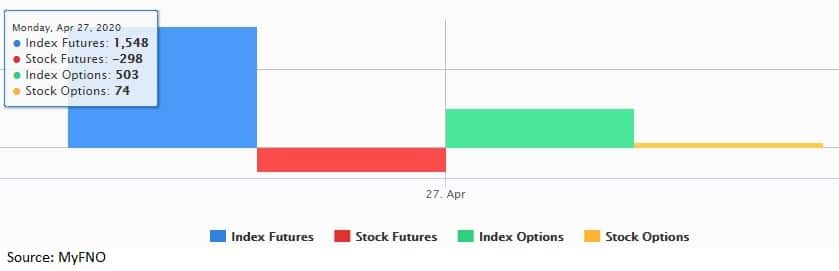

Fund flow

FII and DII data

Foreign institutional investors (FIIs) sold shares worth Rs 916.42 crore, while domestic institutional investors (DIIs) bought shares worth Rs 1,141.97 crore on April 27, provisional data available on the NSE showed.

Stock under F&O ban on NSENo security is under the F&O ban for April 28. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!