The quality test: Should you invest in smart beta funds focusing on quality?

Smart beta funds focusing on quality prefer to invest in quality companies with high valuation and strong cash flows. These funds are likely to offer good downside protection and tend to outperform in bear markets

1/10

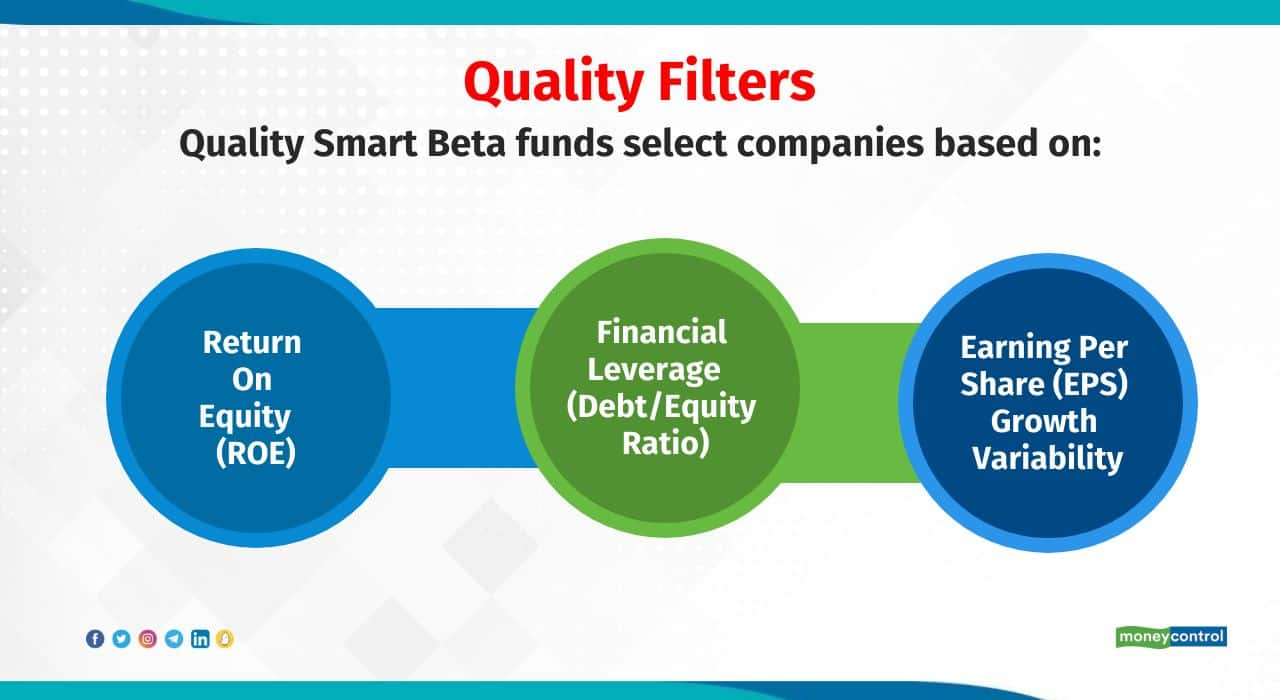

Smart beta funds are gaining popularity among investors. But one type of smart beta fund has been going through a rough patch: the quality focused smart beta fund. What is quality smart beta? It aims to shortlist companies from a broad-based index on the basis of good financials. A quality smart beta fund looks at return on equity (ROE), financial leverage (debt/equity ratio) and earnings growth variability. The weight of each stock is based on the combination of the stock’s quality score and its free float market capitalisation. Each stock is capped at the lower of 5 percent or five times the weight of the stock in the index based on free float market capitalisation. The index is rebalanced twice a year.

2/10

This rule-based approach to ‘quality investing’ makes it an attractive proposition for disciplined investors. Vinayak Savanur, founder of Sukhanidhi Investment Advisors, said, “Investors with moderate risk appetite and keen to contain their downside risk in equities should look at these quality smart beta index funds. These schemes charge less than the actively managed schemes and do away with fund manager risk, which is quite pertinent in the long term.”

