India's homegrown real-time payment system, Unified Payments Interface (UPI)’s global aspirations, took a big leap forward after Prime Minister Narendra Modi on July 14 said that Indian tourists will be able to make rupee payments using UPI from atop the Eiffel Tower.

"In France, an agreement has been made for the use of India's UPI... It will be started from the Eiffel Tower, and now Indian tourists would be able to make payments in Rupees, through UPI, in the Eiffel Tower," the PM said.

This comes just months after the UPI platform echoed throughout Singapore as the two countries inked a pact to launch cross-border connectivity between the UPI and its Singapore counterpart PayNow.

The UAE, Bhutan and Nepal have already adopted the UPI payment system and the NPCI International is in talks to extend the UPI services in the US, European countries and West Asia.

“The utilisation or the destination of UPI was just in India and now it is making its strides globally,” said Ritesh Shukla, Chief Executive Officer of NPCI (National Payments Corporation) International Payments Limited (NIPL).

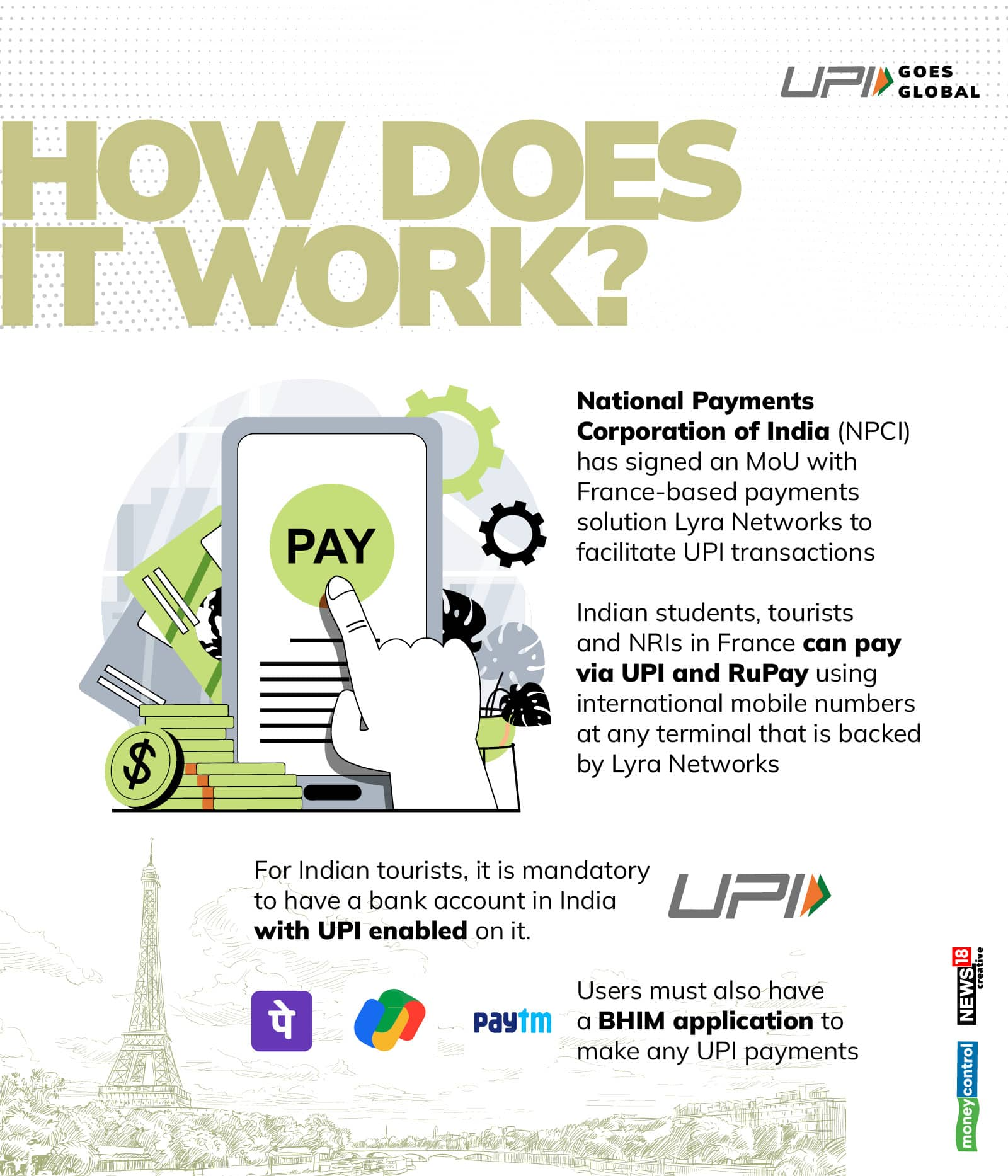

How it works

NPCI's arm NPCI International has signed an MoU with France-based payments solution Lyra Networks to facilitate UPI transactions. Indian students, tourists and NRIs in France can pay via UPI and RuPay using international mobile numbers at any terminal that is backed by Lyra Networks.

It is mandatory for Indian tourists to have a bank account in India with UPI enabled in it, and the users must also have a BHIM application or UPI-connected apps to carry out any UPI transactions.

UPI transactions to cross 1 billion transactions per day

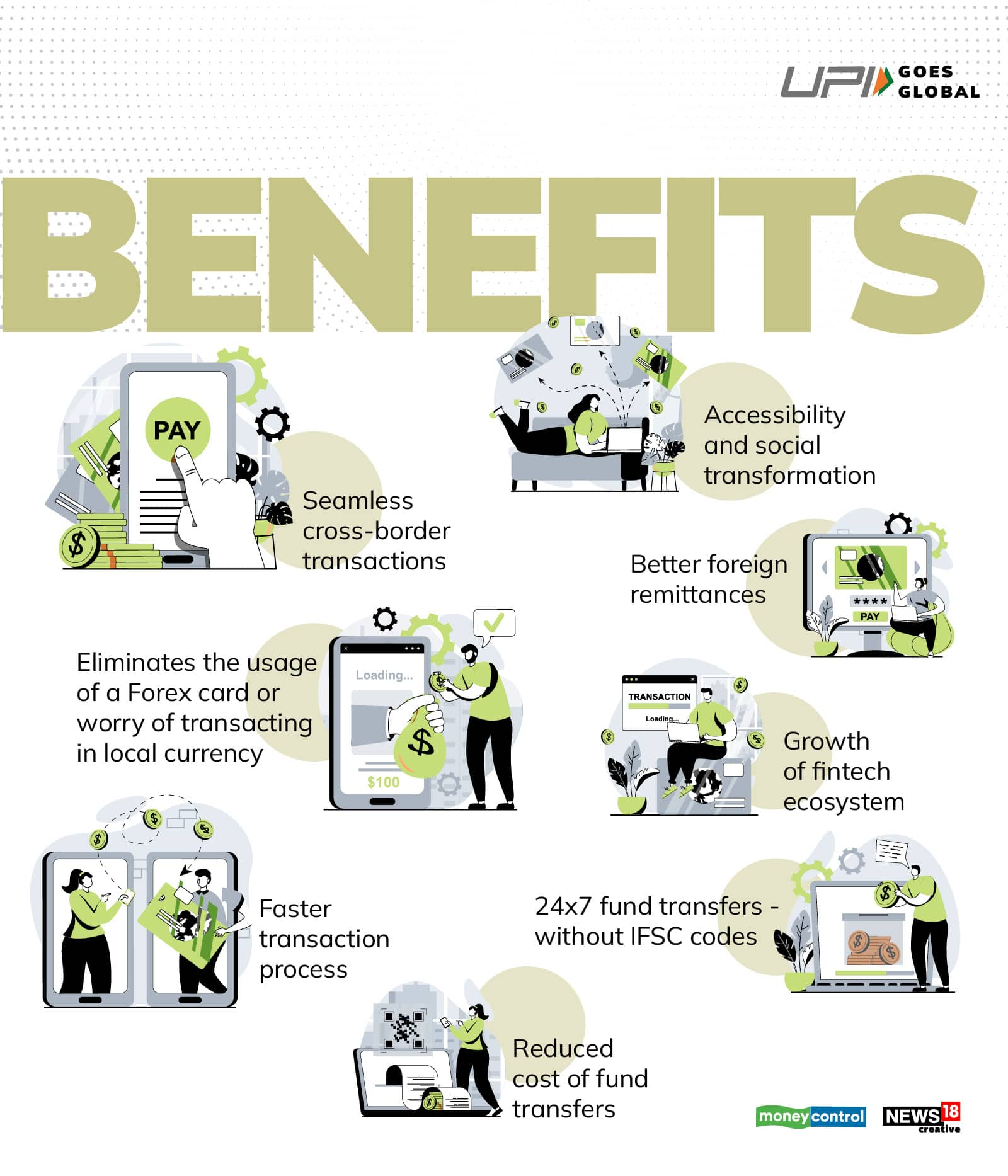

While the UPI platform going global will accelerate cross-border transactions in a faster and easier way, experts also say that the adoption of UPI globally will further accelerate the growth of UPI transaction volumes.

