The market extended losses for yet another week, with the BSE Sensex and Nifty50 losing more than 1 percent amid nervousness in global markets after the Federal Reserve and several other central banks declared significant rate hikes in the week ended September 23.

The Nifty50 has broken all the crucial supports of 17,400-17,500 last week and managed to settle above the 17,300 mark, at 17,327 with 1.16 percent decline, denting the overall market sentiment. Given the subdued environment, the index may touch its August lows of around 17,150 and if that gets broken, then falling below the psychological 17,000 mark can't be ruled out in the coming sessions, with hurdle on the upside at 17,700-17,800 levels, experts said.

"As we have witnessed a decisive breach below the major support zone in the Nifty, one should not rule out the possibility of it testing the immediate swing low of 17,150-odd zone, while the sacrosanct support lies at the psychological mark of 17,000," Osho Krishan, Senior Analyst - Technical and Derivative Research at Angel One, said.

On the flipside, a series of resistances could be seen starting from 17,500 to 17,800 in the comparable period, he said.

Considering the recent price action, the market expert advised traders not to carry aggressive overnight bets for a while and, instead, adopt the strategy of one-step-at-a-time and respect levels on either side.

Let's take a look at the top 10 trading ideas by experts for the next three-four weeks. Returns are based on the September 23 closing prices:

Jatin Gohil, Technical & Derivative Research Analyst at Reliance Securities

Divis Laboratories: Buy | LTP: Rs 3,642.6 | Stop-Loss: Rs 3,440 | Target: Rs 4,069 | Return: 12 percent

After a higher level of reversal (from Rs 3,974 to Rs 3,446), the stock respected its prior multiple lows (Rs 3,450) connecting horizontal trendline and resumed its up-move. On September 23, the stock rose to an eight-day high of Rs 3,700, where volume was above average. Its daily RSI (relative strength index) is positively poised above the 50 mark. As per the current set-up, we believe the stock will continue its up-move.

We believe the stock has the potential to surpass its downward sloping 100-day SMA (simple moving average of Rs 3,734), which could lead it towards prior swing high (Rs 3,974) initially and its 200-day SMA (Rs 4,069) subsequently.

On the lower side, the stock will continue to find support around its prior multiple lows connecting horizontal trendline.

State Bank of India: Sell | LTP: Rs 550.6 | Stop-Loss: Rs 579 | Target: Rs 486 | Return: 12 percent

The stock reversed after testing its prior highs (Rs 542 and Rs 549) connecting rising trendline and breached its weekly rising trend. The stock formed a bearish reversal pattern-Shooting Star-right after deliberation pattern. The key technical indicators gave sell signal after bearish divergence on the short-term timeframe chart.

This could drag the stock towards Rs 516-500-486, which coincides with its 20-week EMA (exponential moving average), psychological level and its 50-week EMA. In case of any rebound, its prior highs connecting rising trendline will cap the up-move.

On the higher side, the stock will face major hurdle around its prior swing high.

Federal Bank: Sell | LTP: Rs 116.75 | Stop-Loss: Rs 130 | Target: Rs 92 | Return: 21 percent

The stock formed a bearish reversal pattern-Double Top around Rs 128 and poised for a down move. Again its weekly RSI reversed after testing 70-mark. In the past, the stock suffered a sharp decline after an identical formation in its weekly RSI. Since May 2019, the stock witnessed sharp reversals and reported fall between 24-28 percent from its respective peaks at least three times.

As is said, history repeats itself, I feel, it could drag the stock towards its psychological level (Rs 100) initially and trendline support (Rs 92) subsequently. In case of any rebound, the stock will face hurdle around its Double Top formation.

Jigar S Patel, Senior Manager - Equity Research at Anand Rathi

Rossari Biotech: Buy | LTP: Rs 937.95 | Stop-Loss: Rs 885 | Target: Rs 1,050 | Return: 12 percent

Rossari Biotech has witnessed a very sharp correction of 51 percent between October 2021 and June 2022. Since then the stock has been consolidating at Rs 825-880 (see chart) and it has made a solid base near Rs 900 levels.

On August 3, 2022, it gave a classic breakout from said levels along with massive volume picking up which hints at further upside.

At current juncture, the said counter has taken support near its top of the previous range breakout. One can hold (if already bought) and add (if considering fresh buy) at the current market price. Upside is seen till Rs 1,050 with credible support at Rs 885.

NMDC: Buy | LTP: Rs 127.90 | Stop-Loss: Rs 117 | Target: Rs 145 | Return: 13 percent

On the daily chart, NMDC has been making higher highs and higher lows since the last couple of months. Also volume is picking up on a daily basis which is complementing its up move.

From the indicator perspective, the weekly RSI (relative strength index) is above 50 along with weekly stochastics overbought, which further confirms upside in counter.

One can buy in small tranches at current levels and buy another tranche at around Rs 121-122 levels (if again tested). Upside is expected till Rs 145 and support is seen around Rs 117.

Pfizer: Buy | LTP: Rs 4,212 | Stop-Loss: Rs 3,950 | Target: Rs 4,700 | Return: 12 percent

Pfizer has seen a free fall since September 2021 till June 2022 which resulted in a 31 percent correction. Since then, the stock has been consolidating between Rs 4,000 and Rs 4,200 besides making higher highs and higher lows and it has made a solid base near Rs 4,200.

On the indicator front, the weekly RSI has shown bullish divergence (refer chart) which is adding more confirmation for further upside in the counter.

One can hold (if already bought) and add (if considering fresh buy) at the current market price. Upside is seen till Rs 4,700 with credible support seen at Rs 3,950.

