Stocks With Multiple Faces! Common Names Across Smart-Beta MFs

A Moneycontrol personal finance study shows that different smart-beta funds can have common stocks. It implies that these stocks possess the characteristics of different factors

1/10

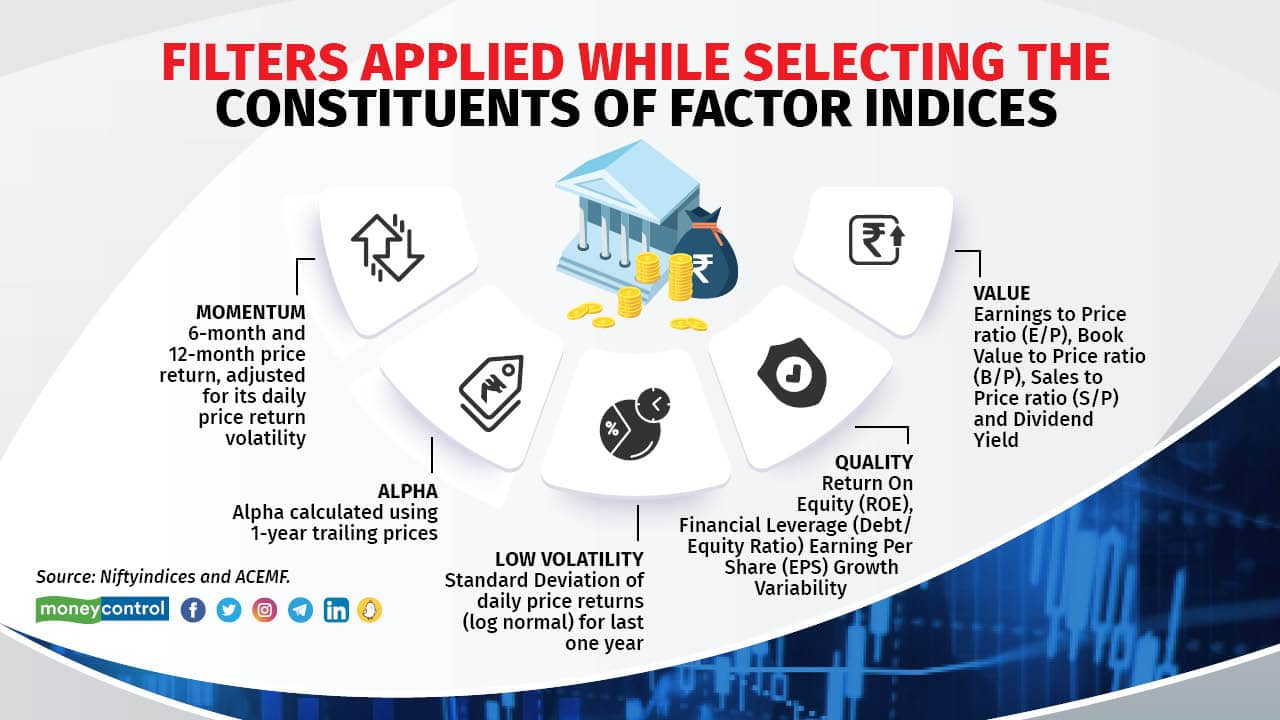

In India, smart beta indices work around multiple factors like low volatility, alpha, quality, value, equal weighing and momentum. These funds pick up broad market indices and overlay them with factors with a view to outperform them over the long term. NSE India has launched 34 such factor/strategy-based indices. Each smart beta index has a unique way of shortlisting stocks from their parent indies. For instance, the constituents of Nifty 200 Quality 30 index are shortlisted from the basket of Nifty 200 by applying the quality filters, such as return on equity (ROE), Debt to Equity (D/E) ratio and EPS growth variability. But did you know that there could be common stocks across multiple factors?

2/10

A Moneycontrol personal finance study on stocks, part of the 5 major factor indices, shows that 8 stocks are common among those three and more different factor indices. In other words, these stocks possess the characteristics of different factors. For instance, ITC is part of the four factor indices – Momentum, Alpha, Low volatility and Quality. Indices considered for the study are Nifty 200 Momentum 30 index (Momentum), Nifty Alpha 50 index (Alpha), Nifty Low Volatility 50 index (Low Volatility), Nifty 200 Quality 30 index (Quality) and Nifty 500 value 50 index (Value). Value as of July 31, 2023. Source: Niftyindices.com and ACEMF.

3/10

ITC

M-CAP type: Large Cap

No. of active schemes that hold the stocks as of July 2023: 224

Also read: The quality test: Should you invest in smart beta funds focusing on quality?

M-CAP type: Large Cap

No. of active schemes that hold the stocks as of July 2023: 224

Also read: The quality test: Should you invest in smart beta funds focusing on quality?