In fact, daily transactions on the platform can touch one billion in the next three years as UPI hits its full potential, said Dilip Asbe, Managing Director and Chief Executive Officer of National Payments Corporation of India (NPCI) in March at the India Fintech Conclave event of Moneycontrol.

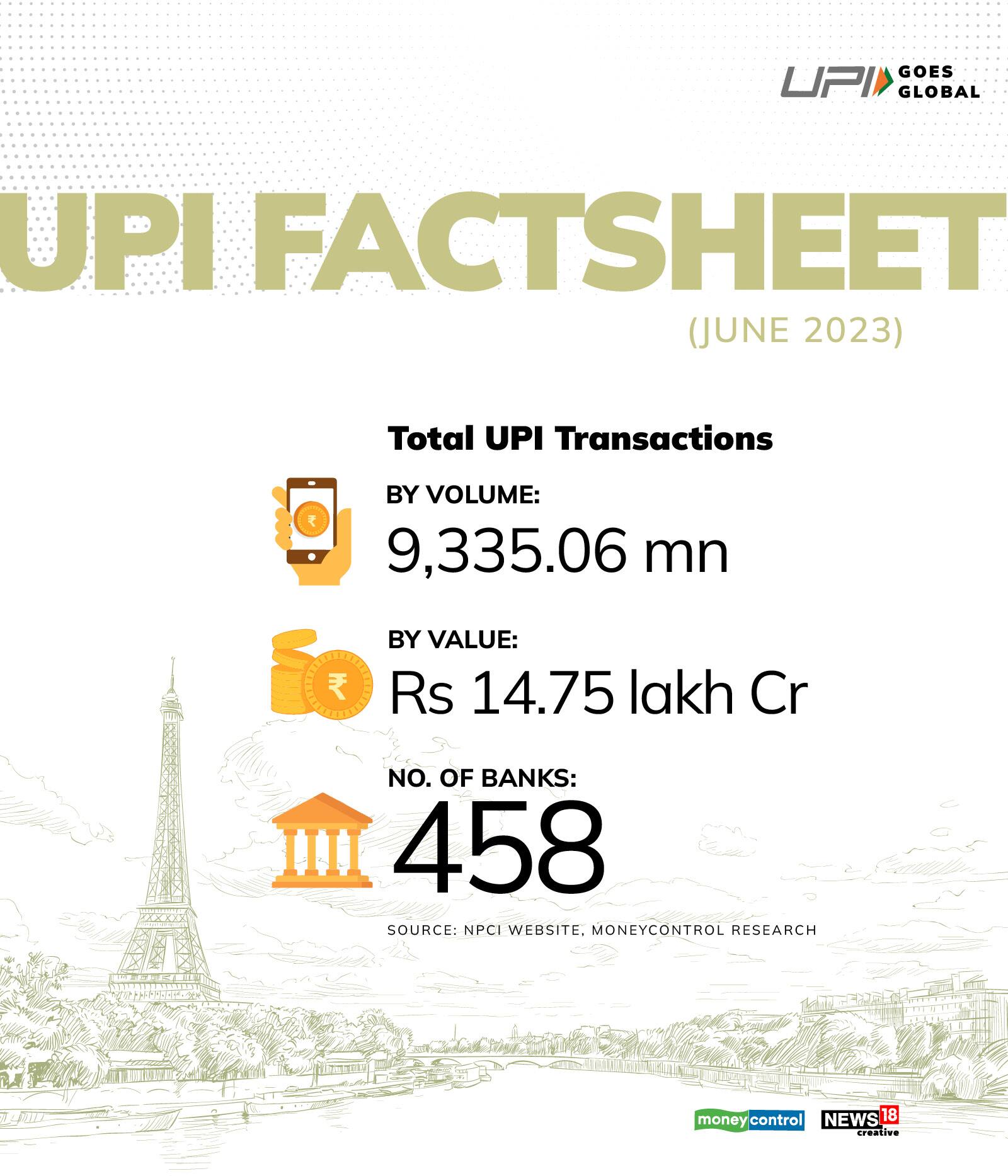

As of June 2023, UPI transaction volume is clocked at 9.33 million and the total value of UPI transactions for June touched Rs 14.75 lakh crore.

