In what marks the first mainboard initial public offering of 2024, Jyoti CNC Automation is selling shares to raise Rs 1,000 crore.

The company is a manufacturer of metal-cutting computer numerical control (CNC) machines. It had the third-largest market share in India, accounting for about 10 percent of the market in FY23, and ranked 12th in the world, representing 0.4 percent of the global market share in CY22.

Jyoti CNC Automation is offering 30.2 million shares in a price band of Rs 315 to Rs 331 apiece to raise Rs 1,000 crore at the upper price band. The entire IPO constitutes a fresh issue of shares.

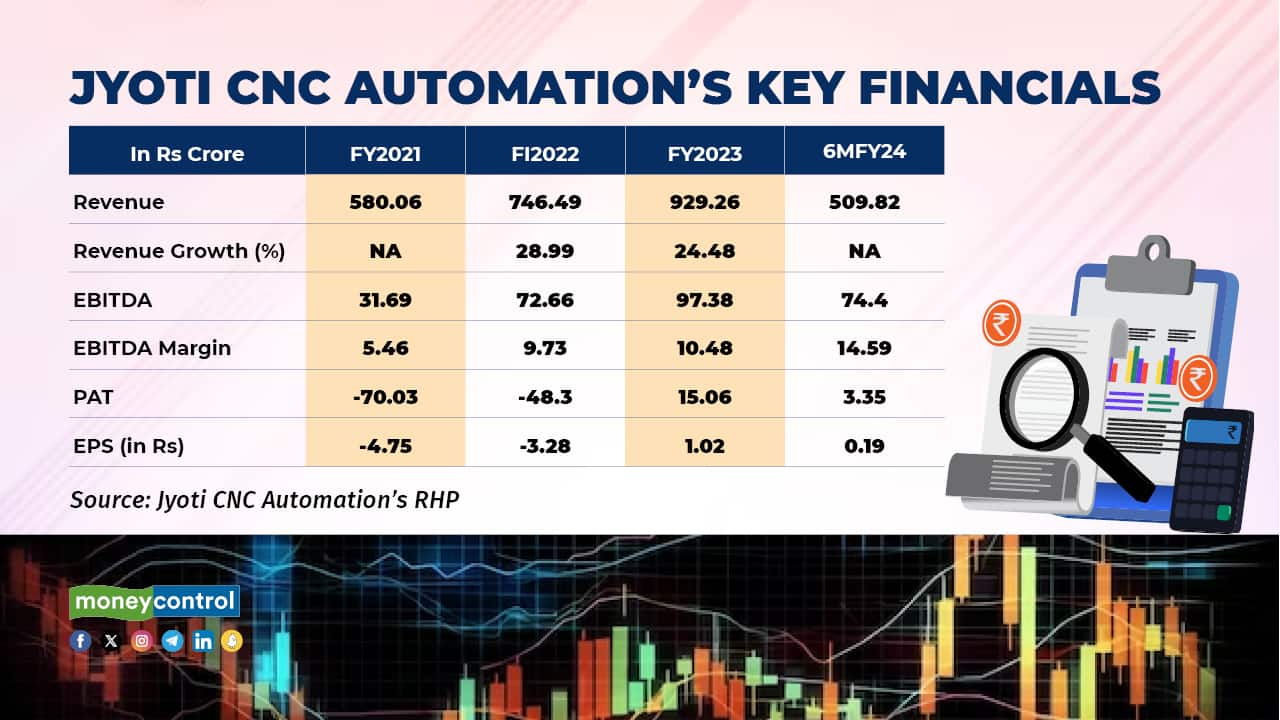

Key FinancialsJyoti CNC Automation turned profitable in FY23 after reporting losses in the preceding two financial years. The EBITDA margin doubled to 10.48 percent in FY23 from 5.46 percent in FY21.

The company’s interest expenses are elevated as a result of substantial borrowings. Repaying the loans with part of the net proceeds of the IPO could make it easier for the business to enhance profitability.

