LiveNow

Closing Bell: Sensex, Nifty end lower on Budget day; PSU Banks shine, realty, metals drag

Indian equity indices ended with little change in the volatile session on February 1 after the Finance Minister has presented the inline Interim Budget with no big announcements. At close, the Sensex was down 106.81 points or 0.15 percent at 71,645.30, and the Nifty was down 28.20 points or 0.13 percent at 21,697.50.

We wrap up today's edition of the Moneycontrol live market blog, and will be back tomorrow morning with all the latest updates and alerts. Please visit https://www.moneycontrol.com/markets/global-indices/ for all the global market action.

Akihiro Ueda, CEO of Terra Charge:

I am pleased with how the budget has promised to focus on EV manufacturing and develop EV charging infrastructure in the country and I believe the positive push would offer the much-needed push toward green mobility. Typically, the reduction of the GST compliance burden is a highlight of this budget. Similarly, the government's push to strengthen the EV charging network across the country through rooftop solarization projects, is also commendable. I believe this would help EV charging infrastructure development companies to amp their charging and installation capacity and in turn address the root of range anxiety, promoting the adoption of electric vehicles across all segments.

Additionally, the reduction of GST compliance for trade and industry could ease the burden of EV entrepreneurs to some extent. However, I wish there were more announcements on the fronts of GST reforms to accelerate the growth of EV charging infrastructure and promote EV adoption in the country. While the budget’s emphasis on green mobility is commendable, I feel it missed an opportunity to uplift the EV sector’s niche segments, such as EV battery recycling.

Stock Market LIVE Updates | Tata Motors Q3 net profit may rise 53%, revenue 22% on strong JLR sales growth

Tata Motors is likely to see a robust growth in net profit and revenue in the fiscal third quarter, on the back of strong growth in Jaguar Land Rover volumes, price hikes, and superior product mix. The automobile major will announce its Q3 FY24 results on February 2.

According to the average estimate of six brokerages, Tata Motors’ net profit is expected to grow 54 percent on-year to Rs 4,547 crore in the October-December quarter. Revenue may gain 22 percent on-year to Rs 1,08,169 crore. EBITDA margin too is expected to see a sharp jump of 273 basis points to 13.63 percent. Read More

Srinath Ramakkrushnan, Co-founder & COO, Zetwerk

Zetwerk applauds the 2024-25 interim budget's focus on development, infrastructure, and clean energy. Increased infrastructure spending, including corridors and port improvements, will boost economic activity and logistics efficiency. The net-zero target and free rooftop solar project are commendable steps towards green integration. The decision to cut import duties on essential components for making mobile phones will be leveraged by the sector.

Upgrading railway bogies to Vande Bharat standards will enhance safety, convenience, and passenger experience, further bolstering our infrastructure and manufacturing activities.

The research and development corpus of Rs1 trillion and focus on developing deep-tech in the defence sector will prompt private companies to innovate and contribute to 'Atmanirbharta'."

These measures will generate employment and empower our youth. We believe that successful implementation of these plans will add further momentum to the tailwinds propelling the Indian manufacturing industry and economy in general. Overall, this budget positions the Indian economy for continued success in the near and mid-term.

Stock Market LIVE Updates | Hero MotoCorp January Auto Sales

Total sales up 21.6% at 4,33,598 units vs 3,56,690 units, YoY

Domestic sales up 18% at 420,934 units vs 3,49,437 units, YoY

Stock Market LIVE Updates | Abbott India Q3 Results:

Net profit rose 26% at Rs 311 crore against Rs 246.8 crore and revenue up 8.7% at Rs 1,437 crore versus Rs 1,322.2 crore, YoY.

Fund Flow:

FIIs net sell Rs 1,879.58 crore in equities and DIIs net buy Rs 872.49 crore in equities today (Provisional)

JUST IN | Bank of England (BoE) keeps interest rates unchanged at 5.25%

Stock Market LIVE Updates | Pricol Q3 Results:

Net profit up 26.9% at Rs 34 crore versus Rs 26.8 crore and revenue up 20.8% at Rs 572.6 crore versus Rs 474.2 crore, YoY.

Stock Market LIVE Updates | Mphasis Q3 net profit down 4.7% at Rs 373.6 crore versus Rs 391.9 crore, QoQ.

Stock Market LIVE Updates | City Union Bank Q3 Earnings

Net profit up 16.2% at Rs 253 crore versus Rs 217.8 crore and Net Interest Income (NII) down 7.2% at Rs 515.9 crore versus Rs 555.7 crore, YoY.

Stock Market LIVE Updates | Indian Hotels Q3 Results

Net profit up 18.2% at Rs 476.9 crore versus Rs 403.6 crore and revenue up 16.5% at Rs 1,963.8 crore against Rs 1,685.8 crore, YoY.

Stock Market LIVE Updates | Thyrocare Technologies Q3 Results:

Net profit flat at Rs 14.7 crore and revenue up 5.2% at Rs 134.7 crore versus Rs 128 crore, YoY.

Stock Market LIVE Updates | Godrej Agrovet Q3 Results:

Net profit down 27.6% at Rs 83 crore versus Rs 114.6 crore and revenue up 0.9% at Rs 2,345.2 crore versus Rs 2,323.5 crore, YoY.

Deven Mehata, Research Analyst at Choice Broking

On the first day of February, coinciding with the release of the interim budget by Finance Minister Nirmala Sitharaman, the major index NIFTY remained flat. In contrast, Bank Nifty and banking equities showed upward momentum throughout the trading session.

The market has traded Negative with the Sensex losing 0.15 percent and closed at 71645.30 and Nifty was down by 0.13 percent intraday and closed at 21697.45 levels whereas Bank Nifty closed positive, up by 0.42 percent and settled at 46188.65.

Among sectors Nifty PSU Bank, Nifty Auto and Nifty FMCG ended in green while Nifty Metal, Nifty Media and Nifty Infra ended on the lower side. In Nifty stocks, Maruti Suzuki, Cipla and Power GRID were the top gainers while Ultratech Cement, LT and Grasim were the prime laggards.

