Banks’ outstanding credit to non-banking financial companies (NBFCs) has risen on the back of high demand for credit, stabilising asset quality trends and improving collection efficiency, bankers and industry experts have told Moneycontrol.

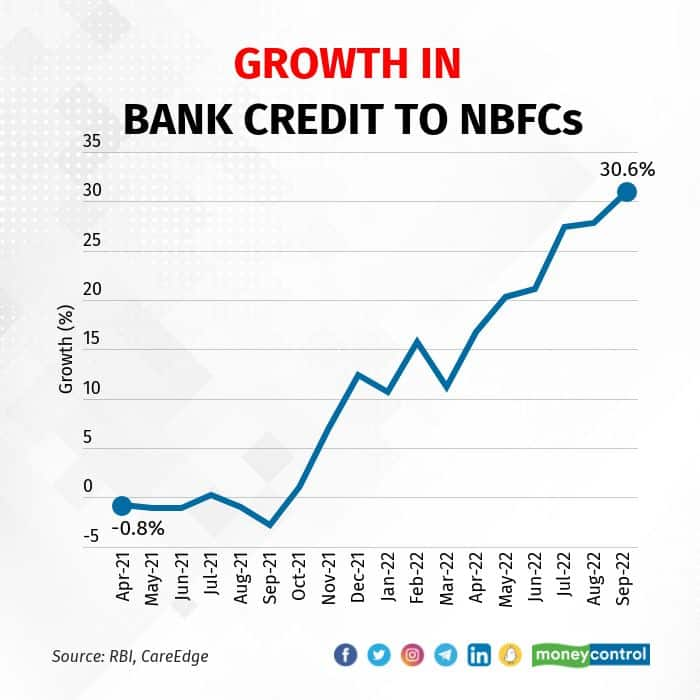

Banks’ credit to NBFCs rose by 30.6 percent year on year (YoY) to Rs 11.7 lakh crore in September 2022, mainly due to a favourable base effect, according to Reserve Bank of India (RBI) data.

This is nearly double the overall credit growth in the system. In absolute terms, bank credit to NBFCs increased by Rs 2.74 lakh crore over the last year and by Rs 93,000 crore from March 2022.

A favourable base effect is one where the comparative number for the base period, in this case September 2021, is unusually low, which leads to the percentage growth in the current period being large in comparison.

“The impact of COVID is largely behind, the economy is picking up and NBFCs are seeing healthy collection trends. That’s probably why banks are more confident to on-lend to NBFCs,” said a banker with a state-owned bank on condition of anonymity.

Banks are, however, still cautious about choosing their borrowers.

Most banks’ preference is still tilted towards AAA or AA+-rated NBFCs as the sector is still not completely out of the woods, the banker said. Once there is more clarity and confidence, credit dispensation to lower-rated NBFCs will also start, the banker added.

According to Hemali Dhame, associate vice president, research, at Kotak Securities, banks, in recent times, have aligned their exposure towards better-rated or lower-risk NBFCs. The asset quality of listed players is healthier, generally, said Dhame.

Also read: Bajaj Finance’s Q2FY23 earnings confirm the strong has become stronger

What’s driving credit exposure?Demand for credit from NBFCs has picked up on account of a recovery in economic activity after the COVID-induced lockdown.

Credit demand from both secured and unsecured segments has picked up, said Krishnan Sitaraman, senior director and deputy chief ratings officer, CRISIL Ratings.

Sitaraman elaborated that underlying segments like housing and vehicle sales are showing good growth, while there is a demand pick-up in segments like microfinance, personal loans and education loans.

Apart from that, NBFCs are also looking at bond market substitution by borrowing more from banks than from debt capital markets as interest costs in the latter have firmed up more than that for bank borrowings.

To put it in perspective, commercial papers issued by NBFCs maturing in three months are trading in the 7.25-7.45 percent range amid tighter banking system liquidity surplus. Rates on non-convertible debentures (NCDs) for a three-year period is more than 7.9 percent for top-rated NBFCs. On the other hand, the 10-year benchmark government bond yield is at 7.28 percent.

“The difference in rates is stark and borrowings from the market are turning out to be very expensive even for top-rated NBFCs,” said a managing director of a Mumbai-based NBFC, on condition of anonymity. “There is no option but to borrow from banks.”

Also read: Three-month CP, CD yields near 10-year G-Sec levels amid rate hike, tight liquidity conditions

Banks comfortable to lendBanks, on the other hand, have become more comfortable lending to NBFCs as the impact of the pandemic on shadow lenders is waning. Many NBFCs have strengthened their balance sheets by improving capital ratios, provisioning and asset quality, further instilling confidence among banks to lend to this sector, said experts.

“In the last four years, NBFCs have reduced leverage and have been maintaining enough liquidity. Also, most NBFCs have made provisioning over and above the regulatory requirement. This would absorb any higher-than-expected losses and not impact profitability,” said Aditya Acharekar, associate director, CareEdge.

In an interview to Moneycontrol, George Alexander Muthoot, MD of Kerala-based Muthoot Finance, had said funding had never been an issue for the NBFC. The NBFC’s consolidated loan assets under management increased to Rs 64,356 crore, up by 6 percent year on year (YoY) in April-September.

“We have about 31 percent capital adequacy, much higher than the regulatory requirement of 15 percent. We have a mix of bank funding and NCDs. Banks are generally willing to lend to us because of our good credit rating,” Muthoot had said.

Although risks like inflation and high interest rates persist, it is unlikely to have an impact on NBFCs’ asset quality, said experts.

“Repayment risk from NBFCs is unlikely as we are not expecting high asset risk in their portfolios,” said Kotak Securities’ Dhame.

CRISIL’s Sitaraman agreed with Dhame.

While NBFCs’ borrowing costs will “no doubt” go up, shadow lenders should be able to pass on some of that to their borrowers, he said. Since their credit costs this fiscal should be lower than in the last few, their profitability should be steady. That, combined with better capitalisation, provisioning cover and liquidity levels should mean that most NBFCs should not face too much of a challenge on debt repayments, added Sitaraman.

Will high credit growth sustain?Experts said that September’s high bank credit figure may be exaggerated, since it comes on the back of a low base. Further, once instruments like targeted long-term repo operations (TLTRO) mature in March-April, the overall lending by banks to NBFCs should get moderated slowly, said Venkatakrishnan Srinivasan, founder and managing partner at Rockfort Fincap, a Mumbai-based debt advisory firm.

Under the TLTRO scheme announced during the COVID days, banks were given funds at repo rate. In turn, banks were tasked to invest in various investment grade instruments, including with NBFCs.

“This scheme has helped NBFCs to come out of stress as most of the capital market institutional investors have stayed away from such investments during that period. Hence the overall investments of banks increased with NBFCs over the period when compared to other investor segments,” said Srinivasan.

Another reason why this trend may not sustain is because some banks are switching to external benchmark lending rates for pricing their NBFC exposures comparatively higher, said experts.

“As a result, incremental pass-through is likely to be sharper and the mix of bank loans in NBFCs' borrowing mix may not increase much further,” said Deepak Shinde and Krishnan ASV, institutional analysts at HDFC Securities.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.