Asbe also said that in the next 10-20 years, the vision is to be self-sufficient on the cross-border pipes as well.

“It is a time-consuming process but the beginning has been made with the Singapore-India corridor. In 30 seconds, one country’s bank account can be credited and the other country’s bank account. This has given the confidence to the world in UPI,” he said.

India’s UPI system is steadily becoming attractive globally. The facility is seeing international extension to inbound foreign travellers from G20 countries for making merchant payments and non-resident Indians (NRIs) in selected international countries.

Union Minister Ashwini Vaishnaw on February 13 said that India has signed memoranda of understanding (MoUs) with 13 countries that want to adopt the UPI for their digital payments.

“What we are doing is is that we are enabling our consumers from India to be able to pay through any UPI-powered app, which is connected to different funding sources like credit card or prepaid wallet or anything… this can address multiple use-cases,” NPCI International's Shukla added.

Today, the UK, Nepal, Bhutan, Singapore, Australia, Oman and France use UPI for payments.

“Clocking 1 billion transactions a day by 2025 is the holistic picture it will include everything like the global penetration of UPI as well. We all have a role to play to achieve this dream that we have nurtured to take UPI to many places,” Shukla said.

The beneficiaries

In 2022, the National Payments Corporation Of India (NPCI), the umbrella organisation that offers UPI services, signed an MoU with France's fast and secure online payment system, called Lyra.

With this, non-resident Indians (NRIs), tourists and Indian students studying in France are likely to benefit from making cross-border payments without the worry of conversion rates. The move is likely to bring down the remittance cost between the two countries.

France is one of the few favourite European countries chosen by Indian students for higher studies. In 2021-22, more than 4,00,000 foreign students opted for higher education in France, out of which 10,000 students were from India.

UPI’s reach in France is likely to benefit students and tourists

“This solution will enable anybody from India from business owners to students studying abroad to travellers… A user should just simply have a bank account or a credit card or current account that is connected to UPI…Use cases are multi-fold, we are just creating a bridge,” Shukla added.

To send money from India to France using an international money transfer provider, the fees range from Rs 787.65 with Currency Fair to Rs 2,680 per transaction with Open Financial Exchange. However, the fee could be even higher or lower with different banks.

“Experience-wise there is nothing like UPI in the new digital world. For both Rupay and UPI, the only limitation so far has been acceptance abroad, with such bilateral ties acceptance will improve and thereby result in more customers getting benefitted,” said Prabhu Rangarajan, Cofounder of M2P fintech.

Revolutionising cross-border payment solutions for fintech startups

UPI going global is a shot in the arm for many fintech startups that are focused on cross-border payment solutions.

“There is a huge opportunity for fintechs to come and build and design on top of UPI, develop better interfaces and play an important role in driving adoption,” said Shukla.

In February of 2023, PhonePe introduced ‘UPI International,’ a facility with which PhonePe users travelling to international destinations can pay foreign merchants via UPI and in the currency of that country.

There are multiple neo-banking startups, which will tap into this move to drive innovation in the e-payment space.

“We have to wait and watch, the short-term impact might be negligible.. but in the long term, Fintechs who build around these use cases might benefit in a big way,” the fintech founder added.

What are the challenges?

Businesses and residents are awaiting more clarity on the linkage for businesses and the cost of the transfer.

“These are initial phases, the cost of transfer and remittance fees are very high for France. We have to wait and watch to get more clarity on the cost of the transfer,” the fintech founder quoted above said.

However, Shukla clarified that the cost of remittances and other charges to transact using UPI in the international market will be decided by the relevant authorities and banks as the adoption accelerates.

“We are all about creating scale, the ultimate price to the consumer will be decided by the financial institutions or banks in case of credit card, or an exchange rate in case a consumer goes to an exchange to use UPI,” he said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.