BUSINESS

Railway engineering sector: Slow but on track

Growth has slowed in December quarter, but companies are still promising in the light of orders in hand and expected recovery in execution

BUSINESS

Cummins India Q3 earnings: Recovery in the capex cycle paying well

Cummins India’s domestic market witnessed 26 percent growth Year-on-Year along with a 23 percent increase in exports.

BUSINESS

Thermax: Higher execution supporting growth

High valuations could be a dampener in the near term for Thermax

BUSINESS

Does Adani Ports and SEZ offer value?

Though the group overhang is a bother, the company’s stock offers attractive risk-reward proposition

BUSINESS

KEC International: Capitalising on the upswing in capex cycle

The company is driven by a robust order book, improved balance sheet, and strong earnings visibility

BUSINESS

Budget 2023 — Infrastructure firing on all cylinders

The increase in capex will increase the revenue visibility and valuations of companies operating in this core area

BUSINESS

Larsen & Toubro: On a high growth graph, stock loaded with value

Strong execution and order inflows to drive higher growth and support the L&T stock

BUSINESS

Bharat Electronics: Growth, valuation tailwinds blow in favour of investors

The company’s order book is strong, margins are expected to improve, and better execution to increase revenue visibility

BUSINESS

Indian Energy Exchange — Set to power ahead

A bargain in a volatile market that offers good earnings visibility and comfort in valuations

BUSINESS

Budget 2023 Expectations: Will the push for capex-led growth continue?

We believe the government would keep the infrastructure spend elevated and announce incentives, like production-linked schemes, to encourage private investments and capital expenditure

BUSINESS

MTAR Technologies: Appealing valuation, earnings traction offer investors room to play

Apart from the organic route, the company is investing in newer businesses and technologies, particularly in light of the import restrictions on certain defence equipment

BUSINESS

Indian Energy Exchange: Volumes make a comeback, spark earnings upgrade hopes

Business improving gradually now stock price should follow supported by reasonable valuations and buyback announcement

BUSINESS

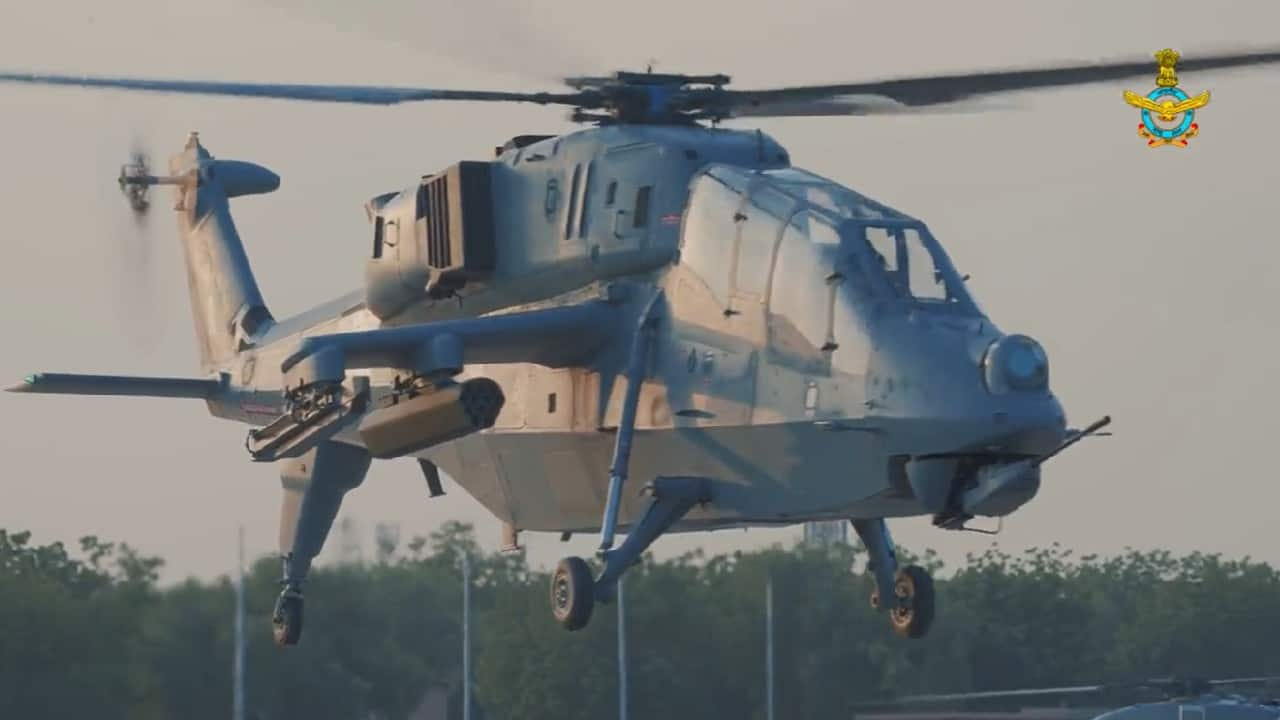

Hindustan Aeronautics: The stock is scaling new highs

Strong entry barriers and high technical capabilities provide sustainability and certainty to the business

