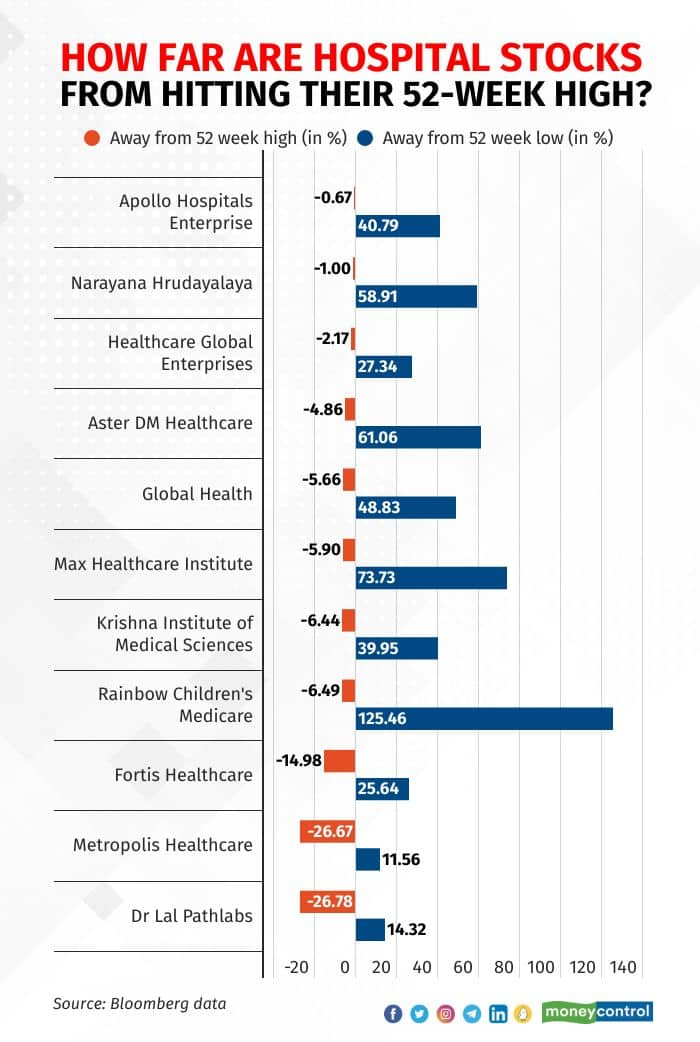

Analysts are tickled pink with the outlook for the hospital sector improving. Despite the stocks hovering close to their 52-week highs, analysts are cheery about investing in this space.

Rising incomes, healthcare needs and higher health insurance penetration have led to a promising demand outlook for the Indian hospital industry. With favourable demand-supply dynamics coupled with the growing prominence of healthcare services in the country, hospital stocks are well-positioned for sustained growth, analysts believe.

The scenario for Indian hospital stocks has evolved over time, said Ashish Kumar, Smallcase Manager, and Founder, Stoxbazar.

Earlier, investor sentiment for the sector took a beating with the Indian healthcare industry facing various challenges, such as relatively less developed healthcare infrastructure as compared to other countries, limited availability of advanced medical equipment and technology, concerns regarding the quality and accessibility of healthcare services in India, and a complex regulatory framework.

However, over a period of time, the healthcare sector in India has taken a turn for the better.

The government has implemented reforms to enhance infrastructure, promote medical tourism, and streamline regulations. These initiatives have positively impacted the perception of Indian hospital stocks, attracting both domestic and international investments.

Read more | Apollo Hospital: Wait until the fog clears

Aditya Khemani, Executive Group Vice President and Fund Manager at Motilal Oswal AMC said hospitals are in a sweet spot. "Hospital stocks form around 10 percent of my portfolio," he added.

Hospital is totally a non-discretionary consumption service. Plus, health insurance penetration in India is also very low. Though, over the last three-four years, health insurance penetration has increased by about 25-30 percent every year, he explained.

Before COVID, hospitals were not a go-to sector for investors. These stocks have not made too much money in the last 10 years because they were in a perpetual greenfield capex mode. It takes about seven years to turn around a hospital, which is why financials were not so attractive. But during COVID, hospitals were booming. And now, they are on the right track spending money on brownfield expansion, Khemani elaborated, adding "And hence, valuation-wise, hospital stocks are obviously not cheap."