India VIX was negative by 9.97 percent intraday and settled at 14.45.

Index has a support around 21550-21400 zone. Coming to the OI Data, on the call side, the highest OI observed at 22000 followed by 21800 strike prices while on the put side, the highest OI is at 21700 strike price. On the other hand, Bank Nifty has support at 45700-45500 while resistance is placed at 46500 and 46650 levels.

Rahul Kalantri, VP Commodities, Mehta Equities

The Rupee closed stronger to gain 8 paisa at 83.04 amid recovery in domestic equity markets and fall in dollar against major currencies, including India. Better economic growth forecasts for 2024 from the IMA as well as increase in India's growth forecast gave support to the rupee. We expect the rupee to remain in a range ahead of the U.S non-farm payroll data with the pair likely to trade in the range of 82.80-83.45.

Shishir Baijal, Chairman and Managing Director, Knight Frank India

The union budget presented today by the honourable Finance Minister has further strengthened the government’s commitment towards long- term social and infrastructure development. Though it is an interim budget due to the impending elections, today’s announcements by the Union Finance Minister are significant in many aspects. The 11.1% increase in infrastructure outlay which is 3.4% of GDP will further enhance the railway, roads and logistics infrastructure of the country. The three new economic railway corridors identified under the PM Gati Shakti program are massive projects with the potential to grow economic hubs and boost development of the tier-2 and tier-3 cities along their alignment. The intention to complete 2 cr housing units in the next five years will aid the ‘Housing for All’ mission of the government. Additionally, the proposed boost to housing for the middle-class living in sub-par accommodation is also a welcome inclusion. We look forward to the details of this as we expect this to have great long-term ramifications. Further, the enhanced focus on domestic tourism development will provide a fillip to the hospitality industry.

Siddhartha Khemka, Head - Retail Research, Motilal Oswal Financial Services:

Nifty traded in a narrow range post-major event and closed with a loss of 28 points at 26697 levels. Sector-wise it was a mixed bag. Major buying was seen in government companies especially PSU Bank which was up 3% post-FM speech. On the global front, the US Fed concluded by maintaining its status quo and did not hint at an early rate cut which dampened global sentiments.

In the Interim Budget, the government emphasized empowering 4 pillars of Viksit Bharat namely Youth, Poor, Women, and Farmers. Further, the government continues to focus on consolidating the fiscal deficit and investing in infrastructure. Some of the sectors to benefit are affordable housing & finance, infra, railway, defense, and consumption. With two major events now behind, we expect markets to take support from the ongoing earning season and should remain in positive territory.

Rajesh Bhosale, Technical Analyst, Angel One

On the crucial budget day, the Nifty benchmark index kicked off with a modest positive start. However, unlike typical event days, there was limited momentum, and prices fluctuated within a 100-point range, eventually closing with a marginal loss of 0.13%, a tad below 21700.

While we expected no major announcement considering it being an interim budget, the surprise came from the narrow trading range making it a total non-event. The Nifty experienced a pattern of alternating between up and down days for the seventh consecutive day, indicating market uncertainty. Despite the hope that the budget would provide clarity on the near-term direction, the session proved to be disappointingly lackluster. Analyzing the last four candles, prices consolidated within the 21400-21850 range. The next significant trend will only become apparent with a breakout on either side of this zone. A breach below 21400 could lead prices towards recent lows of 21100, potentially triggering further decline. Conversely, surpassing 21850 may propel Nifty towards the 22000-22100 range. Given the recent irregularities, it is prudent for traders to focus on the intra-day trend to take a trade or wait for a breakthrough from the mentioned range before making bold moves.

In the upcoming session, the market may continue to respond to the aftermath of the budget announcement, with individual themes playing a significant role for traders seeking out performance opportunities. As the focus shifts from the key event, attention will revert to global developments, necessitating vigilance on the global front by traders.

VST Tillers Tractors January Auto Sales | Total sales down 3.7% at 4,146 units versus 4,306 units, YoY.

Stock Market LIVE Updates | Eicher Motors January Auto Sales:

Total sales up 2% at 76,187 units versus 74,746 units

Exports down 20% at 5,631 units versus 7,044 units

Stock Market LIVE Updates | GMM Pfaudler Q3 Results:

Net profit rose 69.5% at Rs 31.7 crore versus Rs 18.7 crore and revenue up 8% at Rs 856 crore versus Rs 792.3 crore, YoY

Prashanth Tapse, Senior VP (Research), Mehta Equities

Nobody was expecting any major announcement in this Budget and hence we saw a range-bound trend with a negative bias. Global markets too were subdued and hence select profit-taking was seen in telecom and realty stocks.

Amisha Vora, Chairperson & Managing Director, Prabhudas Lilladher Group:

Normally in an election year, we generally see a populist budget. However, the Honorable Finance Minister has put the growth in clear perspective with prudence taking over populism in this budget. It outlines development that will be all-round, all-inclusive, and all-pervasive towards making India a Viksit Bharat by 2047. FY23-25 interim budget has carried forward Govt focus on Net zero by 2070 (Rooftop Solarisation, Non fossil fuel, E vehicles), 11% higher capex allocation (18% effective increase) , higher allocation for PM Awas, MNREGA, Aquaculture and Tourism.

Fiscal situation seems to be in fine shape with CAD at ~1% of GDP and fiscal deficit at 5.8% of GDP with next year target at 5.1% of GDP. FY25 assumptions of 11.5% growth in GST and 11.7% in corporate tax and 13% in income tax look reasonable.

