LiveNow

Closing Bell: Nifty around 19,550, Sensex down 232 pts; all sectors in the red

Prashanth Tapse, Senior VP (Research), Mehta Equities

Amidst volatility and choppy trading, markets received fresh drubbing and ended lower. Markets witnessed pessimism due to hawkish comments from the US Fed chairman, which indicated that rate hike would continue to combat inflation. Benchmark indices also stayed vulnerable amidst simmering Middle-East geopolitical tensions. Technically, Nifty could find support at the 19501 mark, while any uptick would be seen only if the index breaches its biggest hurdle at the 19887 mark.

Deepak Jasani, Head of Retail Research, HDFC Securities

Nifty fell for the third consecutive session on Oct 20 pulled down by weak global cues. At close, Nifty was down 0.42% or 82.1 points at 19542.7. Volumes on the NSE improved mildly. Broad market indices fell more than the Nifty even as the advance decline ratio fell sharply to 0.48:1.

Global equities fell and oil and gold prices climbed as investors responded to the threat of a weekend escalation that would spread the conflict between Israel and Hamas to the wider Middle East region. The sight of U.S. government bonds yields hitting 5% for the first time since 2007 amid an increasingly threatening conflict in the Middle East left investors searching for safety.

Nifty fell on October 20 showing persistent weakness. However it has formed a doji after a fall, suggesting possibility of a bounce. On weekly charts, it fell 1.06%. 19432-19492 band could provide support to the Nifty in the near term while 19730 could be tough to breach on upmoves.

Siddhartha Khemka, Head - Retail Research, Motilal Oswal Financial Services:

Domestic equities witnessed selling pressure for third consecutive day amid weak global cues. Nifty opened lower and remained negative throughout the session to close with loss of 82 points at 19543 levels. Selling continued in broader market with Nifty mid /small cap 100 indices down -1%/-0.8%. Except Private Bank, all sectors ended in red. We expect earning season to pick up pace in a truncated week which would direct the market trend along with global cues. On global front, ECB would announce interest rate decision next week. Banking sector will be in focus on Monday as investors would react to Q2 results of ICICI and Kotak Bank that would be announced over the weekend. Among the key results to be announced next week would be from Axis Bank, TechM, Maruti, Bajaj Finserv, SBI Life and Dr Reddy.

Dilip Parmar, Research Analyst, HDFC Securities

Indian rupee appreciated after falling for the last three weeks amid the central bank’s intervention by supplying the dollar ahead of the USD 5 billion USDINR swap maturity on 23rd October. The rupee has become the second-best performer among the Asian currencies following the South Korean won. Going ahead the focus will remain on geopolitical progress and the movement of bond yields. The risk market is likely to remain on tenterhook while haven assets may remain in demand over the weekend following geopolitical worries.

The rupee saw resilience to global worries amid stronger domestic macro, it will find difficulty in holding the gain if the foreign fund continues to pull the money. Spot USDINR is expected to trade within a range of 82.80 to 83.30 in the coming days.

Jatin Gedia – Technical Research Analyst at Sharekhan by BNP Paribas:

The Nifty opened gap down and consolidated for the whole day to close in the red down ~95 points. On the daily charts we can observe that Nifty is trading at the crucial support zone of 19530 – 19500 where 61.82% Fibonacci retracement level of rise from 19333 – 19850 is placed. The hourly momentum indicator is showing a positive divergence however price confirmation is missing.

The daily momentum indicator has triggered a negative crossover which is a sell signal. Considering prices are trading at crucial support levels only a breach below 19500 – 19450 zone shall lead to a sharp decline. In terms of levels, 19550 – 19500 is the crucial support zone while 19640 – 19660 shall act as an immediate hurdle zone. Today the fall was more evident in the broad market with the Midcap index was down ~1%. The fall appears a bit overstretched in the short term and we expect a pullback during the next week.

Bank Nifty is trading around the 43600 – 43700 zone where the previous swing low it touched in August, 2023 is placed. There are signs of recovery in heavyweights of Bank Nifty like Kotak Bank , IndusInd Bank and HDFC Bank which increases the probability of a pullback in the Bank Nifty as well. We expect a recovery during the next week.

Amol Athawale, Vice President - Technical Research, Kotak Securities:

Markets languished in negative territory through the session and ended weak on the back of weak global cues and rising commodity prices. If international crude prices continue their upward trajectory, investors would turn jittery and more profit-taking could be seen in the domestic equity markets in the near to medium term. Technically, on daily and intraday charts, the Nifty formed a double top formation and reversed. Post reversal, the index is comfortably trading below the 20 and 50 day SMA ( Simple Moving Average ) which is largely negative.

In addition, on weekly charts it has formed a bearish candle which is indicating continuation of weakness in the near future. As long as the index is trading below the 20 day SMA the weak sentiment is likely to continue. For traders, 19700 would be the immediate hurdle and below the same, the index could slip till 19450-19350. On the other side, above 19700 or 20 day SMA it could retest the level of 19800-19850.

For Bank Nifty, as long as it is trading below 44500 or 50 day SMA the weak sentiment is likely to continue, below which, it could slip till 200 day SMA or 43200-43000. On the flip side, above 43900 a minor pullback rally is possible till 44300.

Ajit Mishra, SVP - Technical Research, Religare Broking

Markets edged lower in a dull session and lost nearly half a percent. After the initial downtick, the Nifty oscillated in a narrow band and finally settled at 19,547 levels. The majority of sectors traded in sync wherein oil & gas, metal and realty were the top losers. The broader indices too felt the heat and lost nearly a percent each.

Weak global cues combined with pressure in the key sectors are currently weighing on the sentiment and we don’t expect relief anytime soon. Traders should align their positions accordingly and continue with a hedged approach.

Kunal Shah, Senior Technical & Derivative analyst at LKP Securities:

The Bank Nifty index has been locked in a persistent struggle between bullish and bearish forces, resulting in a period of consolidation that has extended for the past two days. The index is currently teetering at a crucial "make or break" point. The level of 43500 is regarded as decisive. A breach below the 43500 level is anticipated to trigger additional selling pressure in the market. On the other hand, if this level manages to hold on a closing basis, it could prompt a substantial short-covering rally. The potential target for such a move is around 44500, where there is a notable accumulation of open interest on the call side.

Vinod Nair, Head of Research at Geojit Financial Services:

The added uncertainty stemming from West Asia tensions and the imperative for continued monetary tightening emphasized by the US Fed Chair created a layer of volatility in the market. While heightened oil prices and elevated US bond yields will impact the domestic monetary environment and operational metrics of the companies. Furthermore, the varied results of blue-chip companies, influenced by subdued global & domestic demand, are steering the market towards a consolidation trajectory in the near term.

Rupak De, Senior Technical analyst at LKP Securities:

The benchmark Nifty recently experienced a significant decline, falling below the 50-day moving average (50DMA). The current trend appears to be negative, with immediate support situated at 19,500. A further decline below this level could potentially lead the index towards the range of 19,150 to 19,000.

On the upside, the zone between 19,600 and 19,650 is expected to act as a strong resistance. A move above 19,650 could trigger short covering in the market.

Rupee Close:

Indian rupee ended 12 paise higher at 83.12 per dollar versus previous close of 83.24.

