Indian startups in the seed to early stages recorded 37 deals in January, close to the 40 recorded in the year-ago period, data from analytics firm Venture Intelligence shows, signalling a thaw in the prolonged funding winter.

The total size of investment fell slightly to $129 million, down 14 percent from $150 million in January 2023, the data shows. Early-stage players like Fireside Ventures, Anicut Capital and Matrix Partners dominated the most active investor charts in January, replacing Peak XV Partners and Accel India, among others.

Stage-wise funding

Stage-wise funding

“As a consumer focused Fund, we have always been bullish on startups building for the new Indian consumer. In our view, the deal momentum continues to be bullish, we announced eight new investments and several follow-on investments in 2023 and we see that momentum continuing in 2024,” Dipanjan Basu, co-founder and partner, Fireside Ventures, told Moneycontrol.

But the same isn't true for the growth-stage deals in India which stand at 13 this month against 27 in January 2023. The deal amount has also gone down to $206 million from $589 million, a fall of about 65 percent.

In 2023, the so-called funding winter had already hit investments into startups amid a correction in valuations for Indian new-age tech companies.

Also Read: VC funding in Indian startups sinks to a 6-year low in November

While the number of late-stage deals has remained the same at a low three both in January 2024 and 2023, there was a 41 percent fall in the amount of funding which stood at $31 million. In January 2023, the amount was $52 million.

Speaking to Moneycontrol earlier, Anand Lunia, founding partner of IndiaQuotient, said there is an increased concentration at the seed-stage because there is a clear fall in series A, B and later deals.

The plummeting late-stage investments have pushed the overall investments in Indian startups in the red.

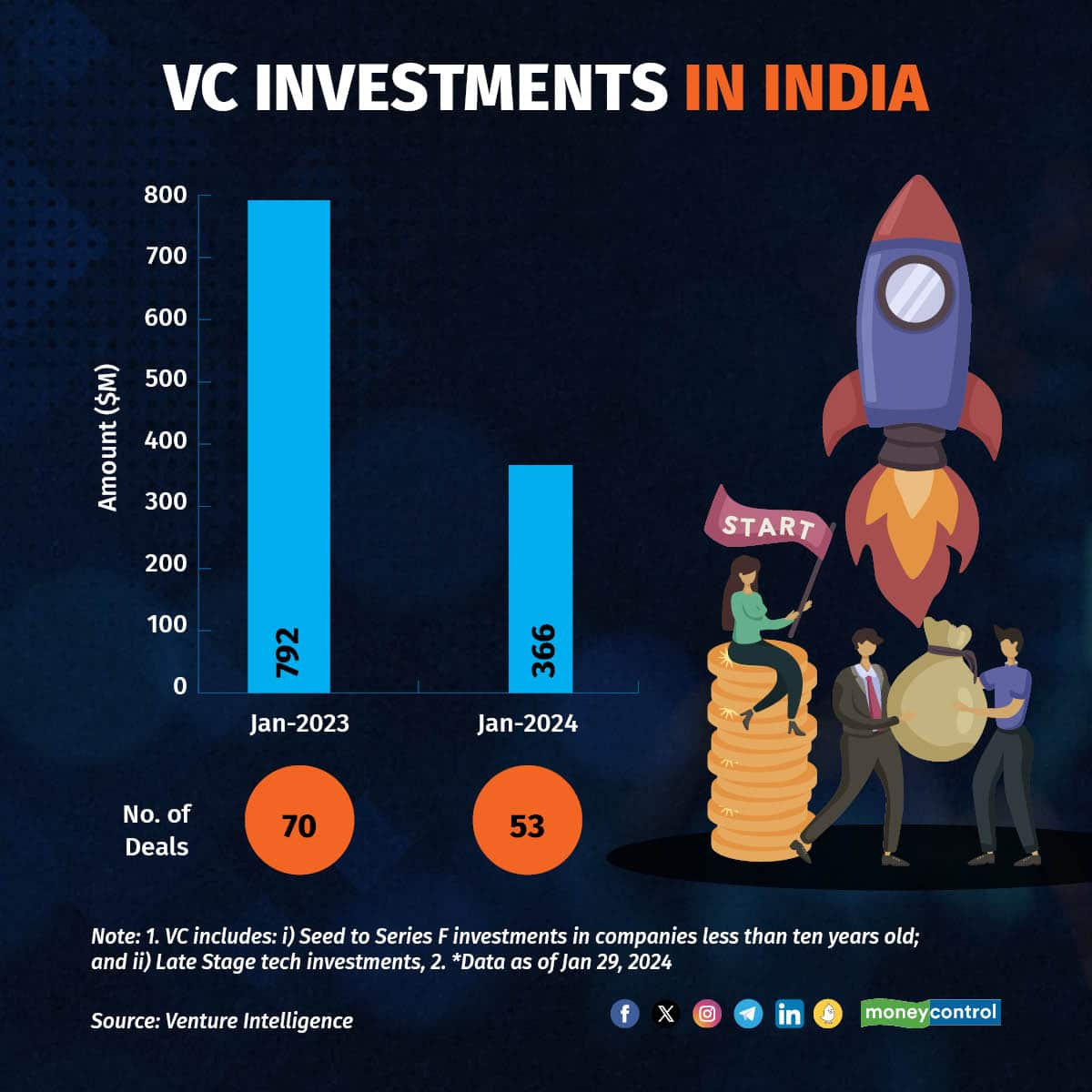

New-age tech companies recorded only $366 million in 53 deals in January, a fall of about 64 percent from $1,027 million in 48 deals in December, Venture Intelligence data shows. The month also recorded a massive year-on-year decline of 54 percent from $792 million in 70 deals in the year-ago period.

January Funding

January Funding

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.