In its moment of most need, back in 2022, the liquified natural gas market saved Europe. Now, that same LNG market is the continent’s new vulnerability. The good news is that the weakness should be short-lived; the bad news is that it won’t go away before the next winter.

The beauty of LNG is that the gas has been super-cooled and processed for loading onto tankers and shipping around the world, very much like oil.

Thus Europe can source the commodity from anywhere: from the US to Qatar, from Australia to Nigeria. The drawback is that everyone else in the world can do the same, procuring it from anywhere and increasing competition.

Rivalry to buy LNG is visible in today’s market, with European benchmark prices recently climbing to a near six-month high above €37 ($40) per megawatt-hour. Although higher than at any point this year, European gas prices are a fraction of the more than €300 reached in August 2022. Prices averaged €20 between 2010 and 2020.

Granted, other factors have also contributed to higher prices: notably, an outage in a Norwegian gas pipeline, strong financial flows into gas financial contracts and fears about losing the last remaining shipments of Russian gas into Europe. But in the background, the battle for LNG cargoes is playing a role.

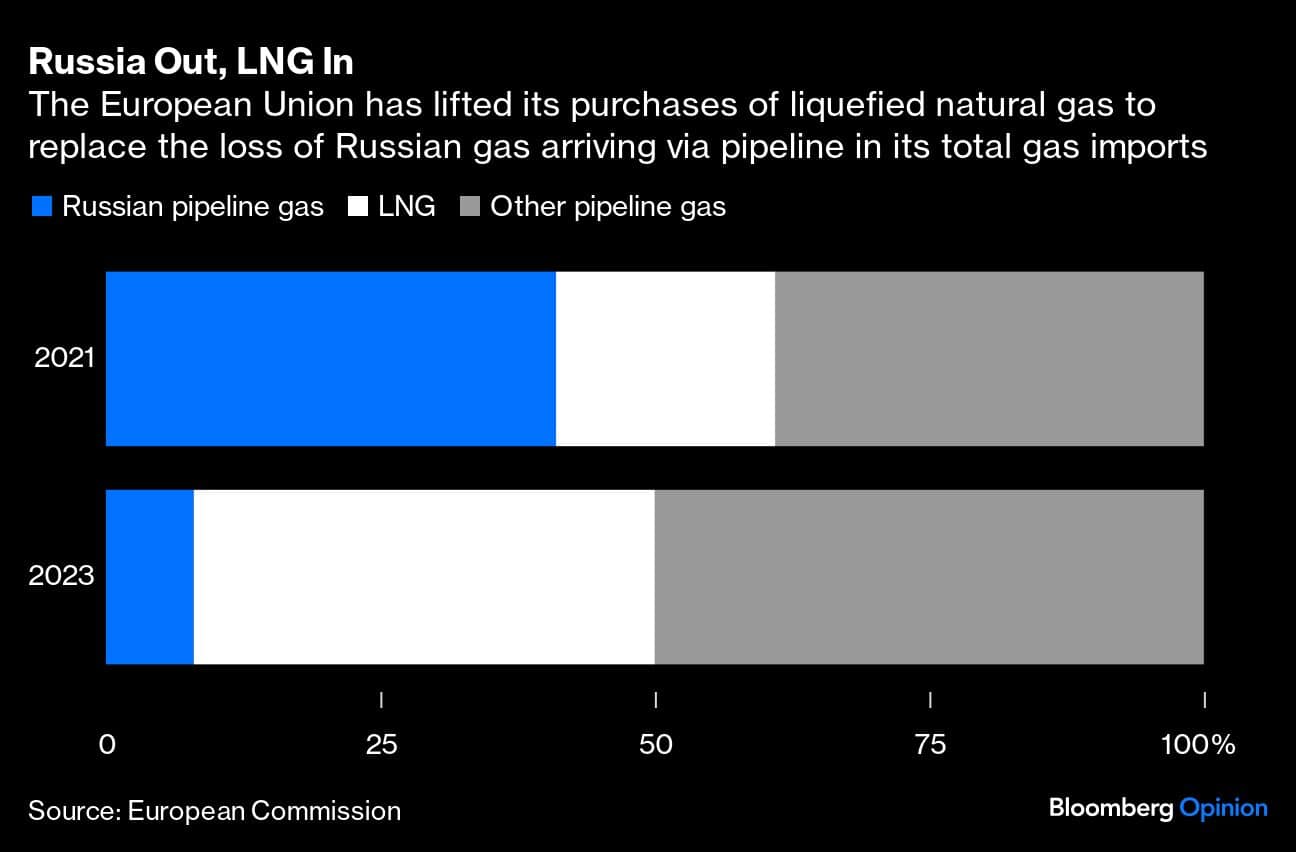

Before Russian President Vladimir Putin ordered the invasion of Ukraine in 2022, Europe used to depend on Russian gas shipped via pipeline for more than 40 percent of its imports. LNG accounted for about 20 percent. But after Moscow largely cut the flow, the continent’s import reliance flipped upside down. By last year, LNG accounted for about 42 percent of Europe’s gas imports, while Russian pipeline gas fell to just 8 percent.

In 2022 and 2023, Europe had the global LNG market for itself. High costs priced out other importers — Pakistan and Bangladesh, among several others — while China, typically the world’s top buyer of the product, was absent as its manufacturing sector was recovering slowly from the pandemic lockdowns. At the same time, soaring prices encouraged LNG companies to run their facilities as hard as they safely could, keeping the supply elevated.

Fast forward to 2024, and the market has changed. Europe is now starting to see stronger competition. China is back, with record imports nearly every month. India is also buying, and so are other smaller importers. With many emerging nations experiencing heatwaves, demand for electricity is rising, and with it LNG consumption. On the supply side, the industry appears exhausted after the 2022-23 marathon. Heavy maintenance is hitting production, along with unplanned outages. Global output has consistently been below last year’s level each month so far this year.

The result is that Europe is importing less LNG than it did in 2022 and 2023. Last week, the amount of gas departing import terminals in Europe dropped to the lowest level for this time of the year since the pandemic. For now, that’s not a significant problem. The region emerged from the 2023-24 winter with unusually high inventories thanks to a mild cold season. Since then, however, the pace at which the underground storage is filling has slowed down.

But the competition for LNG could turn more problematic this coming winter if the region faces a colder-than-usual season and other LNG importers simultaneously have weather trouble. For the last two years, the El Nino weather phenomenon, which has pushed up global temperatures, has helped the continent to reduce the impact of the energy crisis. But El Niño is quickly fading, and meteorologists say that the opposite weather trend, called La Niña, is likely to dominate from October or November. If so, Europe could face a normal or even chillier winter.

It's a stark reminder that Europe hasn’t yet emerged from its energy crisis. Admittedly, prices have fallen, but they remain much higher than before Russia invaded Ukraine. Other than mild winters, the other reason why prices have dropped in Europe is because demand has been much lower than before the pandemic, largely as energy-intensive companies in Germany reduced production.

For Europe, the 2024-25 winter is likely to be the last difficult one. From 2026 onward, new supply will arrive, notably from Qatar and the US, easing any global competition for cargoes. But for now, the LNG market will remain a saviour — and a potential source of risk — for the continent.

Credit: Bloomberg

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.