Market Close: Benchmark indices ended lower for the third consecutive session on October 20 with Nifty around 19,550.

At close, the Sensex was down 231.62 points or 0.35 percent at 65,397.62, and the Nifty was down 82.00 points or 0.42 percent at 19,542.70. About 1333 shares advanced, 2234 shares declined, and 141 shares unchanged.

ITC, Divis Labs, HUL, BPCL and Tata Steel were biggest losers on the Nifty, while gainers included Kotak Mahindra Bank, IndusInd Bank, TCS, SBI Life Insurance and NTPC.

All the sectoral indices ended in the red with capital goods, metal, power, realty, oil & gas, FMCG, and pharma shed 0.5-1 percent.

The BSE Midcap index shed 1 percent and Smallcap index down 0.7 percent.

Stock Marekt LIVE Updates | JSW Steel Q2 Results:

Net Profit at Rs 2,773 crore versus loss of Rs 915 crore and revenue up 6.7% at Rs 44,584 crore against Rs 41,778 crore, YoY.

Stock Market LIVE Updates | TVS Srichakra board approves formation of a subsidiary in USA

The Board of Directors of TVS Srichakra today approved the formation of a subsidiary in USA, with the intention of acquiring the business of Super Grip Corporation, USA.

Super Grip Corporation is a Tennessee based company, established in 1984, to meet the need for high quality tyres for the industrial tyre market.

Sensex Today | Sumit Pokharna, Vice President and Analyst at Kotak Securities

In the financial year results, TCS, Infosys, and HCL Tech are strategically pivoting towards aggressive cost rationalization, demonstrating remarkable margin improvements. The unexpected positive margin performance reflects their proactive measures, such as elevating utilization rates, enhancing productivity, and reducing the average cost of resources. This suggests that these companies have the potential to expand margins by 60-110 basis points over the medium term, showcasing their adaptability and resilience in response to evolving market dynamics.

Stock Market LIVE Updates | Jefferies On UltraTech Cement:

-Buy call, target Rs 9,700 per share

-Reported in-line Q2 with EBITDA growing 37 percent YoY

-On concall, management indicated sustained demand strength including from rural markets

-Rs 70 crore one-off expenses affecting Q2 EBITDA

-Energy cost could soften further in Q3

-Spot all-India cement price higher by 5-7 percent versus Q2/June average

-Company may look to present phase-3 of expansion to board before end of CY23

Sensex Today | Anuj Choudhary - Research Analyst at Sharekhan by BNP Paribas:

Indian Rupee gained on Friday on reports of selling of Dollars by the Reserve Bank of India (RBI) and softening of the US Dollar. However, weak equity markets and surge in crude oil prices capped sharp gains. Domestic markets declined for the third consecutive session. US Dollar declined on dovish comments by US Federal Reserve Chair, Jerome Powell. Though he cautioned of a possibility of additional rate hikes, if warranted, on resilient economy and a tight labour market, he also added that a surge in bond yields have helped to tighten the financial conditions. This led to expectations that the central bank may not hike rates for now but will hold them higher for longer. Economic data from US was mixed.

We expect Rupee to trade with a slight negative bias as escalating tensions between Hamas and Israel may continue to deteriorate global risk sentiments. US Dollar may bounce back as safe haven demand may come into play and crude oil prices may rise further on concerns over supplies. US 10-year bond yields may are at fresh cyclical highs and is near the psychological resistance of 5% levels. However, any diplomatic efforts to contain the conflict in the Middle East and RBI intervention may support Rupee at lower levels. USDINR spot price is expected to trade in a range of Rs 82.80 to Rs 83.50.

Stock Market LIVE Updates | HSBC On PVR INOX:

-Buy call, target Rs 2,200 per share

-Company reports its best ever quarterly results in Q2

-Results ahead of consensus expectations

-Record levels of ATP, SPH, & Admits driven by blockbuster movies & merger synergies

-Pending normalisation in ad income a key short-term catalyst

-Stock offers multi-year growth opportunities at appealing valuations

Stock Market LIVE Updates | Kotak Bank gets RBI approval to acquire Sonata Finance

RBI conveyed its approval to the Kotak Mahindra Bank, for acquiring 100% of the issued and paid up capital in Sonata Finance and to make Sonata a business correspondent subsidiary of the bank. Upon completion of the aforesaid transaction (subsequent to receipt of other requisite approvals), Sonata will be a Wholly-Owned subsidiary of the Bank.

Stock Market LIVE Updates | Laurus Labs Q2 net profit at Rs 37 crore versus Rs 232.8 crore and revenue at Rs 1,224 crore versus Rs 1,576 crore, YoY.

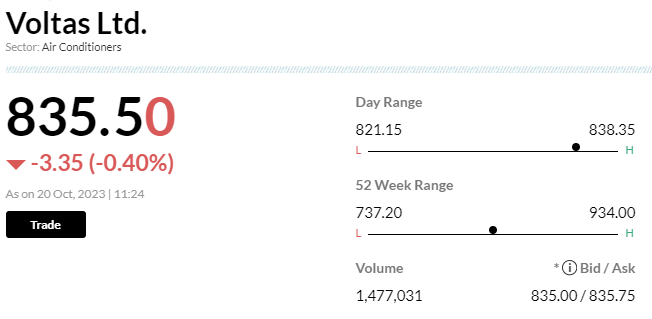

Stock Market LIVE Updates | UBS On Voltas

-Neutral call, target Rs 885 per share

-Q2FY24 provision led P/L miss

-Stable cooling business amid market share versus OPM challenges

-There was 3 percent/5 percent beat on top-line versus consensus

-Project loss led to a sharp 70 percent profit miss

-Performance of Voltbek JV seem to be on track

-JV loss was at Rs 33.2 crore (versus loss of Rs 28.9/31.0 crore, YoY/QoQ)

-Challenge to regain lost market share and OPM is very much visible

Sensex Today | Market at 3 PM

The Sensex was down 242.70 points or 0.37 percent at 65,386.54, and the Nifty was down 89.40 points or 0.46 percent at 19,535.30. About 1153 shares advanced, 2011 shares declined, and 106 shares unchanged.

| Company | Price at 14:00 | Price at 14:55 | Chg(%) Hourly Vol |

|---|---|---|---|

| Omfurn India | 78.95 | 72.50 | -6.45 0 |

| Sahana Systems | 265.90 | 250.05 | -15.85 2.35k |

| Aurangabad Dist | 223.45 | 213.00 | -10.45 750 |

| Aurionpro Solut | 1,560.00 | 1,501.00 | -59.00 545 |

| Maan Aluminium | 111.00 | 107.00 | -4.00 365.90k |

| Reliance Chemo | 220.35 | 212.90 | -7.45 7.67k |

| Sangani HOSP | 41.40 | 40.00 | -1.40 2.00k |

| Karma Energy | 47.50 | 46.00 | -1.50 476 |

| Bafna Pharma | 89.95 | 87.15 | -2.80 6 |

| Shigan Quantum | 109.25 | 106.00 | -3.25 231 |

| Company | Price at 14:00 | Price at 14:55 | Chg(%) Hourly Vol |

|---|---|---|---|

| TARACHAND | 120.00 | 130.95 | 10.95 9.75k |

| Ravi Kumar Dist | 22.35 | 23.95 | 1.60 13.17k |

| Aarvee Denim | 23.75 | 25.25 | 1.50 4.04k |

| Orissa Bengal C | 56.75 | 60.25 | 3.50 48.12k |

| ICICI Securitie | 645.80 | 684.65 | 38.85 39.83k |

| Cheviot Company | 1,174.00 | 1,237.50 | 63.50 98 |

| Swelect Energy | 596.30 | 624.85 | 28.55 3.52k |

| Agni Green | 29.65 | 30.95 | 1.30 1.67k |

| Reliable Data S | 63.00 | 65.60 | 2.60 0 |

| Wonder Elect. | 277.05 | 287.90 | 10.85 5 |

Stock Market LIVE Updates | UBS On Havells India:

