Finally, the bulls lost their control over Dalal Street for the first time in the last eight consecutive weeks, driven by profit booking amid monsoon concerns and caution as voting for general elections started and Q4 earnings season kicked off by Infosys and TCS in week gone by.

The rangebound benchmark indices settled marginally lower during the week with Nifty50 falling 0.19 percent and BSE Sensex 0.24 percent in the week that ended on April 12.

The consolidation, which started after the Nifty rallying to record highs, is likely to continue not only in coming truncated week but also till mid-May or till the general elections results on May 23, experts said, adding the market is expected to get support from FIIs along with stable global cues. Hence the major selling pressure is unlikely.

"Nifty is showing strong resilience by consolidating in the tight range of mere 200 points after the rally of nearly 1,200 points. Also, muted reactions to bad news like monsoon forecast and recent negative developments related to FMPs of mutual funds suggest the absence of large selling in the market," Shailendra Kumar, Chief Investment Officer at Narnolia Financial Advisors told Moneycontrol.

He said though in a definitive sense where the market would be in the short term would surely be a function of the election results, the current resilience is indicating that a sharp fall, if any, would be a buying opportunity for the investors.

Amit Gupta of ICICI Securities said the Nifty is also supported by global equity markets, which have been performing well. "With Brexit being delayed and US-China talks continuing, comfort should continue in global markets."

The flow of funds from foreign institutional investors (FIIs) remained strong in week gone by as they net bought more than Rs 4,000 crore worth of shares, taking the total April tally to over Rs 14,000 crore, and February-March-April inflow to over Rs 62,000 crore, as against a more than Rs 15,000 crore redemption by domestic institutional investors (DIIs).

Market will remain shut on April 17 for Mahavir Jayanti and April 19 for Good Friday.

Here are 10 key things to watch out for this week:

Earnings

After a good start by IT companies, the full-fledged earnings season will begin in the coming week, with 38 companies announcing their quarterly results.

Key companies among them to watch out for would be Reliance Industries, Wipro, HDFC Bank, RBL Bank, Mindtree, ICICI Lombard General Insurance, etc.

Overall, the Nifty50 companies are expected to report strong earnings in Q4 driven largely by banks, and excluding banks, the growth could be in single digits while the topline is likely to remain in single digit.

"We expect bottomline growth of 28.6 percent in Q4 FY19E, although we expect a much muted top-line expansion of 3.5 percent. Operating profit is expected to grow at 7.9 percent versus 2.3 percent in Q3 FY19. Nifty EBITDA ex-financials is likely to be at 18.8 percent and PAT margin at 10.1 percent," Elara Capital said.

The Nifty's largecap universe is expected report a hefty 93 percent growth YoY. This is expected to lag behind the midcap and smallcap universe, which is likely to show a 236 percent profit growth YoY.

Here are companies which are going to announce earnings this week:

Third major IT company Wipro will announce its March quarter earnings on April 16. Other key thing to watch out for would be the share buyback announcement.

The software firm is expected to report around 1.7-2.0 percent growth in dollar IT services revenue and around 1.3-1.5 percent in constant currency which would be within its guidance of 0-2 percent constant currency growth keeping in mind the macro uncertainties. Other key thing to watch out for would be its IT services guidance for Q1FY20.

"With the quarter passing by relatively unscathed on the macro front, we expect Wipro's revenue growth to be in the upper half of this band – at 1.5 percent QoQ CC. Our USD revenue growth estimate is 2.1 percent, implying tailwind of 60bp from cross currencies," Motilal Oswal said.

Its operating performance is expected to be weak with contraction in margin.

IT services EBIT margin is expected to decline 64bps QoQ to 19.2 percent led by slowdown in BFSI and on-site cost pressure, HDFC Securities said.

On the Q1 guidance front, HDFC Securities expects Wipro to forecast constant currency growth in the range of 1-2 percent while Motilal Oswal sees the same in 1-3 percent range.

Key issues to watch for would be performance of Healthcare vertical, comments on sustenance of growth in BFSI vertical, sustainability of margin recovery achieved in the last two quarters and the quantum of buyback that is likely to be announced with the results.

Reliance Industries and HDFC Bank

Oil-retail-to-telecom major Reliance Industries will declare its March quarter results on April 18 and HDFC Bank, the country's second largest private sector lender, on April 20. Hence the stock reaction to both earnings will take place on April 22 (Monday).

Reliance is likely to show weak-to-flat growth in refinery and petrochemical segments but key things to watch out for would be telecom & retail businesses which both are expected to support earnings.

Motilal Oswal expects 7 percent decline in refining throughput for the quarter and gross refining margin at $8 a barrel against $8.8 a barrel in Q3FY19. "Petrochemical segment is expected to suffer due to reduced product margins."

Hence, "Reliance Industries standalone earnings to be weak led by soft refining margins and lower throughput. Petrochemicals earnings to be resilient," said Prabhudas Lilladher which expects standalone profit to down 5 percent QoQ.

On consolidated basis, Motilal Oswal expects Reliance to report 6 percent sequential growth in Q4 profit. "Positive developments in the telecom and retail segments should drive growth further for the company."

Key issues to watch for would be GRM, petrochemical margins, telecom subscribers and future capex.

In case of HDFC Bank, brokerages expect more than 20 percent growth in net profit, net interest income as well as pre-provision operating profit on the back of robust loan growth.