3/10

Let’s focus on the Nifty 200 Quality 30 (N200Q30) and the Nifty Midcap 150 Quality 50 (M150Q50) indexes. From January 2020 to March 2020, when the markets fell sharply due to Covid-19, N200Q30 fell less than the Nifty 200, the mother index. But M150Q50 fell more than the mother index Nifty Midcap 150.

When the equity market bounced back from March 2020 to October 2021, N200Q30 rose less than the Nifty 200. But M150Q50 gained more than the mother index. Though individual quality indices have shown diverse trends, quality stocks tend to reward investors in the long term.

“Quality portfolios generate better risk-adjusted returns and may underperform in a steep bull run. Last two years, quality has underperformed other factors and this may be a good time to invest in this factor,” said Niranjan Avasthi, SVP at Edelweiss MF.

Also read: 10 most popular large-cap stocks among PMS to withstand volatility

When the equity market bounced back from March 2020 to October 2021, N200Q30 rose less than the Nifty 200. But M150Q50 gained more than the mother index. Though individual quality indices have shown diverse trends, quality stocks tend to reward investors in the long term.

“Quality portfolios generate better risk-adjusted returns and may underperform in a steep bull run. Last two years, quality has underperformed other factors and this may be a good time to invest in this factor,” said Niranjan Avasthi, SVP at Edelweiss MF.

Also read: 10 most popular large-cap stocks among PMS to withstand volatility

4/10

Value focused smart beta indices did well as the economy came out of the slowdown. Investors in such phases prefer to remain invested in attractively valued names, especially in the backdrop of rising interest rates in CY22. Although quality indices did well in 2018 and 2020, they have languished in the past couple of years.

5/10

Risk is always prevalent when you invest in stocks. Prices can tank due to a sudden increase in interest rates, a scam or a stock-specific event such as a product failure or a fine imposed by a regulator. Whatever the reason, investors need to consider the possibility of a fall in prices, especially when they are keen to invest in mid-cap and small-cap stocks.

Sharwan Kumar Goyal, fund manager at UTI AMC, said, “Many mid-small cap companies are in a single line of business. They may get impacted due to a slowdown in the economy, rising interest rates or rising prices of raw materials much more than their large-cap counterparts. Hence, long-term investors in mid- and small-sized companies must pay due attention to the quality scores of these companies.”

Quality companies have relatively stronger balance sheets, higher ROE and stability of earnings, which are less susceptible to recession and other macroeconomic events. Therefore, quality companies tend to hold up better during turbulent market conditions, he added.

Also see: Bottom-fishing: Mutual funds launch tech funds as IT sector bleeds

Sharwan Kumar Goyal, fund manager at UTI AMC, said, “Many mid-small cap companies are in a single line of business. They may get impacted due to a slowdown in the economy, rising interest rates or rising prices of raw materials much more than their large-cap counterparts. Hence, long-term investors in mid- and small-sized companies must pay due attention to the quality scores of these companies.”

Quality companies have relatively stronger balance sheets, higher ROE and stability of earnings, which are less susceptible to recession and other macroeconomic events. Therefore, quality companies tend to hold up better during turbulent market conditions, he added.