-Buy call, target Rs 1,880 per share

-Q2FY24 soft consumer demand & limited B2B capacity drags P/L normalisation

-Miss on topline was largely driven by sharp miss on Lloyd

-Miss on topline was largely driven by ECD segment (fans, small appliances)

-Margin miss could be attributed to larger loss in Lloyd

-Havells’ ex Lloyd margin ramp up of 241/153 bps (YoT) in Q1/H1FY24

-Havells’ ex Lloyd margin ramp up reflects a decent normalisation

Stock Market LIVE Updates | Rama Steel Tubes board approves fundraising, setting up plant at Raigarh

The board of directors of the company at its meeting held October 20, 2023, has, approved the proposal for Fund Raising for an amount not exceeding Rs 500 crore through a rights issue/QIP placement etc. and approved the proposal for setting up of Plant at Raipur, Chhattisgarh, which will have annual production capacity of up to 200000 MT and total capex requirement for the setting up of said projects shall be around RS 200- 250 crore.

Sensex Today | BSE Auto index shed 0.5 percent dragged by Samvardhana Motherson International, Ashok Leyland, Hero MotoCorp:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| MOTHERSON | 93.20 | -3.11 | 150.05k |

| Ashok Leyland | 173.00 | -2.04 | 121.81k |

| Hero Motocorp | 3,224.35 | -1.37 | 33.11k |

| M&M | 1,554.95 | -0.91 | 16.77k |

| Balkrishna Ind | 2,547.00 | -0.9 | 1.74k |

| Bosch | 20,084.00 | -0.66 | 206 |

| Apollo Tyres | 383.00 | -0.52 | 398.25k |

| Maruti Suzuki | 10,716.25 | -0.5 | 4.16k |

| Cummins | 1,699.35 | -0.29 | 3.95k |

| Eicher Motors | 3,485.15 | -0.28 | 1.83k |

Stock Market LIVE Updates | CLSA On UltraTech Cement:

-Upgrade to outperform, target raised to Rs 9,450 per share

-Q2 largely in-line, price increase & lower costs to drive earnings

-Capacity adds remain on track & 3rd phase is likely to be announced by December

-Forecast a 11 percent 3-year volume CAGR & FY26 EBITDA/t of Rs 1,300

Stock Market LIVE Updates | Hindustan Zinc's Q2 net profit down 35% YoY

Hindustan Zinc's Q2 net income was Rs1740 crore, falling 35% year-on-year, missing the estimated Rs1914 crore (Bloomberg Consensus). Their revenue was Rs6620 crore, down 19% year-on-year, compared to the estimated Rs6789 crore. Total costs amounted to Rs4710 crore, showing a 1.5% decrease year-on-year.

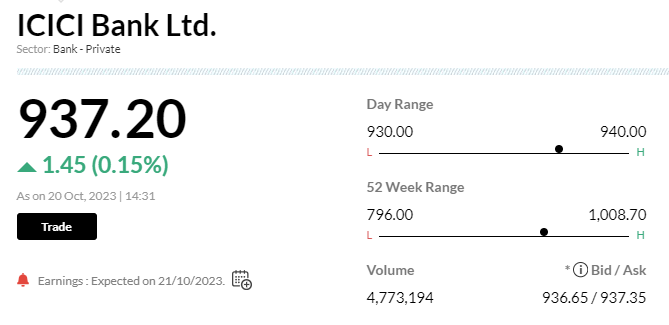

Stock Market LIVE Updates | ICICI Bank’s net profit may rise 25% YoY in Q2; margin trajectory, provisions to be eyed

ICICI Bank is set to report net profit growth of up to 25 percent year-on-year (YoY) to Rs 9,422 crore in the July-September quarter for fiscal year 2023-24 (Q2FY24), led by strong net interest income (NII) growth and steady asset quality picture, estimated analysts. However, sequentially, profit is likely to decline 2 percent from Rs 9,648 crore in Q1FY24 owing to margin pressures.

The private sector lender’s Q2 scorecard is due on October 21, 2023. The bank via an exchange filing said that the media briefing would begin from 4:15 pm onwards.

According to an average estimate of five brokerages, ICICI Bank’s NII is expected to increase 22 percent YoY to Rs 18,080 crore in Q2FY24 amid strong pick-up in loan growth and lower provisions. Loan-loss provisions are expected to drop by 6 percent YoY to Rs 1,550 crore in the September-ended quarter.

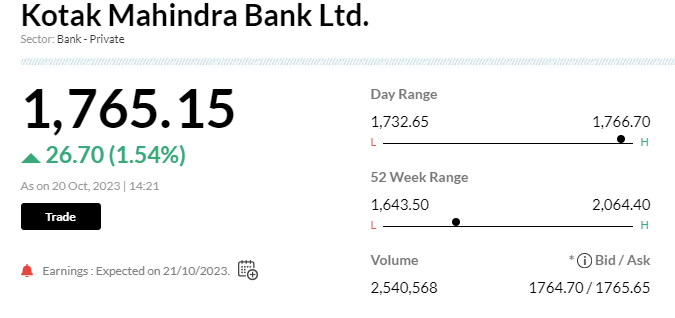

Stock Market LIVE Updates |Kotak Mahindra Bank preview: Q2 profit may rise 18% YoY on strong NII growth

Kotak Mahindra Bank is likely to register net profit growth of up to 18 percent year-on-year (YoY) to Rs 3,092 crore in the July-September quarter for fiscal year 2023-24 (Q2FY24), led by rise in net interest income (NII) and resilient asset quality, forecasted analysts. However, the bank may clock a 10 percent quarter-on-quarter (QoQ) decline from Rs 6,234 crore in Q1FY24 due to contraction in margins.

The private sector lender is scheduled to report Q2FY24 results on October 21.

As per an average consensus of five brokerages, Kotak Mahindra Bank’s NII is estimated to rise 22 percent YoY to Rs 6,226 crore in the September-ended quarter as compared to Rs 5,099 crore in the year-ago period amid steady deposit growth momentum. But sequentially, NII is likely to be flat from Rs 6,234 crore in Q1FY24.

