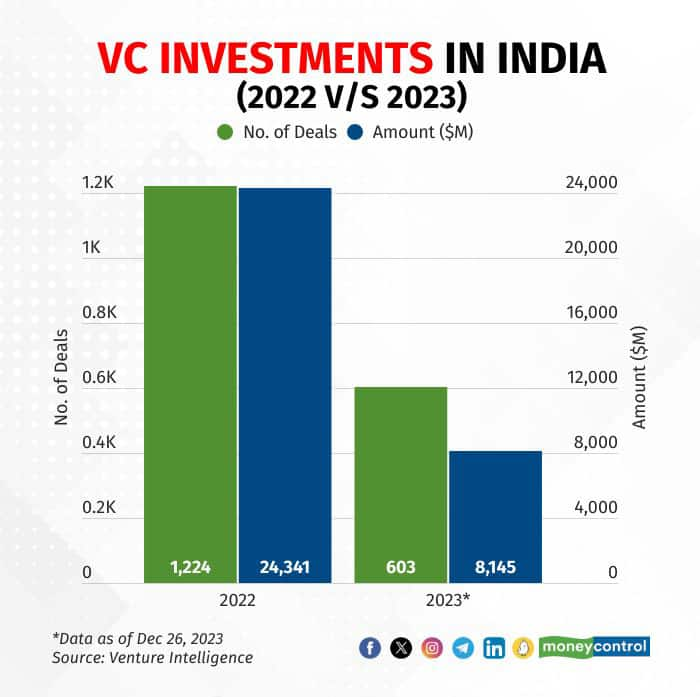

The overall funds coming into Indian startups through the private equity (PE) and venture capital (VC) routes plummeted to a third in 2023 over the previous year, even as December showed early signs of recovery with a series of funding announcements in the month.

PE/VC funds made 603 bets on startups worth $8.14 billion in 2023, while last year, even with the funding winter beginning to cast a shadow on startup investments in India, private market investors had made 1,224 bets worth $24.3 billion, the data from Venture Intelligence showed.

Indian startups experienced their most challenging year for investments in the past seven years, witnessing a funding level lower than any other year except for 2016, when the funding totalled $4.6 billion.

VC Investments in India (2022 v/s 2023)No relief from Funding Winter?

VC Investments in India (2022 v/s 2023)No relief from Funding Winter?During Moneycontrol and CNBC TV-18’s Global AI conclave Shailendra Singh, Managing Director at Peak XV Partners, said that funding into Indian startups will pick up over the coming months on the back of a continued rally in listed tech stocks.

Singh said that when shares of public companies perform well, there is a trickle down effect that is positive for private companies as well.

“Over the course of next year, we believe we will see a relatively later stage market opening up because fundamentally India is the best country of choice today to invest in and we feel very excited about the quality of ideas and founders,” added Mridul Arora, partner at Elevation Capital.

However, investors believe that the attributes of a comparatively better funding environment expected in 2024 will be completely different from what the ecosystem witnessed during the exuberance in 2021.

“2024 will still be less than where 2021 was, but it will be better than 2020, 2022 and 2023. Companies that will raise larger amounts of capital are the ones which will be a lot more focused on profitability. Companies will be given money to not necessarily expand market share but effectively improve on the capability, so that they could behave well after being listed on the public stock exchanges,” said Ashish Kumar, co-founder and general partner at Fundamentum, told Moneycontrol.

Kumar believes that there will be a significant focus on enabling genuine companies which will go public and create wealth for retail investors in the coming years.

Top VC Investments in India (2023*)December funding

Top VC Investments in India (2023*)December fundingIn December, startups breathed a sigh of relief amid better investment numbers compared to the last three months. The month recorded $1,027 million in funding in 48 deals, which surprisingly was better than last year's $961 million in the same month in about 57 funding deals.

Also Read: VC funding in Indian startups sinks to a 6-year low in November

However, Vikram Chachra, founding partner at 8i Ventures, said that while VCs are talking about green shoots, there are not many to get hopeful. “It's not something to get excited about. We need to see much more activity. We are still seeing the majority of very obvious and very clear winners raise funding,” he added.

In fact, Fundamentum’s Kumar said that the term sheets starting from the second week of December have comparatively slowed down with the Christmas and New Year holidays approaching soon.

“The ecosystem in general has had higher output in the last two months… The many deals that are being announced were all decided dominantly two months back. But the announcements keep happening now as people are finishing their pending work because everyone from the financial, legal, diligence personnel, and venture capitalists take off during these holidays,” added Kumar.