Also see: Bottom-fishing: Mutual funds launch tech funds as IT sector bleeds

6/10

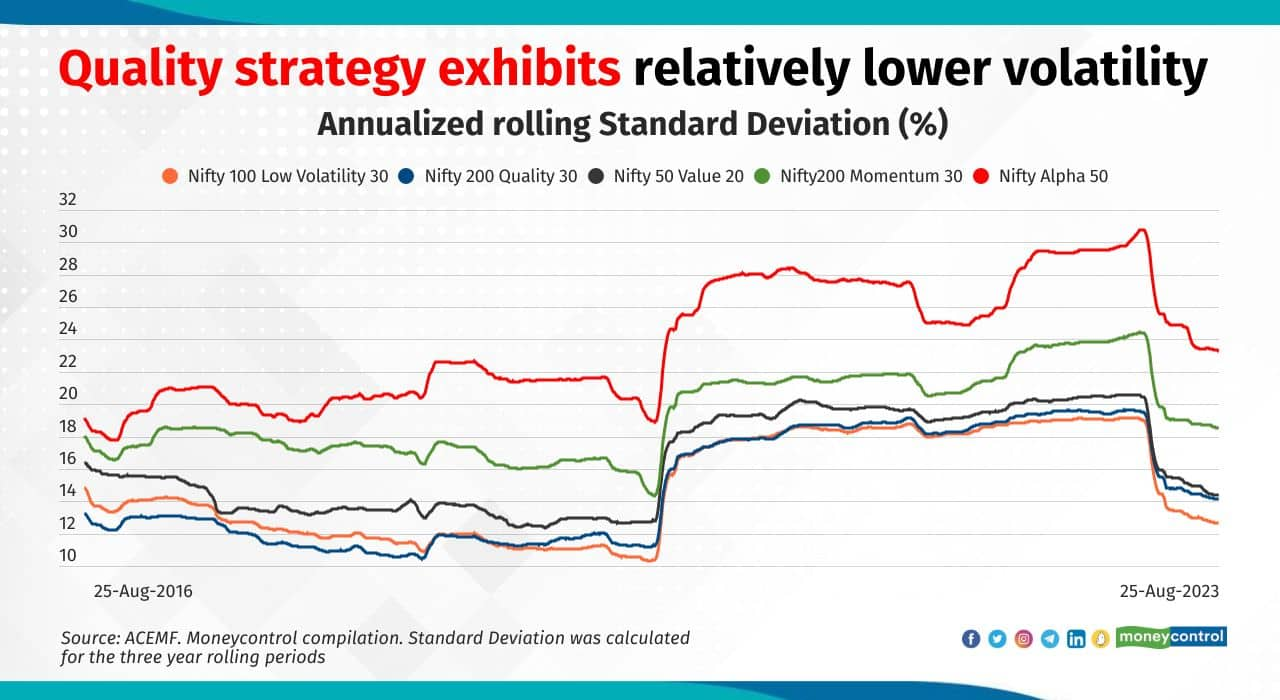

Volatility is the second nature of stocks. Though it cannot be avoided, investors can include high quality stocks in their portfolios. Such stocks fall less than those of companies with weak balance sheets and poor ROE. Also, when the markets recover, high quality stocks at attractive valuations are the first to be grabbed.

“While low-volatility, factor-based indices are aimed at containing the downside in tough times, quality focused smart beta indices can also offer significant downside protection. There may be some overlap between the two. Going by the historical data, in the long term, quality focused smart beta strategies can offer excess returns over their mother indices designed on the market cap basis,” said Goyal.

“While low-volatility, factor-based indices are aimed at containing the downside in tough times, quality focused smart beta indices can also offer significant downside protection. There may be some overlap between the two. Going by the historical data, in the long term, quality focused smart beta strategies can offer excess returns over their mother indices designed on the market cap basis,” said Goyal.

7/10

According to data compiled by Motilal Oswal AMC, shares in fast moving consumer goods have always received high allocation in a quality index. These companies are known for their ability to withstand downturns in the economy. Many investors prefer these stocks as defensive plays in times of recession.

Also see: Does an equal-weight index strategy work in mutual funds?

Also see: Does an equal-weight index strategy work in mutual funds?

