The Indian markets witnessed a historical week as both Sensex and Nifty hit fresh record highs and closed the week with gains of over 1 percent each. The big returns, however, came from the small and mid-cap space.

The Sensex rose 1.08 percent while the Nifty gained 1.19 percent in the week ended November 29, compared to 0.78 percent rise in the S&P BSE small-cap index, and 2.3 percent rally in the mid-cap index in the same period.

The BSE 500 index, which measures the stock performance of 500 large companies listed on stock exchanges in India, rose 1.38 percent outperforming both the Sensex and Nifty for the week ended November 29.

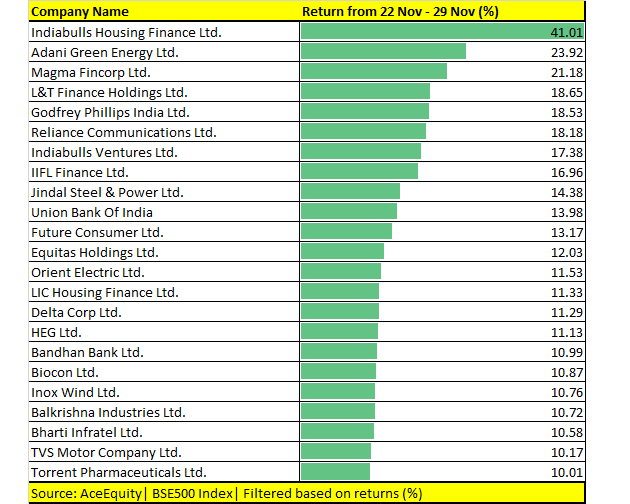

As many as 23 stocks in the BSE 500 index, including companies from both the small and mid-cap space, rose 10-40 percent in just five trading sessions.

Stocks that rose in double digits include TVS Motor, Torrent Pharma, Bandhan Bank, LIC Housing Finance, Union Bank of India, Jindal Steel & Power, L&T Finance Holding, LIC Housing Finance and Indiabulls Housing Finance among others.

It looks like small and mid-cap stocks joined the party on D-Street and some of the smart money moved in this space, especially in the ones which were beaten down, suggest experts. Remember, the BSE small and mid-cap indices are down in double digits from their respective record highs.

"Many of the beaten-down small and mid-cap stocks are at an attractive valuation and smart investors are not looking to chase the markets, but invest in those companies which now provide a higher margin of safety," Dinesh Thakkar – CMD, Tradebulls Securities told Moneycontrol.

"Risk spread of large-cap against small and mid-cap has increased as a result of significant underperformance since the peak of January 18 and smart investors are cashing on that as risk rewards favour them picking beaten down small and mid-caps," he said.

As many as 40 companies in the BSE small-cap index rose 10-40 percent. These include Indoco Remedies, Inox Wind, Future Consumer, DB Realty, and Tilaknagar Industries among others.

What to watch out for in coming week?

Apart from auto sales numbers for the month of November which will start coming out from December 1, markets would react to the GDP data for the September quarter which grew 4.5 percent, the lowest since Q4 FY12-13.

Experts feel that markets could see a knee-jerk reaction but as long as 11,800-11,900 is intact, bulls have nothing to fear.

"The GDP growth figure is as per our estimate for Q2 FY20. The stock market has been trending lower in the last couple of trading sessions, in anticipation of poor numbers. While there may be a mildly negative reaction on December 2, it will not change the medium-term trajectory for equities," Amar Ambani, Senior President and Head of Research – Institutional Equities, YES Securities told Moneycontrol.

Markets would also react to the outcome of monetary policy meetings on December 5 which will be an important market-moving event, and on the global from any progress in the US and China trade talks will give a much-needed lift to Indian markets.

"The coming week is an eventful one as participants will first react to the GDP numbers. Besides, the outcome of RBI’s monetary policy is scheduled on December 5 and the majority expect further cut in the interest rate. However their commentary on future rates would be closely watched," Ajit Mishra, VP – Research, Religare Broking told Moneycontrol.

"On the global front, the US-China trade talks will remain in focus. Broadly, we’re eyeing 12,300 in Nifty and in case of any decline 11,800-11,900 zone would act as a cushion. Amid all, we expect broader markets to do well thus traders should focus more on the stock selection" Mishra added.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.