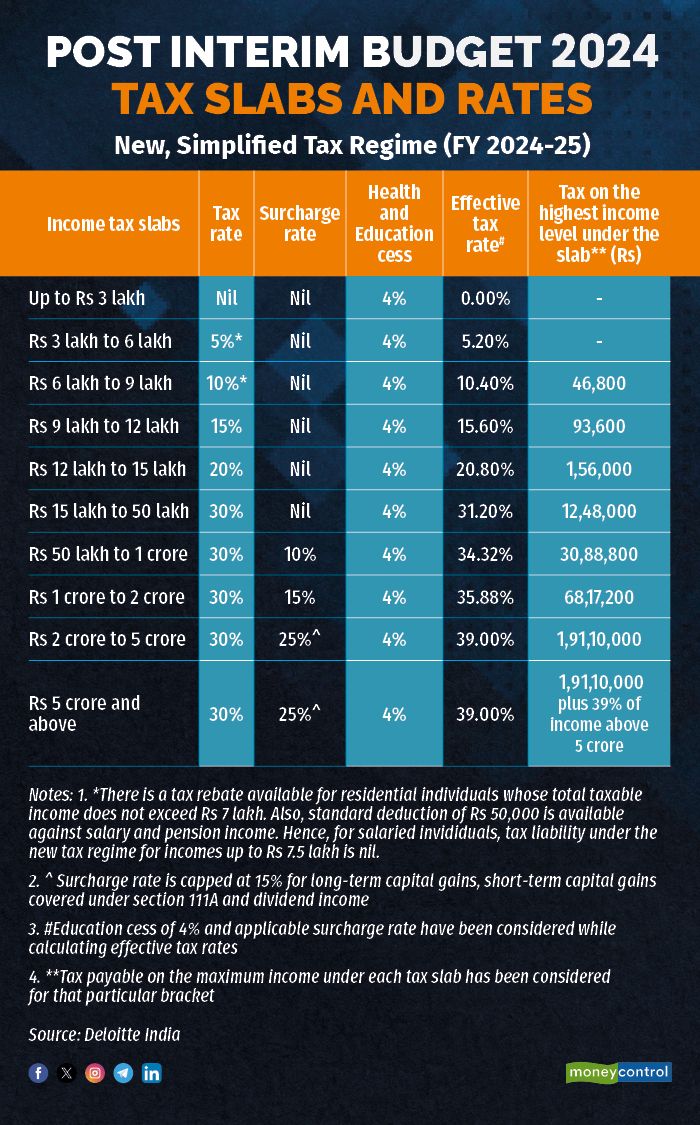

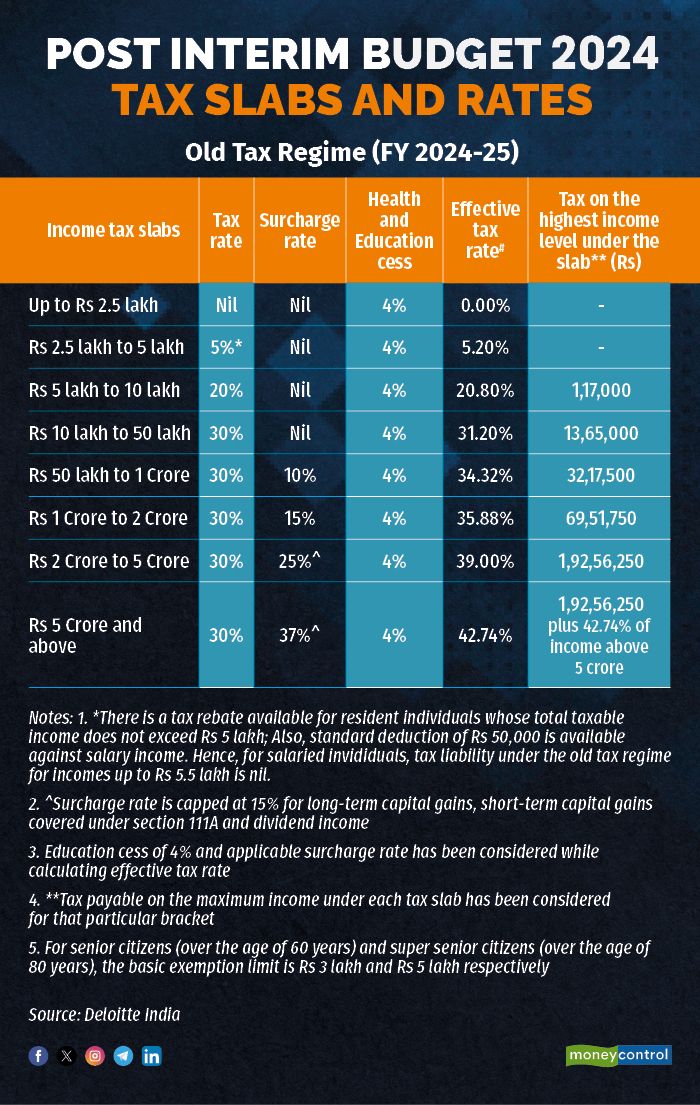

There has been no change in corporate and Income tax rates. Total debt has been lower than earlier estimates and FY25 gross markets borrowings with increased private capex will continue to provide growth capital and momentum to the economy. In a nut shell interim budget just ensures strong fiscal discipline and continuity of policies.

Sundararaman Ramamurthy, MD & CEO BSE:

This Interim Budget the honorable Finance Minister has once again delivered a responsible, innovative and inclusive budget. This budget lays emphasis on Fiscal products and gives room for private capital investment into the growth of India. Continuing with the trends of the last 10 years, the FM once again lays on the foundation for a very strong path for India with due focus on areas of national importance.

Jatin Gedia – Technical Research Analyst at Sharekhan by BNP Paribas:

The Nifty opened on a positive note and witnessed range-bound price action during the day. Despite being an event day, the range was narrow as compared to the recent trading sessions and the Nifty closed marginally in the red, down ~36 points. On the daily charts we can observe that the Nifty has been broadly stuck in the range of 21200 – 21900 for the last couple of weeks. The Nifty has been facing selling pressure at the 61.82% Fibonacci retracement level (21747) and has been unable to close above it on a closing basis. We believe that the range bound action is likely to continue. The daily momentum indicator has triggered a positive crossover while the hourly has a negative crossover. Moreover, prices are stuck in a range. Considering the divergent signals from price and momentum indicator, the Nifty is likely to witness range bound price action. Key support levels are 21550 – 21500 while immediate hurdle zone is placed at 21850 – 21900.