"Loan growth is expected to remain healthy at around 23 percent YoY, driven by retail loans, while deposit growth is estimated at around 21 percent YoY, led by an increase in term deposits," Motilal Oswal said, adding asset quality is expected to remain stable, with GNPA at around 1.4 percent.

Election

Along with earnings, 2019 Lok Sabha elections will continue to be a key factor to watch out for as it will decide which party will rule the country -- is it the BJP, the Congress or a coalition that will come to power?

Opinion polls suggested that the BJP-led NDA is expected to win around 250-270 seats in the general elections, which is closer to the halfway mark. A party, or a coalition, requires 272 seats to form the government.

After strong voter turnout in Phase 1, Indian voters are set to ready for voting in second phase of general elections, which is scheduled for April 18.

The polling in the second phase will be held in 12 states for 96 Lok Sabha constituencies and Union Territory Puducherry for one seat.

States which will be going for polls are Assam, Bihar, Maharashtra, Jammu and Kashmir, Chhattisgarh, West Bengal, Uttar Pradesh, Tripura, Odisha, Manipur, Karnataka and Tamil Nadu.

The voting for all 39 parliamentary constituencies in Tamil Nadu will take place on April 18.

Listing

Diagnostics chain Metropolis Healthcare, after receiving good response for public issue, will make its debut on the markets April 15. It has a fixed issue price at the higher-end of a price band of Rs 877-880 per share.

The Rs 1,204-crore public offer was oversubscribed 5.84 times during April 3-5, driven by a strong subscription from qualified institutional investors.

Polycab India will list its equity shares on April 18 and fixed final issue price at Rs 538, the higher end of price band.

The Rs 1,346-crore public issue received an overwhelming response during April 5-9 and it was oversubscribed 51.96 times, led by a healthy demand from institutional investors.

Analysts who spoke to Moneycontrol said that both Metropolis Healthcare as well as Polycab India will list at a premium to its issue price.

Macro Data

WPI inflation and Balance of Trade data for March will be announced on April 15.

Monetary Policy Minutes of MPC meeting held earlier this month will be released on April 18.

Foreign exchange reserves for week ended April 12 will be announced on April 19.

Technical Outlook

The Nifty index managed to respect its multiple support of 11,550 zone and it witnessed an upmove towards 11,650 zone in the week gone by. It has negated the formation of lower highs of last three sessions, and formed a small bearish candle, which resembles a 'Hanging Man' kind of formation on the weekly scale.

The index made a lower high, lower low formation on the weekly time frame almost after 7 weeks of continuous uptrend, suggesting cautiousness on the higher side, experts said.

"Price set up in daily scale suggests that supports are intact while weekly scale suggests that hurdles are also visible at life time high at 11,761 zones which is restricting its upside momentum," Chandan Taparia, Associate Vice President - Analyst-Derivatives at Motilal Oswal Financial Services told Moneycontrol.

He said index has been consolidating in between 11,550 to 11,760 zones from last eleven trading sessions and now requires a decisive hold of 11,550 zones to retest its life-time high of 11,761 and then a fresh move towards 11,888 zones.

Index trading below the strong psychological mark of 11,500 will extend prices lower towards crucial support of 11,420 and below that towards monthly pivot point levels 11,360, said Shabbir Kayyumi, Head of Technical & Derivative Research at Narnolia Financial Advisors.

F&O Cues

Nifty index remained in the grip of option writers for the second consecutive week, and OTM option premium fell down because of Theta decay even after its jump in volatility.

On the option front, maximum Put open interest (OI) is at 11,500 followed by 11,600 strike while maximum Call OI is at 12,000 followed by 11,800 strike. Put writing is at 11,500 followed by 11,700 strike while Call unwinding is at immediate strike price.

Option band signifies a trading range in between 11,550 to 11,750 zones, Chandan Taparia said.

India VIX moved up sharply by 14.19 percent in the last week to 21 mark, the highest in last six months due to the hedging done by market participants especially in May 30 Derivatives contracts.

India VIX suggests momentum, but the risk is rising for taking fresh trade at higher zones, Chandan Taparia said.

Amit Gupta said if it sustains above this, it may lead to volatility levels seen before 2014 elections to before reaching levels of 30 percent.

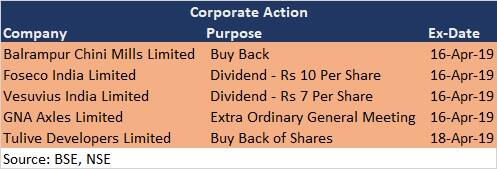

Corporate Action

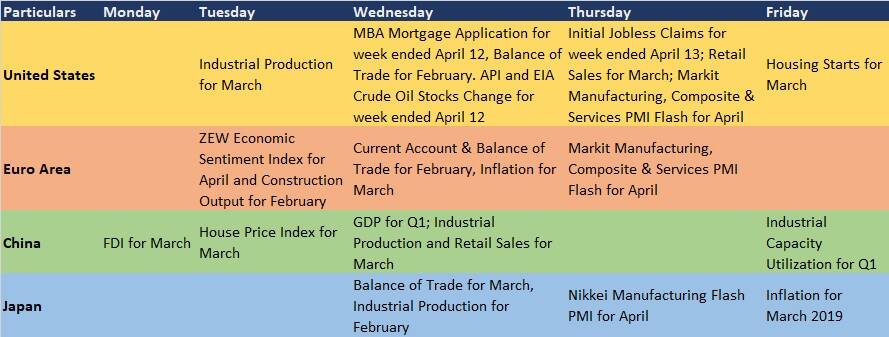

Global Cues

Disclaimer: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.