Foreign investors lowered their investments in FMCG firms in the March quarter as earnings could be blazed by simmering raw material prices.

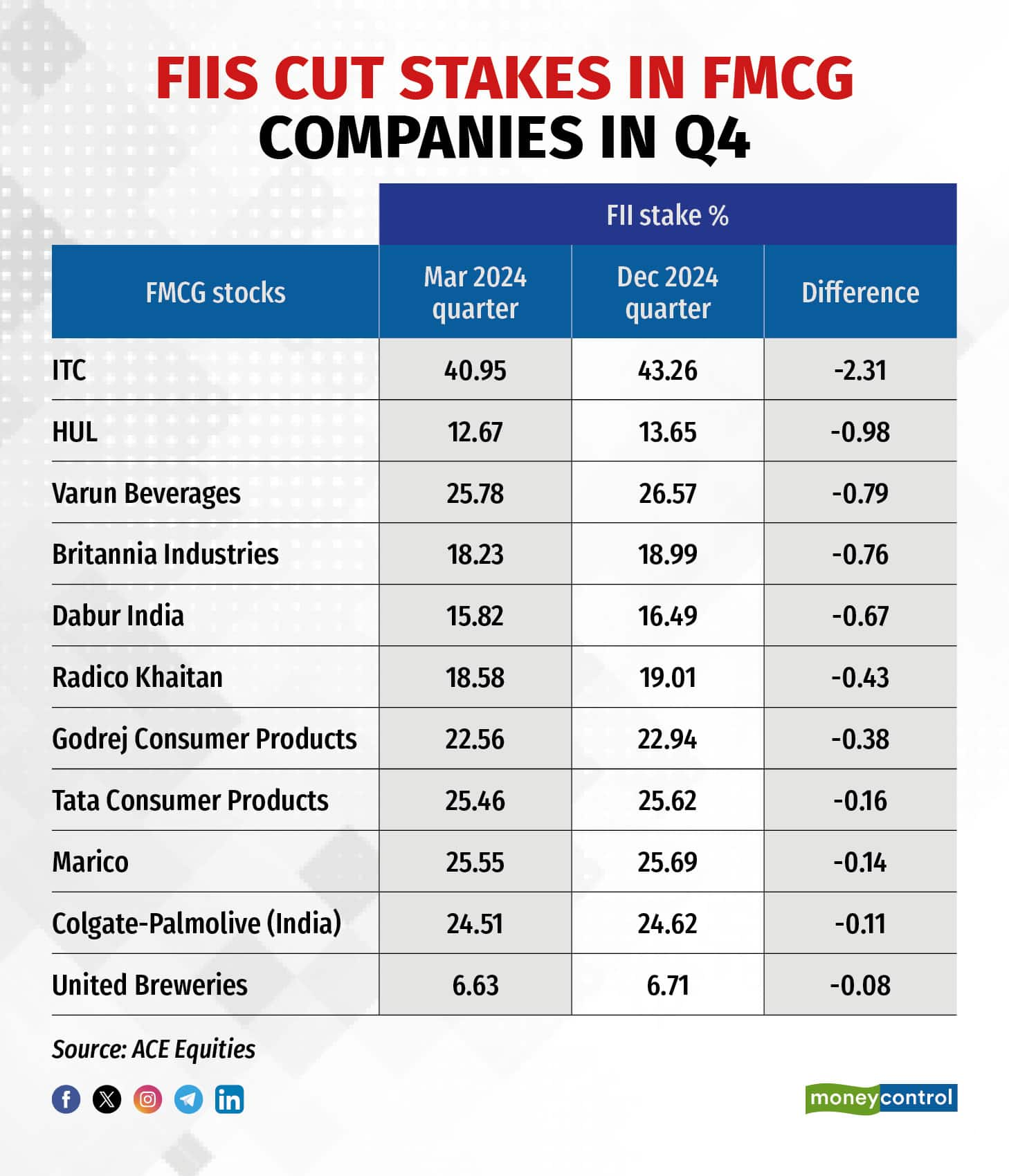

The foreign institutional investors (FIIs) cut down their holdings in Hindustan Unilever to 12.67 percent, bringing it to the lowest level since March 2020, down from 13.65 percent in the preceding quarter, while their exposure to ITC declined to 40.95 percent from 43.26 percent, according to the latest shareholding data.

The FII ownership in Varun Beverages declined to 25.78 percent, marking a six-week low, compared to 26.57 percent in the previous quarter. Similarly, Britannia Industries saw a reduction from 18.99 percent to 18.23 percent. Dabur India also experienced a sequential decrease in FII ownership, down to 15.82 percent from 16.49 percent. Radico Khaitan saw its FII ownership decrease from 19.01 percent to 18.58 percent.

Varun Beverages and Britannia Industries hit a six-week low in FII ownership, while Dabur India and Godrej Consumer Products recorded their lowest FII ownership since December 2015.

Godrej Consumer Products saw a decline in FII stake to 22.56 percent from 22.94 percent, Tata Consumer's FII stake dipped to 25.46 percent from 25.62 percent, Marico's stake reduced to 25.55 percent from 25.69 percent, Colgate Palmolive India's stake dropped to 24.51 percent from 24.62 percent, and United Breweries Ltd saw a decline to 6.63 percent from 6.71 percent.

FMCG firms face pressure from recent spikes in raw material prices like crude oil, palm oil, coffee, and cocoa, potentially halting their margin expansion. Companies are cautious about passing on costs to consumers to maintain competitiveness and sales volumes. Few analysts said that the era of margin expansion is over, with revenue growth expected to be slow because of rising raw material prices.

Recent earnings reports show no significant volume recovery and highlight the challenge posed by rising raw material costs, which could potentially lower the consensus earnings estimates. HUL in its recent earnings urged investor patience amid continued sluggish volume growth in the FMCG sector. Q4FY24 sees a mere 2 percent increase, consistent with previous quarters, following a modest 3 percent rise in Q1.

Nestle shares dropped sharply last week following a Swiss NGO report alleging higher sugar content in its baby food sold in developing countries compared to Europe. The Indian government plans to investigate, according to reports. Nestle responded, citing adherence to WHO codex and local requirements, and voluntary sugar reductions of up to 30 percent in some variants. They emphasised ongoing product review and reformulation to maintain nutrition, quality, safety, and taste.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.