Don’t chase recent toppers while choosing mutual funds: Explained in charts

AMFI data shows that sector and theme funds added close to 50 lakh new investor accounts over the last two years, highest among active equity oriented funds

1/12

The last couple of years saw a growing number of investors choosing mutual funds just looking at their mouth-watering recent returns. It is evident from AMFI data that sector and theme funds (many delivered triple-digit returns past year) added close to 50 lakh new investor accounts over the last two years. Retail investors were attracted towards the short-term eye-catching return of those schemes. There is a good chance, however, that these investors may have ended with lower or middling return when they needed the money back. Here we analyse various metrics that influence the fund performance that explain why one should not chase the top performers in short period.

2/12

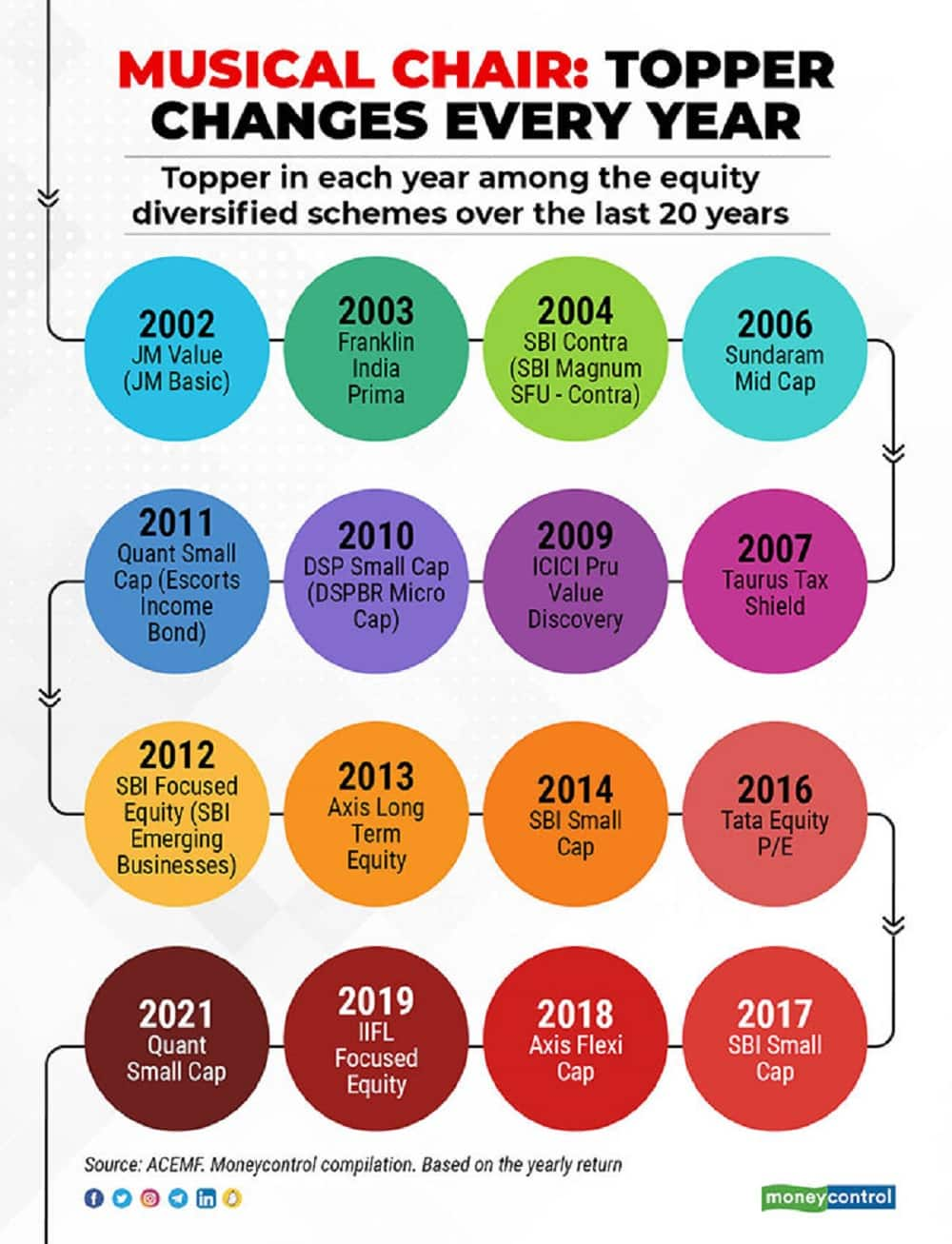

A look at the top performers on a year-on-year basis tells you that today’s winner need not be tomorrow’ topper as well. Similarly, schemes that underperform today may become winners of tomorrow. A Balasubramanian, MD & CEO, Aditya Birla Sun Life AMC says, “performance is the function of the style and not one style works uniformly in every market cycles”. Performance of a scheme depends on how efficiently the fund manager manages the scheme. However, consistency of performance depends on how his conviction works well across market dynamics. Sankaran Naren, ED & CIO, ICICI Prudential AMC says, “Performance is largely an outcome to the process. It is impossible for a fund in a particular category to be the top performer across a complete market cycle. There could be times when the fund may slip a few notches because of the investment calls taken”.

3/12

Along with diversification, it is also important to do your asset allocation. This means having funds with different asset classes and investment styles. For instance, all portfolios must eventually have at least one large-cap fund, mid-cap and a small cap fund each. This helps bring consistency across market cycles. Vinit Sambre, Head-Equities, DSP MF says, “The large cap stocks represent sectors across broader economy. During the initial phase of any bull market, the large caps take the lead in terms of performance which is then followed by midcaps and small caps. Midcaps stocks represent combination of established and emerging companies across broader sectors. As the bull markets sustains momentum they are quick to catch up performance along with the large caps. Smallcaps are companies beyond top250 companies and generally perform the best during raging bull markets like today".

