Microcaps that are fund house favourites but yet to unlock their potential

Many microcap stocks held by mutual funds have not yet performed well. Fund managers continue holding these stocks in their portfolio believing that these businesses may play out well in the future

1/18

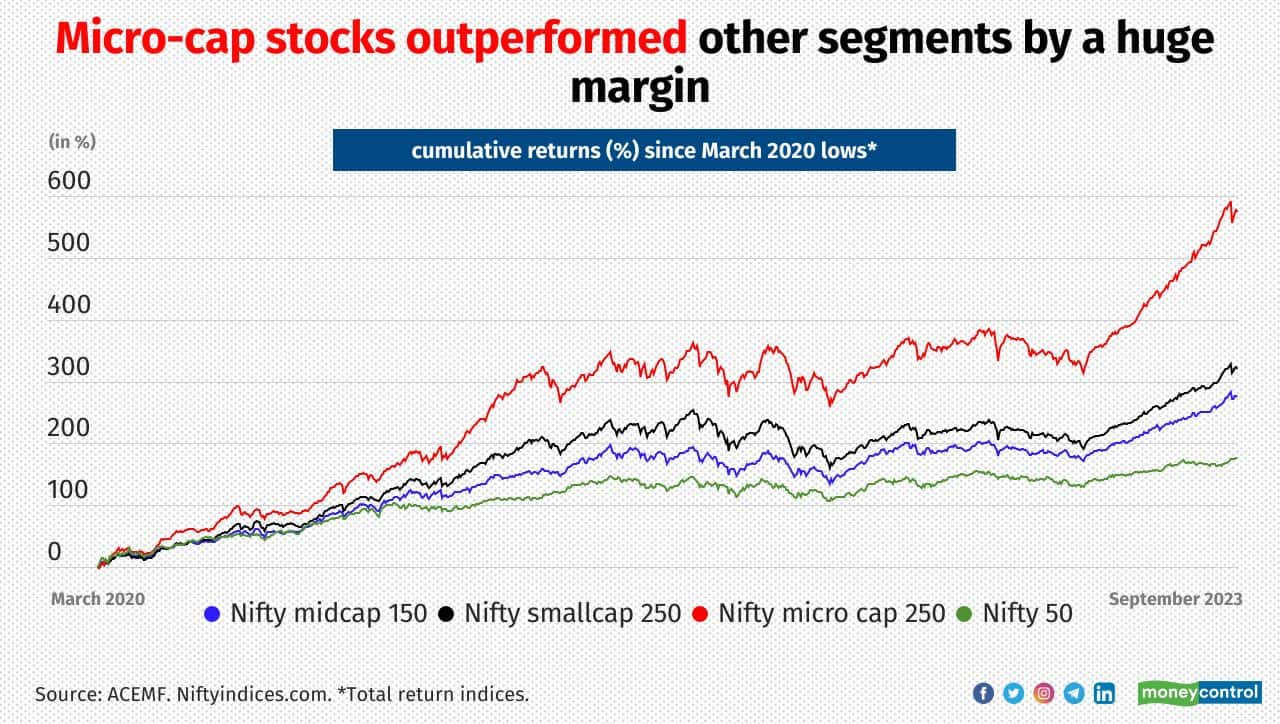

Micro-cap stocks had a solid run over the last 3 years and outperformed other segments by a huge margin. The Nifty Microcap 250 TRI registered a spectacular show by gaining 574% from its March 2020 lows. Meanwhile, Nifty 50 TRI, Nifty Midcap 150 – TRI and Nifty Smallcap 250 - TRI gained 176%, 275% and 321% respectively during the same period.

Typically, micro-cap stocks can turn multi-baggers. However, things do not go always according to plan. Many such cherry picked stocks may not perform as expected and take longer to produce better results. Fund managers continue holding these stocks in their portfolio believing that these businesses may play out well in the future.

Here are the microcap stocks held by active mutual funds that have delivered almost no return over the last one year. Stocks with Market Cap of less than Rs 3,000 crore are considered microcaps. Data as on August 31, 2023. Source: ACEMF.