Bank Nifty witnessed continuation of the positive momentum. During the day, it was the bank Nifty which held on the crucial support zone of 45660 – 45700 where the hourly moving averages were placed and resumed its upmove. We believe that the Bank Nifty is likely to move higher towards 46570 – 46800 from short term perspective. The Daily momentum indicator has triggered a positive crossover which is a buy signal and is likely to provide speed to the upmove.

Aditya Gaggar Director of Progressive Shares:

The interim budget was the much anticipated non-event which was seen through tight market movements as the Index oscillated in a narrow range to settle the day lower at 21,697.45 with a loss of 28.25 points. PSU Banking was the best-performing sector of the day by gaining over 3%; and on the flip side, Media and Metal segments corrected over 1%. A mixed activity was seen in the Auto and Pharma space. Divergence was seen in the Broader markets where Midcaps corrected and moved in tandem with the Benchmark Index while Smallcaps ended in green.

A small bearish candle was formed on the daily chart but the undertone remains bullish with the downside protected at 21,630 which is 21DMA support while the immediate resistance is placed at 21,840.

Kunal Shah, Senior Technical & Derivative Analyst at LKP Securities:

The Bank Nifty bulls demonstrated strength as the index closed above the 46000 level on the interim budget day. The overall undertone remains bullish, with support at 47800 providing a cushion for the bulls. On the upside, the immediate resistance is positioned at 46500, and a breakthrough at this level is anticipated to trigger sharp short-covering moves in the market.

Ajit Mishra, SVP - Technical Research, Religare Broking

Markets oscillated in a narrow range on the budget day and settled marginally lower. The tone was positive at the beginning however profit taking emerged around the previous swing high. Consequently, Nifty surrendered all its gains and finally settled closer to the day’s low at 21,697.45 level. Meanwhile, a mixed trend on the sectoral front kept the participants occupied wherein energy, auto and banking posted decent gains while metal and realty traded under pressure.

Markets are not in a hurry for the next directional move and the recent price action reaffirms our view. Traders have no option but to align their positions accordingly and focus more on stock-specific trading approach. Though we are seeing consistent outperformance from the broader indices despite the overbought condition, we feel it is prudent to restrict exposure and prefer only quality names.

Ashok Leyland: Total sales were down 7% at 15,939 units versus 17,200 units, YoY.

Rupee Close:

Indian rupee ended marginally higher at 82.98 per dollar on Thursday versus Wednesday's close of 83.04.

Market Close: Indian benchmark indices ended with marginal losses in a volatile session on February 1 (Budget day).

At close, the Sensex was down 106.81 points or 0.15 percent at 71,645.30, and the Nifty was down 28.20 points or 0.13 percent at 21,697.50. About 1467 shares advanced, 1762 shares declined, and 75 shares unchanged.

Top Nifty gainers were Maruti Suzuki, Cipla, Eicher Motors, SBI Life Insurance, Power Grid Corporation, while losers included UltraTech Cement, L&T, Dr Reddy's Laboratories, JSW Steel and Grasim Industries.

Mixed trend saw on the sectoral front, with auto, bank, FMCG and power added 0.2-0.8 percent, while capital goods, metal and realty down a percent each.

The BSE midcap index shed 0.4 percent, and the smallcap index ended 0.2 percent lower.

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Brigade Ent | 992.00 | -3.27 | 9.71k |

| Prestige Estate | 1,235.25 | -2.65 | 25.05k |

| Sobha | 1,414.75 | -2.22 | 6.75k |

| Oberoi Realty | 1,304.40 | -1.45 | 6.67k |

| Phoenix Mills | 2,399.70 | -1.17 | 14.42k |

| Godrej Prop | 2,355.70 | -0.92 | 9.74k |

| Mahindra Life | 558.70 | -0.45 | 4.78k |

| DLF | 798.85 | -0.44 | 98.30k |

| Macrotech Dev | 1,067.35 | -0.22 | 14.68k |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Suzlon Energy | 48.31 | 5 | 70.15m |

| Power Grid Corp | 266.70 | 2.83 | 1.00m |

| NTPC | 319.60 | 0.65 | 998.67k |

| NHPC | 91.48 | 0.54 | 17.70m |

| Adani Green Ene | 1,675.00 | 0.35 | 94.77k |

| Tata Power | 390.80 | 0.3 | 1.19m |

| Adani Energy | 1,069.10 | 0.15 | 72.41k |

Sensex Today | Lupin receives approval from USFDA for Dronedarone Tablets, USP

Lupin has received approval from the United States Food and Drug Administration (USFDA) for its Abbreviated New Drug Application for Dronedarone Tablets USP, 400 mg, to market a generic equivalent of Multaq Tablets, 400 mg of Sanofi-Aventis U.S. LLC. The product will be manufactured at Lupin’s Goa facility in India.

Dronedarone Tablets USP, 400 mg, are indicated to reduce the risk of hospitalization for atrial fibrillation (AF) in patients in sinus rhythm with a history of paroxysmal or persistent AF.

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Rail Vikas | 298.55 | -3.16 | 4.45m |

| ABB India | 4,556.00 | -2.48 | 34.47k |

| Larsen | 3,394.10 | -2.47 | 456.67k |

| CG Power | 457.75 | -2.37 | 97.88k |

| SKF India | 4,595.00 | -2.12 | 1.25k |

| Grindwell Norto | 2,328.50 | -1.8 | 1.68k |

| Thermax | 3,136.40 | -1.39 | 2.37k |

| Polycab | 4,285.00 | -1.32 | 15.47k |

| Bharat Elec | 183.55 | -1.24 | 785.72k |

| Timken | 3,343.55 | -1.11 | 608 |

Rahul Bhuskute, Chief Investment Officer at Bharti AXA Life Insurance

The government has positively surprised the bond markets by exceeding the fiscal consolidation roadmap by aggressively reducing the budgeted fiscal deficit by 70 bps to 5.1% in FY25 which provides the confidence of achieving fiscal glide path to below 4.5% well within timelines. As the gross borrowing number is Rs 1.3 trillion lower than market estimates, the bond demand-supply scenario for next year improves significantly, especially with the Rs 2-2.5 trillion of flows expected from foreign investors due to global index inclusion. Bond markets have cheerfully reacted to this and bond yields are down ~10 bps.

