The domestic formulation business has been a highly competitive, yet stable growth driver for most Indian pharmaceutical companies. The year 2020 has shaken that belief. The COVID-19 pandemic has hit the Indian pharmaceuticals market (IPM) growth like never before. There are outliers even in this market like Cipla, Glenmark, Aristo and a few others, who were quick in responding to Covid-19 related medications, but most struggled.

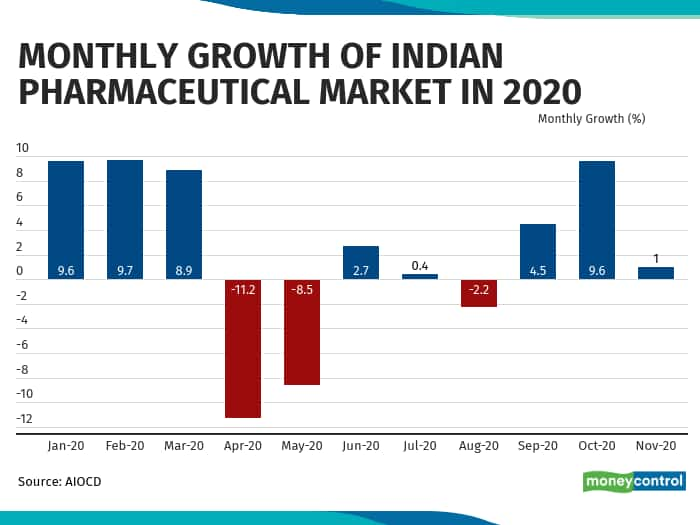

To be sure, the year 2020 had begun on a good note with IPM clocking over 9 percent growth rate in the first three months of January to March. On March 24, the government announced nationwide lockdown, while the pharma industry operations were exempted, it still faced issues on the supply side, as workers were unable to come to factories; shortage of packaging, raw materials and disruption of logistics and distribution channels. On the demand side, restriction on medical representatives’ movement, the shutdown of hospital outpatient departments (OPDs), doctors stopped attending their clinics and deferment of elective and non-emergency surgeries impacted the generation of new prescriptions critical to growth.

April-June quarter saw the full impact of lockdown, with the IPM contracting 6 percent. The last time the Indian pharma market had been through such a situation was during the rollout of GST in Q2FY18 when distributors and retailers resorted to destocking of inventory. Even then, the market ended up growing 1 percent. While there is some recovery, thereafter especially in September-October of 2020, when the lockdowns were fully lifted.

The overall growth rate has dropped to 2.2 percent in 2020. Indian pharmaceutical market stood at Rs 1.44 lakh crore market as per moving annual turnover (MAT) November 2020. The drop in sales in acute-therapies such as anti-infective drugs, gastrointestinal, gynaecological and pain and fever medications continues to exert pressure on IPM growth while growth in select chronic therapies such as cardiac and diabetes has made a good recovery. The new launches were mostly related to Covid-19 related drugs and the price growth has remained in the region of 4-5 percent. The volume growth remains tepid at about 6.9 percent in November 2020.

How will it be in 2021?

There were some positive things that have happened in the pharma industry in 2020. The use of digital to reach out to doctors and reduction in selling, travel and promotional expenses. Analysts say the industry has saved about 6-7 percent on expenses, which directly add to their profit margins. While in 2021, these savings might not sustain fully when normalcy returns, but still, analysts expect some of those savings would be permanent. The adoption of telemedicine by doctors and hospitals is also seen as positive.

The pharmaceutical sector is expecting the sales to normalise by the second half of 2021, with the availability of vaccine and Covid-19 receding. Hospitals and physician clinics have started to function. Many hospital beds in both government and private that were converted for treating Covid patients exclusively are reclaimed by non-Covid patients. While the pharmaceutical industry has certainly performed better than many other sectors, given the essential nature of medicines. But even this industry is pinning its hopes on the end of the pandemic.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.