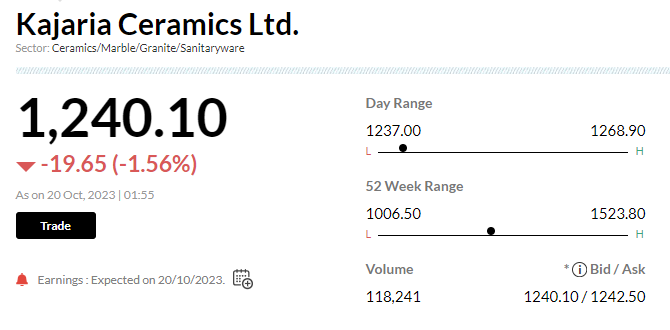

Stock Market LIVE Updates | Kajaria Ceramics Q2 net profit Rs 110 crore; stock down over 1%

Kajaria Ceramics September quarter net profit stood at Rs 110 crore versus Bloomberg estimates of Rs 122 crore. Net revenue was at Rs 1120 crore against Bloomberg estimates of Rs 1164 crore. Total cost fell 0.5 percent year on year to Rs 980 crore.

Stock Market LIVE Updates | HSBC View On Polycab India

-Buy call, target Rs 6,000 per share

-Strong Q2 results driven by domestic C&W business

-Company seeing a very strong demand environment across its end markets

-Strong demand environment across its end markets including housing, infra & industrial

-Company plans to recalibrate its revenue target of Rs 20,000 crore by FY26

-FMEG business to reach 10 percent EBITDA margin by FY26

| Company | Price at 13:00 | Price at 13:54 | Chg(%) Hourly Vol |

|---|---|---|---|

| Maan Aluminium | 117.65 | 107.25 | -10.40 4.39k |

| TARACHAND | 130.00 | 120.00 | -10.00 3.00k |

| Ravi Kumar Dist | 24.05 | 22.35 | -1.70 3.74k |

| A B Infrabuild | 39.00 | 37.05 | -1.95 0 |

| Sigma Solve | 554.90 | 528.95 | -25.95 4.38k |

| GP Petroleums | 62.25 | 59.65 | -2.60 21.94k |

| Manugraph Ind | 24.10 | 23.10 | -1.00 0 |

| Wonder Elect. | 288.80 | 277.05 | -11.75 10 |

| Industrial Inv | 153.60 | 148.10 | -5.50 1.08k |

| Orient Abrasive | 48.50 | 46.80 | -1.70 39.44k |

Stock Market LIVE Updates | CG Power and Industrial Solutions Q2 Results:

Profit rose 35.3% at Rs 242.2 crore versus Rs 179 crore and revenue up 19.5% at Rs 2,001.5 crore versus Rs 1,674.6 crore, YoY.

| Company | Price at 13:00 | Price at 13:54 | Chg(%) Hourly Vol |

|---|---|---|---|

| Globesecure | 68.75 | 80.00 | 11.25 9.29k |

| Aurangabad Dist | 212.20 | 223.45 | 11.25 0 |

| Spencer Retail | 67.60 | 70.30 | 2.70 8.61k |

| OnMobile Global | 122.50 | 126.95 | 4.45 617.38k |

| Murudeshwar Cer | 60.25 | 62.40 | 2.15 126.92k |

| Exxaro | 135.45 | 140.00 | 4.55 15.42k |

| Refex Ind | 677.90 | 697.85 | 19.95 12.98k |

| Veekayem Fashio | 71.95 | 74.00 | 2.05 4.42k |

| Orissa Bengal C | 55.10 | 56.65 | 1.55 4.74k |

| Panacea Biotec | 157.60 | 161.95 | 4.35 93.13k |

Sensex Today | BSE Midcap index fell 1 percnet dragged by Indraprastha Gas, Bank of India, Mphasis:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| IGL | 407.00 | -11.03 | 426.01k |

| MphasiS | 2,153.90 | -4.61 | 21.13k |

| Bank of India | 98.75 | -4.45 | 822.73k |

| HINDPETRO | 251.15 | -4.01 | 92.56k |

| NMDC | 156.70 | -4.01 | 678.04k |

| CG Consumer | 283.35 | -3.95 | 1.01m |

| Aditya Birla F | 230.10 | -3.26 | 322.37k |

| ACC | 1,965.00 | -3.24 | 20.22k |

| BHEL | 125.10 | -3.17 | 934.79k |

| REC | 286.35 | -2.88 | 285.53k |

Stock Market LIVE Updates | HSBC View On Cyient

-Buy call, target Rs 2,294 per share

-Cyient’s revenue growth was largely in-line with expectations

-Revenue growth retained its full year guidance

-Prospects in aerospace and sustainability appear promising

-Connectivity could take longer to recover

-Revenue profile de-risking

-Industry tailwinds in key verticals to drive medium-term resilience

Sensex Today | Gold scales 3-month peak as Middle East conflict lifts demand

Gold prices hit a three-month high on Friday and were set for a second straight weekly gain, with demand bolstered by the Middle East conflict and expectations that the Federal Reserve's rate hikes are nearing an end.

Spot gold was up 0.2% at $1,978.19 per ounce by 0542 GMT, after hitting its highest since July 20. U.S. gold futures added 0.5% to $1,989.90.

Stock Market LIVE Updates | ATUL Q2 Results:

Net profit down 40.2% at Rs 90.3 crore versus Rs 151 crore and revenue down 19.7% at Rs 1,194 crore versus Rs 1,487 crore, YoY.

Stock Market LIVE Updates | HSBC View On Coforge:

-Buy call, target Rs 5,930 per share

-Company reported robust revenue growth for Q2

-Retained its full-year guidance of 13-16 percent

-Deal activity continues to hold up well despite a challenging macro

-Deal activity dominated by non-discretionary service offerings

-Margins a concern, but remain enthused by its growth outlook

Sensex Today | Dollar toys with 150 level vs yen after Powell/Treasuries double-whammy

The dollar nudged at the closely watched 150 level against the yen on Friday, encouraged by a rise in U.S. 10-year Treasury yields towards 5% after Federal Reserve Chair Jerome Powell suggested there was scope for more rate rises.

The yield on the benchmark 10-year Treasury, which nudged at 5% for the first time in 16 years overnight, has risen by 30 basis points this week - marking its biggest weekly rise since April 2022.

Stock Market LIVE Updates | Citi View On Indraprastha Gas

-Buy call, target Rs 560 per share

-Delhi’s EV policy for cab aggregators now closer to reality

-Many unanswered questions on the policy

-This segment contributes 15 percent of IGL’s CNG volumes

-Nil consumption by this segment over long-term could impact DCF by 5-6 percent

-Stock’s correction therefore prices in this risk

-Remain buyers, as near/medium-term volume & margin outlook remains positive

-Prefer MGL followed by IGL among CGDs

Sensex Today | Gold scales 3-month peak as Middle East conflict lifts demand

Gold prices hit a three-month high on Friday and were set for a second straight weekly gain, with demand bolstered by the Middle East conflict and expectations that the Federal Reserve's rate hikes are nearing an end.

Spot gold was up 0.2% at $1,978.19 per ounce by 0542 GMT, after hitting its highest since July 20. U.S. gold futures added 0.5% to $1,989.90.