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| SAIL | 119.60 | -2.37 | 2.26m |

| Jindal Stainles | 563.95 | -2.17 | 67.85k |

| JSW Steel | 802.55 | -1.94 | 27.10k |

| Vedanta | 268.60 | -1.9 | 306.98k |

| Jindal Steel | 744.15 | -1.7 | 128.18k |

| Hindalco | 572.45 | -1.19 | 256.50k |

| APL Apollo | 1,490.30 | -0.77 | 7.21k |

| Tata Steel | 135.20 | -0.52 | 2.50m |

Sensex Today | Nifty Bank index up 0.4 percent led by PNB, Bank of Baroda, Axis Bank:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| PNB | 118.70 | 3.76 | 126.37m |

| Bank of Baroda | 256.10 | 3.43 | 41.44m |

| Axis Bank | 1,083.10 | 1.44 | 8.26m |

| SBI | 648.05 | 1.18 | 24.72m |

| IndusInd Bank | 1,541.15 | 0.46 | 1.93m |

| HDFC Bank | 1,465.50 | 0.2 | 14.21m |

Stock Market LIVE Updates | Praj Industries Q3 Results:

Net profit rose 13% at Rs 70.4 crore against Rs 62.3 crore and revenue down 9.1% at Rs 828.6 .4 crore versus Rs 911.4 crore, YoY.

Stock Market LIVE Updates | Titan Company Q3 profit at Rs 1,040 crore

Sensex Today | Motilal Oswal, MD & CEO, Motilal Oswal Financial Services:

The government has presented a very prudent Budget/Vote-On-Account for FY24-25. In an election year where stakes are very high, government has resisted the temptation, once again, for populism and instead shown excellent strategic sense by opting to continue on the path of fiscal consolidation.

The government is building in a 10.5% nominal GDP growth for FY25, a healthy 12% growth in revenue receipts. However spending growth is just 6%, within which revenue spending is expected to grow just 3% while the more productive capex spending is expected to grow 17% to INR 11.1 Trillion

The government’s commitment to a 4.5% Fiscal Deficit by FY26 is indeed commendable. Towards that effect, it has pencilled in a fiscal deficit of 5.1% for FY25, better than most economists' estimates. This augurs well for overall economic credit creation as indeed for inflation and private capex revival.

The 17% increase in Capital Expenditure allocation on the back of a 3x increase over FY19-24 (from INR 3 trillion to INR 9.5 Trillion) indicates the continued thrust of the government towards infrastructure creation and driving the private investment cycle.

What is a bit of a dampener, however is lack of any big push for consumption. Consumption has been weak, especially in Rural India, as indicated by corporate earnings for last few quarters. The budget doesn’t provide any near-term solution for quick revival for consumption.

I continue to remain bullish in the medium to long term.

Sensex Today | Market at 3 PM

The Sensex was down 20.99 points or 0.03 percent at 71,731.12, and the Nifty was down 10.90 points or 0.05 percent at 21,714.80. About 1454 shares advanced, 1768 shares declined, and 72 shares unchanged.

| Company | Price at 14:00 | Price at 14:58 | Chg(%) Hourly Vol |

|---|---|---|---|

| Lumax Inds | 2,450.10 | 2,314.30 | -135.80 132 |

| D.K. Enterprise | 76.00 | 72.00 | -4.00 0 |

| Vinyas Innovati | 640.00 | 610.00 | -30.00 - |

| Fidel Softech | 123.85 | 118.05 | -5.80 0 |

| AIA Engineering | 4,581.15 | 4,377.45 | -203.70 106.02k |

| Manugraph Ind | 34.40 | 32.95 | -1.45 90.75k |

| IBL Finance | 69.95 | 67.25 | -2.70 44.22k |

| Kalyan Jeweller | 339.95 | 328.20 | -11.75 184.51k |

| Flexituff Ventu | 47.90 | 46.25 | -1.65 50 |

| TARACHAND | 187.45 | 181.00 | -6.45 520 |

| Company | Price at 14:00 | Price at 14:58 | Chg(%) Hourly Vol |

|---|---|---|---|

| Sangam India | 466.05 | 558.15 | 92.10 34.96k |

| India Tourism D | 673.55 | 762.65 | 89.10 82.66k |

| Oricon Ent | 41.60 | 46.00 | 4.40 228.03k |

| GIC Housing Fin | 256.45 | 283.00 | 26.55 42.09k |

| HUDCO | 187.75 | 204.00 | 16.25 12.78m |

| Pattech Fitwell | 57.50 | 62.40 | 4.90 2.31k |

| Akanksha Power | 119.00 | 129.05 | 10.05 - |

| Pearl Polymers | 32.50 | 35.20 | 2.70 2.34k |

| Mirc Electronic | 21.30 | 22.90 | 1.60 846.90k |

| Amber Enterpris | 4,196.50 | 4,510.45 | 313.95 8.40k |

Stock Market LIVE Updates | Welspun Enterprises Q3 Results:

Net profit down 77.7% at Rs 89.5 crore versus Rs 400.7 crore and revenue up 2.1% at Rs 706.7 crore versus Rs 692.4 crore, YoY.

Sensex Today | Shrakhan View on Maruti Suzuki:

Post reporting slightly better than estimated operating performance, the management has shared an optimistic outlook for domestic as well as export segments. Assuming an increase in wholesales in on q-o-q basis we expect the operating performance to improve in Q4FY24. Despite weak demand in the entry-level segment, the management remains optimistic about its recovery. This expectation is based on the anticipated rise in the income levels of entry-level customers.

AEBITDA margin expansion trend has been continuing as this was the eighth consecutive quarter when MSIL has reported y-o-y expansion in AEBITDA margin and has been sustaining AEBIDTA margin above 10% for last four quarters.