4/12

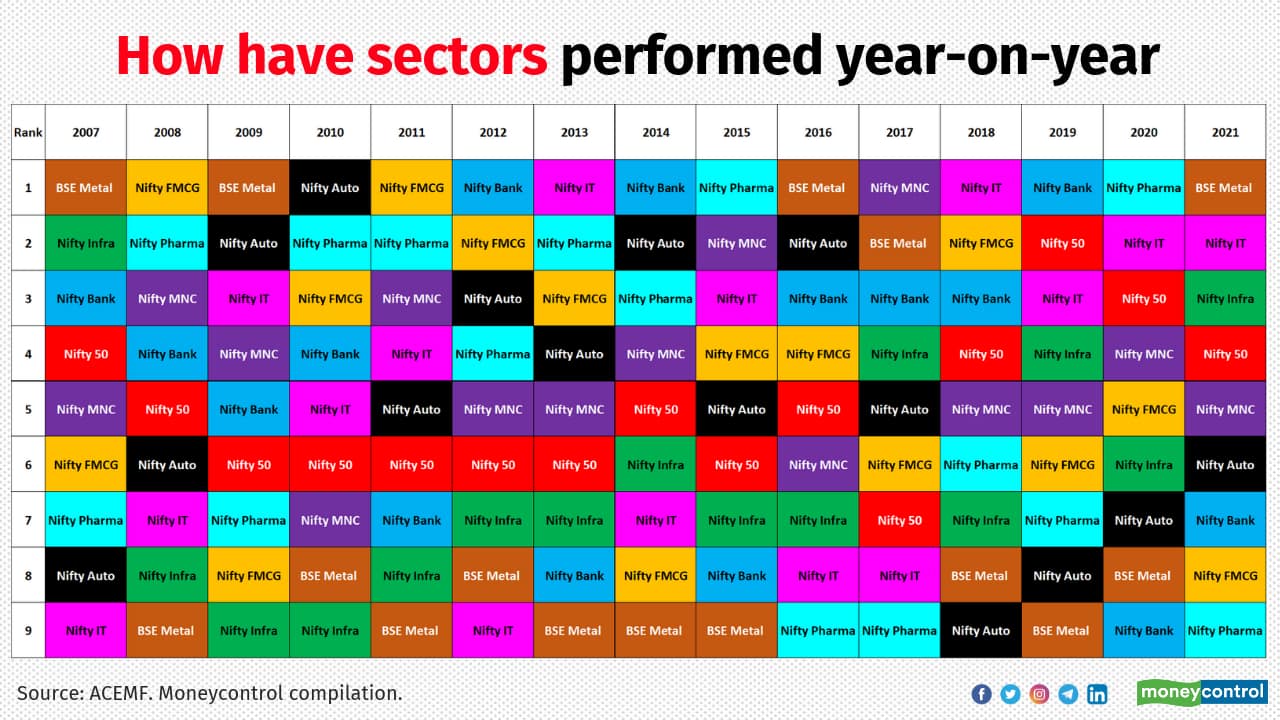

Different sectors perform in different years. Different set of sectors perform in different market cycles. That is why experts suggest investing in diversified equity funds. Harsha Upadhyaya, President & Chief Investment Officer - Equity, Kotak Mahindra AMC says, “Different sectors tend to do varyingly across different time periods and cycles. Business cycle phases in an economy are typically characterized by the fluctuations in economic activity measured by various macro-economic factors including GDP growth, fiscal deficit, IIP, interest rates, inflation and so on. A business cycle is generally defined in terms of periods of expansion, contraction, slump and recovery. For instance, during the early expansion phase, cyclical stocks tend to outperform. In the contraction period, the defensive sectors such as health care, consumer staples, etc. tend to outperform because of their stable cash flows and dividend yields”.