Stock Market LIVE Updates | HSBC View On Persistent Systems

-Hold call, target Rs 5,355 per share

-Q2 revenues beat consensus expectation and deal wins were strong

-Performance of hi-tech vertical encouraging but slowdown in BFS could spill over to Q3

-Best in class execution, but pricey

-Await further clarity on recovery of the BFS vertical

Stock Market LIVE Updates | Morgan Stanlsy View On Astral

-Equal-weight call, target Rs 1,844 per share

-Concall showed volume (plumbing) guidance revised to 20 percent+ for FY24

-Volume (Plumbing) guidance earlier was 15 percent; Q1- 31 percent; Q2- 28 percent

-Adhesive revenue growth of 15-20 percent in FY24 (maintained)

-Astral expects to double its revenues in the next five years

-Astral guided for sustainable margins of 16-18 percent (unchanged)

-FY24 capex Rs 420 crore (was Rs 350 crore); FY25 capex Rs 250-300 crore

Sensex Today | Rajgor Castor IPO booked 27 times, retail portion 43 times on final day of bidding

The Rajgor Castor Derivatives IPO has been booked 27.95 times so far on the final day of bidding on October 20, with bids coming in for 19.14 crore equity shares against an offer size of 68.49 lakh equity shares. Retail investors bid 43.42 times, high net-worth individuals bought 28.37 times and qualified institutional buyers picked up 10.80 times their respective allotted quota.

Through the IPO, the company aims to raise Rs 47.81 crore. The issue will close for subscription on October 20. The offer comprises a fresh issue of 88.95 lakh shares worth Rs 44.48 crore and an offer-for-sale of 6.66 lakh shares worth Rs 3.33 crore by promoters. Read More

Stock Market LIVE Updates | CSB Bank Q2 Results:

Net profit up 10.5% at Rs 133 crore versus Rs 120.6 crore and NII up 6% at Rs 343.7 crore versus Rs 325 crore, YoY.

Stock Market LIVE Updates | Glenmark Life Sciences Q2 Earnings:

Net profit up 11.1 percent at Rs 118.7 crore versus Rs 106.8 crore and revenue up 16.9% at Rs 595.3 crore versus Rs 509.2 crore, YoY.

Stock Market LIVE Updates | Jefferies View On Hindustan Unilever

-Hold call, target Rs 2,720 per share

-Impact of lower input cost inflation was visible in Q2 results

-Lower input cost inflation impact was visible as gross margin saw a sharp improvement

-Higher competitive activity visible in increase in media spends

-HUL trailing industry growth

-Lower product prices have yet to induce customers to consume more

-Customers not consuming more partly reflecting a tough macro

-Cut EPS estimate by 3-4 percent

Stock Market LIVE Updates | HFCL shares trade 4% down on dismal earnings in Q2

Shares of HFCL declined around 4 percent on October 20, a day after the company reported a dismal set of earnings for the July-September quarter.

The telecom equipment manufacturer posted a 15.2 percent decline in its net profit of Rs 69 crore in Q2, down from Rs 82 crore last fiscal. Topline went down 5.3 percent year-on-year to Rs 1,111.50 crore in the September quarter. Read More

Stock Market LIVE Updates | Jefferies View On ITC

-Buy call, target Rs 530 per share

-After nine quarters of DD growth, Q2 was first quarter of MSD EBITDA growth

-Cigarette volume growth also moderated to a multi-quarter low (4 percent Yoy)

-Q2 impressive in context of a similar or even lower level for FMCG peers

-Overall earning miss was entirely due to paperboards, which should get better ahead

-Valuation at 25x P/E appear palatable in a sector which enjoys excessive premium

Sensex Today | Market at 1 PM

The Sensex was down 262.57 points or 0.40 percent at 65,366.67, and the Nifty was down 92.20 points or 0.47 percent at 19,532.50. About 1216 shares advanced, 1901 shares declined, and 94 shares unchanged.

| Company | CMP | Chg(%) | 3 Days Ago Price |

|---|---|---|---|

| Syschem India | 48.49 | 602.75 | 6.90 |

| PRO CLB GLOBAL | 11.30 | 70.95 | 6.61 |

| Natural Biocon | 14.91 | 62.07 | 9.20 |

| Natura Hue | 12.44 | 46.70 | 8.48 |

| Sujala Trading | 39.21 | 45.17 | 27.01 |

| Remi Edelstahl | 57.70 | 39.04 | 41.50 |

| Prakash Woollen | 37.00 | 37.24 | 26.96 |

| Faze Three Auto | 115.01 | 33.16 | 86.37 |

| Nexus Surgical | 17.45 | 32.20 | 13.20 |

| Indo Asian Fin | 17.00 | 29.87 | 13.09 |

| Company | Price at 12:00 | Price at 12:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Simplex Papers | 1,039.85 | 955.05 | -84.80 3.58k |

| Shristi Infra | 27.60 | 25.53 | -2.07 0 |

| Guj Raffia Ind | 36.75 | 34.01 | -2.74 0 |

| Shree Hari Chem | 55.70 | 52.01 | -3.69 464 |

| HB Estate Dev | 45.77 | 42.90 | -2.87 6 |

| Citadel Realty | 28.46 | 26.70 | -1.76 1.08k |

| AMBOAGRI | 30.00 | 28.22 | -1.78 3.33k |

| Deccan Health C | 35.00 | 32.98 | -2.02 1.57k |

| TandI Global | 295.50 | 279.25 | -16.25 4.32k |

| Acme Resources | 24.90 | 23.56 | -1.34 0 |

Stock Market LIVE Updates | Century Textiles and Industries Q2 results:

Net loss at Rs 30.4 crore versus profit of Rs 71.6 crore and revenue down 10.5% at Rs 1,103 crore versus Rs 1,233 crore, YoY.

| Company | Price at 12:00 | Price at 12:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Ras Resorts | 37.69 | 41.65 | 3.96 100 |

| Photon Capital | 105.64 | 116.00 | 10.36 196 |

| Shivagrico Impl | 22.05 | 23.99 | 1.94 0 |

| Trident Lifelin | 165.00 | 178.00 | 13.00 0 |

| Nagpur Power | 126.50 | 136.20 | 9.70 2.67k |

| Jaipan Inds | 39.00 | 41.85 | 2.85 719 |

| DRC Systems | 39.71 | 42.50 | 2.79 1.74k |

| Shradha AI Tech | 46.50 | 49.68 | 3.18 6.62k |

| ITCONS | 44.00 | 46.90 | 2.90 0 |

| Dhatre Udyog | 160.40 | 169.95 | 9.55 9 |

Stock Market LIVE Updates | Titagarh Rail shares soar 9% to trade near 52-week high on robust Q2 results

Shares of Titagarh Rail Systems jumped 9 percent to Rs 866 per share on the BSE on October 20 after the company inked pact with Gujarat Metro Rail Corporation (GMRC) for Ahmedabad Metro Rail Phase-II Project worth Rs 350 crore.