8/10

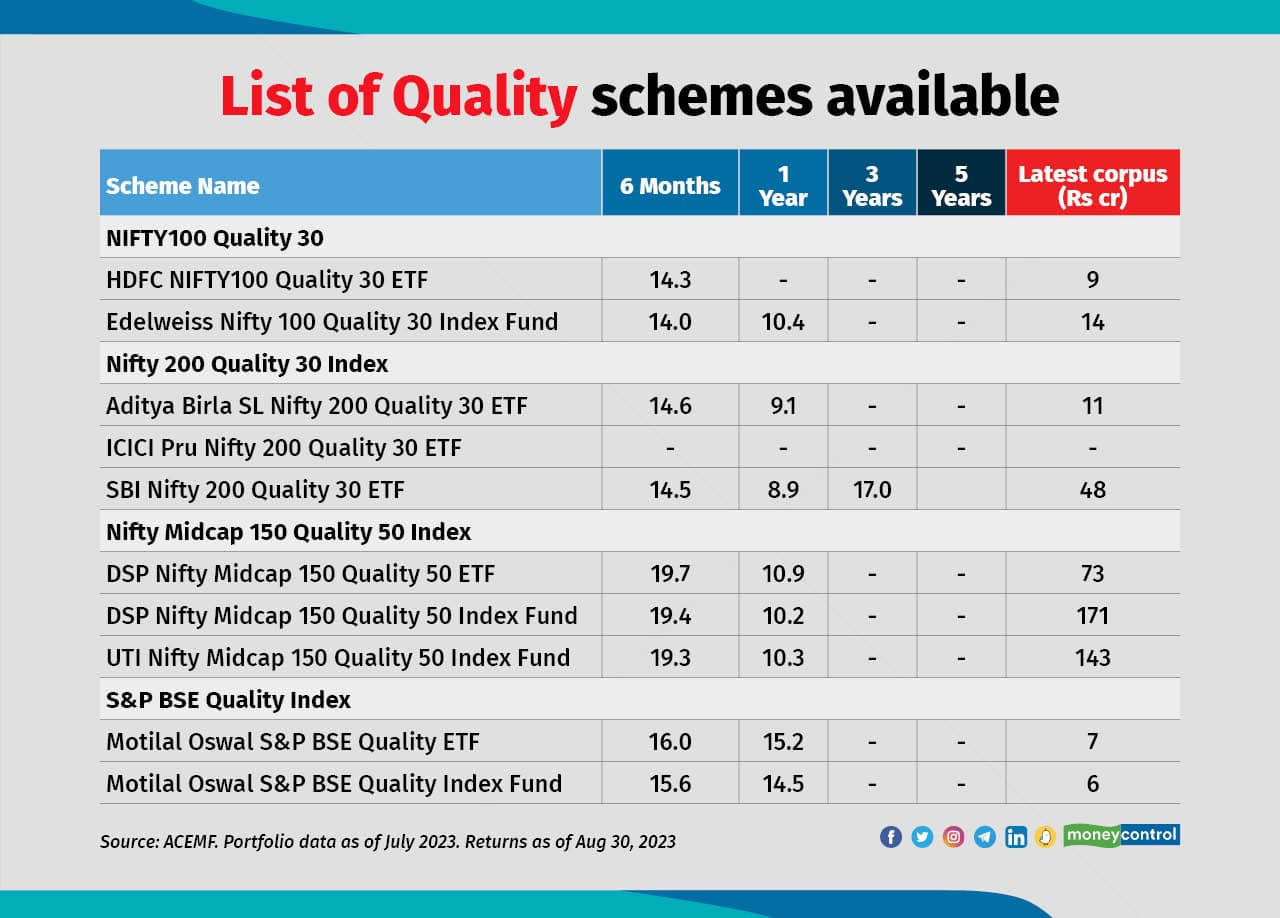

The top 5 stocks in the portfolio of NIFTY200 Quality 30index funds as of July 31, 2023, were Colgate-Palmolive (India), Tata Consultancy Services, Infosys, ITC and Asian Paints. The top 3 sectors were IT – Software, Personal Products and Diversified FMCG.

9/10

The top 5 stocks in the portfolio of NIFTY Midcap150 Quality 50index funds as of July 31, 2023, were Tata Elxsi, APL Apollo Tubes, Tube Investments of India, ICICI Securities and Supreme Industries. The top 3 sectors were Industrial Products, IT – Software and Chemicals & Petrochemicals.

10/10

Investors need to consider the quality of a stock to ensure less drawdowns in bearish phases. A quality focused smart beta strategy ensures exposure to only good quality companies in a rule-based manner.

“Like all factor based smart beta strategies, quality will also have its own cycle. Investors should make sure they are investing for a longer period or at least one full market cycle to capture the full potential returns of such strategies,” said Avasthi.

Also read: MC30 scheme review: Why PGIM India Midcap Opportunities Fund is a long-term wealth creator

“Like all factor based smart beta strategies, quality will also have its own cycle. Investors should make sure they are investing for a longer period or at least one full market cycle to capture the full potential returns of such strategies,” said Avasthi.

Also read: MC30 scheme review: Why PGIM India Midcap Opportunities Fund is a long-term wealth creator

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!