Typically, micro-cap stocks can turn multi-baggers. However, things do not go always according to plan. Many such cherry picked stocks may not perform as expected and take longer to produce better results. Fund managers continue holding these stocks in their portfolio believing that these businesses may play out well in the future.

Here are the microcap stocks held by active mutual funds that have delivered almost no return over the last one year. Stocks with Market Cap of less than Rs 3,000 crore are considered microcaps. Data as on August 31, 2023. Source: ACEMF.

2/18

CarTrade Tech

No. of schemes hold the stock: 5

Sample of schemes that hold the stock over a year: Aditya Birla SL Balanced Advantage, HDFC Large and Mid Cap and ICICI Pru Technology

No. of schemes hold the stock: 5

Sample of schemes that hold the stock over a year: Aditya Birla SL Balanced Advantage, HDFC Large and Mid Cap and ICICI Pru Technology

3/18

Thyrocare Technologies

No. of schemes hold the stock: 7

Sample of schemes that hold the stock over a year: Nippon India Pharma, Nippon India Retirement Fund-Wealth Creation and Nippon India Small Cap

Also see: Risk mitigation: Check out these large-cap safety nets in small-cap mutual funds

No. of schemes hold the stock: 7

Sample of schemes that hold the stock over a year: Nippon India Pharma, Nippon India Retirement Fund-Wealth Creation and Nippon India Small Cap

Also see: Risk mitigation: Check out these large-cap safety nets in small-cap mutual funds

4/18

Greenply Industries

No. of schemes hold the stock: 20

Sample of schemes that hold the stock over a year: Bandhan Emerging Businesses, Canara Rob Small Cap and HDFC Mid-Cap Opportunities

No. of schemes hold the stock: 20

Sample of schemes that hold the stock over a year: Bandhan Emerging Businesses, Canara Rob Small Cap and HDFC Mid-Cap Opportunities

5/18

Oriental Carbon & Chemicals

No. of schemes hold the stock: 6

Sample of schemes that hold the stock over a year: HDFC Large and Mid Cap, HDFC Small Cap and HSBC Small Cap

Also see: 13 Smallcap Gems That Infrastructure Mutual Funds Love to Hold

No. of schemes hold the stock: 6

Sample of schemes that hold the stock over a year: HDFC Large and Mid Cap, HDFC Small Cap and HSBC Small Cap

Also see: 13 Smallcap Gems That Infrastructure Mutual Funds Love to Hold

6/18

Matrimony.Com

No. of schemes hold the stock: 6

Sample of schemes that hold the stock over a year: ICICI Pru ESG

ICICI Pru Smallcap, Tata Digital India and Tata Retirement Sav Fund - Cons Plan

No. of schemes hold the stock: 6

Sample of schemes that hold the stock over a year: ICICI Pru ESG

ICICI Pru Smallcap, Tata Digital India and Tata Retirement Sav Fund - Cons Plan

7/18

Mahindra Logistics

No. of schemes hold the stock: 13

Sample of schemes that hold the stock over a year: Aditya Birla SL Small Cap, Edelweiss Small Cap and Nippon India Small Cap

Also see: Stocks With Multiple Faces! Common Names Across Smart-Beta MFs

No. of schemes hold the stock: 13

Sample of schemes that hold the stock over a year: Aditya Birla SL Small Cap, Edelweiss Small Cap and Nippon India Small Cap

Also see: Stocks With Multiple Faces! Common Names Across Smart-Beta MFs

8/18

Alicon Castalloy

No. of schemes hold the stock: 4

Sample of schemes that hold the stock over a year: Axis Small Cap and Bandhan Emerging Businesses

No. of schemes hold the stock: 4

Sample of schemes that hold the stock over a year: Axis Small Cap and Bandhan Emerging Businesses

9/18

Mayur Uniquoters

No. of schemes hold the stock: 12

Sample of schemes that hold the stock over a year: Bandhan Emerging Businesses, ICICI Pru Dividend Yield Equity and ITI Small Cap

Also see: The quality test: Should you invest in smart beta funds focusing on quality?

No. of schemes hold the stock: 12

Sample of schemes that hold the stock over a year: Bandhan Emerging Businesses, ICICI Pru Dividend Yield Equity and ITI Small Cap

Also see: The quality test: Should you invest in smart beta funds focusing on quality?