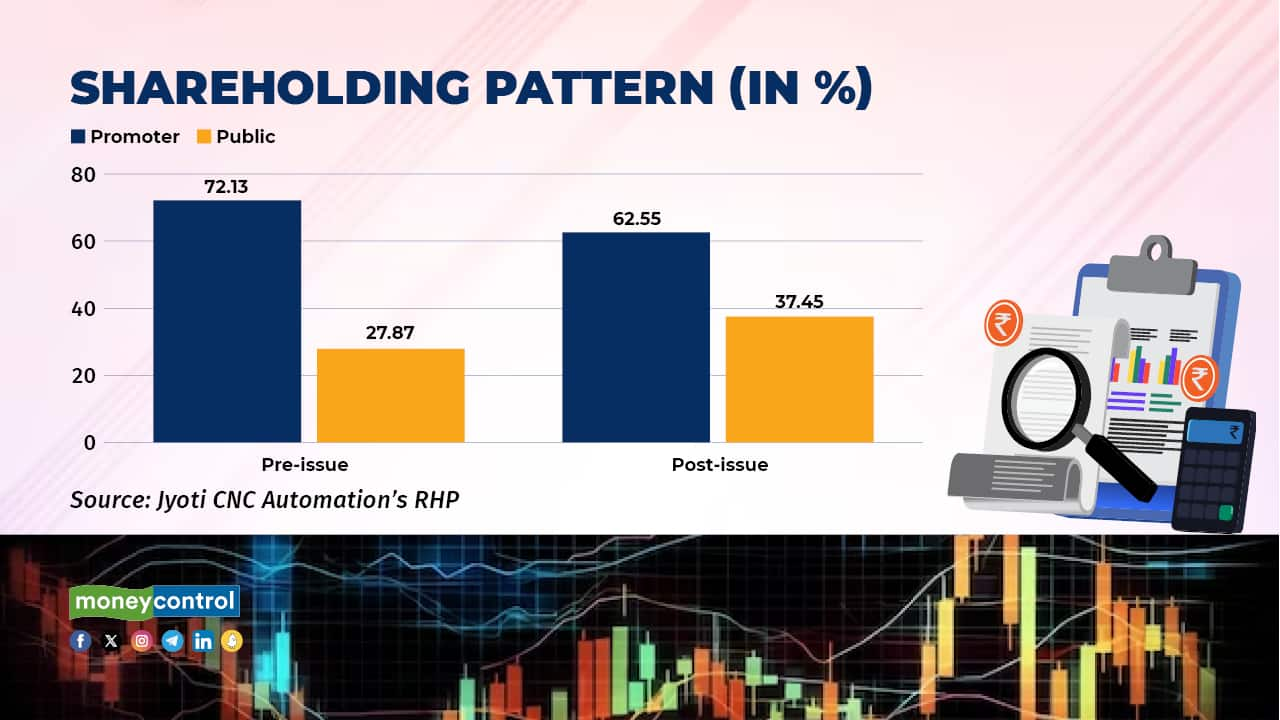

Parakramsinh Ghanshyamsinh Jadeja, Sahdevsinh Lalubha Jadeja, Vikramsinh Raghuvirsinh Rana, and Jyoti International LLP are the individual and corporate promoters of the company. Their shareholding will be diluted to 62.55 percent from 72.13 percent.

The company boasted a return on equity of 18.35 percent and return on capital employed of 9.5 percent in FY23. The ratios are relevant only for the latest year as the company had made losses in the previous two years.

The return on equity and return on capital employed are way lower than those of its peers.