5/12

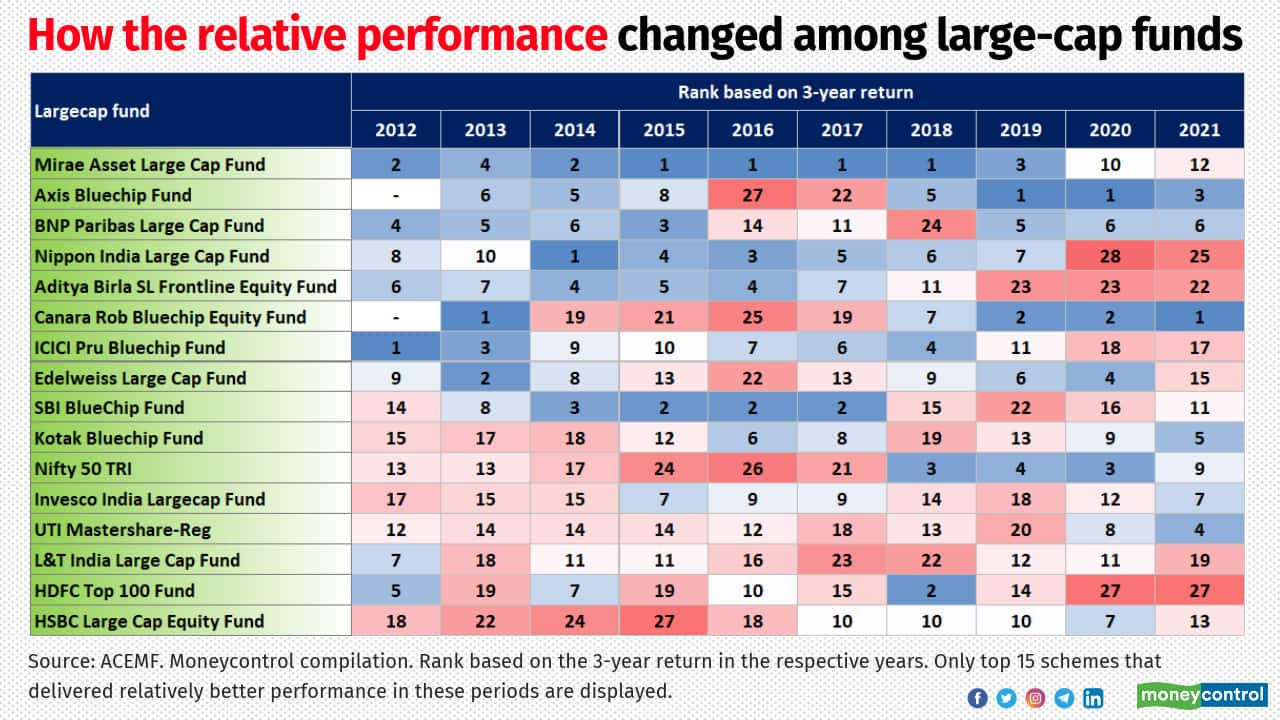

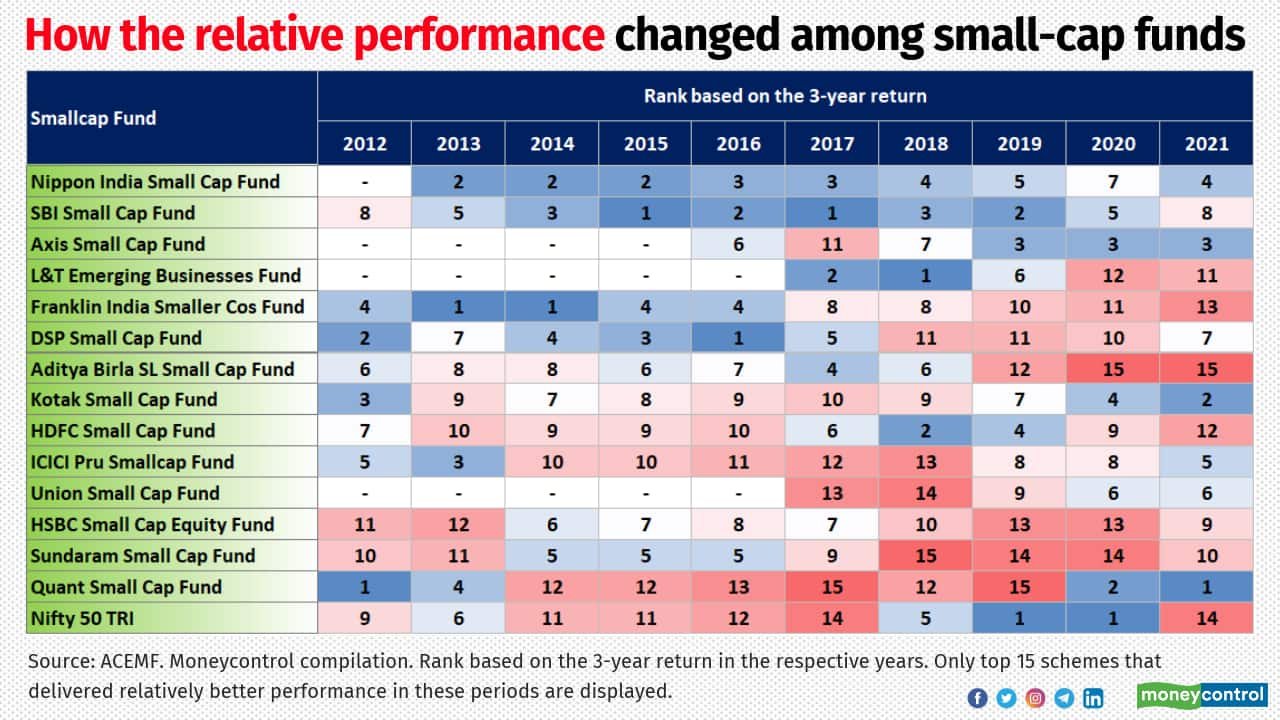

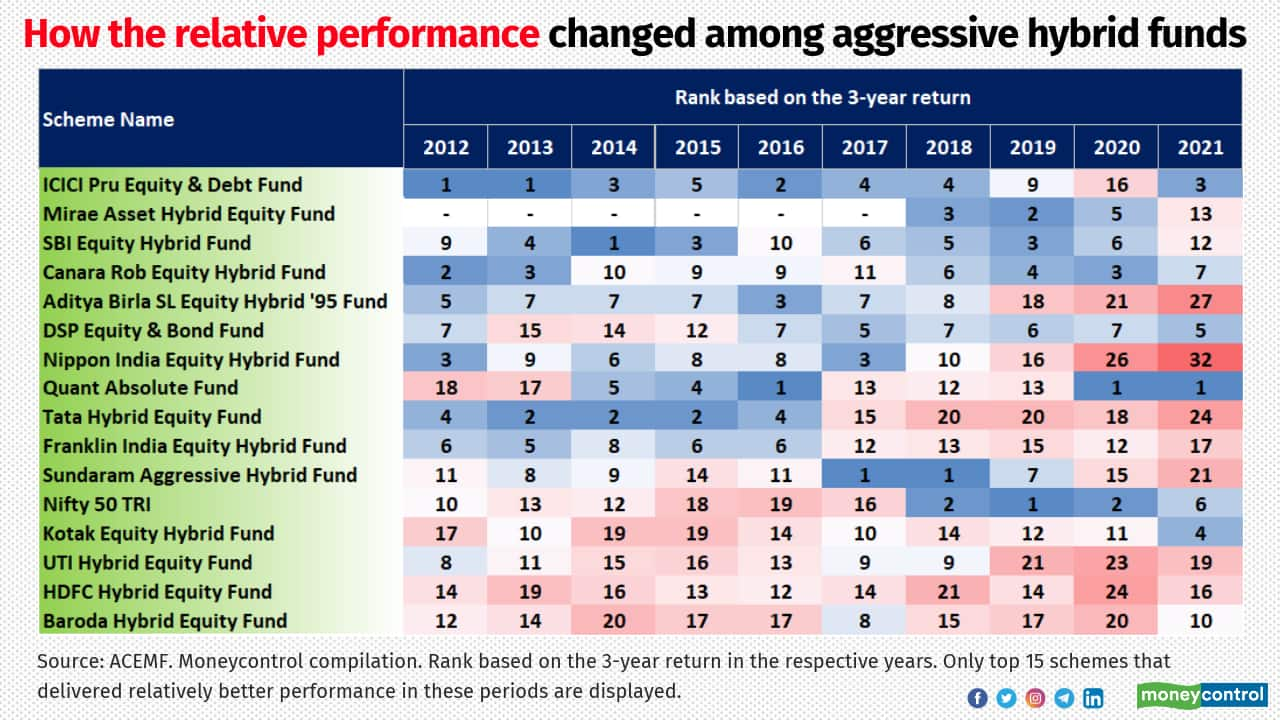

The main types of active management strategies include bottom-up, top-down and factor-based. All decide the outperformance of a scheme. As far as the factor-based strategy, the broadly known single factor strategies are alpha, quality, momentum, value and low volatility. Smart beta funds follow these strategies to pick the stocks. Active managers too use these factors in their investment strategies to maximize return. These factors too have their own cycles. Macro-economic parameters decide the outperformance of each strategy. For instance, low volatility and quality work well in down cycles, while alpha and momentum are expected to do well in upcycles. Below charts portray the relative performance of the schemes in equity diversified categories over the last 10 years. They are ranked based on the 3-year return. Top 15 schemes that demonstrated across years are considered.

6/12