Broking house continue to maintain positive view on MSIL owing to its new product launch strategy, recovery in margins and favourable volume growth cycle in the domestic PV segment. Post incorporating Q3FY24 performance in estimates, maintain Buy rating on the stock with unchanged Price Target of Rs 12,257 in expectation of the success of new launches, improvement in operating performance and structural upward shift in its product mix.

Sensex Today | Aditya Birla Capital Q3 Results:

Net profit at Rs 735.8 crore versus Rs 3,269.4 crore and Net Interest Income (NII) up 20% at Rs 6,803 crore versus Rs 5,670.5 crore, YoY.

Stock Market LIVE Updates | Maruti Suzuki sells 199,364 units in January

In January 2024, Maruti Suzuki India Limited sold a total of 199,364 units, which is its highest ever monthly sales volume. Total sales in the month include domestic sales of 170,214 units, sales to other OEM of 5,229 units and exports of 23,921 units.

Sensex Today | Manmeet Kaur, Partner, Karanjawala & Co:

The government’s plan to assist states in developing ‘Aspirational Districts’ and focus on eastern India’s development is a welcome move. Solar energy’s expansion is going to get a boost with the announcement of rooftop project which will provide free electricity of 300 units per month and from solar surplus. More support to Electric Vehicles which will generate more jobs for vendors/youth in the sector of eclectic installation and maintenance.

Sensex Today | Sunil Nyati Managing Director of Swastika Investmart

While the budget itself contained minimal surprises, it reflected the government's commitment to fiscal prudence and tempered expectations. Unsurprisingly, the market showed muted reaction, choosing to prioritize upcoming earnings reports and global developments as drivers of stock- and sector-specific outperformance. For Nifty, the key resistance zone lies at 21800-21850; a break above this level could pave the way for a new all-time high. Conversely, immediate support sits at 21500, with 21200 providing the next safety net.

Sensex Today | Coal India January Update:

Production up 9% at 78.4 mt against 71.9 mt and Offtake was up 4.8% at 67.6 mt versus 64.4 mt, YoY.

Sensex Today | Sachin Bajaj, Head-Investments, Max Life Insurance on Budget 2024

The interim budget promises continuation of the government's policies and priorities of reforms and overall development. The government has managed to maintain a healthy balance between providing resources for growth while adhering to the path of fiscal consolidation. The fiscal deficit is pegged at 5.1 percent against 5.8 percent for FY24RE and is expected to further consolidate to the government's long-term target of 4.5% by FY26. The focus of the budget remains on infrastructure/capex growth and innovation while remaining prudent on the fiscal front.

Stock Market LIVE Update | Adani Enterprises stock gains after profit jumps over two-fold YoY in Q3

Stock Market LIVE Updates | Sumitomo Chemical India Q3 Results:

Net profit down 40.0% at Rs 54.7 crore versus Rs 90.4 crore and revenue down 28% at Rs 542 crore versus Rs 752.9 crore, YoY.

Stock Market LIVE Updates | Orient Electric Q3 Results:

Net profit down 25.5% at Rs 24.3 crore versus Rs 32.6 crore and revenue up 1.8% at Rs 752 crore versus Rs 739 crore, YoY.

Stock Market LIVE Updates | Bharat Seats Q3 Earnings:

Net profit up 17% at Rs 5.5 crore versus Rs 4.7 crore and revenue up 14% at Rs 250 crore versus Rs 219.2 crore, YoY.

Stock Market LIVE Updates | V-Guard Industries Q3 Earnings:

Net profit was up 48.1% at Rs 58.2 crore versus Rs 39.3 crore and revenue up 18.6% at Rs 1,165.4 crore versus Rs 982.3 crore, YoY.

Stock Market LIVE Updates | TD Power Systems Q3 Results:

Net Profit up 49% at Rs 30 crore against Rs 20 crore and revenue was up 18% at Rs 242.6 crore versus Rs 205.3 crore, YoY.

| Company | Price at 13:00 | Price at 13:54 | Chg(%) Hourly Vol |

|---|---|---|---|

| Balkrishna | 47.00 | 45.20 | -1.80 7.52k |

| Maxposure | 109.00 | 105.00 | -4.00 - |

| Nandani Creatio | 69.95 | 67.45 | -2.50 1.56k |

| Anlon Technolog | 245.00 | 237.05 | -7.95 0 |

| Mirc Electronic | 22.15 | 21.45 | -0.70 1.69m |

| VLS Finance | 273.95 | 265.35 | -8.60 16.20k |

| Dev Information | 162.25 | 157.25 | -5.00 5.21k |

| Silver Touch Te | 720.00 | 698.85 | -21.15 2.21k |

| Khandwala Sec | 32.30 | 31.40 | -0.90 96.19k |

| Systango Tech | 334.90 | 326.00 | -8.90 1.74k |

| Company | Price at 13:00 | Price at 13:54 | Chg(%) Hourly Vol |

|---|---|---|---|

| AIA Engineering | 4,181.00 | 4,526.95 | 345.95 4.42k |

| CARE Ratings | 1,060.55 | 1,130.00 | 69.45 19.63k |

| GE Power India | 267.65 | 282.45 | 14.80 242.39k |

| Subex | 38.45 | 40.45 | 2.00 2.33m |

| Thomas Cook | 177.80 | 185.90 | 8.10 922.38k |

| SML Isuzu | 1,415.00 | 1,477.20 | 62.20 15.70k |

| Lead Reclaim | 31.55 | 32.90 | 1.35 2.36k |

| STC India | 170.20 | 177.45 | 7.25 51.45k |

| Jyoti CNC Auto | 593.60 | 615.85 | 22.25 110.60k |

| Prakash Ind | 207.90 | 215.70 | 7.80 47.58k |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Cummins | 2,245.20 | -2.04 | 8.62k |

| Ashok Leyland | 174.30 | -0.88 | 397.45k |

| Apollo Tyres | 536.20 | -0.79 | 376.12k |

| Balkrishna Ind | 2,438.90 | -0.75 | 6.38k |

| TVS Motor | 1,993.90 | -0.3 | 8.50k |

| Hero Motocorp | 4,608.90 | -0.28 | 9.00k |

| Tube Investment | 3,887.90 | -0.28 | 1.61k |

| MRF | 142,360.00 | -0.1 | 398 |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Maruti Suzuki | 10,636.00 | 4.45 | 31.64k |

| Eicher Motors | 3,912.00 | 1.86 | 40.44k |

| MOTHERSON | 114.75 | 1.37 | 753.65k |

| Bosch | 23,655.25 | 0.36 | 314 |

| Bajaj Auto | 7,691.40 | 0.36 | 8.25k |

| M&M | 1,659.65 | 0.35 | 245.14k |

| Sundram | 1,223.95 | 0.27 | 1.07k |

| Tata Motors | 886.20 | 0.23 | 843.00k |

| TVS Motor | 2,002.20 | 0.12 | 9.45k |

Stock Market LIVE Updates | Aether Industries Q3 Results:

Net profit down 50.3% at Rs 17.4 crore versus Rs 35 crore and revenue down 7.1% at Rs 155.3 crore versus Rs 167.1 crore, YoY.

Sensex Today | Chirag Mehta, CIO, Quantum AMC

There was an expectation that given it’s an election year, the budget could tilt more populist with more support for rural sector. However, contrary to expectations, the government continues to be driven by development and fiscal prudence as the central focus. Given the economic growth momentum, there was need for assuring macroeconomic stability which has been judiciously crafted to give way for fiscal consolidation. The lower tax collection assumption could either be conservative or government signal to assume some growth moderation going forward.

The government continues it capital expenditure spending with on Inclusive development with Agri, Infra (including housing) and Green ecosystem as the key thrust areas with an emphasis on Research and Technological developments. There was a need to support manufacturing momentum and way to revive rural economy. However, probably that could be part of the main budget that gets presented in July as government plans to showcase a pathway for Developed India.

Stock Market LIVE Updates | Raymond Q3 net profit up 94% at Rs 183.6 crore versus Rs 94.8 crore, YoY

Sensex Today | Dr Lal PathLabs Q3 Results:

Revenue up 10.1% at Rs 538.9 crore versus Rs 489.4 crore and net profit up 54% at Rs 81.3 crore versus Rs 52.8 crore, YoY.

Sensex Today | Pradeep Gupta, Co-founder & Vice-chairman, Anand Rathi Group

The FM has continued to focus on strengthening of domestic macro factors including sustained investments in Infra, Agriculture, Domestic Tourism, and also sticking to fiscal responsibility with a lower fiscal deficit which could be music to the ears of foreign investors and impending $25 billion bond inclusion in June as lower budget deficits and pared borrowings will help bring down yields. It could possibly open the door for a ratings upgrade.

Key features of the budget are focus on infrastructure, tourism, logistics and innovation in research. All these measures will bring continuous sustainable growth of the economy. This shows the continued commitment of the existing government to move towards bringing fiscal prudence and reaching to the targeted fiscal deficit of 4.5% of GDP by FY26.

Sensex Today | Oil nudges higher, buoyed by rate cut expectations

Oil prices edged up on Thursday, supported by signals from the U.S. Federal Reserve on a possible start to rate cuts and as China unveiled new support measures for its embattled property market.

Brent crude futures inched up 5 cents to $80.60 a barrel and U.S. West Texas Intermediate crude futures gained 7 cents to $75.92 at 0651 GMT, after falling by more than $2 a barrel in the previous session.

Stock Market LIVE Updates | Tata Motors sales in the domestic & international market for January 2024 stood at 86,125 vehicles, compared to 81,069 units during January 2023.

Stock Market LIVE Updates | Deepak Fertilisers Q3 Results:

Net profit down 76.9% at Rs 57.6 crore versus Rs 249.4 crore and revenue down 32.8% at Rs 1,852.6 crore versus Rs 2,754.8 crore, YoY.

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Aurobindo Pharm | 1,069.80 | -7 | 229.12k |

| Voltas | 1,053.05 | -3.75 | 79.50k |

| Nippon | 505.20 | -3.71 | 44.66k |

| Jubilant Food | 504.10 | -2.98 | 258.55k |

| Glenmark | 883.00 | -2.94 | 41.45k |

| AB Capital | 166.25 | -2.75 | 257.08k |

| Godrej Ind | 876.00 | -2.65 | 13.58k |

| SJVN | 128.35 | -2.61 | 2.08m |

| Supreme Ind | 4,046.15 | -2.43 | 3.52k |

| Deepak Nitrite | 2,249.05 | -2.41 | 12.66k |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Union Bank | 145.55 | 4.08 | 2.15m |

| Max Healthcare | 806.20 | 3.17 | 122.12k |

| Bank of India | 143.25 | 3.13 | 1.03m |

| Canara Bank | 495.50 | 2.83 | 487.68k |

| UCO Bank | 47.59 | 2.28 | 3.93m |

| IDBI Bank | 88.59 | 2.27 | 2.61m |

| Delhivery | 458.45 | 2.15 | 160.01k |

| IGL | 438.65 | 1.99 | 326.36k |

| Torrent Power | 1,058.50 | 1.77 | 64.35k |

| MOTHERSON | 115.20 | 1.77 | 732.04k |

Stock Market LIVE Updates | Tube Investment Q3 Results:

Net profit at Rs 531.1 crore versus Rs 235.3 crore and revenue up 15.3% at Rs 4,053.2 crore versus Rs 3,515.1 crore, YoY.

Stock Market LIVE Updates | Nomura View On Voltas

Buy call, target Rs 1,311 per share

Q3 unitary cooling products (UCP) ahead, strong demand in UCP to sustain

Structural growth tailwinds in UCP and market share gain key catalysts

Stable competition, valuations attractive

Sensex Today | Pradeep Gupta, Co-founder & Vice-chairman, Anand Rathi Group

The FM has continued to focus on strengthening of domestic macro factors including sustained investments in Infra, Agriculture, Domestic Tourism, and also sticking to fiscal responsibility with a lower fiscal deficit which could be music to the ears of foreign investors and impending $25 billion bond inclusion in June as lower budget deficits and pared borrowings will help bring down yields. It could possibly open the door for a ratings upgrade.