Ruchit Jain, Lead Research at 5paisa.com

Hindalco Industries: Sell | LTP: Rs 396.35 | Stop-Loss: Rs 418 | Target: Rs 365 | Return: 8 percent

In the last one-and-a-half months, the stock has consolidated within a channel and prices have given a breakdown below the support in Friday’s session. The prices have also closed below its 20 DEMA support and thus we could see an underperformance in the stock in the near term.

The ‘RSI’ oscillator is also hinting at a negative momentum and hence, any pullback move towards the supports broken is likely to witness selling pressure.

Hence, traders can look to sell the stock on pullback in the range of Rs 400-404 for potential short term targets of Rs 365. The stop-loss on short positions should be placed above Rs 418.

AU Small Finance Bank: Sell | LTP: Rs 637.85 | Stop-Loss: Rs 665 | Target: Rs 605 | Return: 5 percent

In the recent up-move, the stock resisted around the previous swing highs and seems to have resumed its corrective phase. Prices have closed the week below its crucial '20 DEMA’ support and the RSI oscillator has also given a negative crossover indicating a bearish momentum.

As the banking index too has been witnessing a corrective phase, we expect the stock to correct in the near term.

Hence, traders can look to sell the stock in the range of Rs 645-650 for potential short term targets of Rs 605. The stop-loss on short positions should be placed above Rs 665.

Shrikant Chouhan, Head of Equity Research (Retail) at Kotak Securities

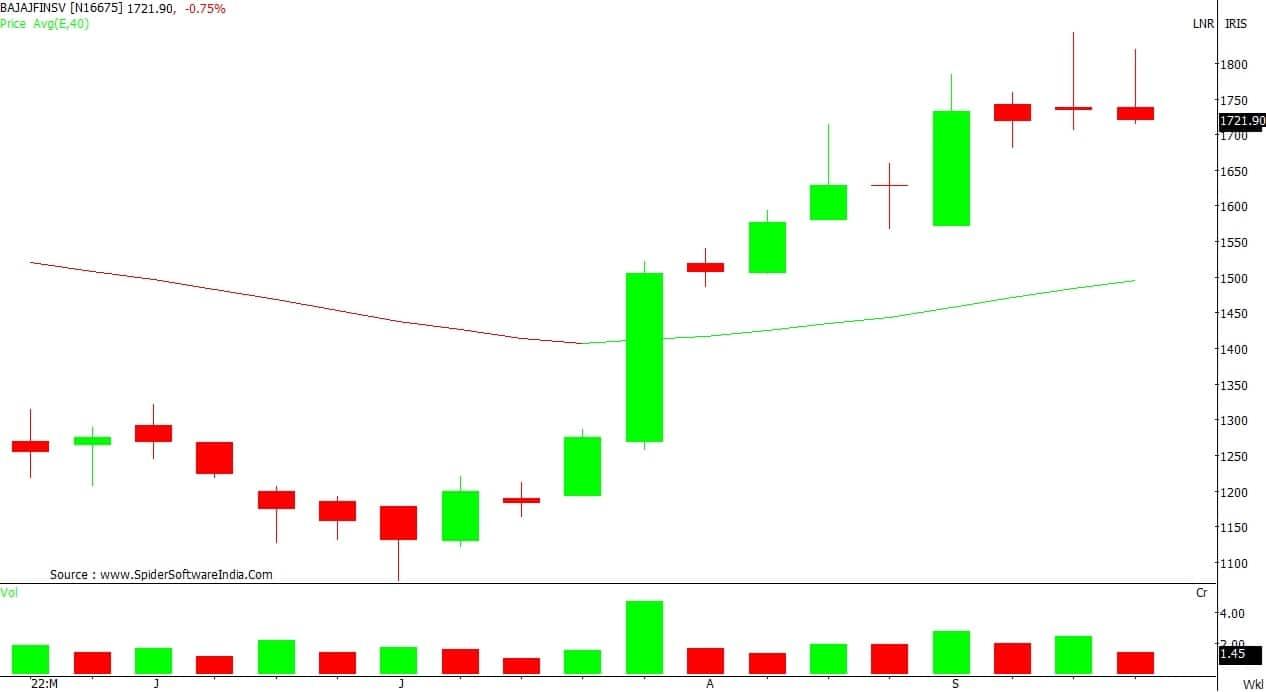

Bajaj Finserv: Sell | LTP: Rs 1,721.9 | Stop-Loss: Rs 1,790 | Target: Rs 1,570 | Return: 9 percent

The stock is diverging negatively and is also forming a lower high after reaching the highest high of Rs 1,844. Based on the oscillators, it looks like the stock is exhausted at higher levels.

On a weekly basis, it has formed an Inverted Hammer candlestick, which is indicating further weakness in the near term.

Sell at current levels and more at Rs 1,750-1,760, with a stop-loss at Rs 1,790. On the downside, the stock may slide towards Rs 1,670 and Rs 1,570 in the near term.

Jindal Steel & Power: Sell | LTP: Rs 425.80 | Stop-Loss: Rs 440 | Target: Rs 390 | Return: 8 percent

The stock has formed an Inverted Hammer pattern on top of the current up move. In the current week, the stock has broken the lowest level of the previous week. It is a sign of further weakness in the near term and in case the stock drops below Rs 420 level then it would send the stock to Rs 390. Sell at current levels and at Rs 430, with stop-loss at Rs 440.

Divis Laboratories: Buy | LTP: Rs 3,642.60 | Stop-Loss: Rs 3,540 | Target: Rs 3,850 | Return: 6 percent

The stock is trading volatile but is within a broad trading range, indicating a sharp break out in the near term. On a weekly basis, it has formed multiple bottom between Rs 3,540 and Rs 3,560, which will help the stock to trade with a bullish trend.

It is a buy at current levels and on the further decline with a final stop-loss at Rs 3,540. At higher levels, it could rally towards Rs 3,750 and Rs 3,850 in the near term.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.