Stock under F&O ban on NSE Yes Bank is under the F&O ban for February 10. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Stock under F&O ban on NSE Yes Bank is under the F&O ban for February 10. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

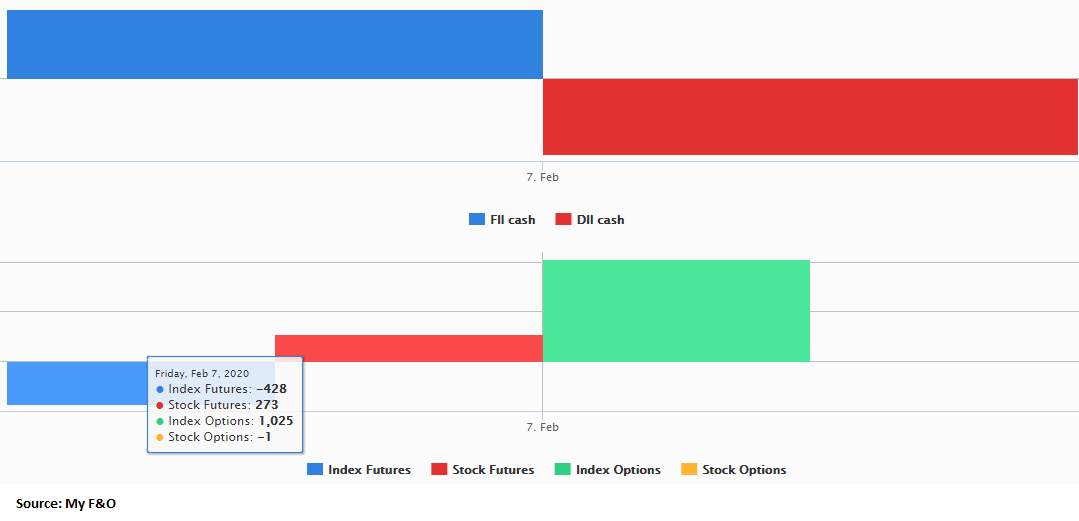

The Indian market consolidated after a fierce four days of gains pushing benchmark indices above crucial resistance levels. The S&P BSE Sensex reclaimed 41,000 while Nifty50 also climbed above Mount 12K.

Sensex fell 164 points to 41,141 while the Nifty closed 39 points lower at 12,098 on February 7. For the week, Sensex rose 3.5 percent while Nifty rallied 3.75 percent.

Experts are of the view that the knee-jerk reaction was largely due to muted global cues and profit-taking at higher levels. The momentum should resume as long as Nifty holds above 12,000 levels. They feel that there could be a possibility of further downside if Nifty trades below 12,160 levels in the coming week as well.

"In spite of the positive monetary policy which will spur growth in the economy, the market has turned flattish due to the outbreak of the novel coronavirus which is hurting the growth of the world's second-largest economy," Vinod Nair, Head of Research at Geojit Financial Services, told Moneycontrol.

Experts feel that there could be a possibility of further downside if Nifty50 trades below 12,160 levels in the coming week as well. The near term outlook is tilted towards bears as MACD gave a bearish crossover or triggered a sell signal on charts.

We have collated 15 data points to help you spot profitable trades:Key support and resistance level for NiftyAccording to the pivot charts, the key support level for Nifty is placed at 12,063.3 followed by 12,028.3. If the index continues moving up, key resistance levels to watch out for are 12,144.0 and 12,189.7.

Nifty BankThe important pivot level, which will act as crucial support for the index, is placed at 31,085.93 followed by 30,969.96. On the upside, key resistance levels are placed at 31,343.03 and 31,484.16.