4/10

Siemens

M-CAP type: Large Cap

No. of active schemes that hold the stocks as of July 2023: 95

M-CAP type: Large Cap

No. of active schemes that hold the stocks as of July 2023: 95

5/10

Bank of Baroda

M-CAP type: Large Cap

No. of active schemes that hold the stocks as of July 2023: 120

Also see: Buy-and-hold: Mutual Fund schemes that churn the least

M-CAP type: Large Cap

No. of active schemes that hold the stocks as of July 2023: 120

Also see: Buy-and-hold: Mutual Fund schemes that churn the least

6/10

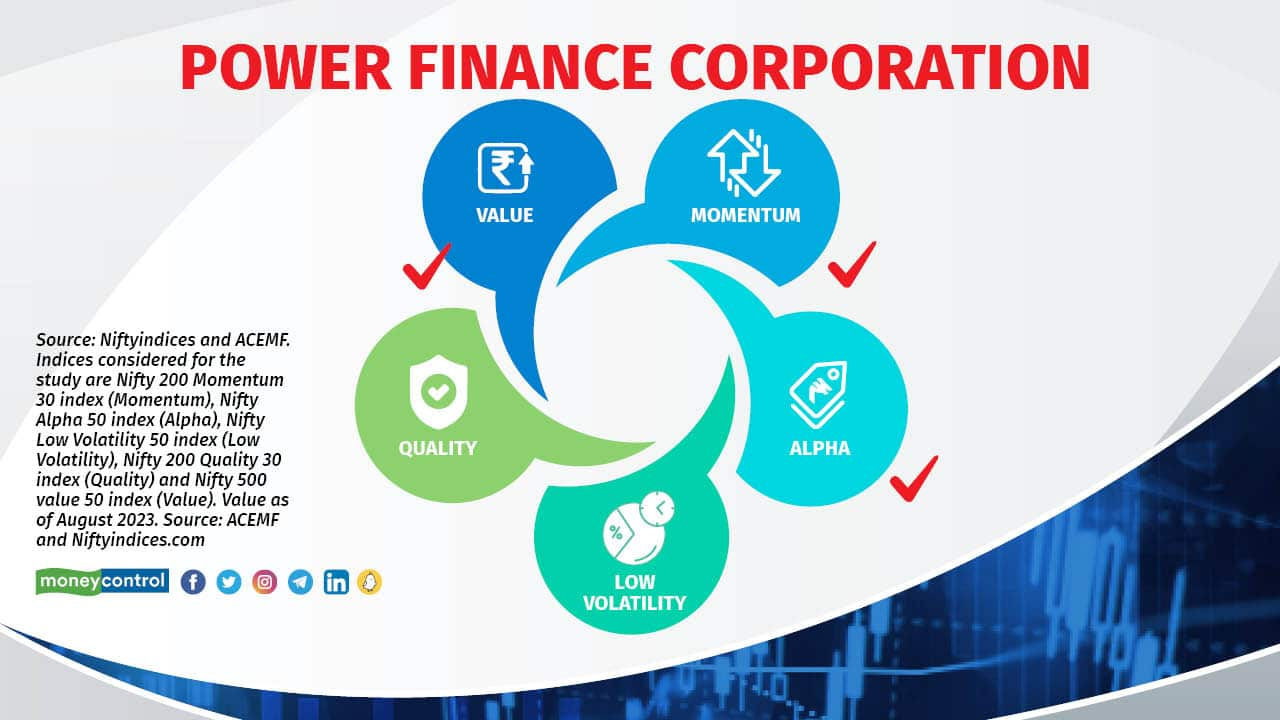

Power Finance Corporation

M-CAP type: Mid Cap

No. of active schemes that hold the stocks as of July 2023: 78

M-CAP type: Mid Cap

No. of active schemes that hold the stocks as of July 2023: 78

7/10

Punjab National Bank

M-CAP type: Large Cap

No. of active schemes that hold the stocks as of July 2023: 37

Also read: MC30 scheme review: Why PGIM India Midcap Opportunities Fund is a long-term wealth creator

M-CAP type: Large Cap

No. of active schemes that hold the stocks as of July 2023: 37

Also read: MC30 scheme review: Why PGIM India Midcap Opportunities Fund is a long-term wealth creator

8/10

Britannia Industries

M-CAP type: Large Cap

No. of active schemes that hold the stocks as of July 2023: 95

M-CAP type: Large Cap

No. of active schemes that hold the stocks as of July 2023: 95

9/10

Coal India

M-CAP type: Large Cap

No. of active schemes that hold the stocks as of July 2023: 83

Also see: 10 most popular large-cap stocks among PMS to withstand volatility

M-CAP type: Large Cap

No. of active schemes that hold the stocks as of July 2023: 83

Also see: 10 most popular large-cap stocks among PMS to withstand volatility

10/10

Bajaj Auto

M-CAP type: Large Cap

No. of active schemes that hold the stocks as of July 2023: 83

See here: Hot small-cap pharma and healthcare stocks that MFs hold currently

M-CAP type: Large Cap

No. of active schemes that hold the stocks as of July 2023: 83

See here: Hot small-cap pharma and healthcare stocks that MFs hold currently

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!