MC30 scheme review: Why PGIM India Midcap Opportunities Fund is a long-term wealth creator

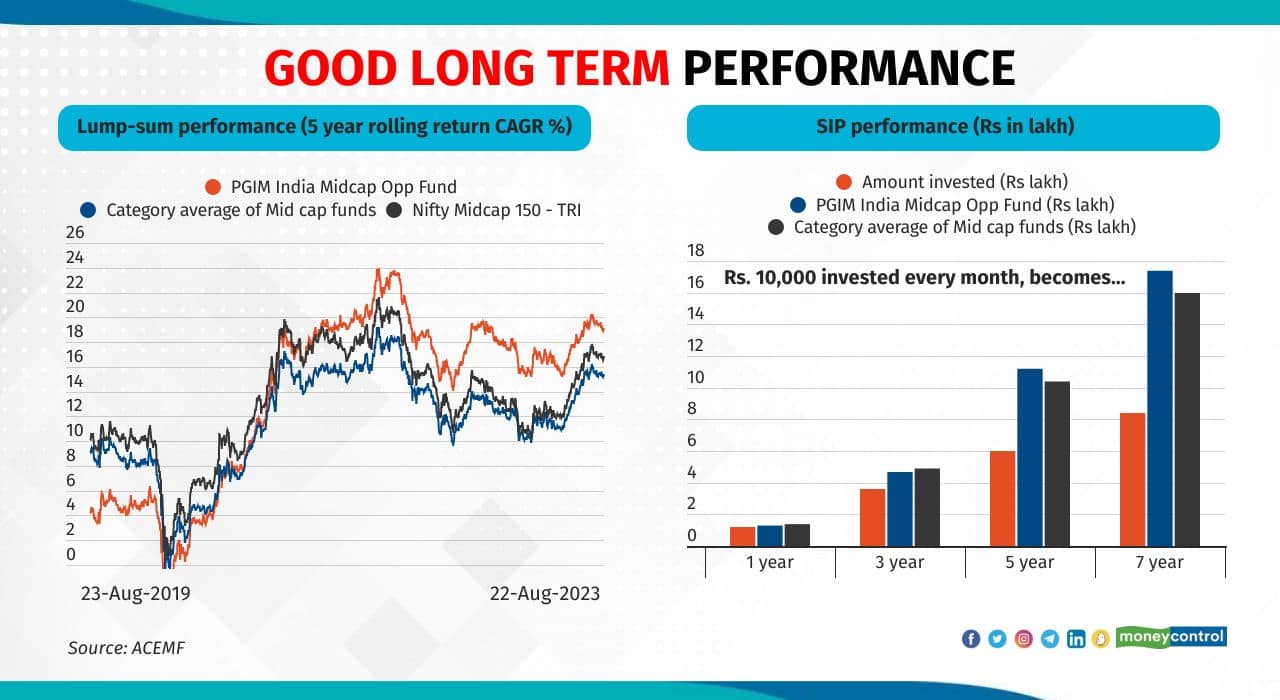

PGIM India Midcap Opportunities Fund has delivered below-average returns in the short term. However, its long-term performance has been noteworthy

1/8

Midcap mutual funds have been instrumental in creating long-term wealth for patient, risk-taking investors. Identifying the right schemes and staying invested for the long term enable investors to achieve their financial goals. MC30, a curated basket of investment-worthy mutual funds, helps you to identify schemes that meet your investment needs.