The company via an exchange filing informed that they signed a contract with GMRC for design, manufacture, supply, testing, commissioning, and training of 30 standard gauge cars for Ahmedabad Metro Rail Phase-II Project. Read More

| Company | 52-Week High | Day’s High | CMP |

|---|---|---|---|

| Bombay Burmah | 1420.50 | 1420.50 | 1,420.50 |

| Mah Scooters | 8600.00 | 8600.00 | 8,321.80 |

| New India Assur | 154.55 | 154.55 | 150.50 |

| MCX India | 2280.55 | 2280.55 | 2,270.00 |

| Angel One | 2369.65 | 2369.65 | 2,279.10 |

| Suven Pharma | 600.00 | 600.00 | 591.25 |

| Supreme Ind | 4883.75 | 4883.75 | 4,765.10 |

| Nestle | 24735.50 | 24735.50 | 24,416.60 |

| One 97 Paytm | 998.30 | 998.30 | 978.70 |

| Equitas Bank | 101.85 | 101.85 | 100.00 |

| Company | 52-Week Low | Day’s Low | CMP |

|---|---|---|---|

| Rajesh Exports | 458.90 | 458.90 | 440.05 |

| Gujarat Gas | 418.70 | 418.70 | 413.95 |

| Navin Fluorine | 3698.75 | 3698.75 | 3,629.50 |

| V-Mart Retail | 1903.45 | 1903.45 | 1,889.00 |

| TCI Express | 1375.85 | 1375.85 | 1,359.60 |

Sensex Today | Hitesh Jain, Strategist, Institutional Equities Research at YES Securities India:

We think the downside in the Indian Rupee is restricted given the RBI's persistent FX intervention around the 83 mark. Moreover, we infer that the RBI will likely roll over the USD 5 billion Dollar swaps which are due to mature next week. The central bank would like to arrest the injection of rupee liquidity (Rs 40,000 crores) emanating from the maturity of Dollar swaps. RBI has persistently emphasized the inflationary impacts of a surplus liquidity in the banking system. Also, there has been relative inaction in the general dollar index throughout October despite rising US Treasury Yields. This tells us that the Fed will likely not raise rates further given that the bond markets are already doing the job of tightening financial conditions. Consequentially, Bulls will not flock to the Greenback, anticipating the US Fed to admit that the current rate is the terminal rate at some point in time, while several Fed governors have already hinted along these lines.

Stock Market LIVE Updates | IL&FS Transportation Networks signs agreement with Sekura Roads to sell entire stake in Jorabat Shillong Expressway for Rs 1,343 crore

IL&FS Transportation Networks has entered into a restated share purchase agreement with Sekura Roads, to sell and transfer its entire equity shareholding in subsidiary Jorabat Shillong Expressway (JSEL), for Rs 1,343 crore, towards settlement of liabilities of JSEL aggregating Rs 1,621 crore. Further, all the liabilities of JSEL has been adjusted against the EV of Rs 1,343 crore.

Stock Market LIVE Updates | Jefferies View On Nestle India

-Hold call, target Rs 20,600 per share

-For third consecutive quarter, Nestle reported EBITDA growth in excess of 20 percent

-This is despite a slight miss on revenues

-Miss on revenue as gross margin expanded smartly

-GM expansion also propelled EBITDA margin to a multi-quarter high

-Company highlighted few of its efforts, including on launches & distribution

-The highlight should help on growth

-Company has also sounded a caution on some input prices, mainly due to adverse weather

Stock Market LIVE Updates | Grasim gets penalty & interest order of Rs 118 crore from Collector

Collector (Stamps), Registration & Stamp (Anti-Evasion), Special Circle Rajasthan, Jaipur has imposed the penalty and interest of Rs 117.71 crore on the Aditya Birla Group company, alleging non-payment of stamp duty of Rs 23.68 crore on a scheme of arrangement between Indian Rayon & Industries and Grasim implemented in the financial year 1999, in the Rajasthan. The company is taking all necessary legal steps and the matter is sub-judice, therefore the financial impact is yet to be determined.

Sensex Today | Nifty PSU Bank index shed 1.4 percent dragged by Punjab & Sind Bank, Bank of India, Punjab National Bank:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Punjab & Sind | 41.10 | -2.61 | 2.46m |

| Bank of India | 100.90 | -2.32 | 3.53m |

| PNB | 72.50 | -2.03 | 27.19m |

| Canara Bank | 367.00 | -1.86 | 3.59m |

| JK Bank | 110.40 | -1.6 | 2.20m |

| Bank of Mah | 45.10 | -1.42 | 16.05m |

| Union Bank | 101.05 | -1.41 | 8.25m |

| SBI | 563.50 | -1.35 | 5.40m |

| Bank of Baroda | 202.40 | -1.34 | 10.77m |

| UCO Bank | 39.15 | -1.14 | 12.45m |

Stock Market LIVE Updates | Hatsun Agro Products Q2 profit surges 82.6% YoY to Rs 77.6 crore, revenue grows 9%

Hatsun Agro Products has reported profit at Rs 77.6 crore for quarter ended September FY24, rising 82.6% over corresponding period last fiscal, partly supported by higher other income and EBITDA. Revenue from operations for the quarter at Rs 1,905.4 crore increased by 9% over the same period last year.

| Company | CMP | High Low | Fall from Day's High |

|---|---|---|---|

| SBI Life Insura | 1,366.85 | 1,367.00 1,336.50 | -0.01% |

1,505.00

1,732.65

3,064.55

630.00

930.00

3,444.05

1,133.10

1,245.45

3,470.00

Stock Market LIVE Updates | Elecon Engineering Company Q2 Earnings:

Net profit up 37.4% at Rs 88.6 crore versus Rs 64.5 crore and revenue up 24.8% at Rs 484.9 crore versus Rs 388.6 crore, YoY.

Stock Market LIVE Updates | BSE Capital Goods index shed 1 percent dragged by BHEL, GMR Airports, Bharat Forge

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| BHEL | 126.10 | -2.4 | 548.73k |

| GMR Airports | 55.41 | -2.12 | 358.95k |

| Bharat Forge | 1,071.80 | -2.07 | 4.40k |

| Bharat Elec | 134.45 | -1.83 | 112.31k |

| ABB India | 4,015.65 | -1.76 | 1.42k |

| Hindustan Aeron | 1,919.20 | -1.76 | 15.74k |

| Polycab | 5,225.10 | -1.3 | 128.73k |

| Thermax | 3,106.30 | -1.29 | 483 |

| Elgi Equipments | 504.60 | -1.17 | 12.39k |

| Larsen | 3,016.50 | -1.15 | 56.15k |

Stock Market LIVE Updates | Jindal Stainless Steel rallies 4% after Q2 net profit zooms 120% on higher incomes

Jindal Stainless Steel Limited shares were traded 4 percent higher intraday on October 20 after the company more than doubled its net profit for the second quarter this fiscal on increased income.

The stainless steel major witnessed a remarkable 120 percent surge in its consolidated net profit, reaching Rs 764 crore in the quarter ended September 2023. This marked a significant increase from the Rs 347.02-crore net profit a year ago, as reported in JSL's regulatory filing on Thursday.

During the second quarter of the current fiscal year, the company's total income rose to Rs 9,828.97 crore from Rs 8,776.61 crore in the previous year. JSL's expenses also increased to Rs 8,944.04 crore, surpassing the Rs 8,335.52 crore reported a year earlier. Read More

Sensex Today | Oil on track for second week of gains on Gaza contagion fears

Oil prices extended gains on Friday and were on track for a second week of increases on heightened fears that the Israel-Gaza conflict may spread in the Middle East and disrupt supplies from one of the world's top-producing regions.

Brent crude futures climbed 97 cents, or 1.1%, to $93.35 a barrel by 0603 GMT. U.S. West Texas Intermediate crude was at $90.37 a barrel, up $1, or 1.1%. The front-month November contract expires on Friday.

