The withdrawal cap of Rs 50,000 imposed on Yes Bank’s depositors may be lifted by March 23, Mint has reported. This would be at least 11 days before the April 3 deadline set by the Reserve Bank of India (RBI).

A person aware of this development, told the newspaper: “With the State Bank of India (SBI) running the bank, concerns over liquidity and viability of Yes Bank as a going concern have receded. Placing caps on withdrawals can be counter-productive. The RBI feels the limit can be withdrawn earlier and that should happen by March 23."

The report quotes another person aware of the matter as saying that the central bank is internally targeting March 16 to remove the cap on withdrawals.

“But it had not factored in certain events. In the event of holders of the bank’s additional tier 1 (AT1) instruments going to the Supreme Court (SC) which is a high probability, the March 16 aim may get pushed off by a week", the person said.

Moneycontrol could not independently verify the report.

On March 5, the RBI superseded the board of the troubled private sector lender with immediate effect. Former SBI CFO Prashant Kumar was appointed as the bank administrator.

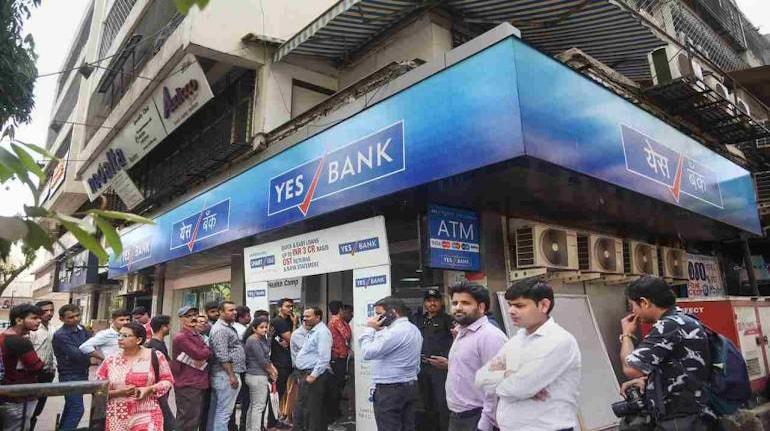

The RBI has capped the withdrawal limit to Rs 50,000 per account per month. The RBI directive came into effect from 6 am on March 6.

However, in a late-night tweet on March 7, Yes Bank informed its customers that they could start withdrawing money from ATMs using their debit cards.

The move by the RBI comes nearly six months after it did the same with Mumbai-based Punjab and Maharashtra Cooperative (PMC) Bank. Yes Bank has been grappling with mounting bad loans and struggling to raise fresh capital.

The RBI asked SBI to pick up a 49 percent stake in Yes Bank to avert its collapse which would have broad implications on the financial system.

SBI Chairman Rajnish Kumar, on March 7, stated that the bank had set an upper cap of Rs 10,000 crore for investment in Yes Bank.

Clarifying that there will ‘no merger’, Kumar has emphasised that 26 percent stake is the "lock-in requirement" and, thus, obligatory, adding that 49 percent is the upper limit approved by the bank board ‘in-principal’.

"Only requirement is the lock of 26 percent for three years, this sets the boundary. This is obligation, anything above that would be requirement and would depend on what others invest," he said.

He also said that the moratorium period could be shorter.

"Believe Yes Bank can be quickly brought out of RBI administration. Prashant Kumar is one of the most competent banking professionals," he added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.