10/18

Astec Lifesciences

No. of schemes hold the stock: 8

Sample of schemes that hold the stock over a year: ICICI Pru Smallcap, ITI Value and Nippon India Small Cap

No. of schemes hold the stock: 8

Sample of schemes that hold the stock over a year: ICICI Pru Smallcap, ITI Value and Nippon India Small Cap

11/18

Sagar Cements

No. of schemes hold the stock: 7

Sample of schemes that hold the stock over a year: Bandhan Emerging Businesses, Bandhan Infrastructure and HDFC Multi Cap

Also see: Buy-and-hold: Mutual Fund schemes that churn the least

No. of schemes hold the stock: 7

Sample of schemes that hold the stock over a year: Bandhan Emerging Businesses, Bandhan Infrastructure and HDFC Multi Cap

Also see: Buy-and-hold: Mutual Fund schemes that churn the least

12/18

Indoco Remedies

No. of schemes hold the stock: 16

Sample of schemes that hold the stock over a year: Franklin India Smaller Cos and ICICI Pru Smallcap and Nippon India Small Cap

No. of schemes hold the stock: 16

Sample of schemes that hold the stock over a year: Franklin India Smaller Cos and ICICI Pru Smallcap and Nippon India Small Cap

13/18

Tamil Nadu Newsprint & Papers

No. of schemes hold the stock: 6

Sample of schemes that hold the stock over a year: Aditya Birla SL Dividend Yield, Aditya Birla SL Pure Value and HDFC Hybrid Equity

Also see: MC30 scheme review: Why PGIM India Midcap Opportunities Fund is a long-term wealth creator

No. of schemes hold the stock: 6

Sample of schemes that hold the stock over a year: Aditya Birla SL Dividend Yield, Aditya Birla SL Pure Value and HDFC Hybrid Equity

Also see: MC30 scheme review: Why PGIM India Midcap Opportunities Fund is a long-term wealth creator

14/18

Butterfly Gandhimathi Appliances

No. of schemes hold the stock: 9

Sample of schemes that hold the stock over a year: Aditya Birla SL Small Cap, ICICI Pru Multicap and Sundaram Small Cap

No. of schemes hold the stock: 9

Sample of schemes that hold the stock over a year: Aditya Birla SL Small Cap, ICICI Pru Multicap and Sundaram Small Cap

15/18

Prataap Snacks

No. of schemes hold the stock: 7

Sample of schemes that hold the stock over a year: Aditya Birla SL Mfg. Equity, Bandhan Focused Equity and Kotak Small Cap

Also see: 10 most popular large-cap stocks among PMS to withstand volatility

No. of schemes hold the stock: 7

Sample of schemes that hold the stock over a year: Aditya Birla SL Mfg. Equity, Bandhan Focused Equity and Kotak Small Cap

Also see: 10 most popular large-cap stocks among PMS to withstand volatility

16/18

Wheels India

No. of schemes hold the stock: 6

Sample of schemes that hold the stock over a year: Bandhan Emerging Businesses, HDFC Multi Cap and Nippon India Tax Saver (ELSS)

No. of schemes hold the stock: 6

Sample of schemes that hold the stock over a year: Bandhan Emerging Businesses, HDFC Multi Cap and Nippon India Tax Saver (ELSS)

17/18

MM Forgings

No. of schemes hold the stock: 13

Sample of schemes that hold the stock over a year: Franklin India Smaller Cos, HSBC Small Cap and Tata Small Cap

No. of schemes hold the stock: 13

Sample of schemes that hold the stock over a year: Franklin India Smaller Cos, HSBC Small Cap and Tata Small Cap

18/18

Subros

No. of schemes hold the stock: 9

Sample of schemes that hold the stock over a year: Canara Rob Small Cap, DSP Small Cap, Nippon India Small Cap and UTI Small Cap

Also see: Hot small-cap pharma and healthcare stocks that MFs hold currently

No. of schemes hold the stock: 9

Sample of schemes that hold the stock over a year: Canara Rob Small Cap, DSP Small Cap, Nippon India Small Cap and UTI Small Cap

Also see: Hot small-cap pharma and healthcare stocks that MFs hold currently

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!