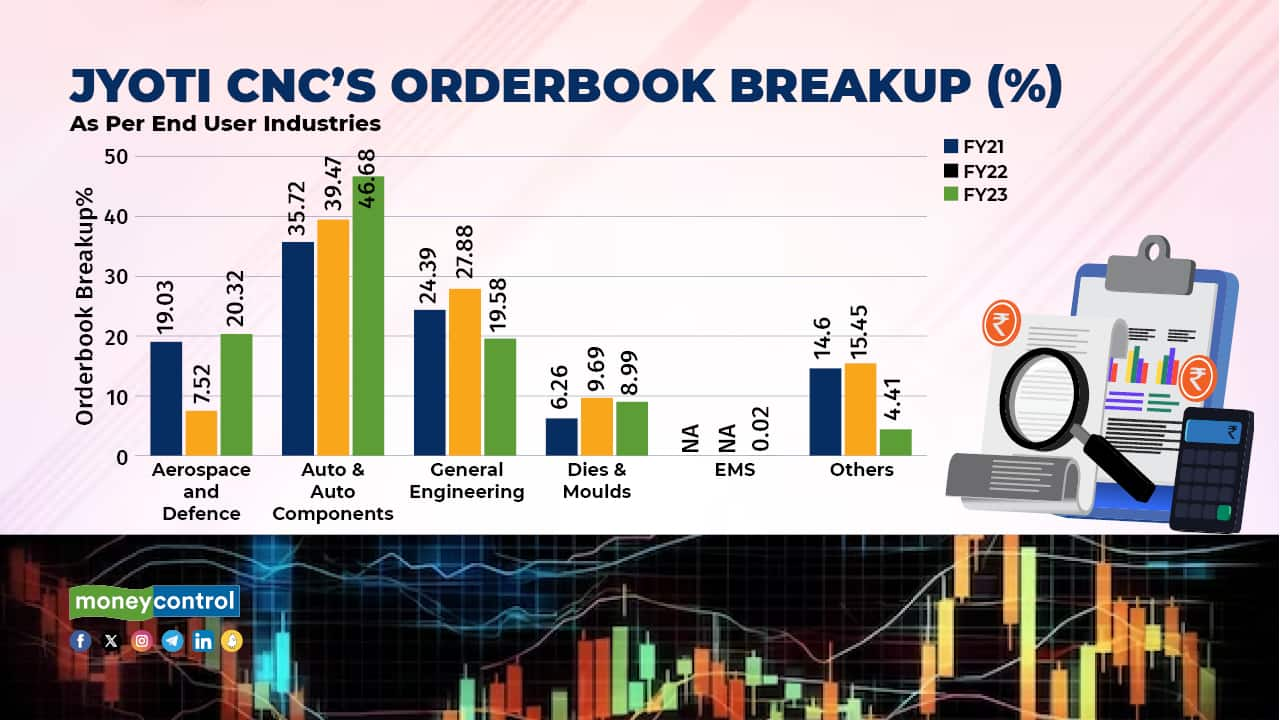

The company has diversified customers across areas such as aerospace and defence, auto and auto components, general engineering, electronics manufacturing services, and dies and moulds.

It had an order book worth Rs 3,315 crore across multiple end-user industries at the end of September 2023, including an order worth Rs 305 crore from an entity in electronics manufacturing services.

In the previous financial year, the company’s end-user percentage contribution to the order book improved significantly for auto and auto components, while it reduced significantly from the general engineering segment.

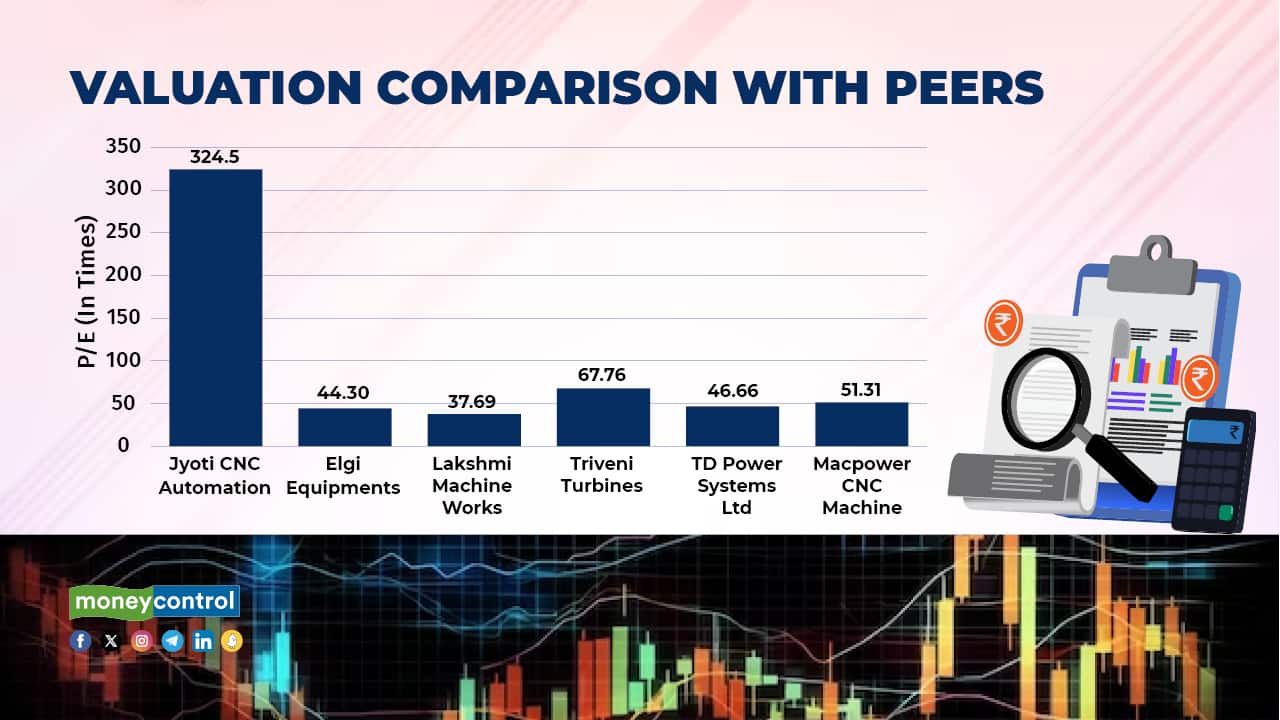

The valuation of the Jyoti CNC Automation IPO is enormously high, making it much more expensive than its listed peers. The ratio may not add much value as the company made losses in the previous years.

The bet is on the company sharply improving its profitability in the coming years so as to justify its steep valuation.

The company's impressive geographical reach, strong order book, and diversified client base are overshadowed by patchy financials and valuation.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.