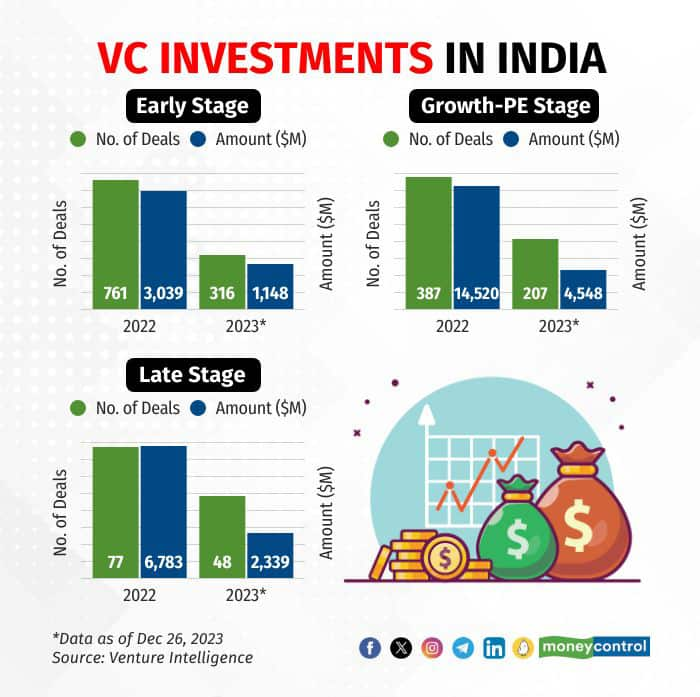

Monthly VC Investments in IndiaStage-wise funding

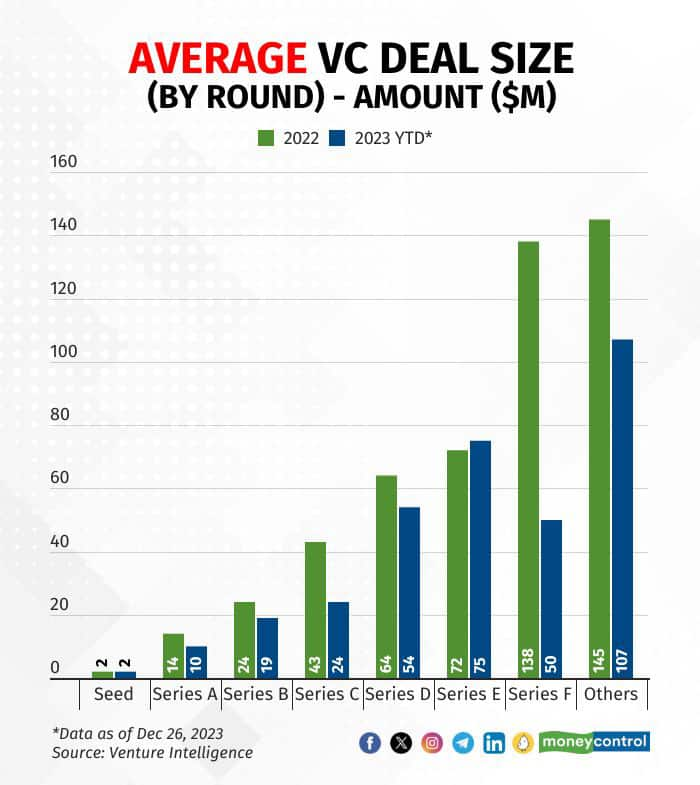

Monthly VC Investments in IndiaStage-wise fundingIn the late stages, startups raised $2,339 million in 48 deals in 2023, down from $6,783 million in 77 deals in 2023. The average funding size saw a slight uptick for series E stage startups to $75 million from $72 million in 2022. However, it is notable that the number of investments in this stage went down 16 from 29 in 2022.

However, more importantly, the data showed that the average funding size for series F ventures witnessed a steep fall to $50 million, which till last year flew high around $138 million.

Average VC Deal Size in 2023 v/s 2022

Average VC Deal Size in 2023 v/s 2022“Usually you will see the impact starting from the public market and then going down to the late stage, early growth stage and then early stage. Early stage will always get impacted the least and whatever’s closest to the public market will always get impacted the most, there's a ripple effect that happens,” Fundamentum’s Kumar said.

In value terms the majority of funding was recorded in the growth stages where startups closed 207 deals receiving $4.54 billion in 2023, which was down from a comparatively high investment level of $14.52 billion in 387 deals last year.

The average funding size, meanwhile, has also plummeted for series B stage ventures from $24 million to $19 million. It fell to $24 million in series C rounds, and $54 million in series D from $43 million and $64 million, respectively in 2022.

Meanwhile, the stage-wise funding data for the year showed that in the early stages startups closed about 316 deals this year recording a total investment of $1,148 million. Last year, startups in this stage had received $3,039 million in funding in 761 deals.

The average round size in the early stages has also fallen slightly. While in the seed stage companies continued to attract $2 million cheques, VCs wrote cheques of lower denominations in Series A at $10 million down from $14 million.

“We are raising a little bit of concentration at the seed stage because there is a clear fall in series A and B deals. But they do have to continue showing activity from their end. Last one year or so we have seen a lot of activities in the seed stage,” said Anand Lunia, founding partner of IndiaQuotient.