Key features of the budget are focus on infrastructure, tourism, logistics and innovation in research. All these measures will bring continuous sustainable growth of the economy. This shows the continued commitment of the existing government to move towards bringing fiscal prudence and reaching to the targeted fiscal deficit of 4.5% of GDP by FY26.

Sensex Today | Nifty PSU Bank index up nearly 3 percent led by UCO Bank, Canara Bank, Union Bank of India:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| UCO Bank | 48.30 | 3.87 | 49.60m |

| Canara Bank | 499.60 | 3.65 | 8.49m |

| Union Bank | 144.75 | 3.5 | 23.61m |

| PNB | 118.15 | 3.28 | 90.05m |

| Bank of India | 143.45 | 3.24 | 23.26m |

| Bank of Baroda | 255.40 | 3.15 | 28.55m |

| Central Bank | 59.25 | 3.04 | 47.08m |

| Punjab & Sind | 52.15 | 2.56 | 13.75m |

| IOB | 50.00 | 1.83 | 46.21m |

| Bank of Mah | 56.00 | 1.36 | 39.75m |

Sensex Today | Market at 1 PM

The Sensex was up 47.14 points or 0.07 percent at 71,799.25, and the Nifty was up 13.10 points or 0.06 percent at 21,738.80. About 1426 shares advanced, 1753 shares declined, and 79 shares unchanged.

| Company | Price at 12:00 | Price at 12:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Virat Crane | 58.90 | 51.50 | -7.40 1.05k |

| Deccan Bearings | 48.51 | 43.90 | -4.61 18 |

| Nirav Comm | 575.55 | 531.00 | -44.55 10 |

| Adinath Exim | 29.88 | 27.80 | -2.08 810 |

| Rama Vision | 81.00 | 76.00 | -5.00 71 |

| Pharmasia | 37.30 | 35.05 | -2.25 88 |

| HP Cotton | 151.00 | 142.05 | -8.95 147 |

| S V J Enterpris | 49.99 | 47.07 | -2.92 1.50k |

| Jayant Infra | 295.00 | 279.00 | -16.00 0 |

| Kalyani Forge | 430.10 | 407.10 | -23.00 9 |

| Company | Price at 12:00 | Price at 12:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| RTCL | 21.22 | 24.20 | 2.98 368 |

| Pradeep Metals | 208.60 | 232.80 | 24.20 8.88k |

| Shree Precoated | 20.58 | 22.69 | 2.11 200 |

| Vadilal Enter | 3,204.35 | 3,505.00 | 300.65 32 |

| Kanpur Plast | 120.50 | 130.25 | 9.75 6.04k |

| Techknowgreen | 229.00 | 245.70 | 16.70 24.17k |

| Mirc Electronic | 20.61 | 22.10 | 1.49 77.43k |

| Punjab & Sind | 49.27 | 52.54 | 3.27 49.48k |

| Chrome Silicon | 39.11 | 41.70 | 2.59 604 |

| Orissa Bengal | 70.45 | 75.10 | 4.65 6.65k |

Stock Market LIVE Updates | Defence stocks mixed as FM makes no big announcements in budget

Defence stocks has a mixed response on February 1 after Finance Minister Nirmala Sitharaman made no major announcements for the sector in her Interim Budget for 2024-25.

Shares of major defence players such as HAL and BEL fell 0.48 percent and 2.04 percent while Bharat Dynamics fell 0.82 percent. Shares of Data Patterns were already trading in the green post its Q3 announcement on January 31. At noon, the stocks were trading 1.94 percent higher.

In the FY23–24 budget, the defence segment received an allocation of Rs 5.94 lakh crore, a 13 percent increase over the previous years. Of this, the outlay for “modernisation and infrastructure development” was increased to Rs 1.62 lakh crore, 6 percent more than FY23. Read More

Stock Market LIVE Updates | Adani Ports Q3 Results:

Net profit up 67.8% at Rs 2,208.4 crore versus Rs 1,315.5 crore and revenue up 44.6% at Rs 6,920.1 crore versus Rs 4,786.1 crore, YoY.

| Company | Quantity | Price | Value(Cr) |

|---|---|---|---|

| GTL Infra | 690554 | 1.95 | 0.13 |

| GTL Infra | 500000 | 1.95 | 0.1 |

| Rajnish Wellnes | 230000 | 10.58 | 0.24 |

| GTL Infra | 249630 | 1.96 | 0.05 |

| Bajaj Finance | 1478 | 6799 | 1 |

| GTL Infra | 200000 | 1.95 | 0.04 |

| GTL Infra | 251620 | 1.95 | 0.05 |

| Yes Bank | 241733 | 24.03 | 0.58 |

| INDUS TOWERS | 50030 | 220.45 | 1.1 |

| INDUS TOWERS | 46761 | 220 | 1.03 |

Sensex Today | A. Balasubramanian, Managing Director & CEO, Aditya Birla Sun Life AMC:

The interim budget speech delivered by the finance minister of India clearly focusses on fiscal consolidation, infrastructure spending, consumption and capital expenditure.

The government continues the path of fiscal consolidation with the fiscal deficit estimated to be 5.1% of GDP for the financial year 2025. Providing an interest free loan towards technology spending by the youth of our country is a positive for the growth momentum. Also, consumption would likely boost by focusing on the agri economy. Lastly, the capital expenditure by the government continues to drive the whole eco system for the overall growth momentum of the country.

Anil Joshi, Managing Partner, Unicorn India Ventures

The interim budget was inline with the expectations. However, startups and sunrise sectors continue to find a special mention even in the interim Budget. The extension of tax exemption to Startups is a good gesture and provision for Rs 1 lakh crore toward sunrise segment at nominal or zero interest rate will certainly help small business.

The focus on boosting EV charging station will drive sale of both vehicles and charging infrastructure. No change to direct and indirect tax was also expected, however we may see new rates in full budget to be proposed in July 2024.