BUSINESS

Railway Engineering Sector: Short-term volatility to provide good long-term opportunity

Railways engineering stock could moderate after recent run up in share prices; use volatility to invest for the long term

BUSINESS

Engineers India: On a path to deliver more value

Strong order book, improving execution, and margins offer great opportunities

MONEYCONTROL-RESEARCH

Uniparts India IPO: High on quality with compelling valuations

The company has advantage in terms of expertise, cost, quality, technology, and innovation

BUSINESS

VA Tech Wabag set to turn over a new growth chapter

With commodity prices softening and supply-chain challenges resolving, the company is poised to grow as it focuses on high-margin businesses

BUSINESS

A contrarian investor? This stock fits the bill

The company is set for higher earnings in the coming quarter with margins stabilising and execution improving

BUSINESS

ABB India: Economic revival to support growth

The company is firing on all cylinders but a further re-rating of the stock looks unlikely

BUSINESS

Keystone Realtors IPO: A play on growth and quality

The company is a perfect blend of growth and quality which should help deliver good returns over the next few years

MONEYCONTROL-RESEARCH

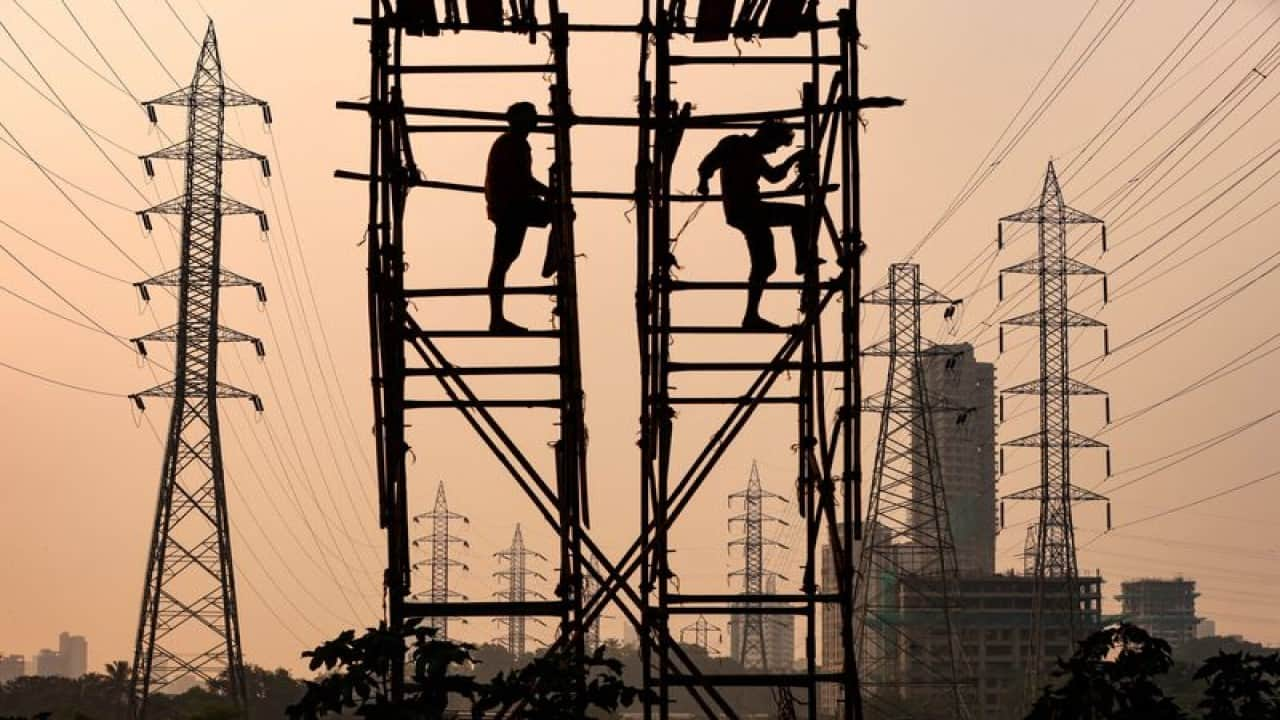

Power Grid Corporation of India: Attractive valuations, dividend yield to support stock

As the core business slows, the company is looking at emerging opporrtunities to deploy additional capital

BUSINESS

Cummins India: Entering a new cycle with improving prospects

Revival in private capex and strong orders in hand provide visibility to growth

MONEYCONTROL-RESEARCH

Bharat Electronics: Back on a high growth path

Overall, the BEL earnings trajectory is good; with the expected improvement in margins and large orders in the coming months, the outlook remains promising and should support the stock

MONEYCONTROL-RESEARCH

Adani Ports & SEZ has the wind at its back

With the pick-up in international trade and strong demand from core sectors the growth momentum is expected to remain high