personal-finance

The return of Equity Savings Funds

Mar 14, 07:03

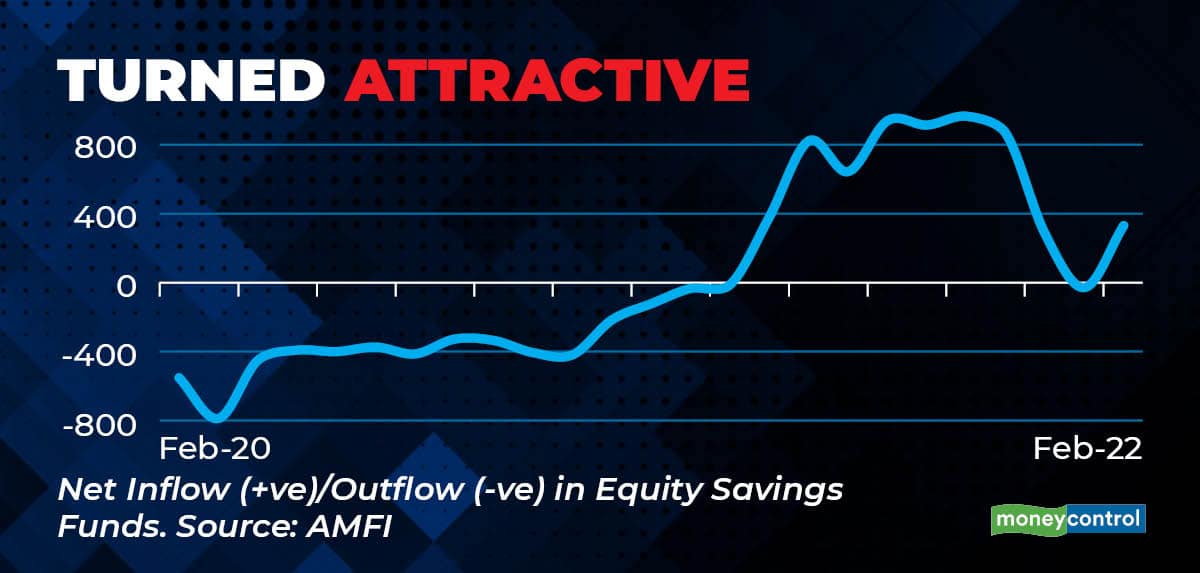

After registered a prolonged net-outflow, Equity Savings Funds (ESF) have become attractive once more and have received notable inflow over the last one year. ESF are allocating at least 65% in hedged and unhedged equities, and enjoying equity taxation. The remainder is invested in debt assets. While equity amps up the returns, debt and arbitrage positions reduce the volatility of returns. ESFs are the static version of balanced advantage funds. With conservative investment approach, ESF offer stability to your portfolio in the peaking volatile equity market, experts say.