Sensex Today | Market at 12 PM

The Sensex was down 235.56 points or 0.36 percent at 65,393.68, and the Nifty was down 85.50 points or 0.44 percent at 19,539.20. About 1398 shares advanced, 1675 shares declined, and 101 shares unchanged.

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Nestle | 24,379.85 | 1.03 | 146.99k |

| TCS | 3,490.70 | 1.01 | 579.05k |

| Kotak Mahindra | 1,755.60 | 0.99 | 1.48m |

| SBI Life Insura | 1,360.30 | 0.9 | 300.74k |

| IndusInd Bank | 1,463.30 | 0.89 | 2.40m |

| HDFC Bank | 1,518.60 | 0.24 | 4.54m |

| Sun Pharma | 1,143.50 | 0.18 | 300.50k |

| ONGC | 186.60 | 0.16 | 3.38m |

| Infosys | 1,434.45 | 0.06 | 1.36m |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| ITC | 438.30 | -2.69 | 7.24m |

| HUL | 2,498.05 | -1.96 | 1.79m |

| BPCL | 347.25 | -1.82 | 738.31k |

| JSW Steel | 767.60 | -1.65 | 633.90k |

| Cipla | 1,203.30 | -1.63 | 267.68k |

| Divis Labs | 3,579.90 | -1.59 | 248.14k |

| Tata Steel | 124.10 | -1.51 | 11.44m |

| Hindalco | 472.85 | -1.48 | 1.28m |

| Grasim | 1,948.10 | -1.4 | 188.34k |

| Power Grid Corp | 203.05 | -1.34 | 9.95m |

Earnings on October 21

Earnings Today:

Stock Market LIVE Updates | Jefferies View On Indraprastha Gas

-Downgrade to hold, target cut to Rs 465 per share from Rs 565 per share

-Delhi government has submitted a policy on EV adoption

-Policy submitted to lieutenant governor for final approval

-This could potentially impact 30 percent of IGL's overall volumes starting FY25

-New gas unlikely to compensate for slowdown in NCR

-New gas accounts for 88 percent of IGL's volumes

-Downgrade FY25/26 EPS 7/9 percent, lower valuation multiple to factor growing EV risk

| Company | Price at 11:00 | Price at 11:51 | Chg(%) Hourly Vol |

|---|---|---|---|

| Bazel Internati | 42.46 | 38.52 | -3.94 500 |

| Ironwood Edu. | 26.59 | 24.40 | -2.19 278 |

| Amarnath Sec | 55.54 | 51.03 | -4.51 76 |

| Sagarsoft India | 140.55 | 130.00 | -10.55 24 |

| Beekay Niryat | 38.70 | 35.94 | -2.76 134.83k |

| Glance Fin | 68.95 | 64.10 | -4.85 188 |

| Gokak Textiles | 54.00 | 50.51 | -3.49 254 |

| V R Films | 47.70 | 44.75 | -2.95 6.00k |

| Incredible Ind | 36.90 | 34.72 | -2.18 1.15k |

| LLOYDS ENTER | 45.20 | 42.55 | -2.65 2.91m |

| Company | Price at 11:00 | Price at 11:51 | Chg(%) Hourly Vol |

|---|---|---|---|

| Conart Engineer | 53.16 | 60.00 | 6.84 1.15k |

| Dhunseri Invest | 897.90 | 983.00 | 85.10 352 |

| Simplex Papers | 954.05 | 1,039.85 | 85.80 3.58k |

| SDL | 44.50 | 48.44 | 3.94 3.00k |

| Peninsula Land | 37.40 | 40.52 | 3.12 19.73k |

| Steel Str Infra | 22.00 | 23.78 | 1.78 1.95k |

| Margo Finance | 35.00 | 37.80 | 2.80 164 |

| Dhatre Udyog | 159.95 | 172.35 | 12.40 364 |

| Citadel Realty | 26.60 | 28.46 | 1.86 107 |

| CCL Internation | 23.52 | 25.00 | 1.48 712 |

Stock Market LIVE Updates | TVS Motor Company makes a debut in Venezuela

TVS Motor Company announces its entry into the Venezuelan market today. This makes TVS Motor the first Indian automobile manufacturer to enter the market with a host of 14 SKUs for the enthusiastic riders of Venezuela, with their local distributor, SERVISUMINISTROS JPG.

Stock Market LIVE Updates | Titagarh Rail Systems inks contract with Gujarat Metro Rail Corporation

Titagarh Rail Systems signed a contract with Gujarat Metro Rail Corporation (GMRC) for the design, manufacture, supply, testing, commissioning and training of 30 standard gauge cars valued at Rs 350 crore for Ahmedabad Metro Rail Phase-II Project.

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| BSE Auto | 37578.44 -0.32 | 29.93 0.82 | 0.79 28.84 |

| BSE CAP GOODS | 47332.38 -0.73 | 41.96 -1.18 | 0.92 47.46 |

| BSE FMCG | 18779.31 -1.2 | 16.82 -1.23 | -0.13 16.04 |

| BSE Metal | 23069.93 -1.08 | 10.62 -0.55 | 0.39 23.93 |

| BSE Oil & Gas | 18660.50 -1.34 | -8.57 -1.51 | -2.54 0.05 |

| BSE REALTY | 4789.91 -0.79 | 38.96 -2.03 | 4.63 41.06 |

| BSE IT | 32071.33 0.12 | 11.86 -0.42 | -2.97 12.02 |

| BSE HEALTHCARE | 28076.03 -0.54 | 21.89 -0.79 | -0.97 19.53 |

| BSE POWER | 4475.50 -0.56 | 2.15 -1.38 | -4.39 -6.02 |

| BSE Cons Durables | 45792.11 -1.02 | 15.28 -0.89 | -1.60 9.73 |

Stock Market LIVE Updates | Cyient slumps as FY24 revenue growth seen at lower end of guidance, but brokerages remain bullish

Cyient on October 20 fell over 3 percent after the tech company's management said that its DET (digital, engineering and technology) revenue growth is likely to be at the lower end of 15 – 20 percent range this fiscal. At 11 am, the Cyient stock was quoting at Rs 1,713.95 on the NSE, down 2.8 percent from previous close. Trading volumes at the time were close to 3 lakh shares.

Speaking to CNBC-TV18, Krishna Bodanapu, executive vice chairman and managing Director, Cyient said, "Company is guiding for revenue at lower end of guidance due to softness in communication sector. This quarter is the bottom for the communication vertical. We don’t expect communication vertical to see significant growth in Q3, but it won't slide." Read More

Stock Market LIVE Updates | Voltas shares slip as Q2 profit fails to meet estimates, margin falls over 3%

Voltas traded in the red on October 20 as the air conditioner maker failed to meet net profit and EBITDA margin estimates for the quarter that ended September. Voltas reported a consolidated net profit of Rs 36 crore, compared to the net loss of Rs 6 crore in the corresponding period of the previous fiscal.

However, a poll conducted by CNBC TV-18 predicted a profit of Rs 98 crore and a consolidated revenue of Rs 2292.8 crore, up 29.7 percent YoY. EBITDA gained 30.2 percent YoY to Rs 70.4 crore.

The EBITDA margin declined to 3.1 percent, down 270 bps YoY. Motilal Oswal had predicted an EBITDA margin of 5.1 percent. Nomura attributed the key drag to the business of the project, “which continued to be impacted due to provisions on account of delayed collection in overseas projects”.