Prudent calls taken by the fund managers eventually lead to the outperformance of the schemes. Apart from that, cash calls and efficient deployment of the remaining 20 percent portion in mid or small-cap stocks apart from the 80 percent prescribed limit are few that decide the relative better performance of the largecap schemes.

7/12

Larger corpus, inflows and buy and hold strategy are few dampeners for the consistency in outperformance of midcap schemes.

8/12

Prudent allocation to different M-caps and exposure to overseas equities are few factors determine the outperformance among flexicap funds.

9/12

Prudent stock selection and how the fund adapts to the changing market conditions play important role to generate consistent returns in smallcap funds.

10/12

Though 3-year lock-in provide comfort to take long position, outperformance relies on inflows and how efficiently the scheme adopts the emerging opportunities in the market.

11/12

Prudent allocation to different M-caps, active fixed income strategy and cash calls are few factors decide the consistency of outperformance among equity oriented balanced funds.

12/12

It is impossible for a fund in a particular category to be the top performer across market cycles. Every scheme has its own ups and down. Instead of looking at the latest performance, investors have to look at how the fund has performed in various cycles in the past. One of the metrics, rolling return, helps you to identify these schemes. Though past performance is not indicative of future returns, it will at least show how the fund managers’ strategies worked across time frames and cycles. MC30, a curated basket of 30 investment worthy mutual funds, helps you to identify these schemes. It applies both return and risk metrics such as rolling return and Sortino ratio. Rolling return calculated over seven-year periods helps to select the schemes that delivered consistent returns in all cycles. On the other hand, Sortino ratio, a statistical tool, helps identify schemes that delivered relatively better returns while taking minimal risk. MC30 also takes into consideration the quality of a scheme’s portfolio. To know more about MC30, click here.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!