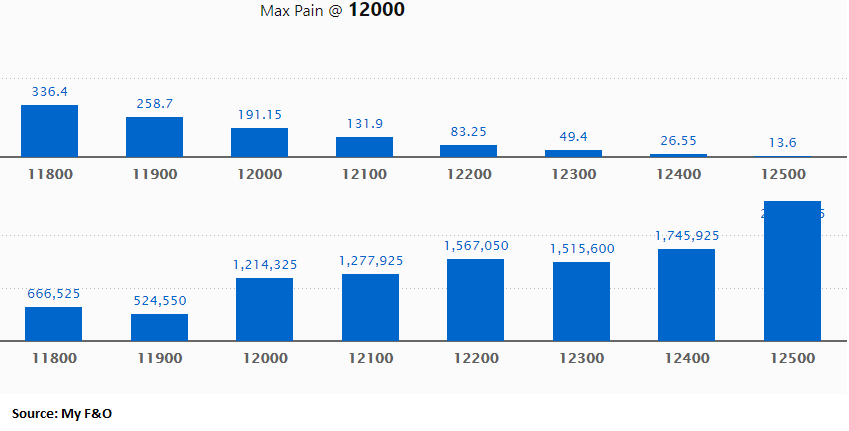

Call options dataMaximum call open interest (OI) of 26.68 lakh contracts was seen at the 12,500 strike price. It will act as a crucial resistance level in the February series. This is followed by 12,400 strike price, which holds 17.45 lakh contracts in open interest, and 12,200, which has accumulated 15.67 lakh contracts in open interest.

Significant call writing was seen at the 12,500 strike price, which added 2.72 lakh contracts, followed by 12,300 strike price that added 2.21 lakh contracts and 12,200 strike price, which added 1.44 lakh contracts.

Call unwinding was witnessed at 11,800 strike price, which shed 81,600 contracts, followed by 12,600 which shed 67,650 contracts.

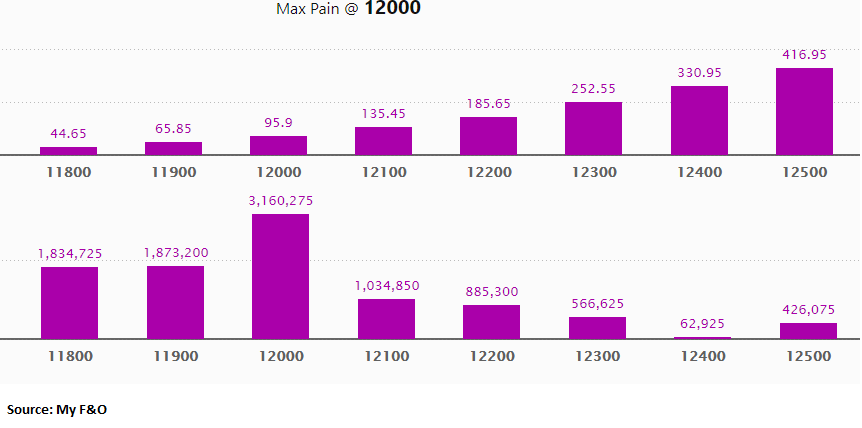

Maximum put open interest of 31.60 lakh contracts was seen at 12,000 strike price, which will act as crucial support in the February series. This is followed by 11,500 strike price, which holds 22.52 lakh contracts in open interest, and 11,600 strike price, which has accumulated 18.81 lakh contracts in open interest.

Put writing was seen at the 11,600 strike price, which added 1.34 lakh contracts, followed by 11,400 strike, which added 80,400 contracts.

Put unwinding was seen at 11,700 strike price, which shed 69,450 contracts, followed by 12,100 strike price which shed 13,575 contracts.

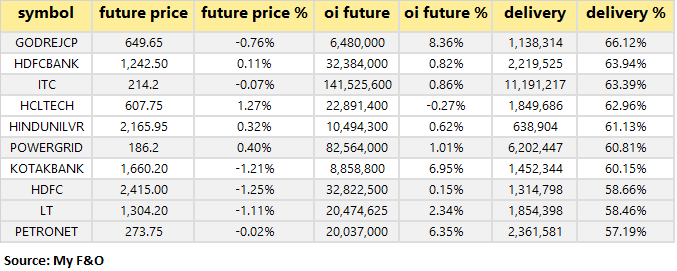

A high delivery percentage suggests that investors are showing interest in these stocks.

