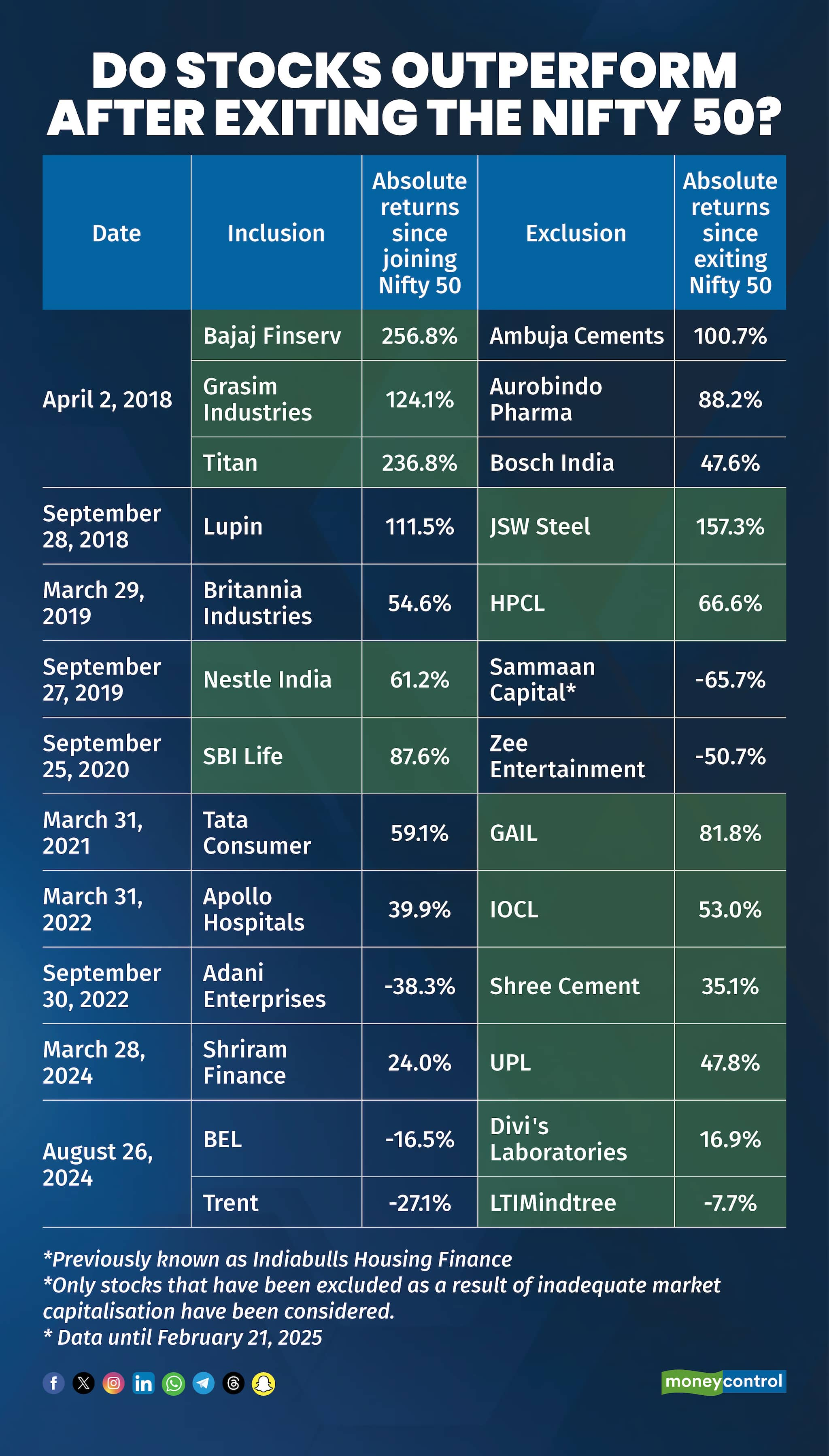

The inclusion of a stock into the Nifty 50 index is usually seen as a strong positive for the counter, bringing a slew of inflows and buying interest. Among heavy scrutiny on social media on the performance of stocks included and excluded from the benchmark, Moneycontrol conducted a quick analysis. According to data analysed, it is likelier for stocks excluded from the 50-pack gauge to perform better than the included stock.

From 2018, thirteen stocks have been excluded from the headline NSE index as a result of their inadequate market capitalisation. Of these, eight counters have performed better than the companies included into the index at the same time.

For example, on March 28, 2024, UPL was replaced by Shriram Finance. However, UPL's return of around 48 percent is double that of Shriram Finance's 24 percent growth during the same time period.

JSW Steel, HPCL, GAIL, IOCL, Shree Cement, UPL, Divi's Laboratories and LTIMindtree are the eight counters that were deleted from the Nifty 50, but performed better than the incoming peers. On the flip side, Ambuja Cements, Aurobindo Pharma, Bosch India, Sammaan Capital and Zee Entertainment are the five counters that underperformed the newcomers.

Among the stocks included in the Nifty 50, the five companies that outperformed were Bajaj Finserv, Grasim Industries, Titan, Nestle India and SBI Life.

Also Read | Nifty 50 rejig: Zomato and Jio Financial to replace Britannia and BPCL

When stocks are newly included into the index, there is often a surge in the stock price as ETFs and index funds that track the Nifty 50 buy the counter to mimic the index's constitution. On the flip side, the recently deleted share is sold-off in droves, which might lead to a fall in the stock price. However, falling this short-term trend, the data posits that the outgoing stocks usually outperform their incoming peers.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.