Last weekend, the Reserve Bank of India (RBI) and the Central Bank of United Arab Emirates (CBUAE) signed two memorandums of understanding (MoU). The first MoU was for establishing a framework to promote the use of local currencies, i.e., the Indian rupee (INR) and the UAE dirham (AED) for cross-border transactions. The second MoU was for cooperating on interlinking their payment and messaging systems. Both MoUs are a step forward towards internationalising the INR and the Indian payment system.

The turmoil in the world's political and economic systems over the last 15 years has led to a shift from a unipolar system where the US drove most of the agenda to a multipolar world where multiple countries are vying for both political and economic supremacy. Within economic multipolarity, the spotlight is on the US dollar which retains its supremacy in the international monetary system.

The supremacy of the US dollar (USD) has been questioned and attempts have been made to challenge it. Major European countries gave up their currency to adopt the euro as a single currency. Initially, the euro did show promise but due to the 2010 European crisis and stagnant growth thereafter, the progress stalled. The Chinese have been trying to position the renminbi as an international currency by giving loans in its currency. The Chinese and Europeans were also the early adopters of the central bank digital currency with one key objective being to increase international transactions in their currencies.

Challenging The Dollar

The European and Chinese attempts led to a decline in the share of the USD in foreign exchange reserves but the USD is still omnipresent in international trade and finance. There are ongoing attempts by policymakers worldwide to lower reliance on the USD for international transactions.

India’s policymakers have joined the fray by positioning the INR as an alternative currency for international transactions. They are using two strategies to further this cause. One, promoting usage of the INR in international transactions. The government is doing this through bilateral agreements with trading partners especially in the South Asian region. The INR was already being used in Nepal and Bhutan and is being used in Sri Lanka since its economic crisis of 2020. The Indian government, apart from providing financial aid, nudged the island nation to use the INR in bilateral trade.

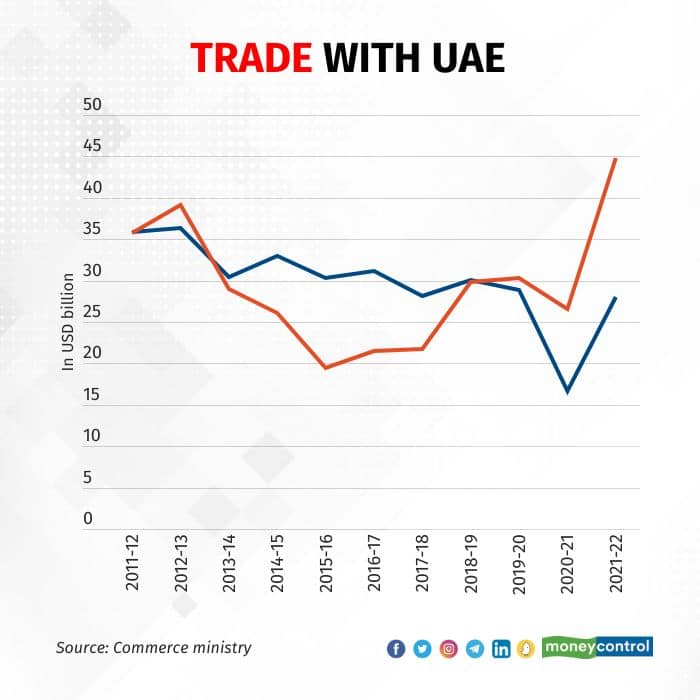

The MoU with the UAE expands the list of countries settling transactions in INR. The MoU paves the way for settling bilateral transactions in INR and AED. This is a significant move as the UAE is a large trade partner with India. India’s bilateral trade with the UAE was worth $73 billion in 2021-22, with exports estimated at $28 billion and imports at $44.8 billion.

The share of India’s exports to the UAE as a percentage of total exports was 6.65 percent in 2021-22 while the share of imports from UAE in total imports was about 7.3 percent.

Alternate Payment System

Alternate Payment System

The UAE is one of India’s top three trade partners – the second-largest export destination and usually the second or third-largest source of imports. Under the MoU, India and the UAE will institute a Local Currency Settlement System (LCSS) to promote the bilateral use of their domestic currencies. The MoU covers all current account transactions and permitted capital account transactions. This arrangement would also promote investments and remittances between the two countries. It will also reduce transaction costs and settlement time for transactions, including remittances from Indians residing in the UAE. It will also help develop the INR-AED market and safeguard India from oil shocks in future.

The second strategy involves interlinking payment systems. The technology in payment systems has advanced and democratised in recent years. Globally, payments have increasingly moved towards using QR codes where the payment systems of two countries could be interlinked in a seamless manner. India recently interlinked its UPI payment system (United Payment Interface) with Singapore’s Fast Pay system.

The MoU with the UAE will enable interlinked payments between the two countries on multiple fronts. The UPI of India will be linked to the Instant Payment Platform (IPP) of the UAE. The RUPAY card switch and UAESWITCH will be connected. The Structured Financial Messaging System (SFMS) of India will be linked with the messaging system in the UAE.

After Singapore and the UAE, India is now exploring similar interlinkages with Indonesia. One could hear of many more initiatives going forward. While India might be exploring local currency settlements with smaller countries, it could explore interlinked payment systems with even bigger developed countries. For instance, France has agreed to interlink UPI with its payment systems.

Overall, the global turmoil and India’s initiative have led to interesting developments in the world of currency and the Indian rupee. The RBI recently released a report which laid a path for internationalising of INR. It is early days but India is treading well on the path so far.

Amol Agrawal teaches at Ahmedabad University. Views are personal, and do not represent the stand of this publication.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!