"Valuations are at the upper end of what they have traded in the past. But I think a further re-rating from here on could be difficult barring a few names which are giving a discount. But one can expect a 15 percent earnings compounding," he pointed out.

Stocks such as Apollo Hospitals, Narayana Hrudayalaya, Healthcare Global Enterprises, Aster DM Healthcare and Fortis Healthcare have shot up over 130-260 percent in the past three years.

Hospital stocks have demonstrated strong growth potential and have the potential to continue delivering favourable returns to investors, according to Kumar. "The sector's consistent growth in both topline and bottom line metrics indicates a promising outlook without the risk of becoming overvalued."

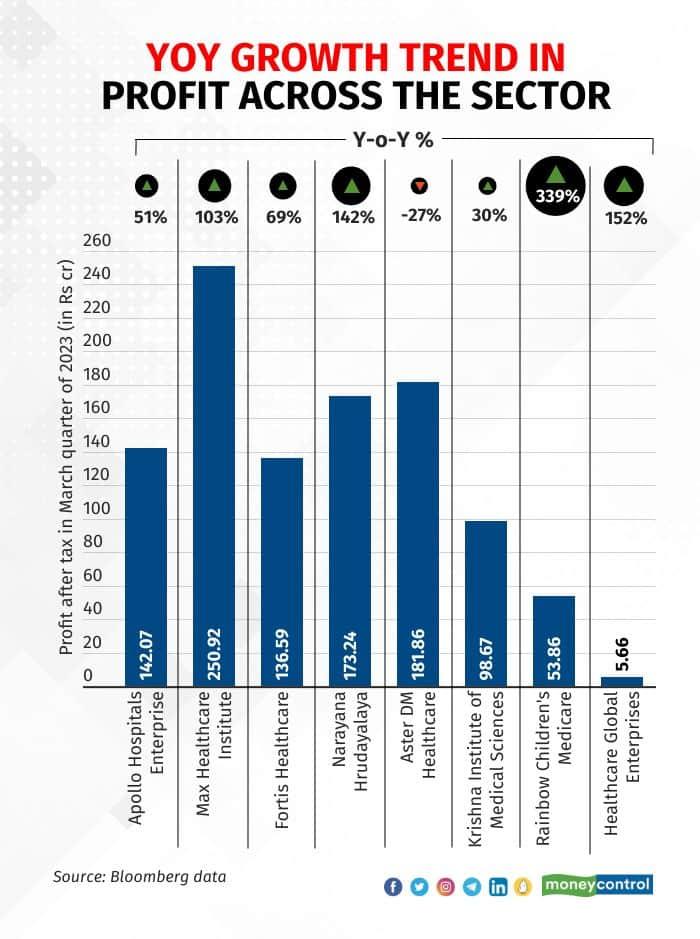

Several hospital stocks have delivered a stellar quarterly performance in Q4 FY23 with improvement in operating margins too, while investment in capacity expansion has helped them in topline growth, noted Apurva Sheth, Head of Market Perspectives & Research, SAMCO Securities.

The management of Fortis Healthcare has guided for a low double-digit growth in the hospital division for FY24. The growth will be aided by increasing occupancy to 70 percent, the addition of around 200 new brownfield beds, price hikes, speciality improvement and payor mix change. The hospital also continues to actively look not just for brownfield expansion strategies but also for inorganic expansion.

Even Apollo Hospitals plans to add 2,000 beds in the next two years at a capex of Rs 3,000 crore. The management remains very optimistic about the growth prospects for the health services business and sees higher occupancy and earnings before interest, taxes, depreciation and amortisation (EBITDA) driving a 13-15 percent revenue growth in FY24. Plus, the Chennai-headquartered healthcare company aims to take occupancy to 70 percent by the end of FY24.

Read more | Hot Stocks | Bet on Apollo Hospitals Enterprises, HUDCO for short term

Max Healthcare too, plans to more than double its bed capacity to 7,442 by FY28. The expansion will largely be brownfield in nature and would be funded from internal accruals, thereby adding enough visibility for bed additions.

"We believe the earnings momentum should continue going forward, given that there is high demand for private healthcare service providers since public investment in healthcare is low," he added.

According to Sheth, large super-speciality hospitals have a competitive advantage over smaller clinics and hospitals since it is a capital-intensive business. Larger hospitals also attract senior doctors and top talent from their own educational establishments. Thus, large listed hospital chains are likely to do better over the medium to long term, he believes.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.