BUSINESS

Here are 10 smallcaps that mutual funds bought amid volatile market conditions

Correction in equity markets gave opportunity to fund managers to buy small and mid-cap stocks are cheap prices.

MCMINIS

The return of Equity Savings Funds

BUSINESS

How equity MFs became an unlikely balm for COVID-induced financial woes

Though the equity market took a step back amid the rise in COVID-19 cases, majority of stocks saw an impressive rebound from their March 2020 lows. Investors continued to use the market correction to invest in Indian equities. Domestic mutual funds followed suit. Most of the equity oriented funds have delivered commendable returns over the last two years

BUSINESS

Less risk, consistent returns: SIPs work in debt funds too. Here’s the proof

Those who want fixed-income assets as part of their portfolio or create an emergency corpus can consider starting SIP in the debt funds that are part of MC30

MCMINIS

The losing allure of FMPs

BUSINESS

Don’t chase recent toppers while choosing mutual funds: Explained in charts

AMFI data shows that sector and theme funds added close to 50 lakh new investor accounts over the last two years, highest among active equity oriented funds

MCMINIS

Which funds did well during the COVID rally?

BUSINESS

These sector and thematic mutual funds delivered up to 280% over the last two years

The post Covid-19 market rally spelt good news for technology and commodity mutual funds

BUSINESS

MC30: The best mutual funds to invest in

Mutual funds are meant for long-term investments, more so MC30 schemes

BUSINESS

MC30: Ranking slips for three funds, but that’s no reason for worry

We do not take schemes out of MC30 just because their ratings dip

MCMINIS

Why do rich investors like money-market funds?

BUSINESS

Nano cap stocks; not just microcaps. The smallest companies held by mutual funds. Do you own any?

Nano cap stocks are not defined by SEBI or AMFI. But as per international standards, these are stocks with market capitalisation of less than Rs 370 crore. A high-return, high-risk strategy

BUSINESS

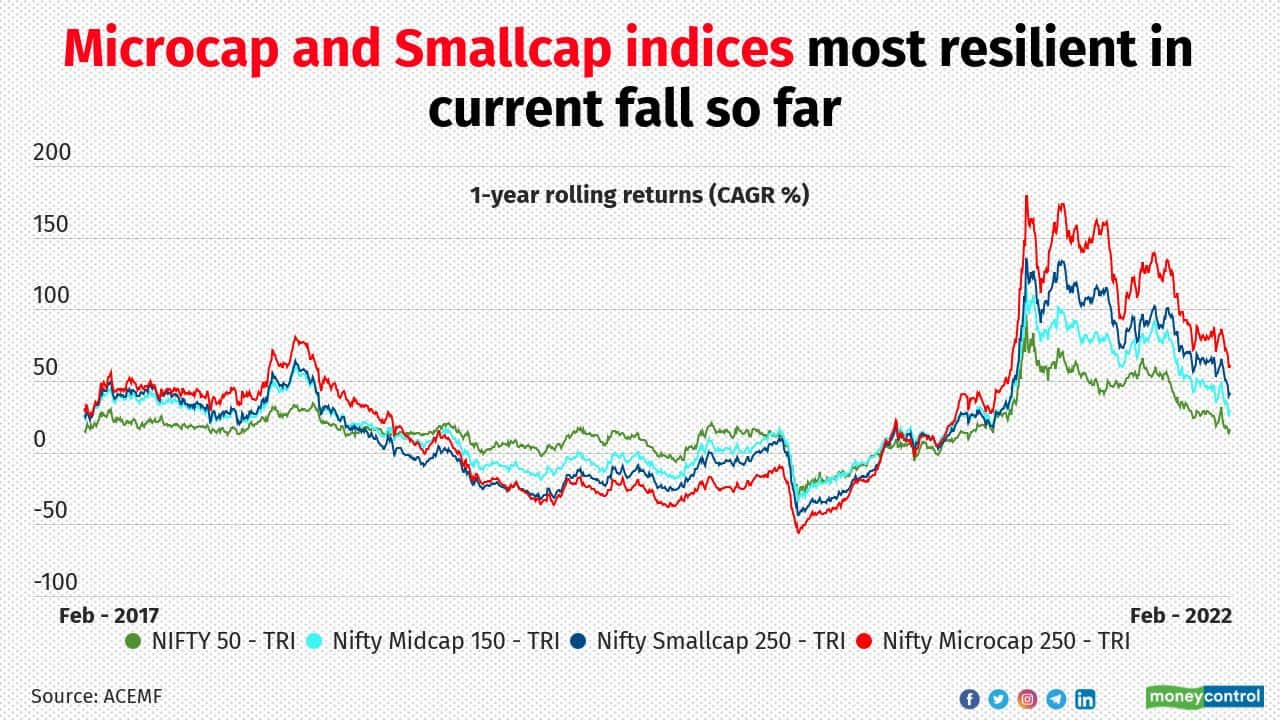

Ten microcap stocks that mutual funds bought amid market correction. Do you own any of these?

