Madhuchanda Dey

Moneycontrol Research

There is no denying the fact that bad assets are one of the biggest challenges confronting the Indian economy. Looking at the gravity of the problem, the government undertook a radical step by issuing an Ordinance to amend the Banking Regulation Act to empower the RBI to play a more active and decisive role in the resolution process.

However, the key question that beckons our attention is how valuable are these assets. Will they find takers and at what price and, more importantly, what value will the banks get out of liquidation?

Poor interest coverage ratio

Our research into the leverage profile of India Inc throws up numbers that are difficult to digest at first glance. The study of listed Indian companies suggests that outstanding debt of close to Rs 12.6 lakh crore belongs to companies that have interest coverage ratio of less than one.

The interest coverage ratio is a financial ratio that measures a company’s ability to make interest payments on its debt in a timely manner. Creditors use this formula to calculate the risk involved in lending - if a company can’t afford to pay the interest on its debt, it certainly can't afford to meet principle payments. A bad interest coverage ratio is any number below 1, as this translates to the company's current earnings being insufficient to service the company's current outstanding debt.

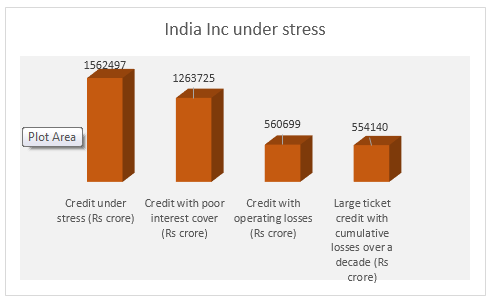

This number assumes importance because the quantum of outstanding debt belonging to corporates that are not generating enough earnings is close to 16.9 percent of the country’s outstanding credit. If we delve deeper, and try to figure out how many of these companies are breaking even at the operating level, the finding isn’t reassuring either.

The total debt outstanding of companies that are not breaking even at the operating level is close to Rs 5.6 lakh crore – 7.5 percent of outstanding non-food credit.

However, in order to appreciate the extent of the pain we also need to look at companies that have an interest coverage ratio of less than 1.5. If the same gets included then the outstanding stress in the system stands at a whooping Rs 15.6 lakh crore or close to 21 percent of outstanding non-food credit.

Cumulative net loss in the last decade

We first focus on companies that owe more than Rs 5,000 crore each to the Indian banks and have debt service coverage ratio of less than one. There are 45 such companies with outstanding debt of close to Rs 8 lakh crore or 10.8 percent of outstanding credit. In this group, only one out of the 45 companies has outstanding debt which is lower than the cumulative after-tax-profit of last twelve years.

About 75 percent of the companies (underlying outstanding debt of Rs 5.5 lakh crore) in this set have reported a cumulative net loss in the last decade i.e. the sum total of profits in the last twelve years is negative.

Hence, close to 44 percent of the highly indebted companies have either negative networth or have eroded their networth in the last decade.

Jaiprakash Associates, Adani Power, Videocon Industries, Reliance Communications, Jindal Steel & Power, Lanco Infratech, Bhushan Steel, GVK Power, Jaiprakash Power, Alok Industries, KSK Energy, Aban Offshore, Amtek Auto, Monnet Ispat, Essar Steel, Essar Oil, Gammon India, Jindal Stainless, Electro Steel, IVRCL, Era Engineering, Jaypee Infratech, Kingfisher Airlines, ABG Shipyard, Shree Renuka, Ballarpur Industries, Punj Lloyd, Bharati Defense, Bajaj Hindustan, REI Agro, Castex Technologies, Ruchi Soya, Essar Shipping, Jyoti Structures etc are some of the more predictable names that will be taken up at the earliest. But the resolution is not going to be an easy task.

Book value of assets lower than outstanding debt

As indicated, a majority of these companies have a poor track record of profitability. If we try to figure out how much can be realised if the business gets liquidated, the study shows that only a dozen companies from this sub-set have value of assets in excess of their outstanding debt. That gives an initial idea of the kind of haircut that is likely to befall the banking sector as resolution kicks into high gear.

In addition to these much talked-about names, there are another 122 companies, each of these with outstanding debt in excess of Rs 1,000 crore but have interest coverage ratio less than one. The underlying debt of this category is a meaningful Rs 2.7 lakh crore or 3.7 percent of outstanding bank credit. The number of cases being much larger, the bandwidth to resolve these cases are going to be perhaps more difficult. Bankers and the RBI are clearly staring at a very bumpy ride ahead.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.