Stage-wise VC Investments in IndiaTop Investors

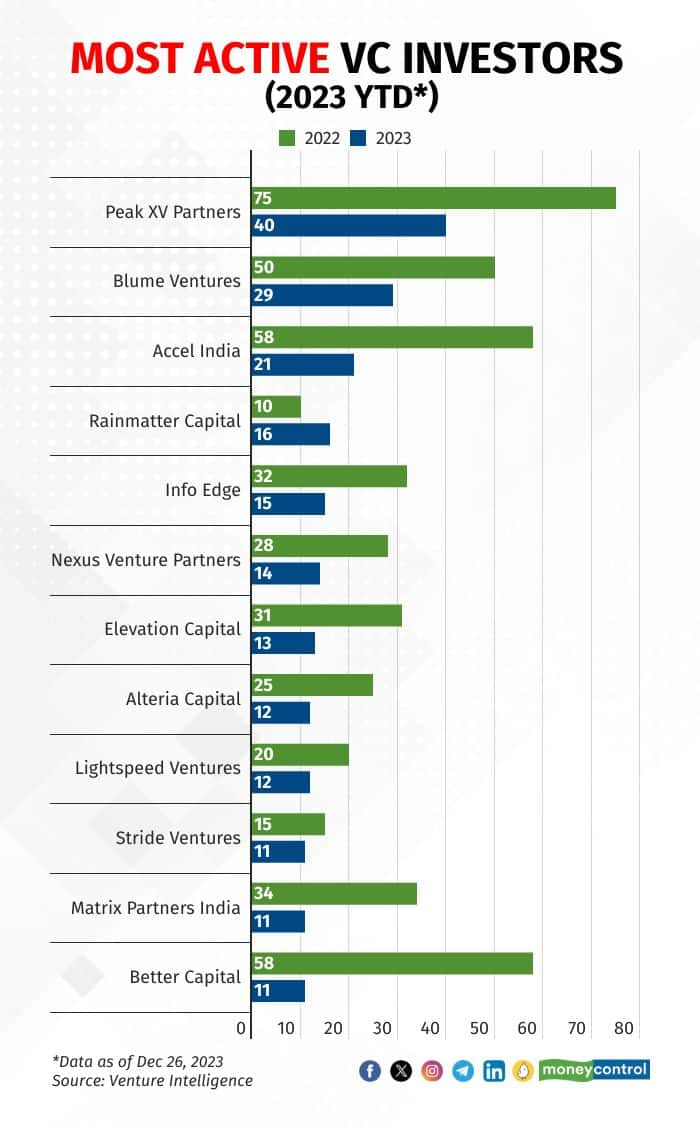

Stage-wise VC Investments in IndiaTop InvestorsTo be sure, Peak XV partners (previously Sequoia India) that focused on early-stage ventures this year continued to remain on top of the most active venture capital firms list in 2023. However, the number of deals closed fell to 40 from 75 in 2022.

Blume Ventures and Accel India were next in line with 29 and 21 deals closed, respectively. Both, however, cut down on the number of investments from 50 and 58 respectively in 2022, which also brought down Accel from second on the list to third.

Other most active investors included Rainmatter Capital, Info Edge, Nexus Venture Partners, Elevation Capital, Alteria Capital, Lightspeed Ventures, Stride Ventures, Matrix Partners India and Better Capital.

Importantly, Better Capital made the most visible turn in its strategy investing in about 11 startups this year, down from 58 in 2022.

Moneycontrol recently reported that according to Peak XV Partners Managing Director Rajan Anandan venture capitalists are sitting on $20 billion of cash to invest in Indian startups for the coming year.

Most Active VC Investors (2023*)

Top sectors investors are bullish onAnandan, during his talk at the Global Partnership for AI Summit in Delhi, added that the most important theme on VCs' minds at the moment is artificial intelligence.

Interestingly, this is a sentiment that is replicated among VCs across the board.

“In the late stage, when you look at 2024 and 2025 my sense is that some of these AI platforms, AI led services platforms, and use of technology in services and manufacturing will get big money,” said Fundamentum’s Kumar.

Elevation’s Arora added, “We continue to see a lot of excitement, including excitement that we have on SaaS and especially AI within that, which has obviously been a big buzzword globally, but also we are seeing the talent pool in India building some interesting products.”

Another area where VCs continue to be bullish is the fintech space. “I feel that it is the end of the funding cycle, but there's a new technology cycle that will also begin. And as fintech focused investors we believe, a lot of it is going to be driven through the digital public infrastructure. That's an area that excites us,” Chachra added.

Interestingly, IndiaQuotient’s Lunia believes there is a lot of potential yet to be explored within edtech and healthtech, sectors which have both seen investments plummeting this year.

“Education is an unfinished business, VCs have practically not done anything, made no difference… Healthtech is another business where there is a lot to explore. There are a few that started with some interesting models but after that nothing has been done,” he added.

Lunia said that the firm will explore investments in these sectors in the coming year, with the launch of a new fund.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.