Small and microcap indices fell much less than their mid and large-cap counterparts

BUSINESS

Here are the top 10 stocks of ULIPs managed by LIC

ULIPs accounted for less than a percent ( or Rs 24,775 crore) of LIC's overall assets under management as of March 2021

MCMINIS

Why are retail investors not staying long with debt funds?

MCMINIS

Why are active funds losing retail investors?

BUSINESS

How restricting fresh lumpsums in international mutual funds impacts investors

The restriction is applied to fund houses on buying listed shares or securities or units of schemes overseas (other than exchange traded funds)

BUSINESS

Budget 2022's capex focus: Here are the top 10 infrastructure stocks held by mutual funds

The budget's push will provide a leg-up to investments in the infrastructure segment

BUSINESS

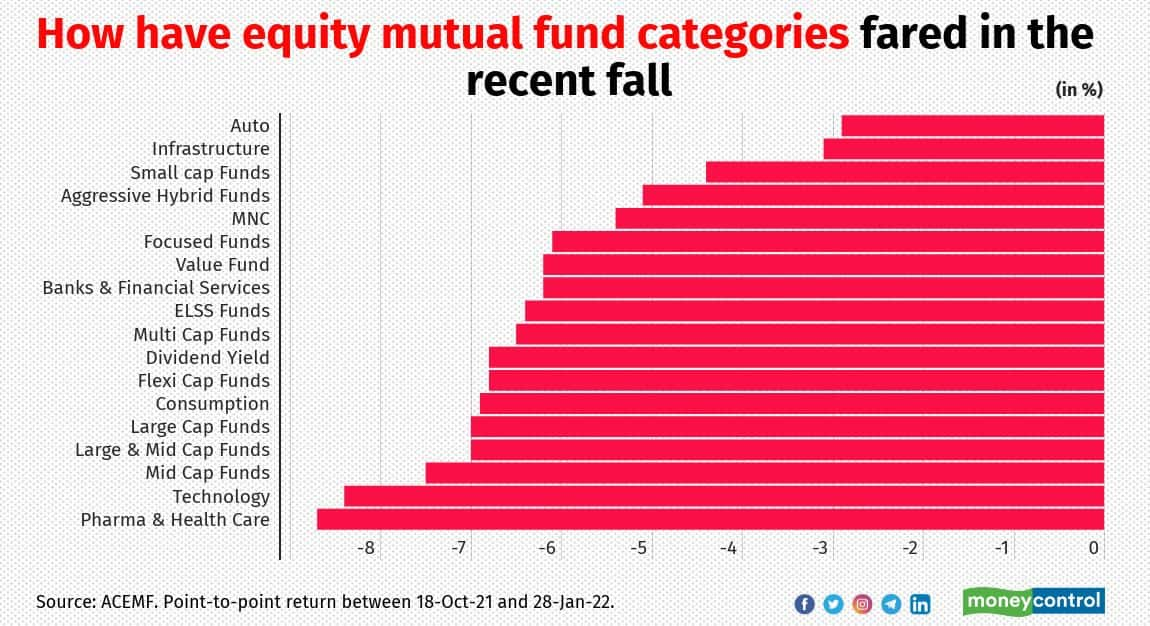

How equity mutual funds fared in the market fall that started in October last year

While the auto, infrastructure and small cap funds contained the fall well, pharma, technology and mid Cap schemes witnessed huge volatility

MCMINIS

Credit funds continue to see outflows

BUSINESS

Here are the top 10 banking stocks that mutual funds bought afresh

Large banks with strong balance sheets and formidable deposit franchises have been the preferred bets for mutual funds

BUSINESS

Top 10 stocks that mutual funds exited amidst the recent market fall

In light of the current market fall, taking a cautious approach, mutual funds trimmed their equity holdings

MCMINIS

Sector funds continued volatile show in 2021

BUSINESS

BSE Realty Index crosses 4000: Here are the top 10 real estate stocks added afresh by mutual funds

Experts believe the low interest-rate regime, rock bottom home loan rates, stable residential prices, and continuing work-from-home trend are the key triggers driving residential affordability