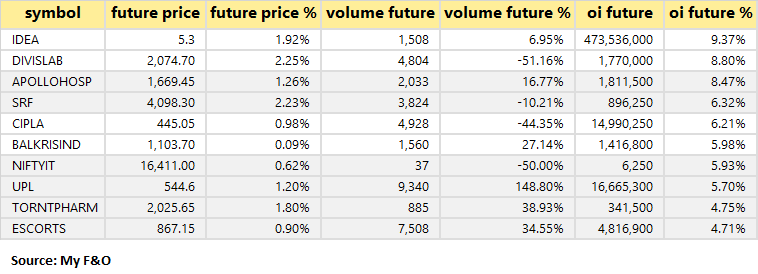

Based on open interest (OI) future percentage, here are the top 10 stocks in which long build-up was seen.

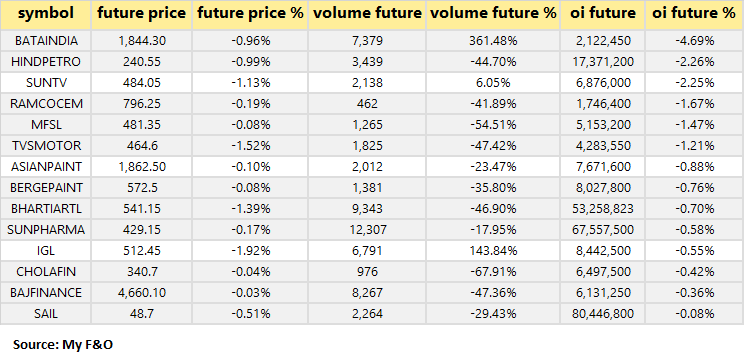

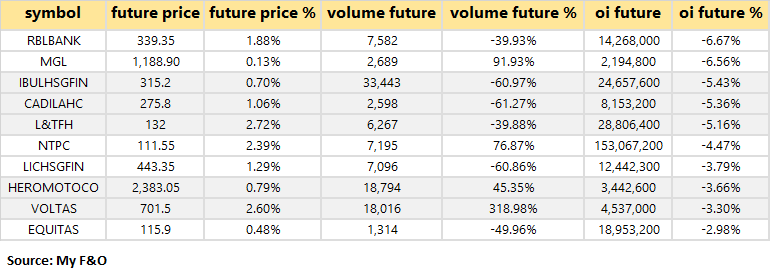

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on open interest (OI) future percentage, here are the top 10 stocks in which short build-up was seen.

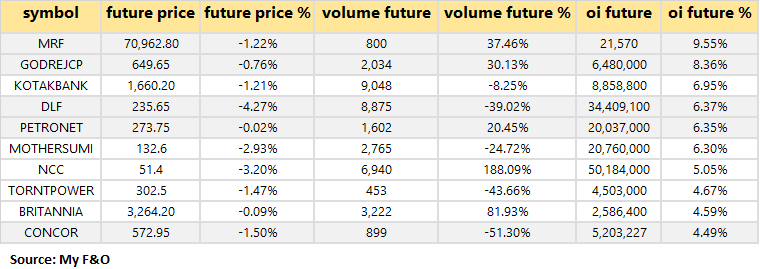

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on open interest (OI) future percentage, here are the top 10 stocks in which short-covering was seen.

Kajaria Ceramics, Punjab & Sind Bank, Ingersoll Rand (India), IOL Chemicals and Pharmaceuticals, Shivam Autotech, Golden Tobacco, Jayshree Tea & Industries, DFM Foods, Grasim Industries, Balrampur Chini Mills, JMT Auto, Motherson Sumi Systems, Sandhar Technologies, Kalpataru Power Transmission, Sundaram Finance, Shree Rama Multi-Tech are the companies that will declare their results on February 10.

Stocks in the news Stock under F&O ban on NSE Yes Bank is under the F&O ban for February 10. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Stock under F&O ban on NSE Yes Bank is under the F&O ban for February 10. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit. Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.