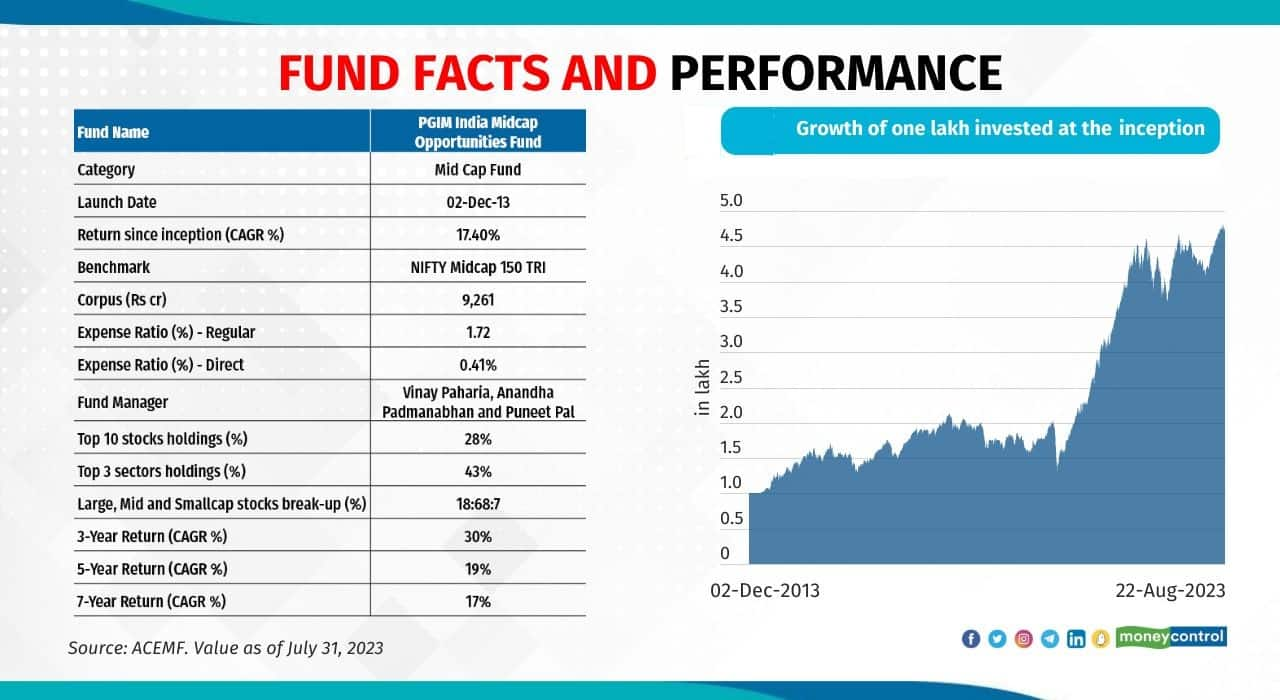

PGIM India Midcap Opportunities Fund (PMOF) is a midcap fund that’s part of the MC30 basket and suitable for long-term holding. Though the scheme has delivered below-average returns in the short term, its long-term performance has been noteworthy. Started in December 2013, the scheme has delivered a compounded annualised growth rate of 17 percent since launch. The scheme is managed by Vinay Paharia, Anandha Padmanabhan Anjeneyan and Puneet Pal.

PGIM India Midcap Opportunities Fund (PMOF) is a midcap fund that’s part of the MC30 basket and suitable for long-term holding. Though the scheme has delivered below-average returns in the short term, its long-term performance has been noteworthy. Started in December 2013, the scheme has delivered a compounded annualised growth rate of 17 percent since launch. The scheme is managed by Vinay Paharia, Anandha Padmanabhan Anjeneyan and Puneet Pal.

2/8

PMOF underperformed the category and its benchmark badly in the initial few years. After Aniruddha Naha took over fund management in April 2018, the scheme became a top-quartile performer in the midcap category. His ability to identify the right stocks in promising sectors at the right time helped the scheme to deliver better returns. Paharia, who took over in March 2023, also has a strong track record of managing top-rated equity schemes in his previous stint with Union Mutual Fund.

3/8

PMOF invests at least 65 percent in midcap stocks and the rest in large and smallcap stocks. It follows a high-risk, high-return strategy that suits investors with a big appetite for risk. Though the scheme has topped the returns chart in the long run, it has delivered below-average returns over the past 12-15 months, mainly due to its relatively underweight position in PSUs and overweight position in consumer discretionary stocks.

“Our portfolio is constructed more with structural growth companies that are consistent in earnings and earnings visibility and significant earnings growth. Over the last two years, within the Nifty 500, weaker companies that are with low growth and low quality outperformed superior companies that are with high growth and high quality by about 10 percent,” Paharia explained.

Also see: 10 most popular large-cap stocks among PMS to withstand volatility

“Our portfolio is constructed more with structural growth companies that are consistent in earnings and earnings visibility and significant earnings growth. Over the last two years, within the Nifty 500, weaker companies that are with low growth and low quality outperformed superior companies that are with high growth and high quality by about 10 percent,” Paharia explained.

Also see: 10 most popular large-cap stocks among PMS to withstand volatility

4/8

The Indian equity market has been on a record-making spree over the past 15 months, with bouts of volatility. PMOF delivered suboptimal returns within the category during this period due to its concentrated bets in some segments. The fund managers have worked to bring the scheme back on track. There has been significant portfolio churn since Paharia took over. The number of holdings was increased to 64 in July from 44 six months ago. Paharia said there was a sharpening of the investment process.

“We churned much between March and May as we introduced more stocks and exited from very cyclical ones. We exited cyclical sectors like commodities and added more structural growth companies,” he said.

He also reduced holdings in consumer durables and banks and added allocation to auto components and financial services.

“We churned much between March and May as we introduced more stocks and exited from very cyclical ones. We exited cyclical sectors like commodities and added more structural growth companies,” he said.

He also reduced holdings in consumer durables and banks and added allocation to auto components and financial services.

5/8

The PMOF fund managers have been more actively churning their portfolio than their peers. However, unlike in the past, the scheme is likely to adopt the buy-and-hold strategy under the new leadership.

Also read: Hot small-cap pharma and healthcare stocks that MF hold

Also read: Hot small-cap pharma and healthcare stocks that MF hold

6/8

The scheme has relatively higher allocations to midcaps than its peers. In the past year, the average allocation to midcap stocks was about 70 percent compared to about 67 percent for the category. PMOF’s large-cap and smallcap allocations stood at 18 percent and 7 percent, respectively.

7/8

Over the past six months, PMOF added about 40 stocks, including HDFC Bank, Kotak Mahindra Bank, PI Industries, United Spirits and Blue Star.

Also read: MF investment in these 12 midcaps, smallcaps surges 3-fold and more in 6 months

Also read: MF investment in these 12 midcaps, smallcaps surges 3-fold and more in 6 months

8/8

PMOF can be part of the core portfolio of investors with a big risk appetite, with a time horizon of five years or more.

Read here: Manufacturing: The new hot stock picking ground for MFs. Here are their top midcap picks

Read here: Manufacturing: The new hot stock picking ground for MFs. Here are their top midcap picks

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!