Stock Market LIVE Updates | PTC India zooms 9% on nod to ONGC's bid to acquire subsidiary

The PTC India stock price gained 9 percent on October 20 morning, a day after the company approved ONGC’s bid to acquire subsidiary PTC Energy for Rs 925 crore.

The company approved the acquisition subject to the adjustments in bid value as per the bid format. PTC India will now seek shareholders’ approval for the sale PTC Energy to ONGC, the company told exchanges on October 19.

PTC India set up PTC Energy in 2008 to develop an asset base, engaging in the business of generation, supply, distribution, business, transmission, and import or export of coal, conversion of coal or fuels into electricity and provide consultancy services in the energy sector.

At 11.10 am, the stock was trading at Rs 149.70 on the BSE, up 8.20 percent from the previous day.

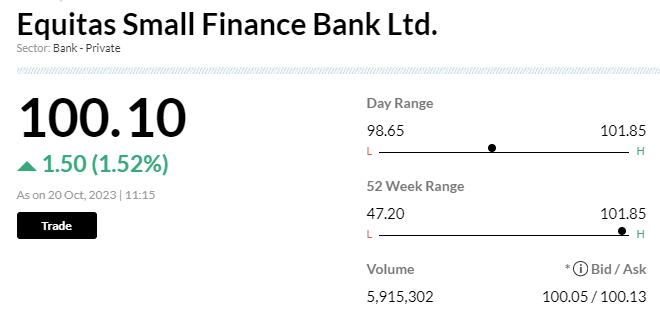

Stock Market LIVE Updates | Equitas SFB hits 52-week high after Q2 profit soars 70%

Shares of Equitas Small Finance Bank hit their 52-week high of Rs 101.85 on October 20 morning, a day after the private sector lender reported a 70.2 percent year-on-year (YoY) jump in net profit at Rs 198.1 crore in the September quarter of this fiscal year.

It posted a net profit of Rs 116.4 crore in the year-ago quarter, the company said in a post-market hours regulatory filing on October 19.

Net interest income (NII), the difference between the interest income a bank earns from its lending activities and the interest it pays to depositors, rose 25.6 percent to Rs 765.6 crore from a year ago.

The net interest margin (NIM) slipped 33 basis points (bps) to 8.43 percent.

Stock Market LIVE Updates | Tanla Platforms soars 9% as investors cheer sharp rise in Q2 net profit

Shares of Tanla Platforms surged over 9 percent in early trade on October 20, a day after the company reported a sharp rise in its net profit for the July-September quarter.

The company's net profit for the quarter under review jumped 29.1 percent on year to Rs 142.50 crore, up from Rs 110.40 crore in the same quarter of the preceding fiscal. Despite the robust rise, net profit growth was still impacted by lower interest income (cash outflow of M&A payout) and higher depreciation on intangible assets arising out of Tanla's acquisitions in recent times.

Revenue also surged 18.5 percent on year to Rs 1,008.60 crore, marking the first quarter where the topline crossed the Rs 1,000-crore mark. The rise in topline was aided by growth of 7 percent in organic revenues and 27 percent in the digital platforms segment.

Sensex Today | Market at 11 AM

The Sensex was down 226.21 points or 0.34 percent at 65,403.03, and the Nifty was down 75.50 points or 0.38 percent at 19,549.20. About 1619 shares advanced, 1398 shares declined, and 102 shares unchanged.

| Company | Price at 10:00 | Price at 10:55 | Chg(%) Hourly Vol |

|---|---|---|---|

| AURUMPP | 70.95 | 67.40 | -3.55 1 |

| Agarwal Float | 65.50 | 62.90 | -2.60 9.00k |

| Manugraph Ind | 24.15 | 23.20 | -0.95 2.23k |

| Jai Corp | 348.00 | 334.75 | -13.25 7.25m |

| Art Nirman | 52.95 | 51.00 | -1.95 26 |

| Websol Energy | 187.90 | 181.05 | -6.85 5.06k |

| Omaxe | 88.90 | 85.75 | -3.15 76.46k |

| Globesecure | 72.00 | 69.50 | -2.50 13.00k |

| Madhya Bharat A | 334.75 | 323.40 | -11.35 13.67k |

| HEC Infra Proje | 56.25 | 54.35 | -1.90 1.18k |

| Company | Price at 10:00 | Price at 10:55 | Chg(%) Hourly Vol |

|---|---|---|---|

| Emami Realty | 80.90 | 91.90 | 11.00 19.46k |

| Phantom Digital | 432.00 | 472.25 | 40.25 600 |

| Nelcast | 158.35 | 166.95 | 8.60 19.04k |

| Vindhya Telelin | 2,305.55 | 2,422.80 | 117.25 1.26k |

| Hariom Pipe | 625.05 | 656.75 | 31.70 23.30k |

| Somi Conveyor | 64.25 | 67.50 | 3.25 2.04k |

| OnMobile Global | 118.45 | 124.25 | 5.80 133.78k |

| Bombay Burmah | 1,354.55 | 1,419.20 | 64.65 9.24k |

| E Factor Experi | 146.10 | 153.00 | 6.90 - |

| Nahar Spinning | 286.90 | 300.00 | 13.10 10.05k |

Sensex Today | Arun Agarwal, VP of Fundamental Research, Kotak Securities:

Voltas Ltd’s Q2FY24 results were impacted EBIT losses in the Electro-Mechanical Projects and Services (EMP) segment. EMP segment EBIT loss was on account of provision taken due to delayed collections in overseas projects. However, EMP segment’s order book continues to grow, and was higher 58% yoy. In the Unitary Cooling Products (UCP) segment, the company reported 15% yoy revenue growth. UCP segment EBIT margins was higher yoy.

Stock Market LIVE Updates | Tanla Platforms Q2 profit jumps 29% YoY to Rs 142.5 crore with quarterly revenue crossing Rs 1,000 crore for first time

The CPaaS provider has recorded a 29% year-on-year growth in profit at Rs 142.5 crore for the quarter ended September FY24, with quarterly topline crossing Rs 1,000 crore mark for first time. Revenue from operations grew by 19% on-year to Rs 1,008.6 crore during the quarter.

Stock Market LIVE Updates | Tata Communications shares fall 2% after Q2 net profit declines 58%

Shares of Tata Communications Ltd dropped nearly 2 percent after it reported a 58 percent fall in its September quarter net profit.

The company's net profit fell by 58 percent year-on-year (YoY) to Rs 221.3 crore, with expenses increasing by 16 percent to Rs 4,600 crore, mainly due to network and transmission costs. However, their data services segment, contributing over 80 percent of total income, saw a 14 percent revenue increase driven by strong demand in connectivity and digital portfolio segments. Read More

Stock Market LIVE Updates | Sigachi Industries subsidiary forms joint venture Sigachi Arabia with Saudi National Projects Investment

Sigachi Industries said its subsidiary Sigachi MENA FZCO, incorporated in Dubai, has formed a joint venture - Sigachi Arabia - with Saudi National Projects Investment (SNP), to enter the rapidly growing Saudi Arabian market. Sigachi MENA FZCO will hold 75% stake and SNP 25% in the joint venture.